Gordon Model

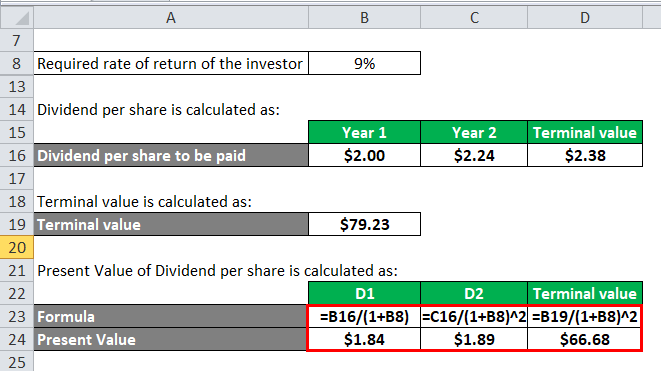

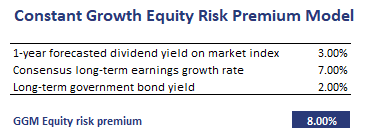

Despite the sensitivity of valuation to the shifts in the discount rate the model still demonstrates a clear relation between valuation and return.

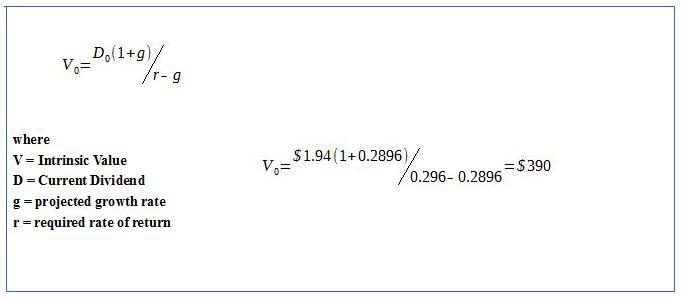

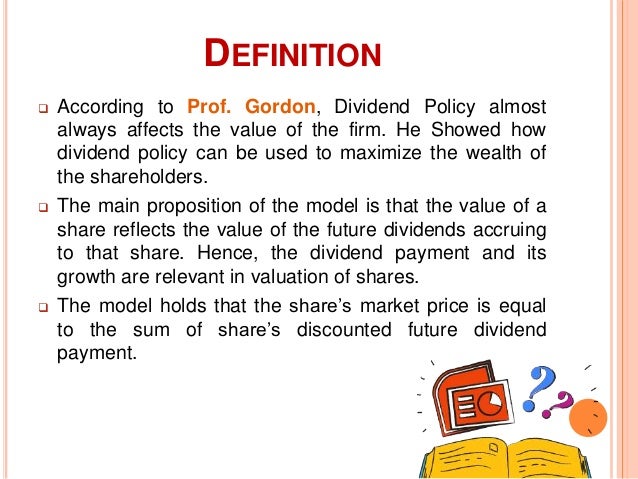

Gordon model. Gordon of the university of toronto who originally published it along with eli shapiro in 1956 and made reference to it in 1959. The gordon growth model ggm helps an investor to determine the intrinsic value of a stock based on the constant rate of growth of its future dividends. The gordon growth model is also referred to as the dividend discount model.

