Gordon Model Of Dividend Policy Ppt

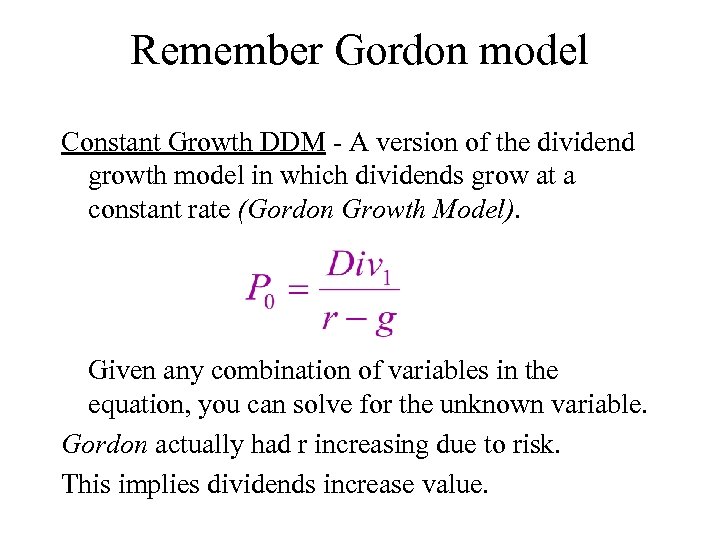

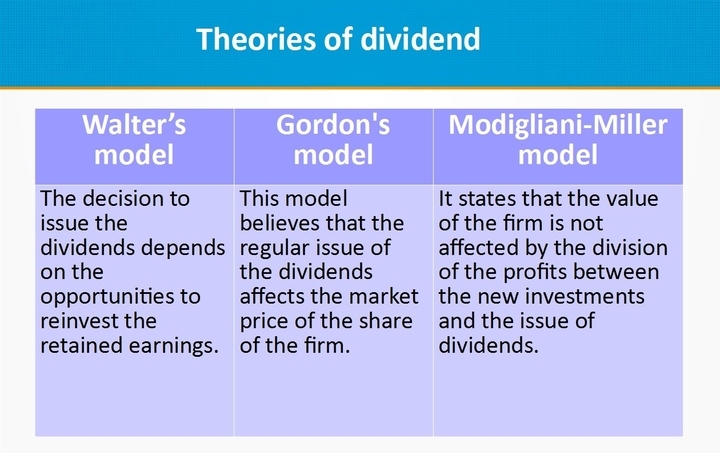

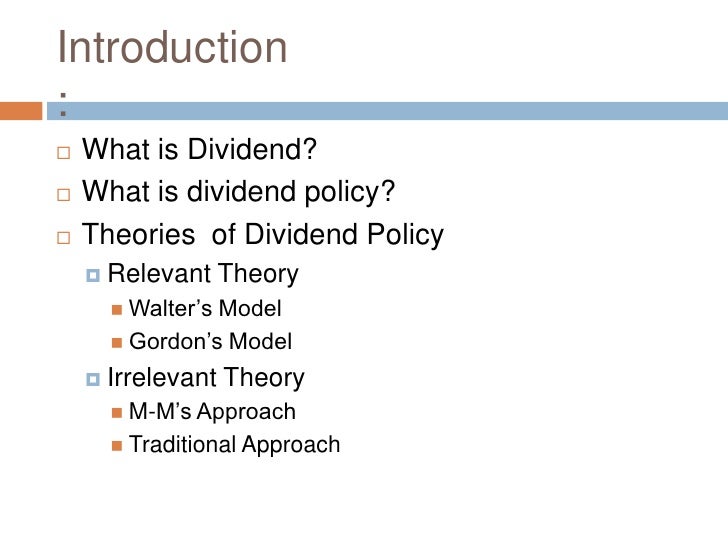

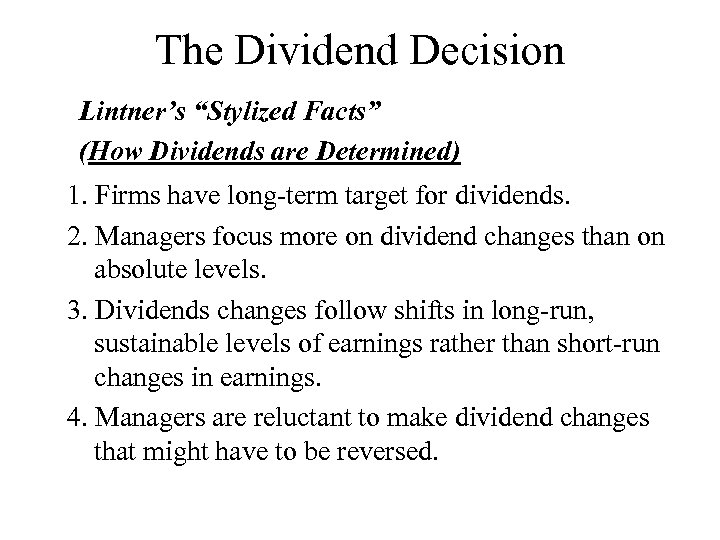

He also contends that dividend policy depends on the profitable investment opportunities.

