Gordon Model Of Dividend Policy Problems

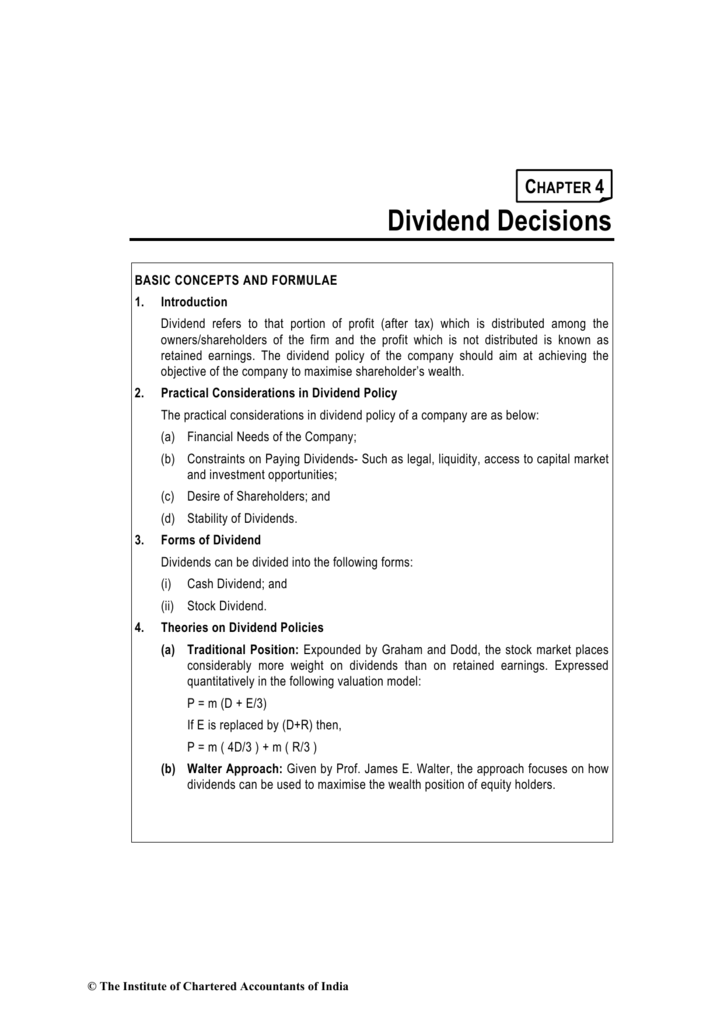

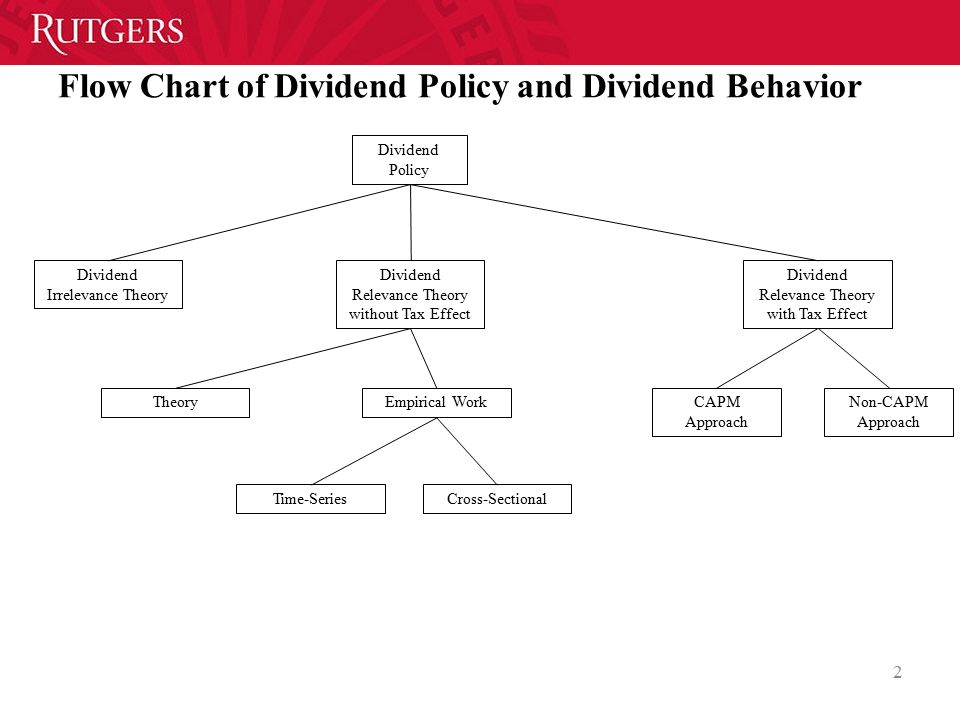

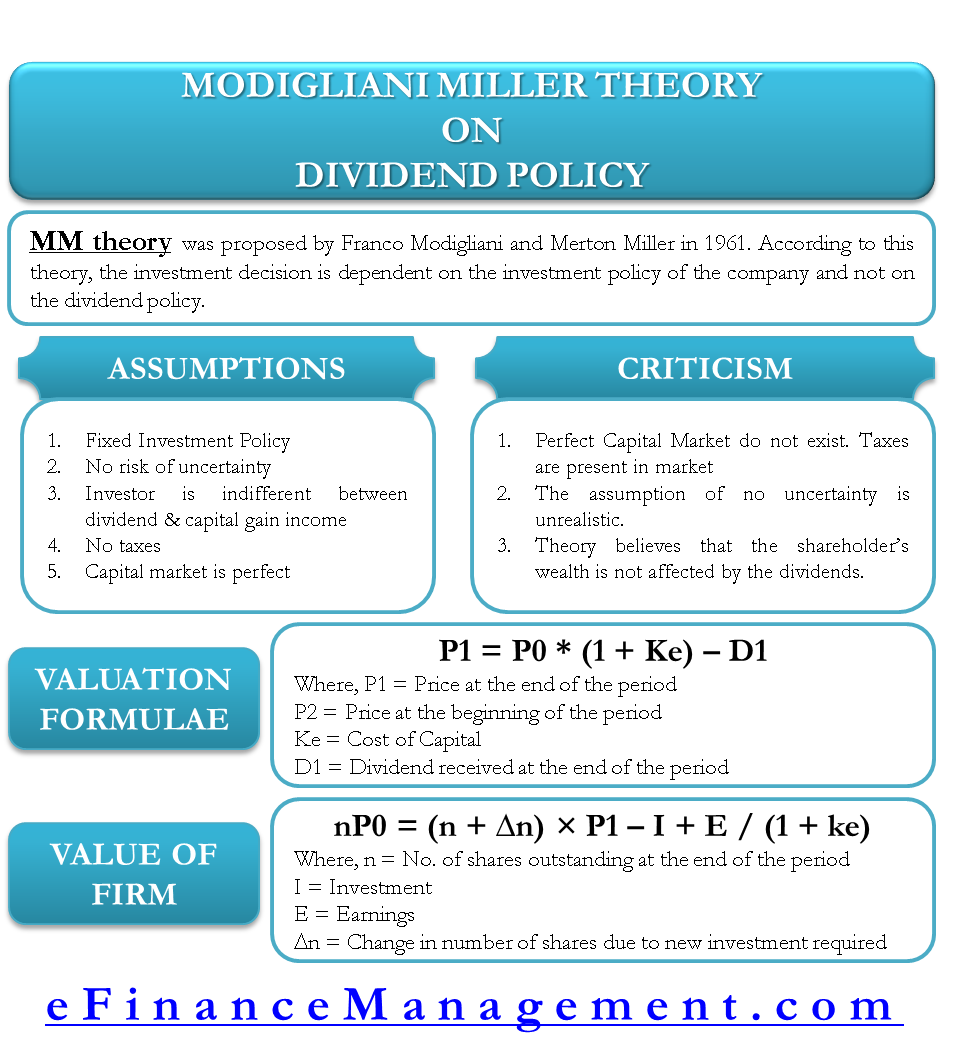

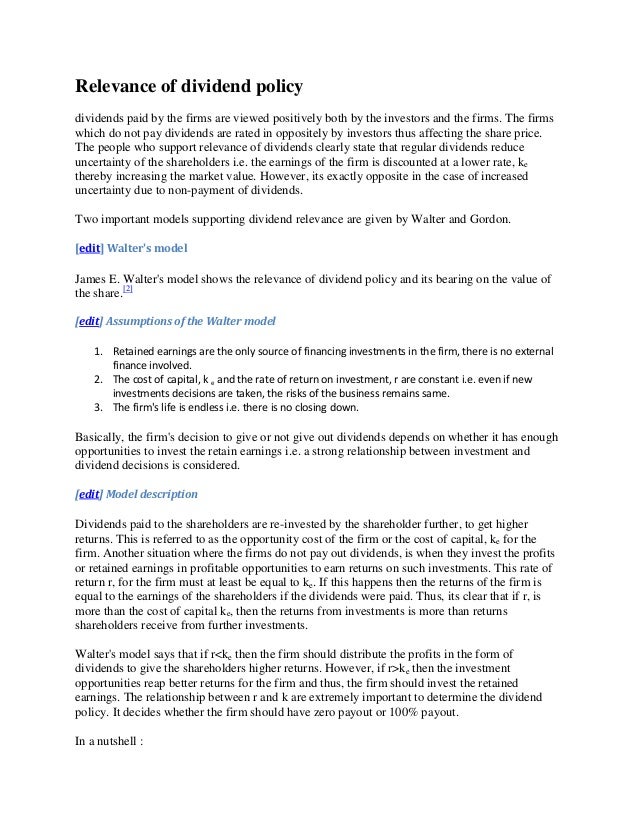