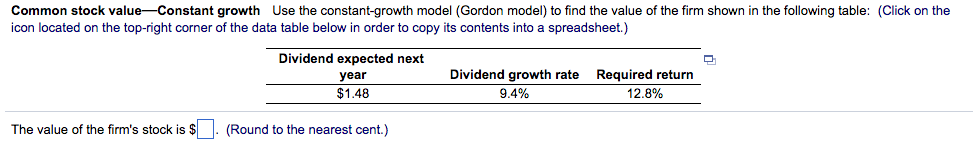

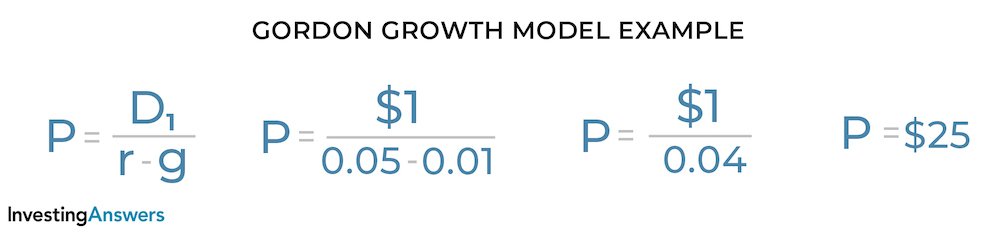

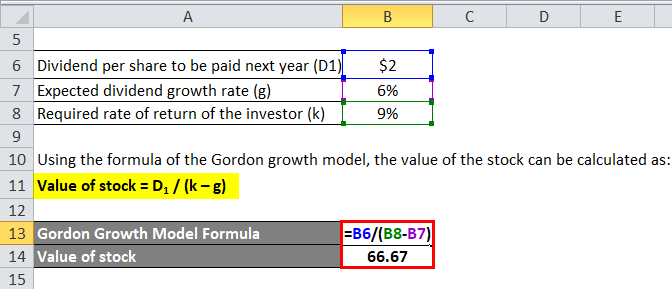

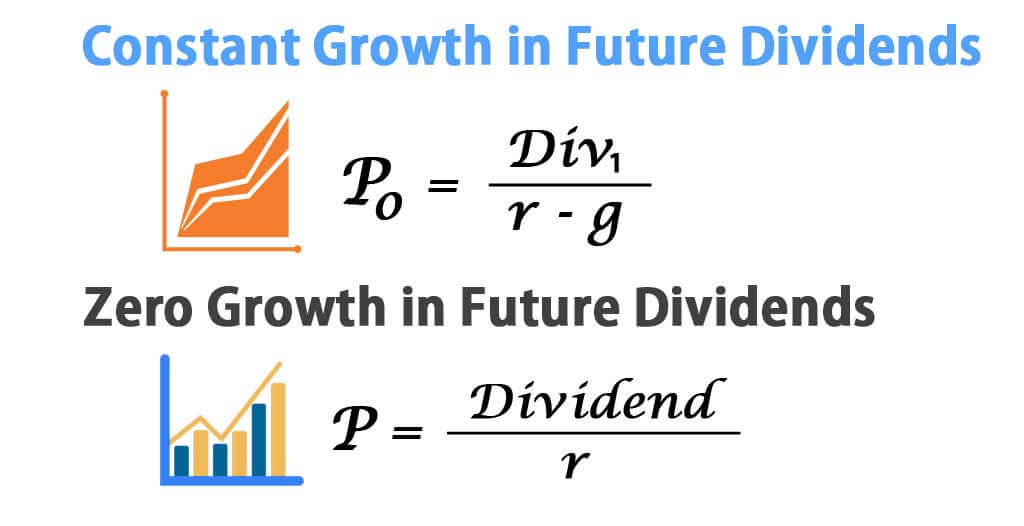

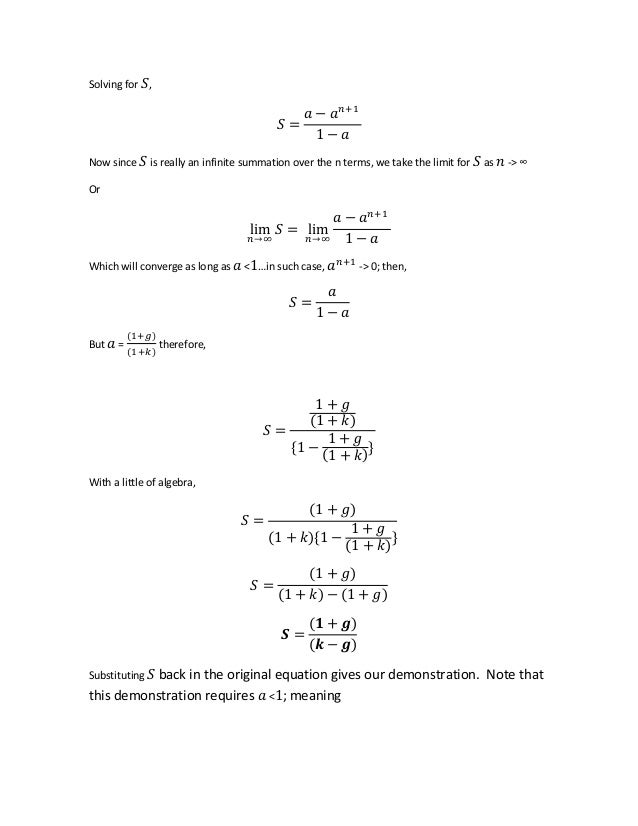

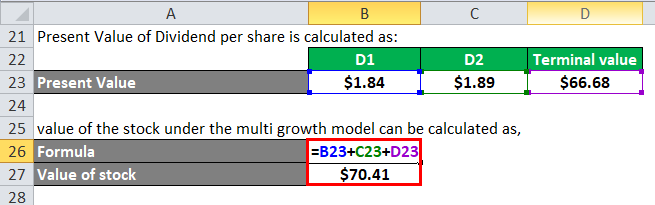

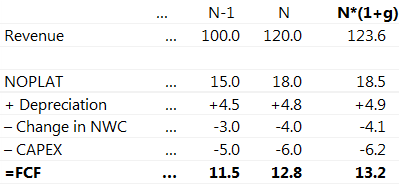

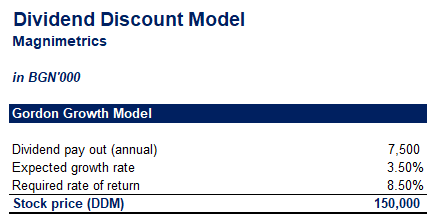

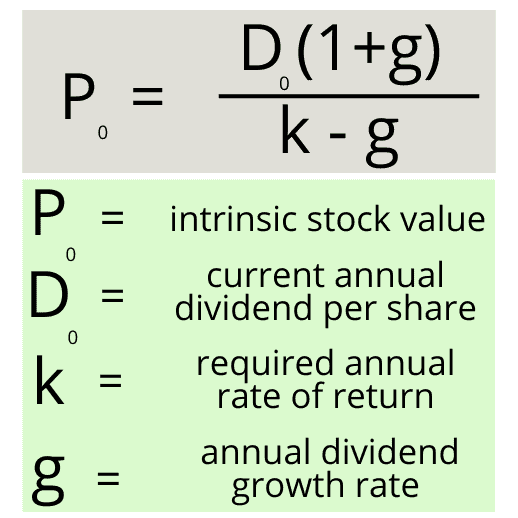

