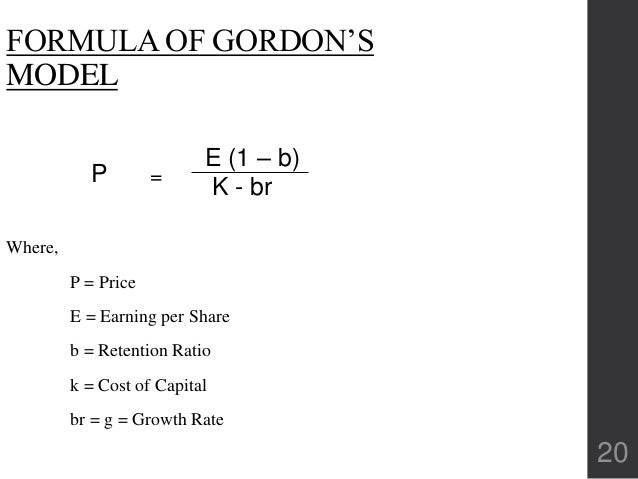

Gordon Model Of Dividend Formula

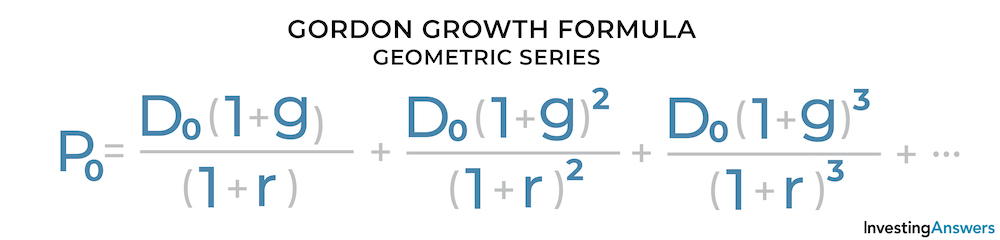

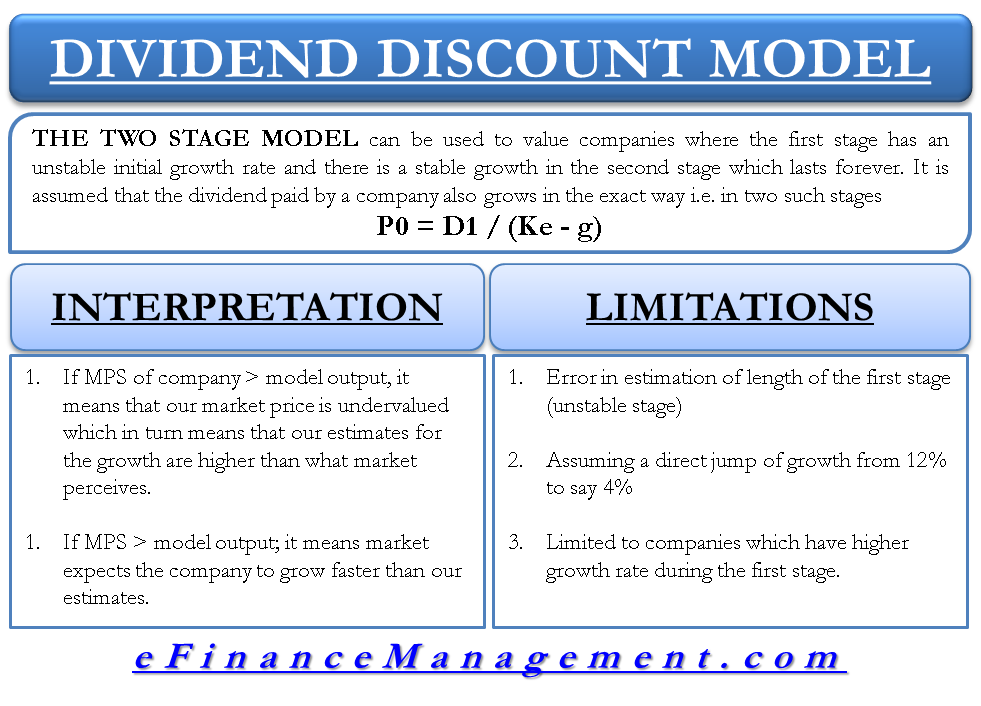

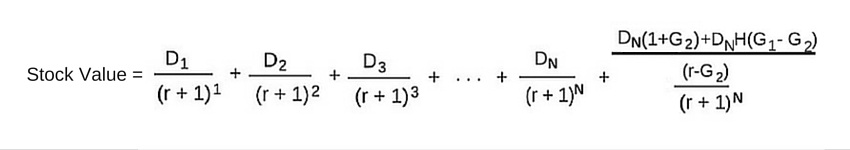