According to them the dividend policy of a firm is irrelevant since it does not have any effect on the price of shares of a firm ie it does not affect the shareholders wealth.

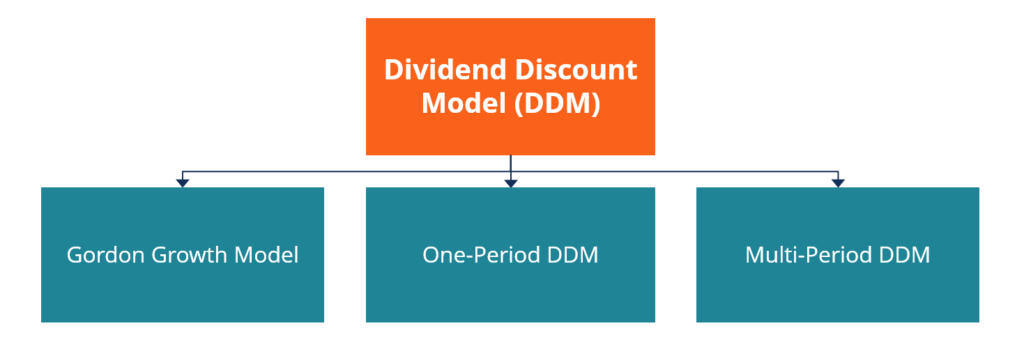

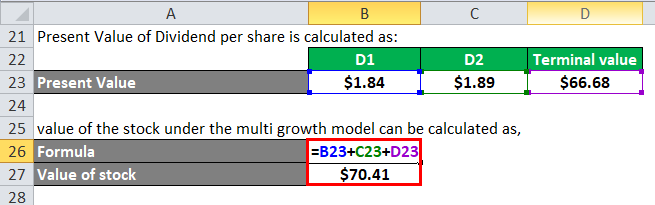

Gordon model of dividend policy problems. This dividend discount model may tell you a stock is always a good value. Gordons model abhishek stephen. Modigliani miller hypothesis provides the irrelevance concept of dividend in a comprehensive manner.