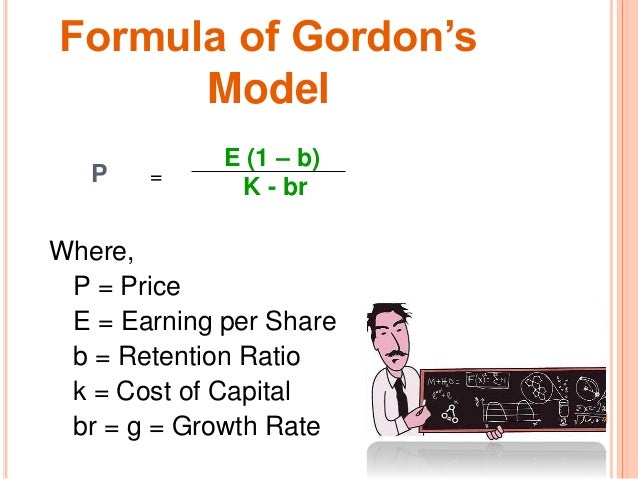

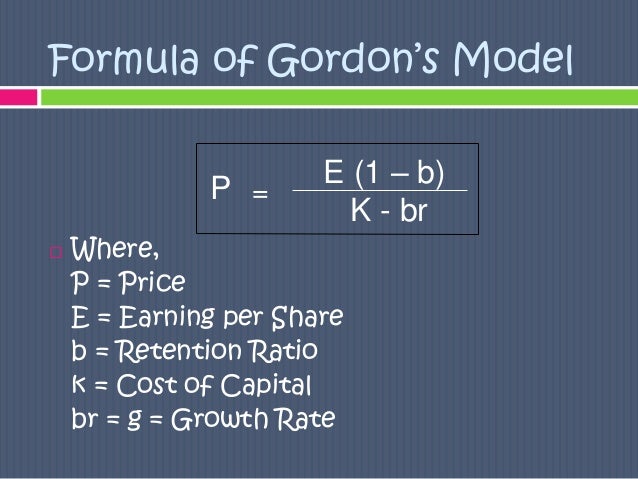

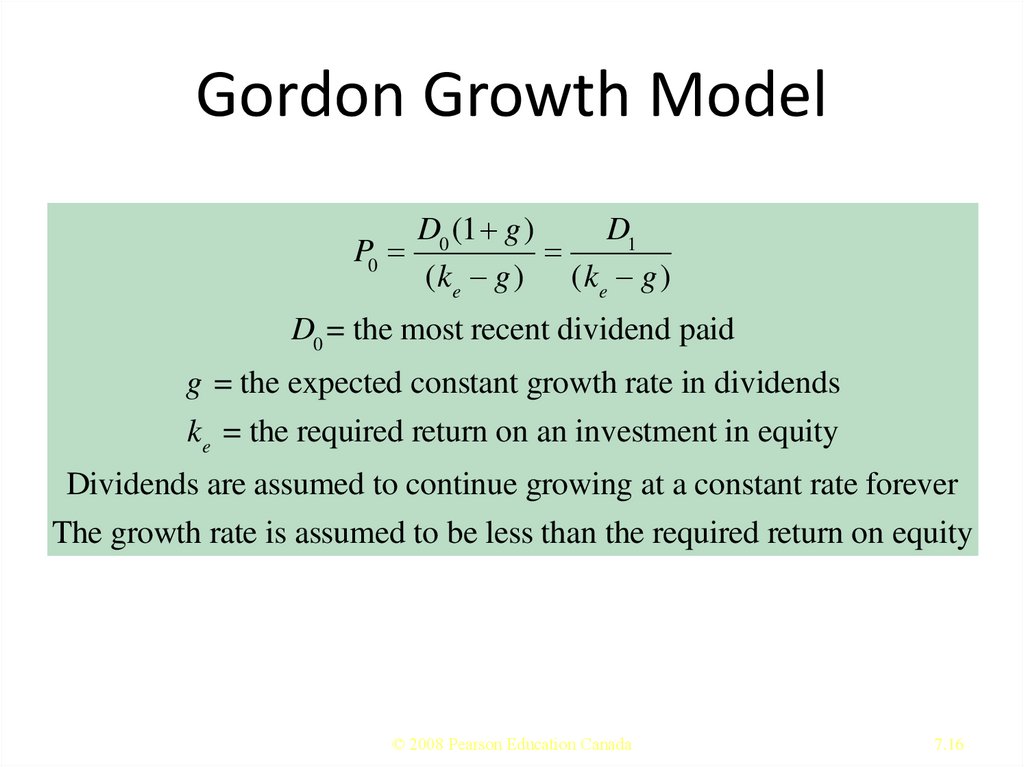

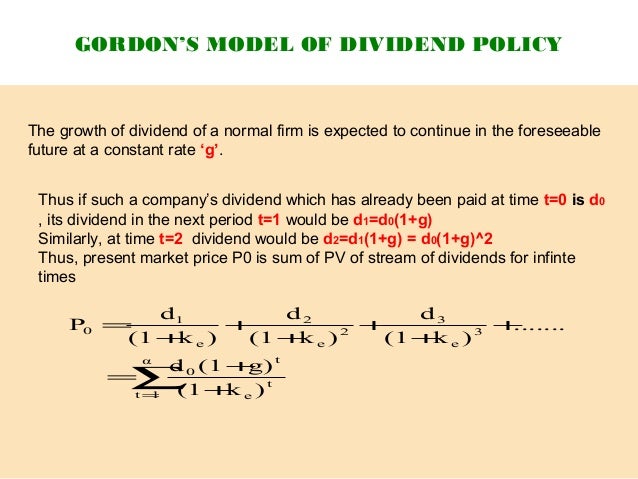