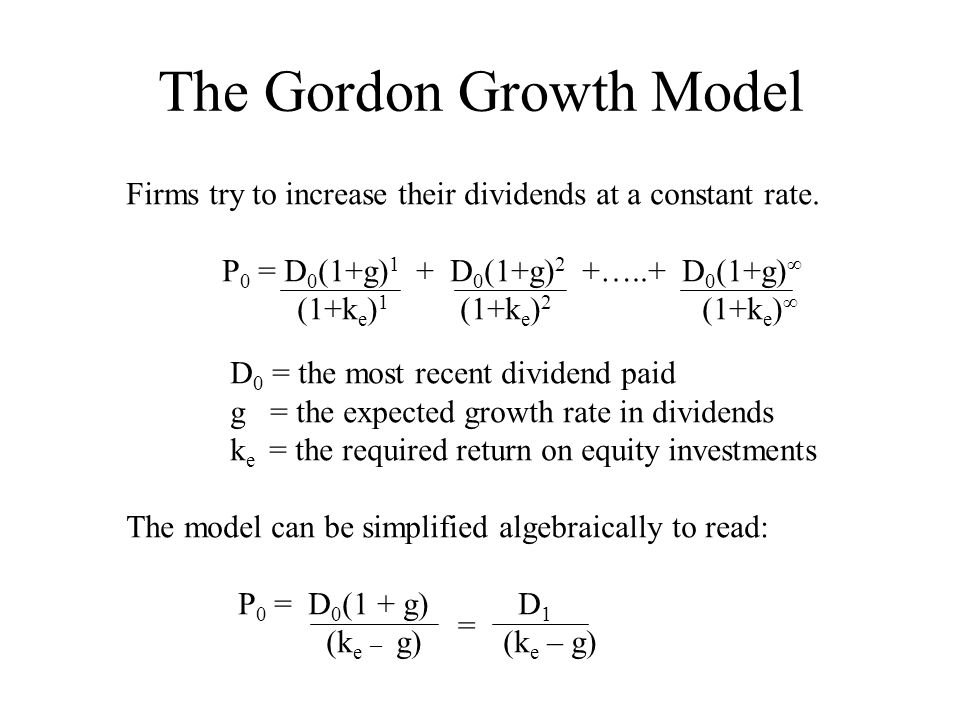

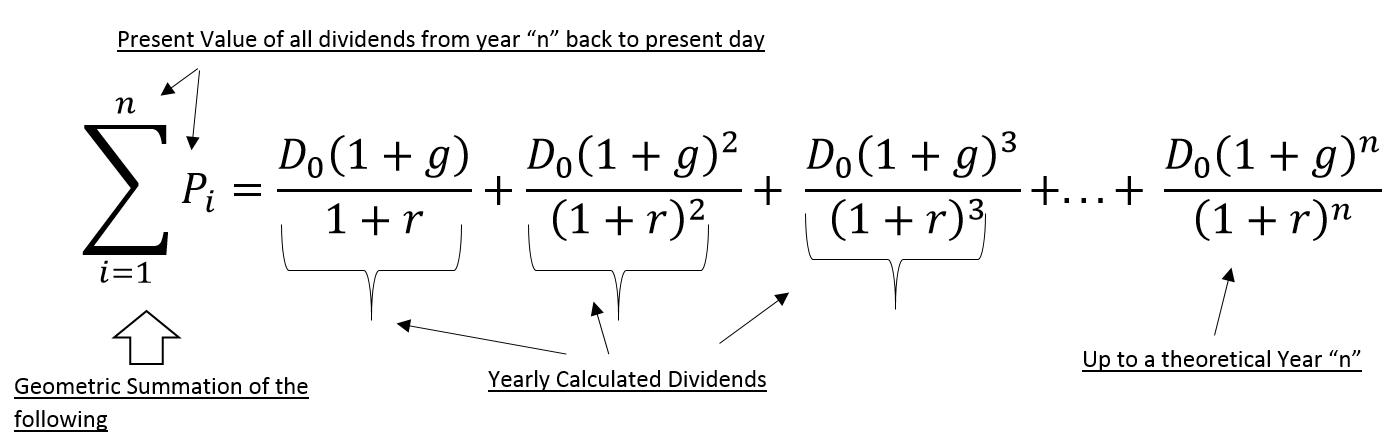

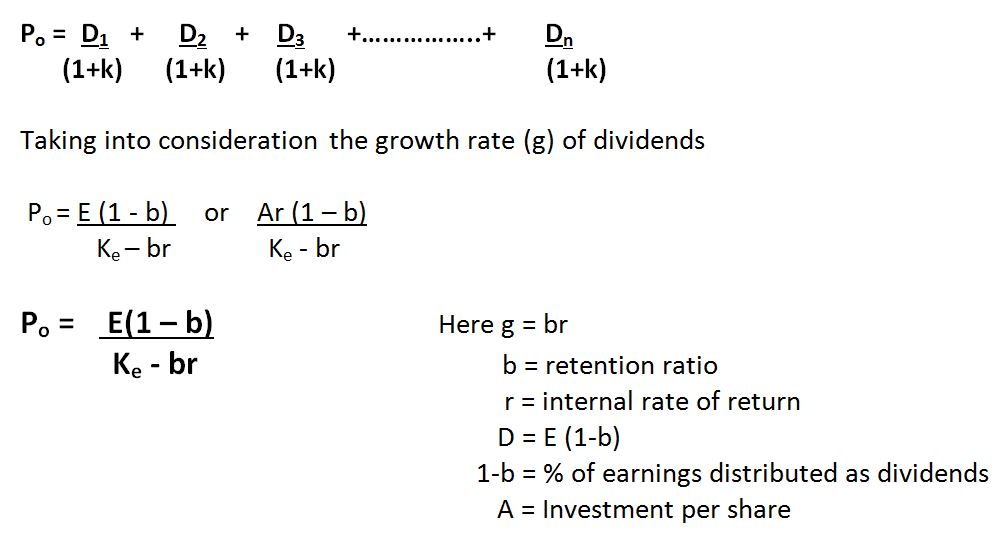

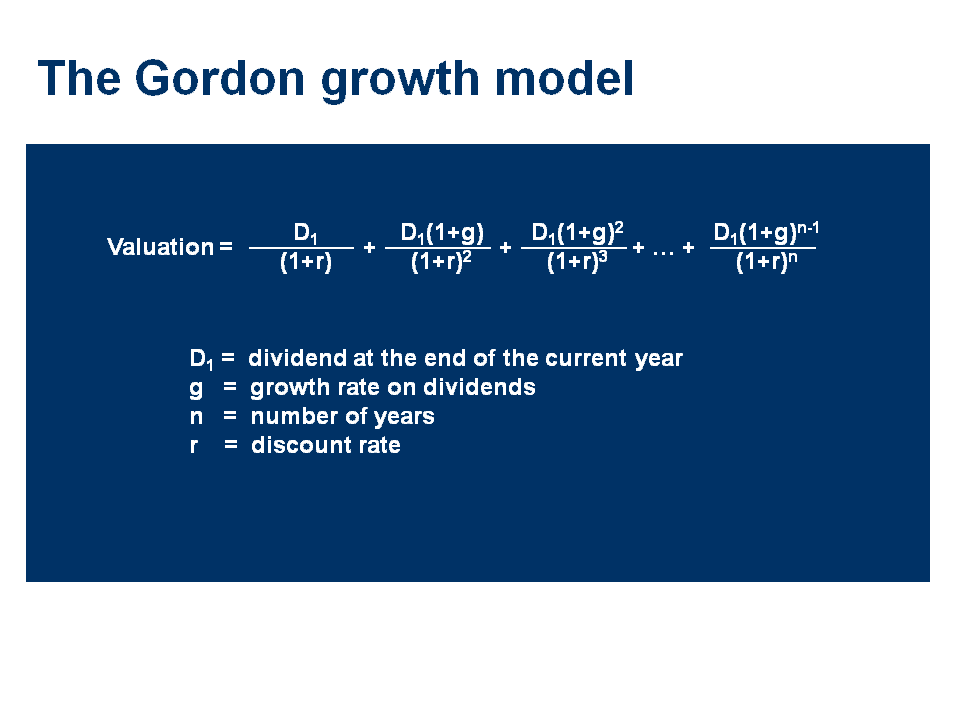