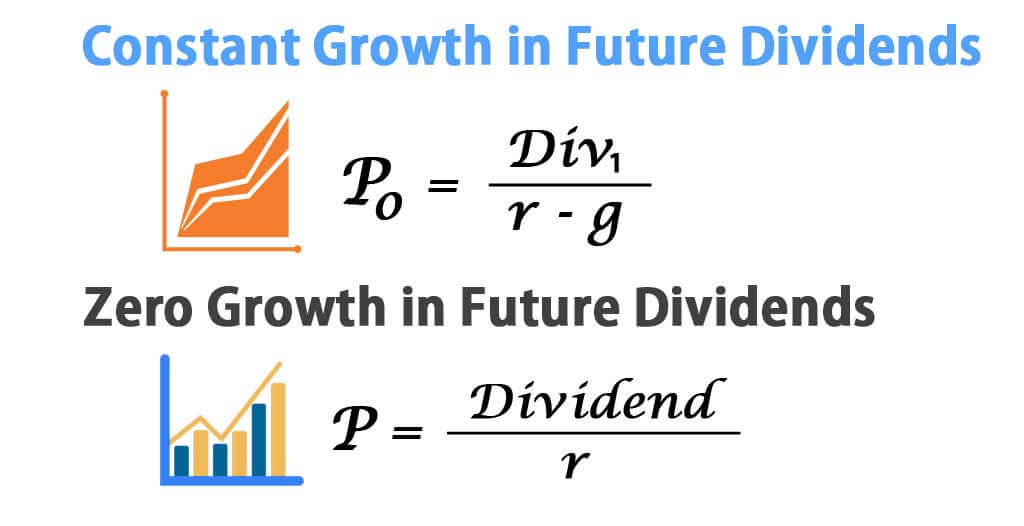

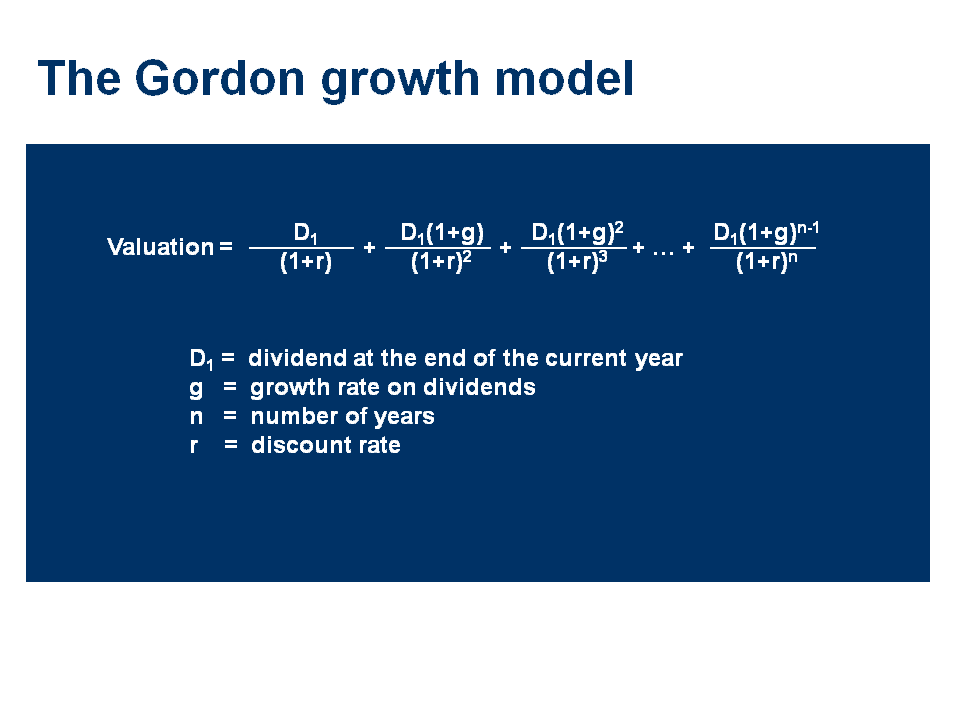