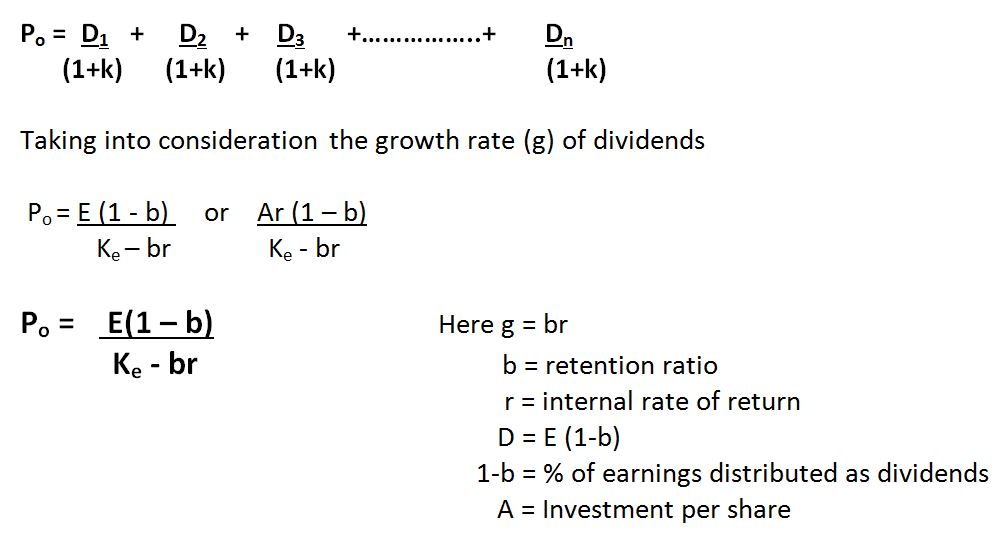

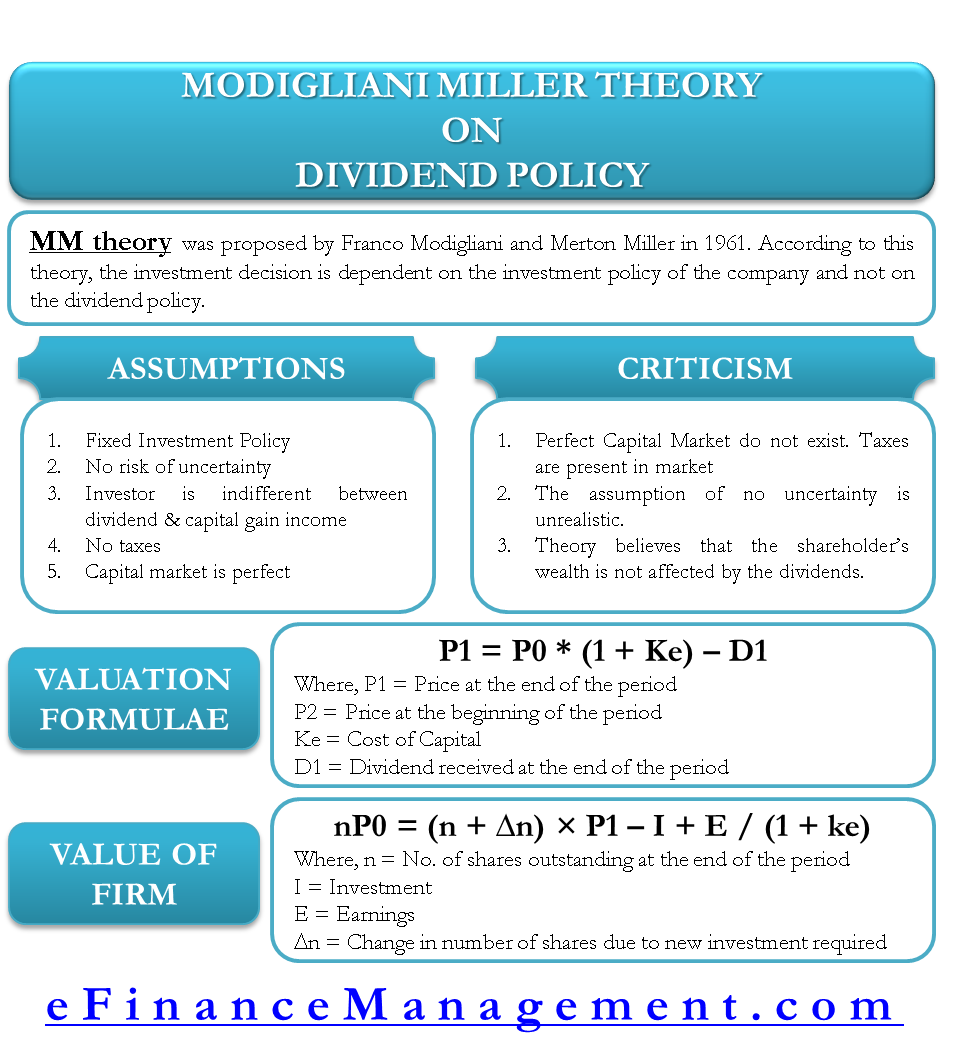

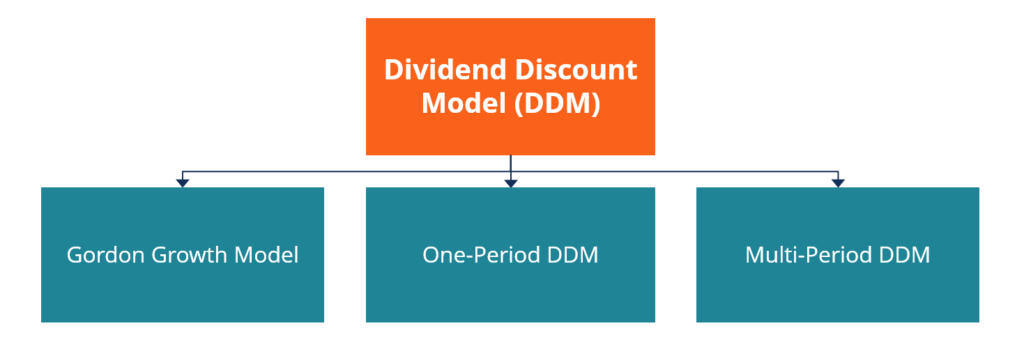

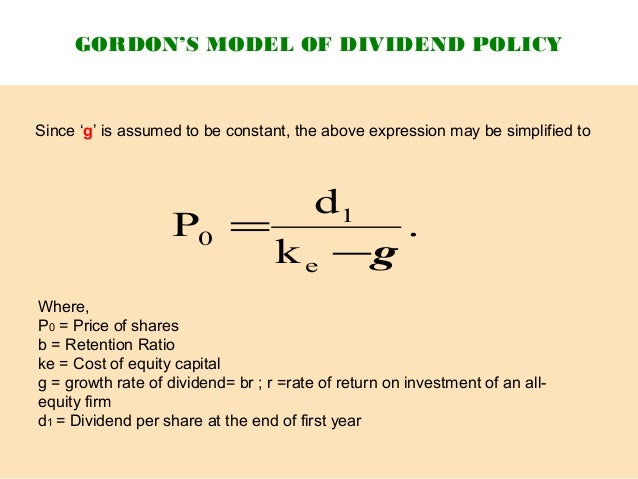

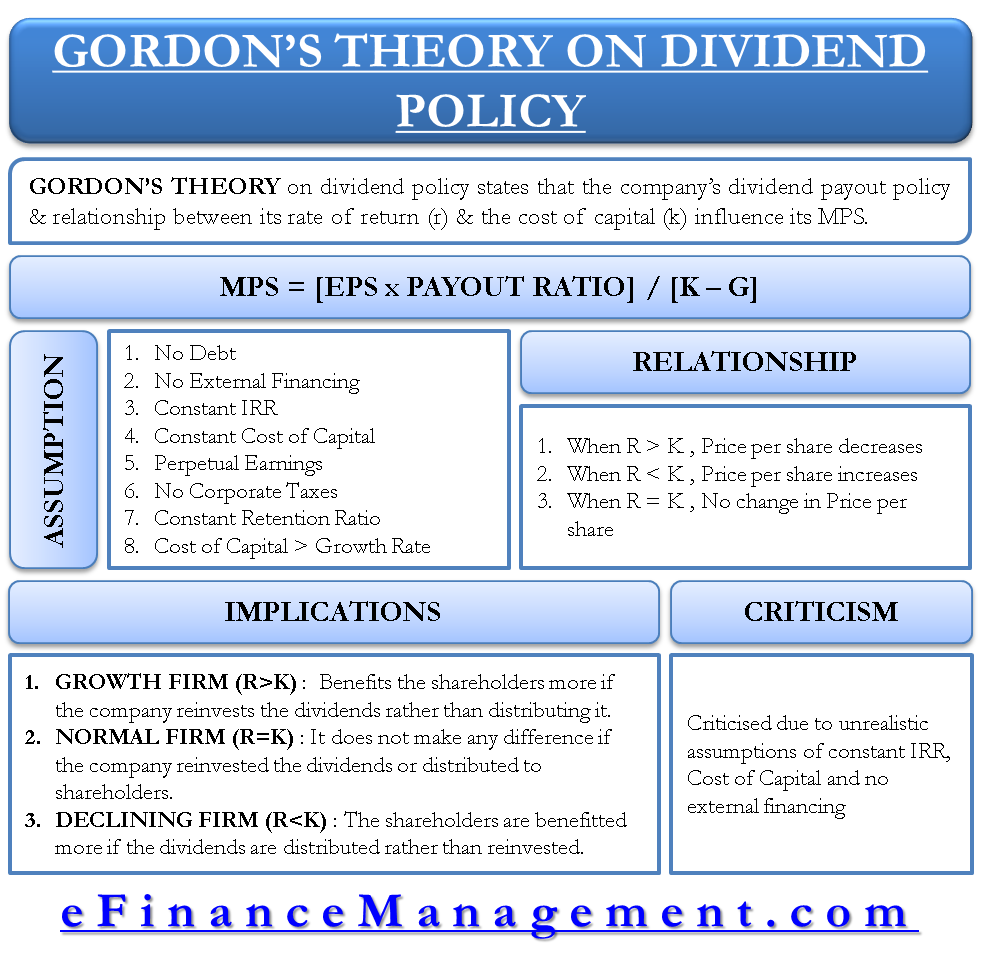