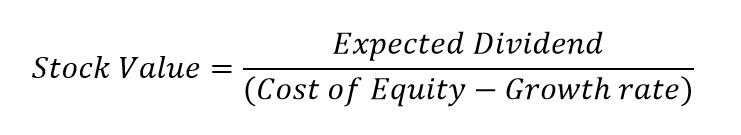

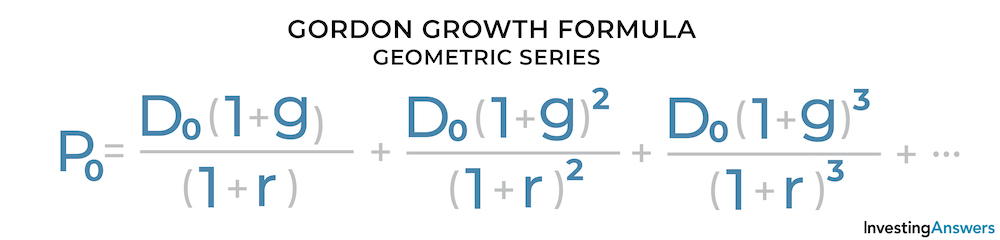

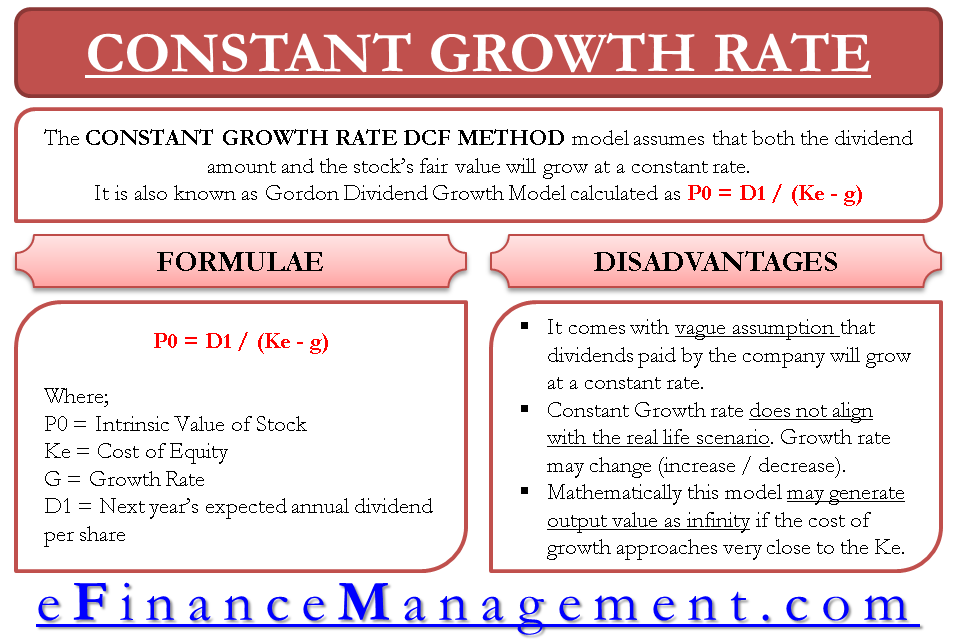

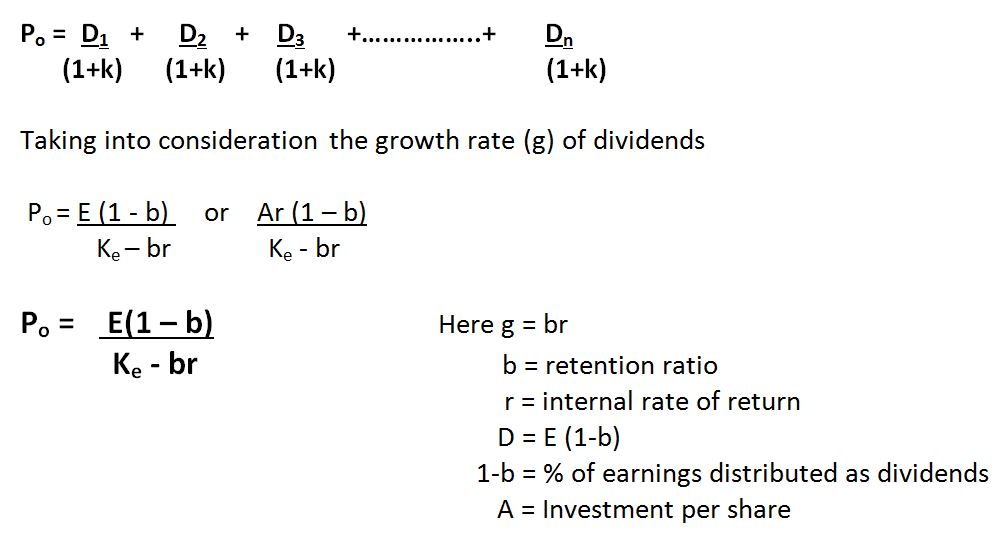

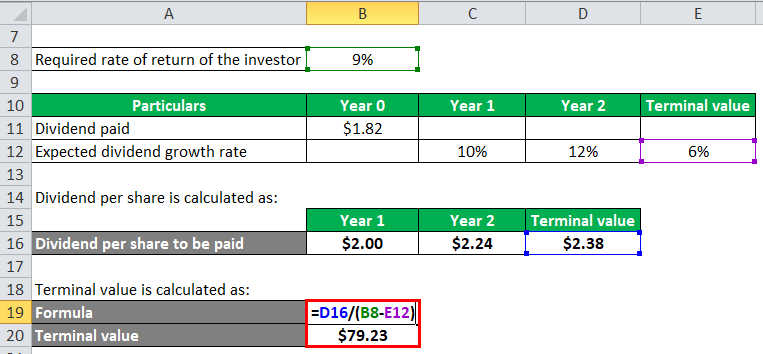

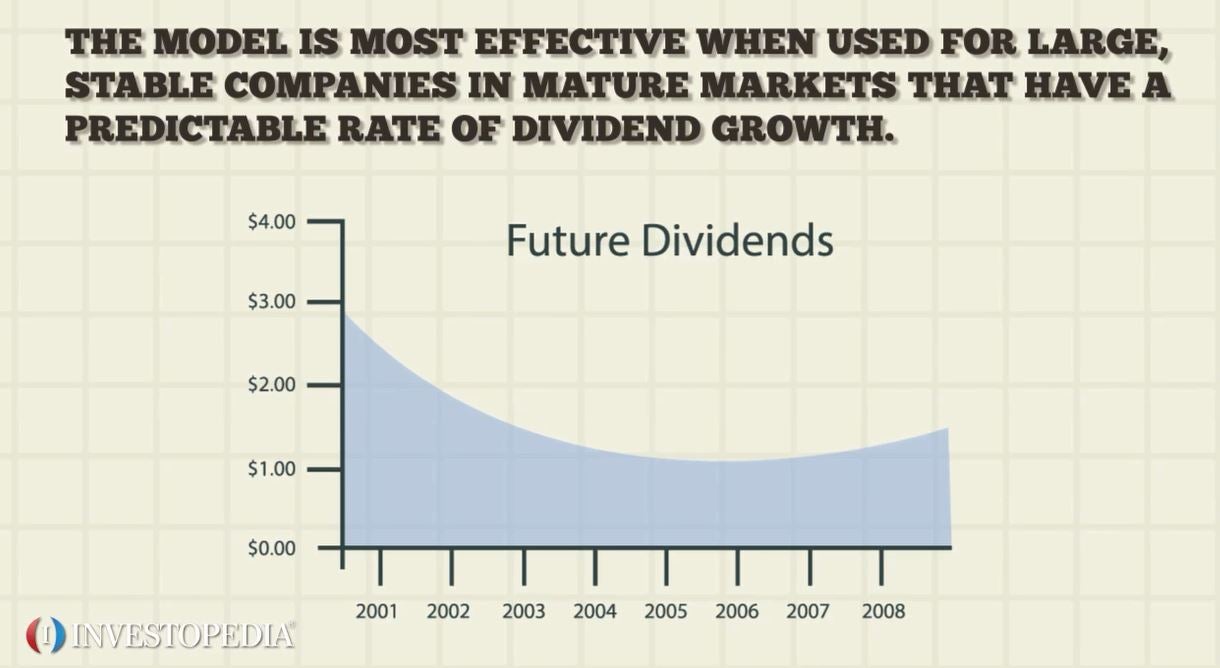

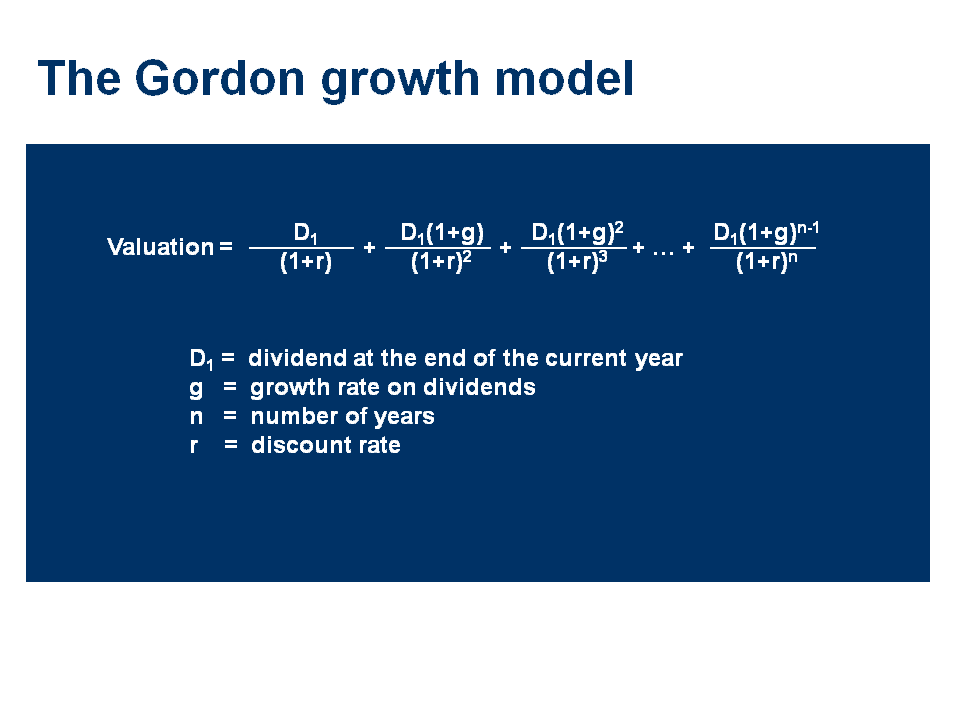

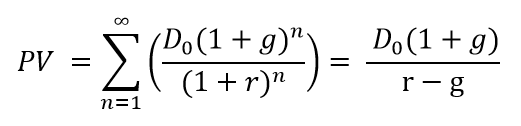