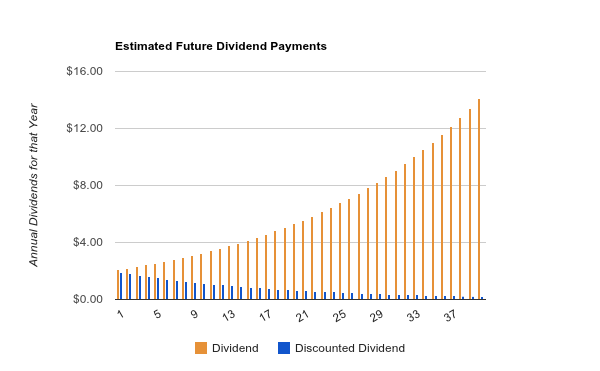

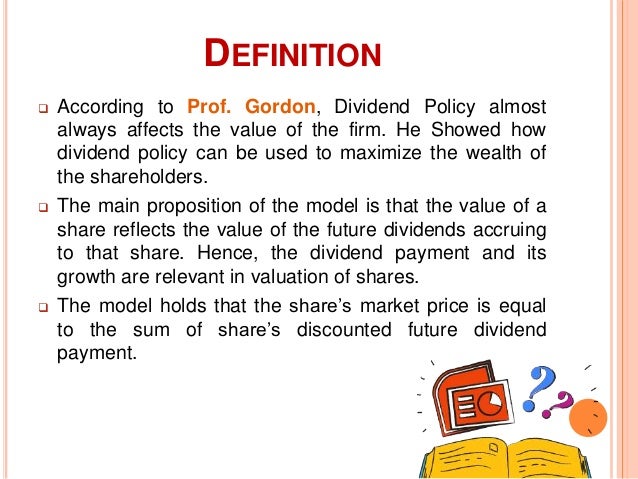

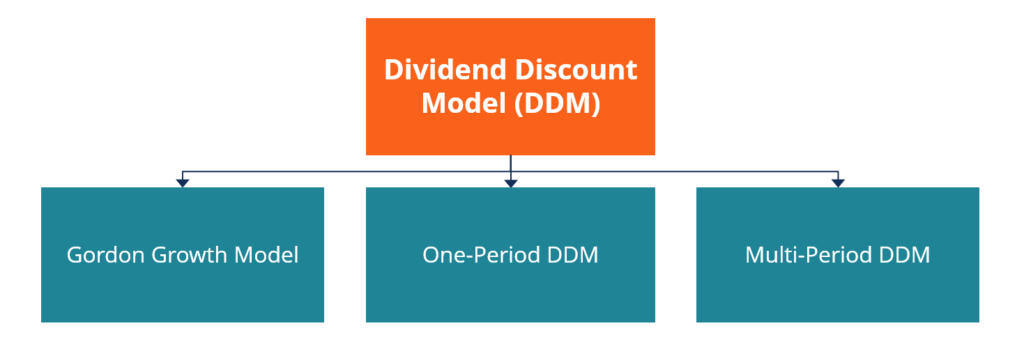

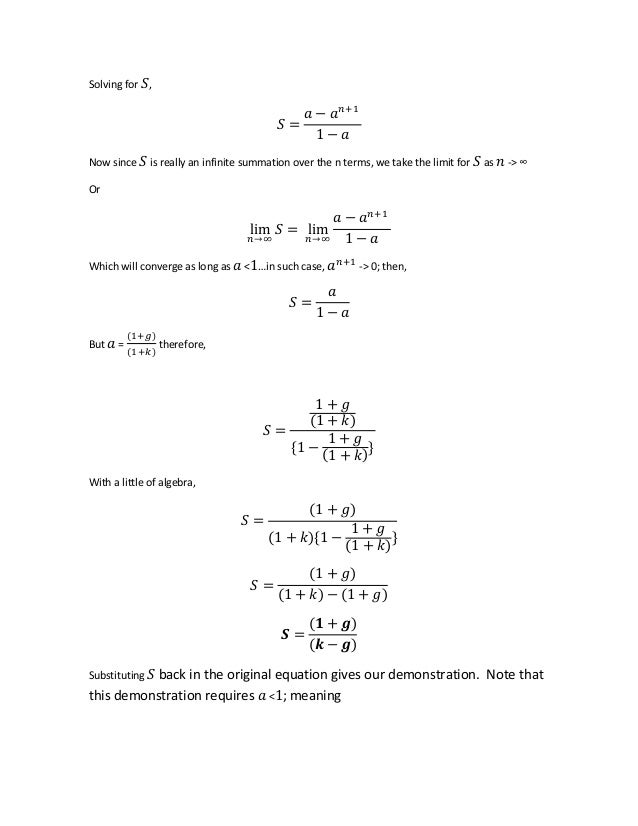

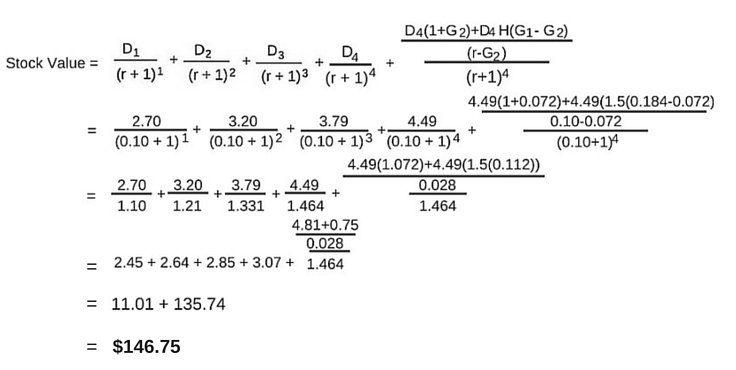

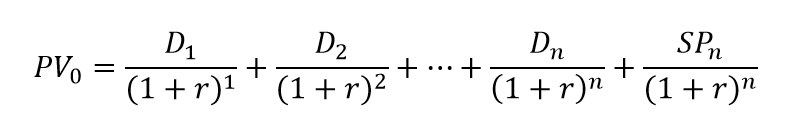

The dividend discount model is premised on the assumption that price of a share is determined by the discounted sum of all of its future dividend payments ie.