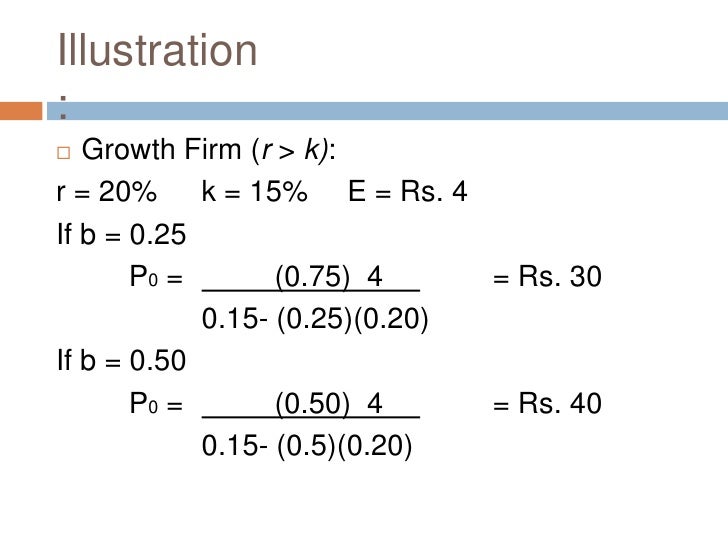

Gordon model of dividend policy ppt. A firms dividend policy has the effect of dividing its net earnings into two parts. Modigliani millers irrelevance modelbr depends onbr depends onbr 34. Gordons formula to calculate the market price per share p is p eps 1 b k g where p market price per share.