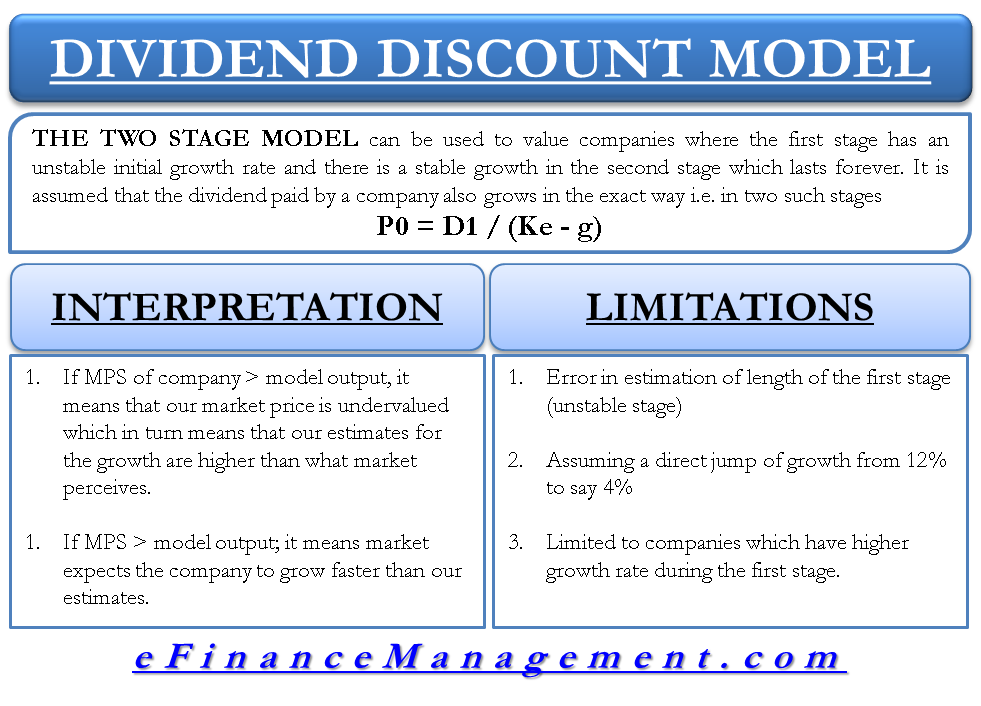

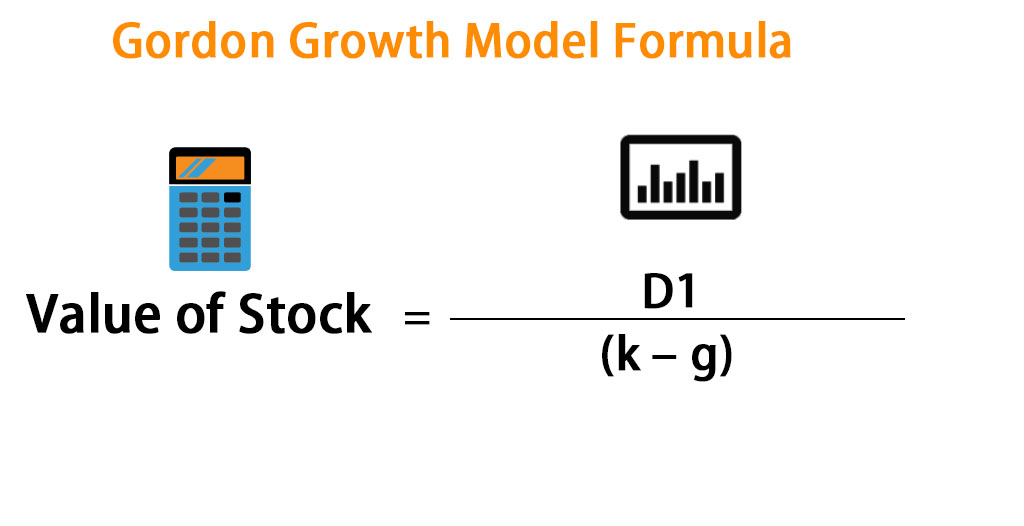

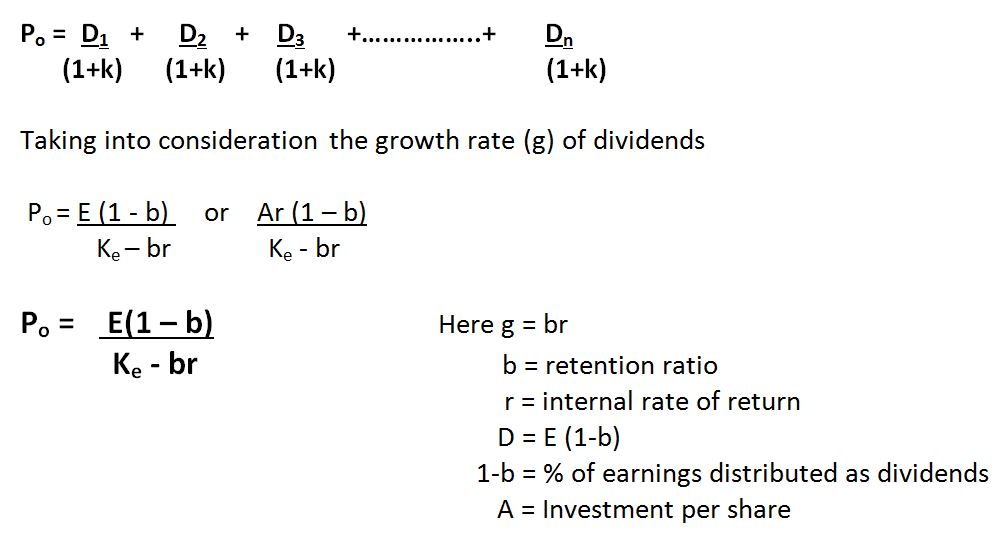