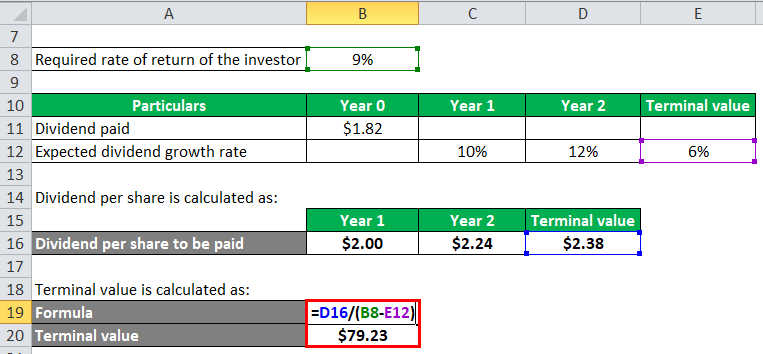

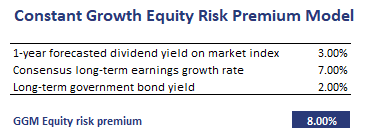

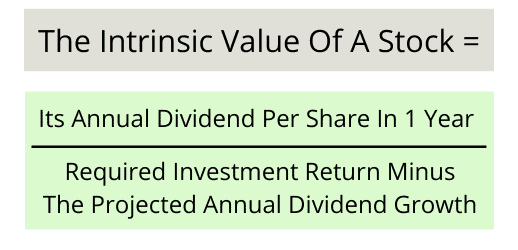

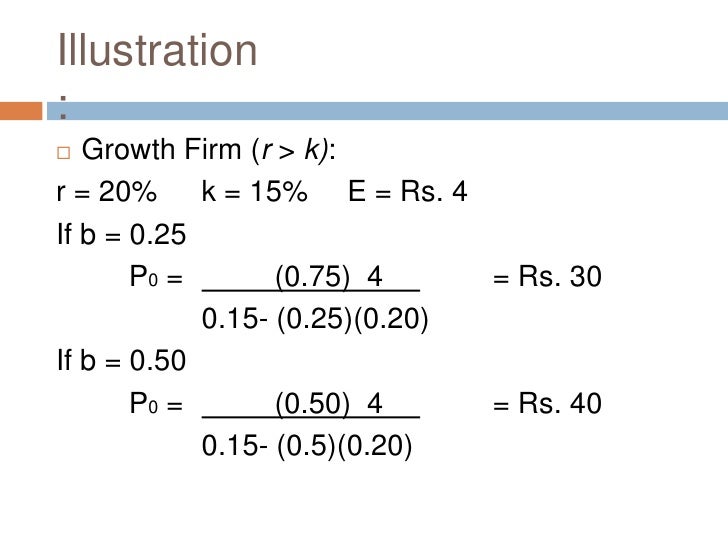

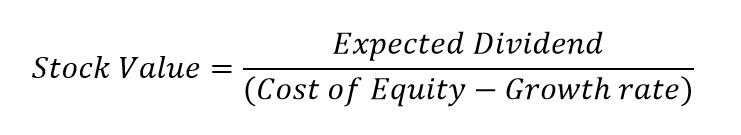

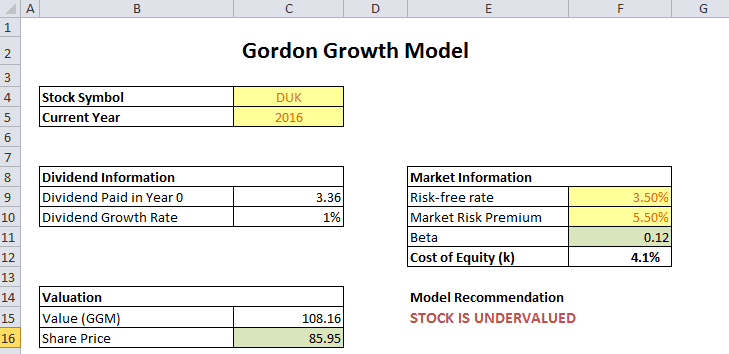

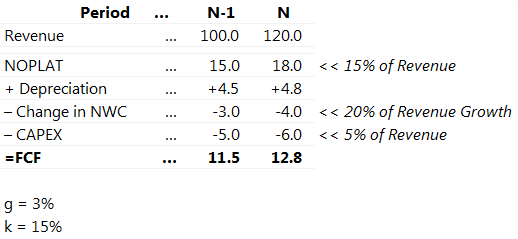

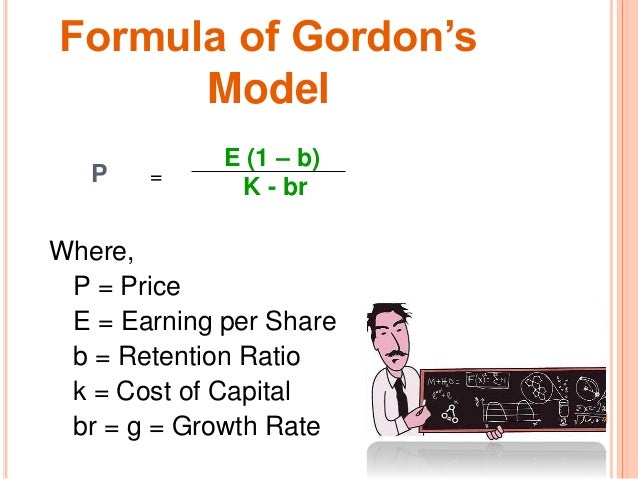

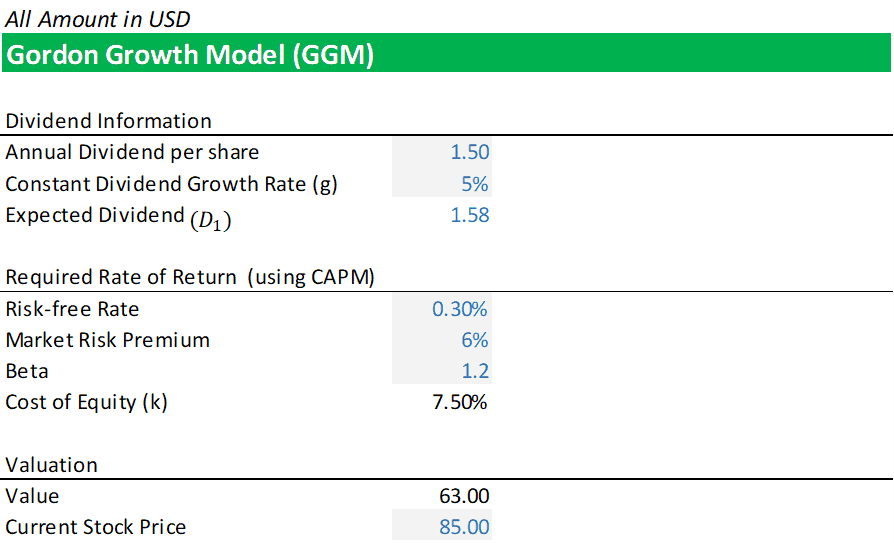

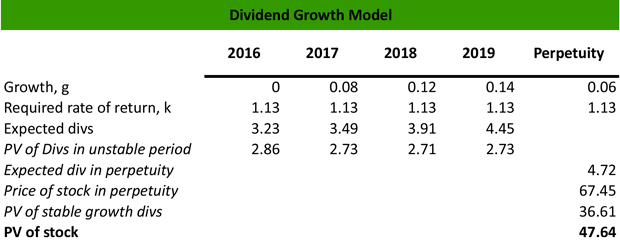

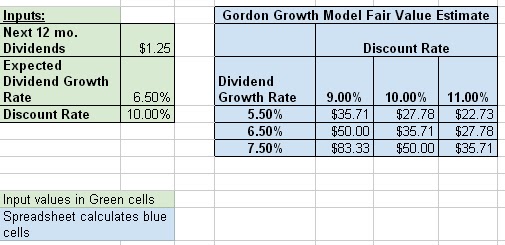

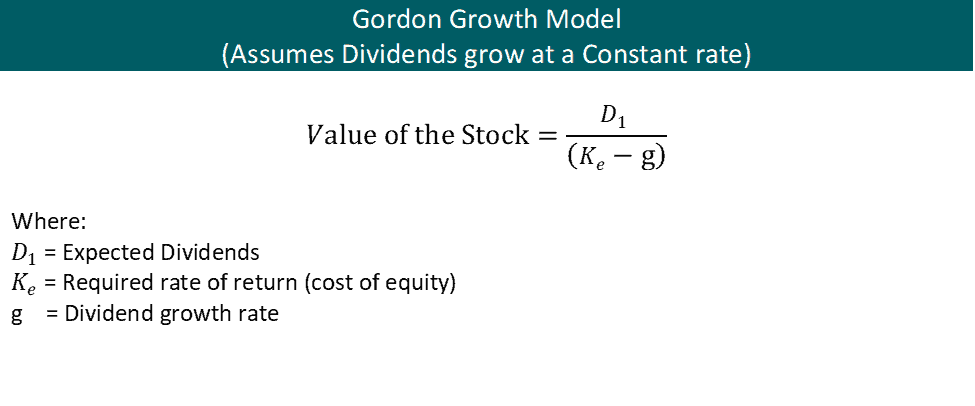

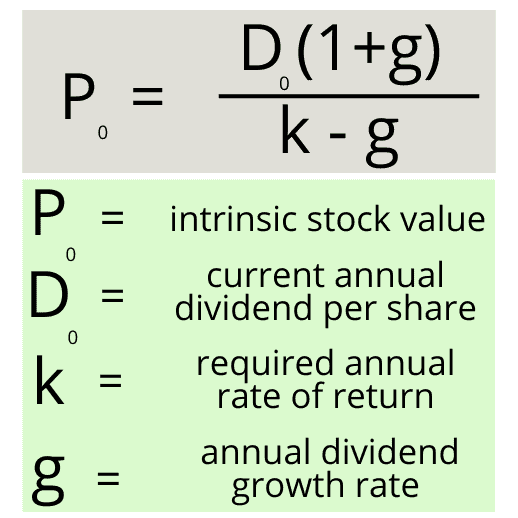