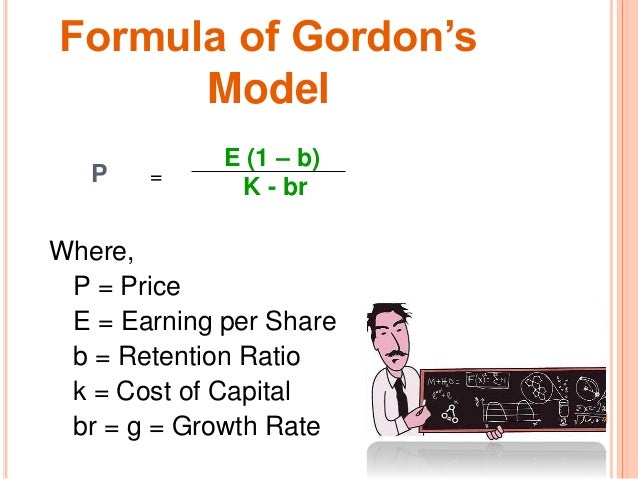

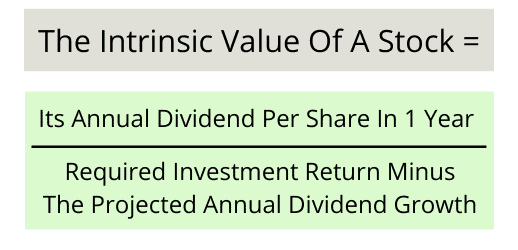

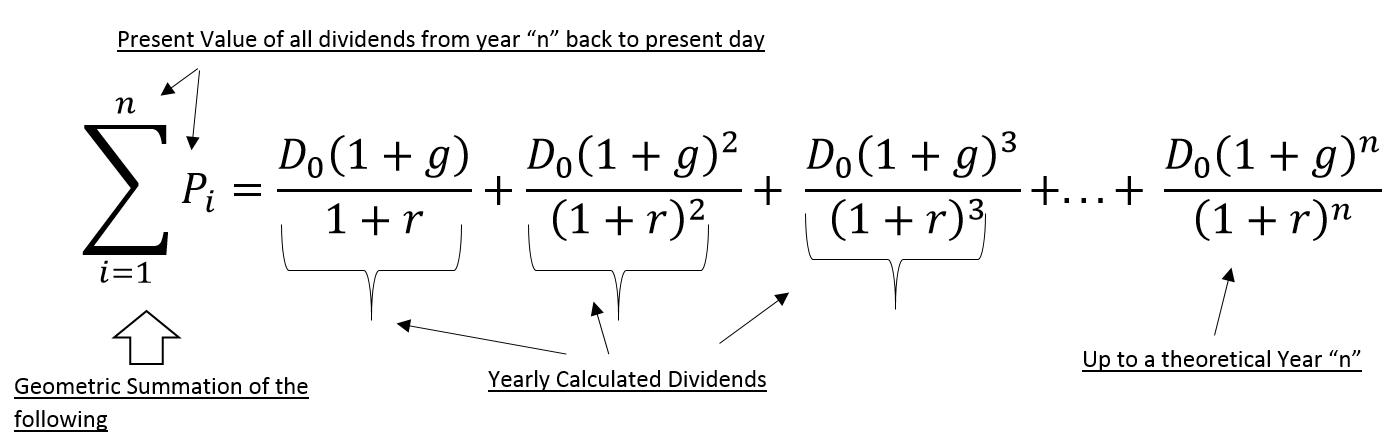

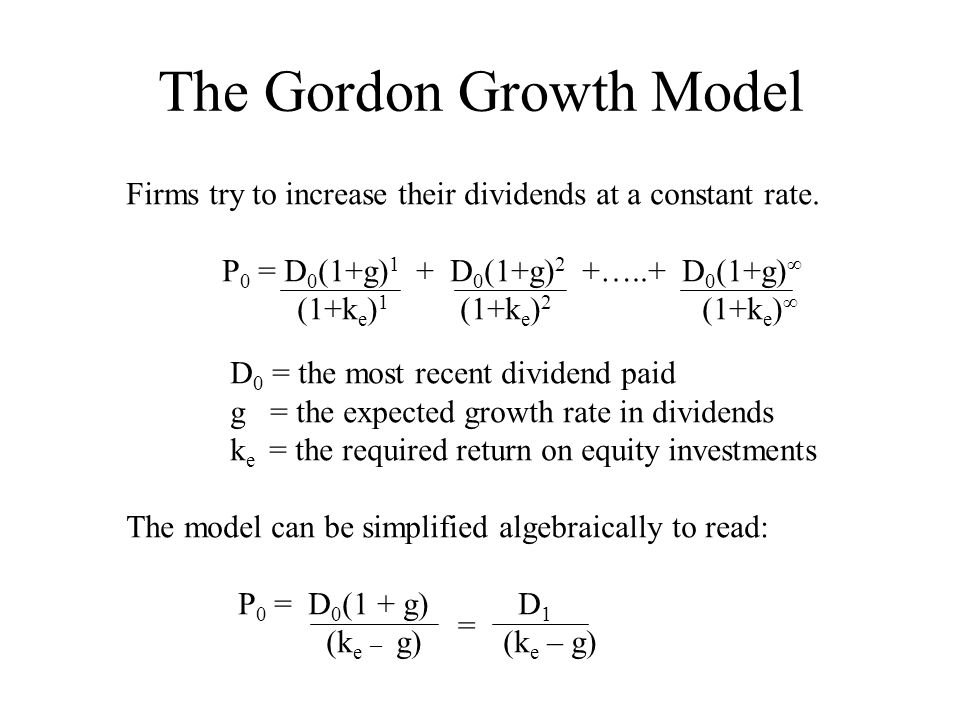

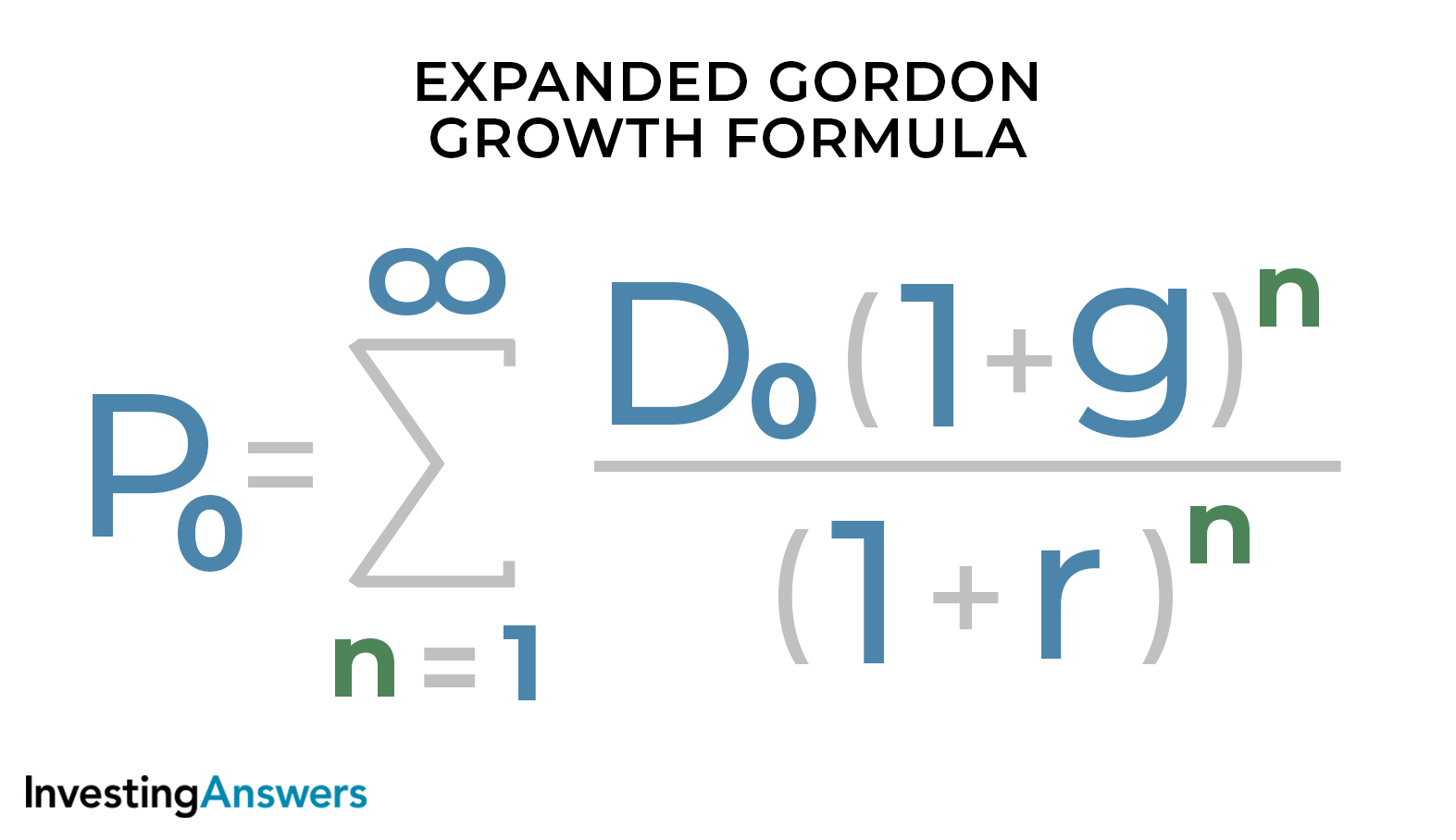

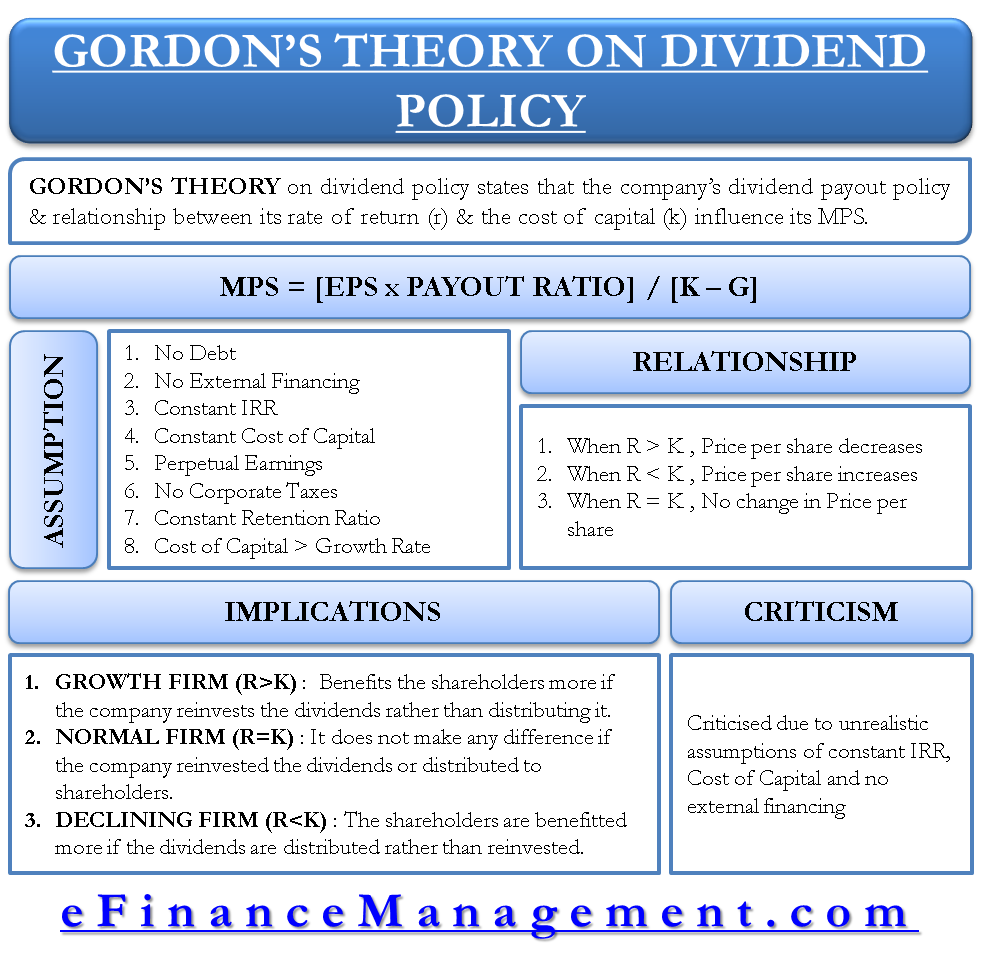

The formula is applicable for dividend paying stocks only and the formula for the stock valuation is computed