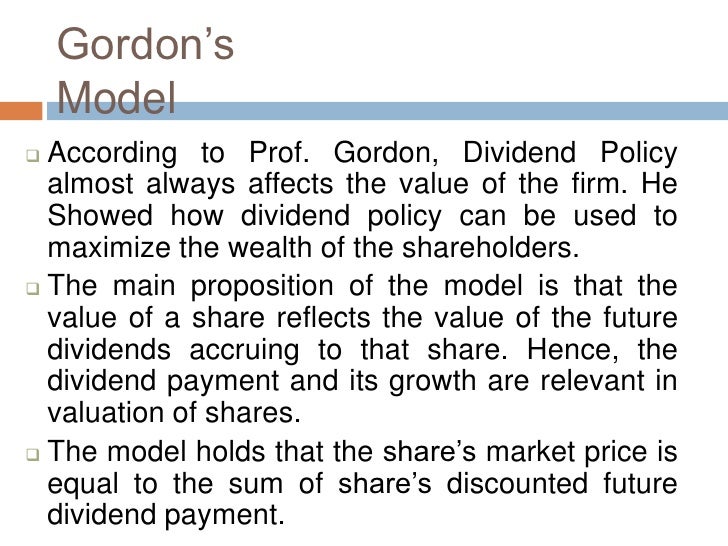

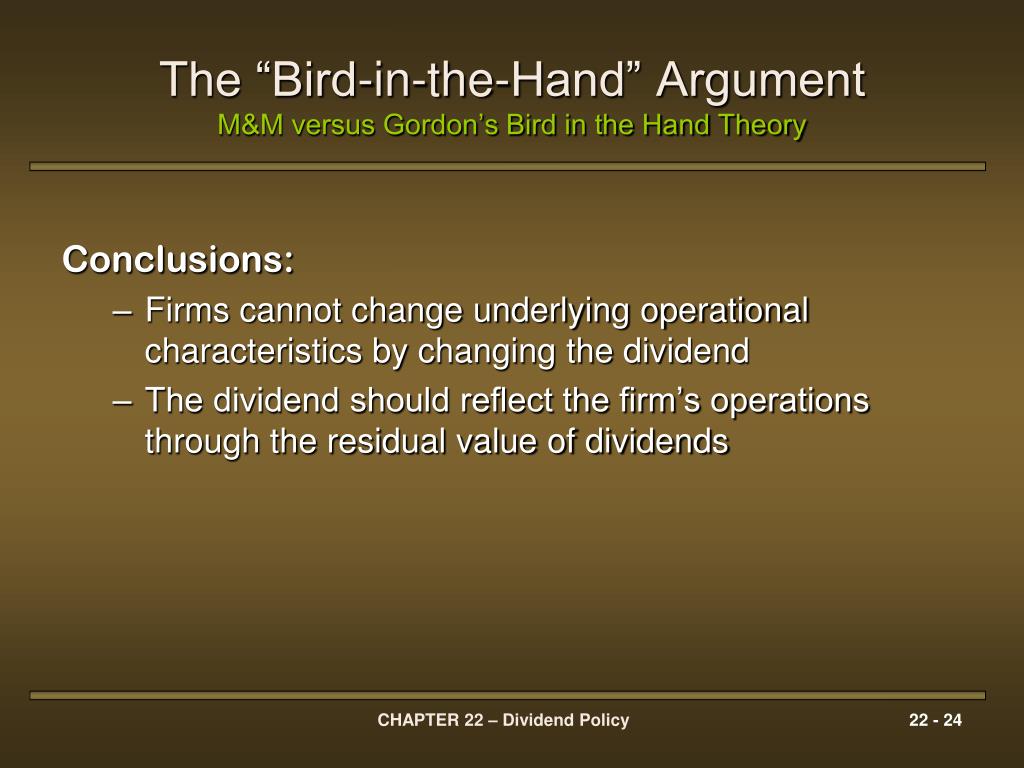

Retained earnings and dividends. The crux of the argument of gordons model is the value of a dollar of dividend income is more than the value of a dollar of capital gain. Thus gordon clearly states the relationship between internal rate of return r and the cost of capital k.