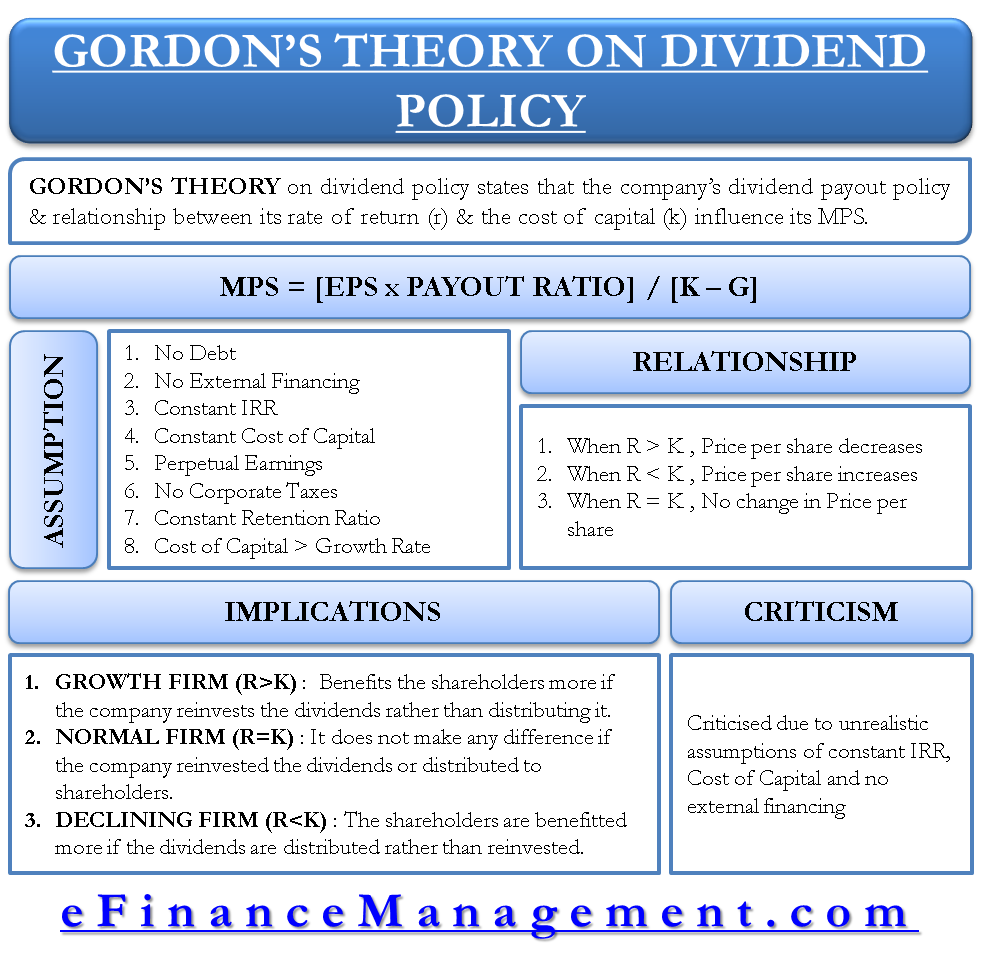

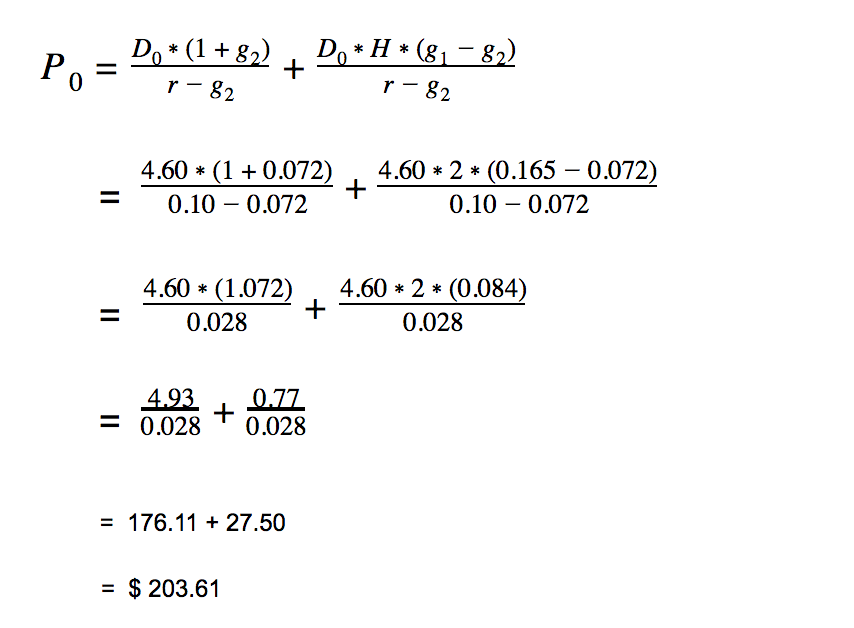

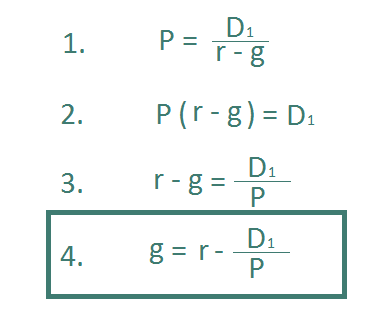

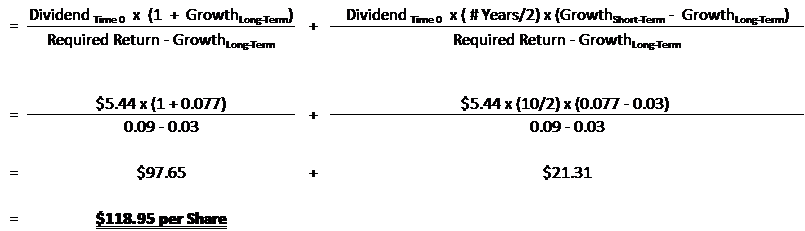

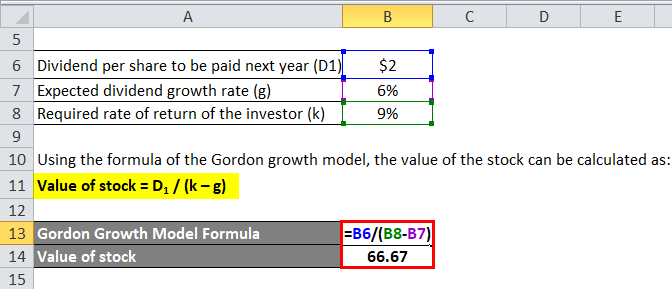

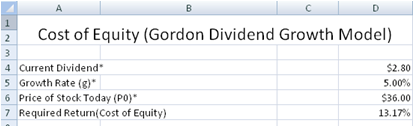

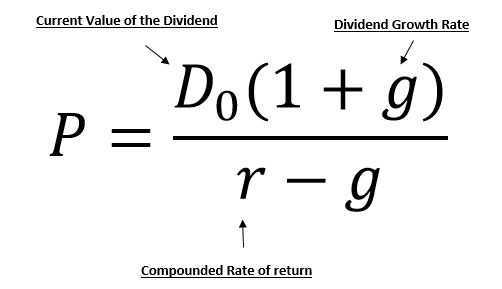

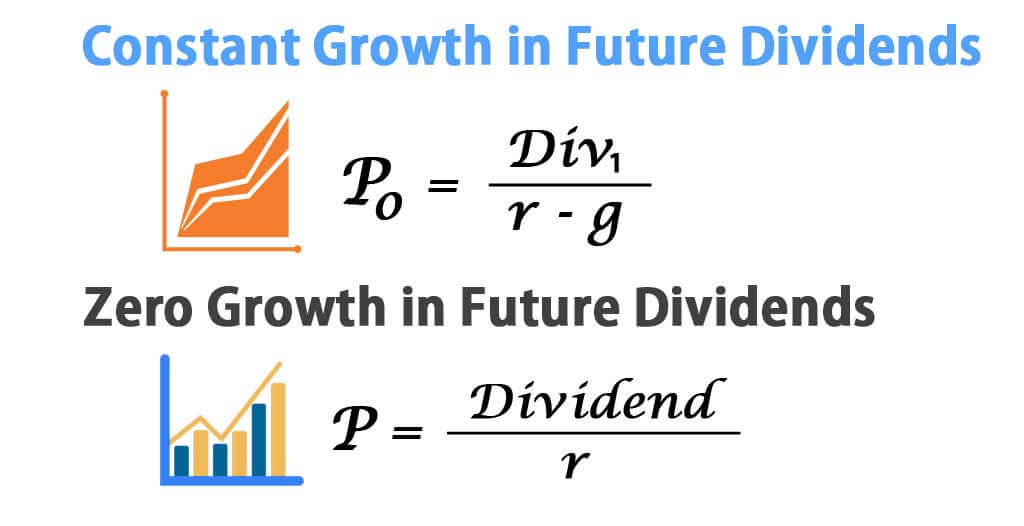

Gordon model of dividend formula. P current stock price g constant growth rate expected for dividends in perpetuity r constant cost of equity capital for the company or rate of return d 1. The formula is applicable for dividend