by dividing the next years dividend per share by the difference between the investors required rate of return and dividend growth rate. Here the dividend capitalization model is used to study the effects of dividend policy on a stock price of the firm. Gordon growth model is a type of dividend discount model in which not only the dividends are factored in and discounted but also a growth rate for the dividends is factored in and the stock price is calculated based on that.

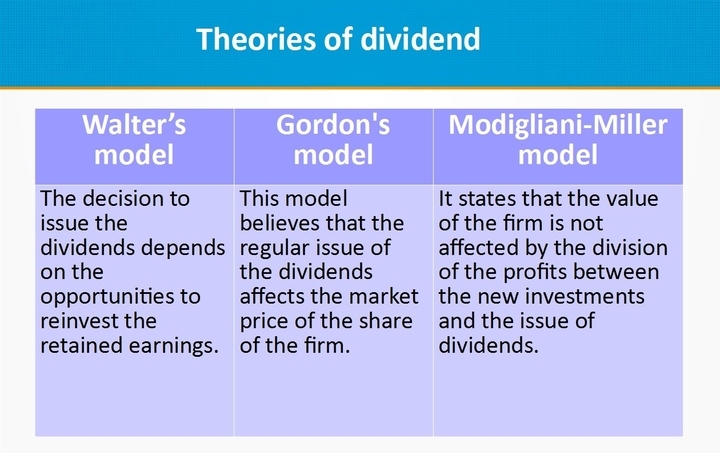

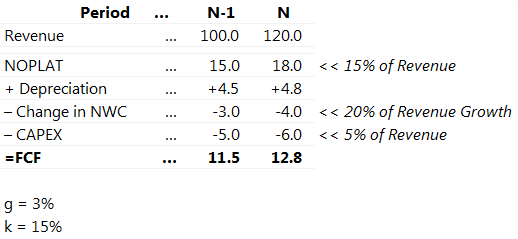

It is used to calculate the intrinsic value of a stock based on the net present value npv of its future dividends. When is the gordon growth model used. One