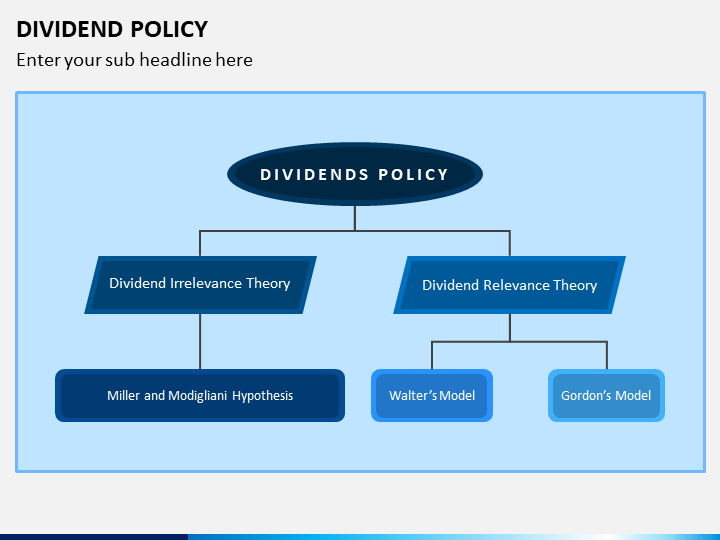

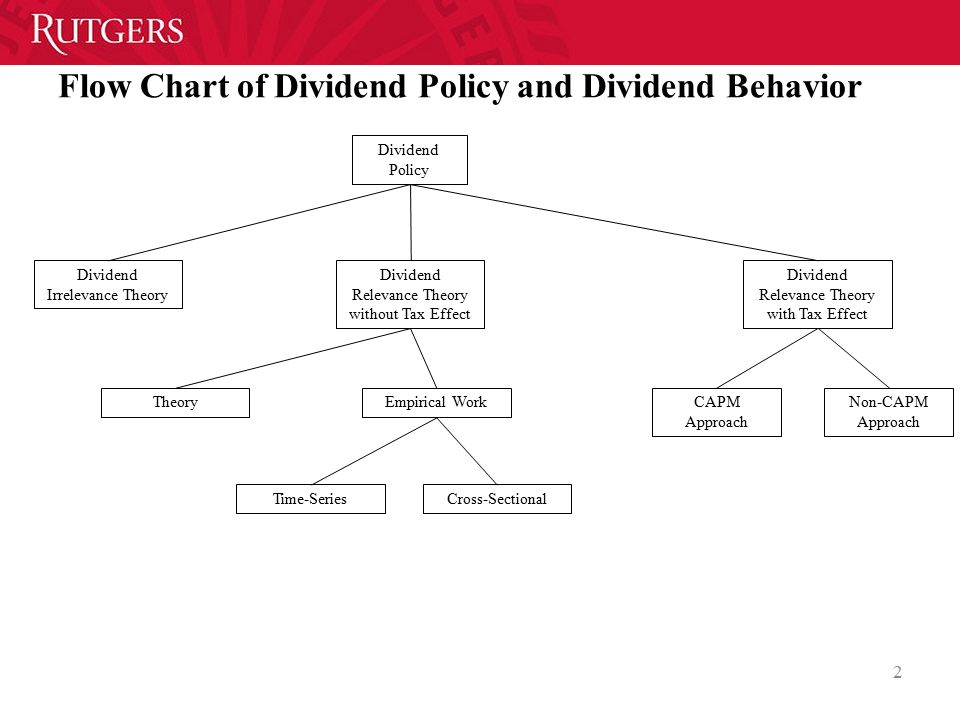

Unit v dividend theory introduction and objectives of dividend policy forms of dividend dividend relevance walter gordon. This is an account of the uncertainty of the future and the shareholders discount future dividends at a higher rate. Irrelevance theoriesbr 33.