paying stocks only and the formula for the stock valuation is computed by dividing the next years dividend per share by the difference between the investors required rate of return and dividend growth rate. Divided by the difference between 2 numbers.

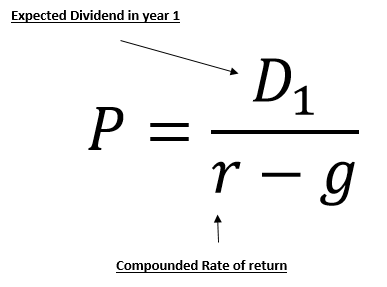

What is the gordon growth model formula. It is simply a companys expected annual dividend payment 1 year from now. As a formula the gordon growth model is quite simple.

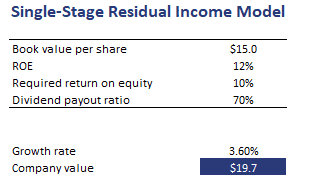

D 1 expected dividend amount for next year. When investors buy shares they expect to get either or both of two types of cash flows dividend during the period for which they hold the share and capital appreciation based on an expected price at the end of the holding period. The first number is your desired annual return on investment.

Gordon growth model formula p dfracd1r g p fair value of the stock. The gordon growth model is also referred to as the dividend discount model. P d 1 r g where.

R cost of equity or the required rate of return. Net present value of all future dividends.

.png)