very popular model explicitly relating the market value of the firm to dividend policy is developed by myron gordon.

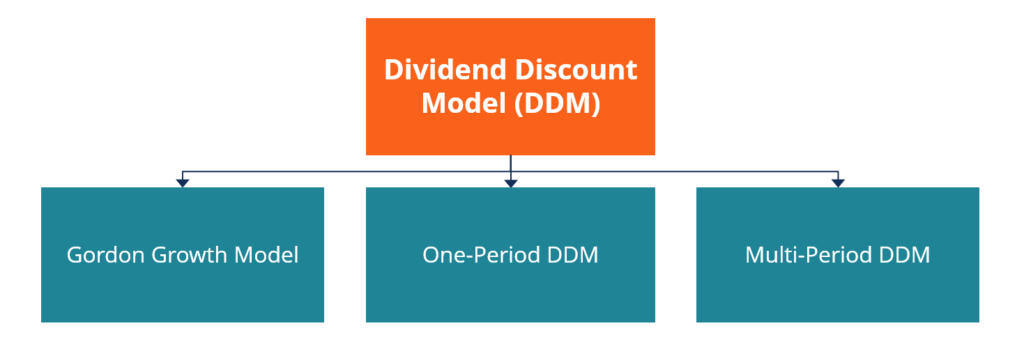

It is named after myron j. The gordon growth model ggm is a version of the dividend discount model ddm. The beginning of the gordon model can be seen in these concepts described in that chapter.