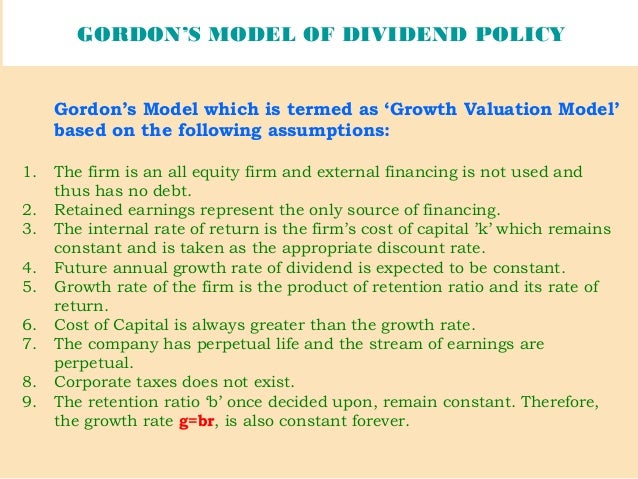

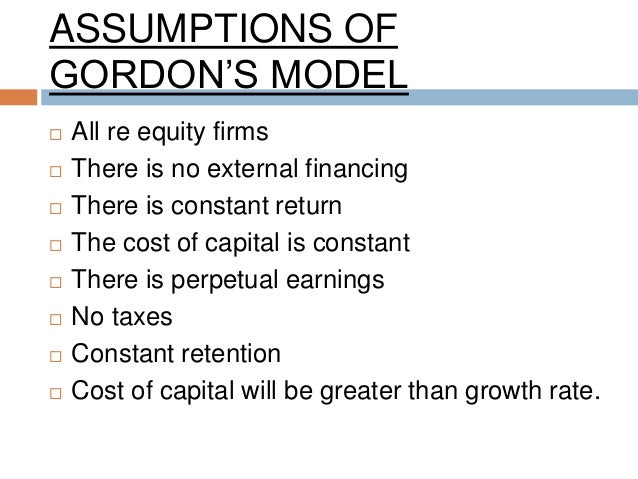

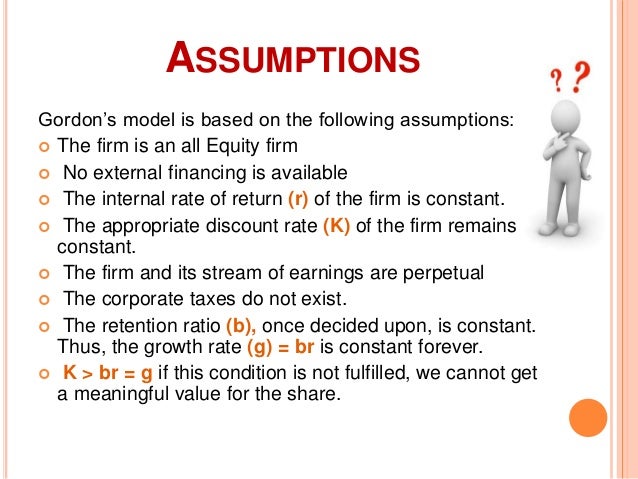

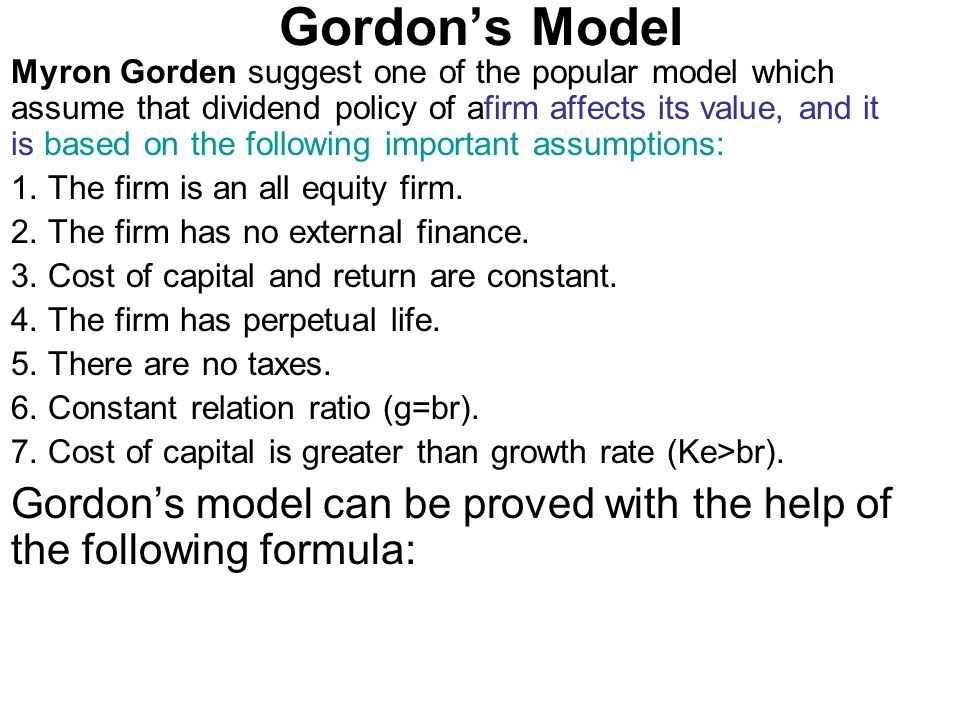

I the firm is an all equity firm. Valuation formula of gordons model and its denotations. Gordon dividend decision model.

His basic valuation model is based on the following assumptions. Walter suggesting that dividends are relevant and the dividend decision of the firm affects its value. Gordons model abhishek stephen.

Criticisms of gordons modelbr as the assumptions of walters model and gordons model are same so the gordons model suffers from the same limitations as the walters modelbr 32. Gordons model assumes that the cost of capital k growth rate g. Ii no external financing is available or used.

The firm is an all equity firm. This is important for obtaining the meaningful value of the companys share. Gordon dividend policy almost always affects the value of the firm.

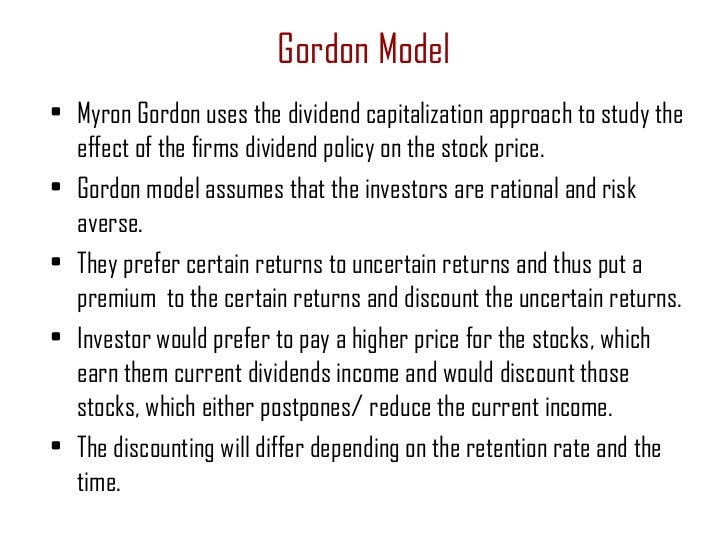

Payment of current dividends completely removes the possibility of risk. One very popular model explicitly relating the market value of the firm to dividend policy is developed by myron gordon. Definition according to prof.

Gordon argued for the relevance of dividend decisions to valuation of firm. No external financing is available. View unit vppt from acc 545 at lovely professional university.

He believed that investors or shareholders prefer current dividends to future dividends as they are rational and not committed to take risks. Gordons model is based on the following assumptions. Myron gordon has also developed a model on the lines of prof.

The internal rate of return r of the firm is constant. He showed how dividend policy can be used to maximize the wealth of the shareholders.