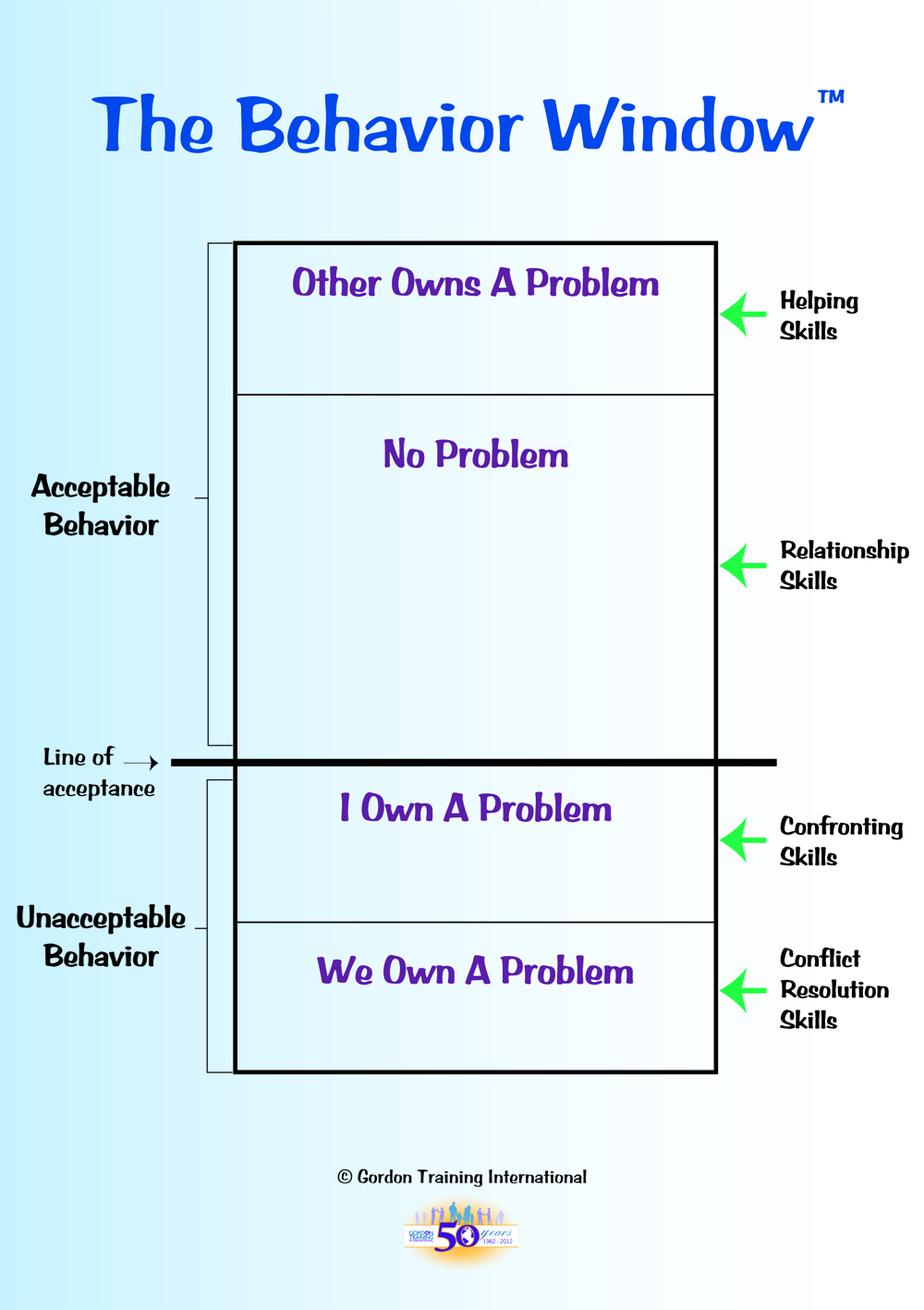

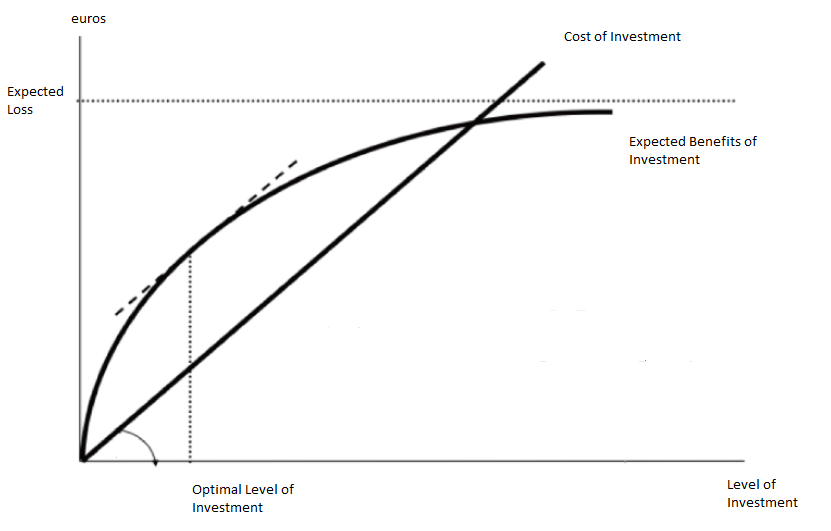

Leadership is a set of functions that are the property of the group and should be distributed to group members. The gordon growth model can be used to determine the relationship between growth rates discount rates and valuation. The equation most widely used is called the gordon growth model ggm.

The gordons model given by myron gordon also supports the doctrine that dividends are relevant to the share prices of a firm. The gordon growth model is used by investors to determine the relationship between valuation and return.

:max_bytes(150000):strip_icc()/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)