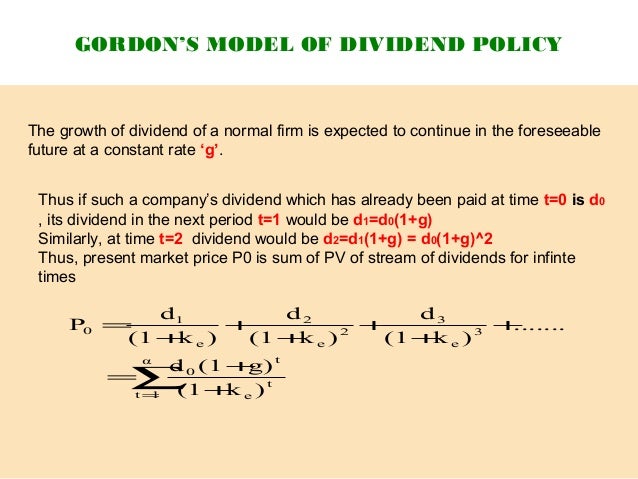

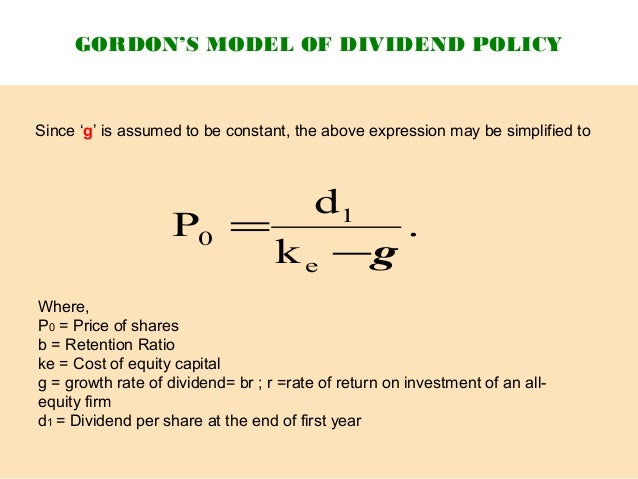

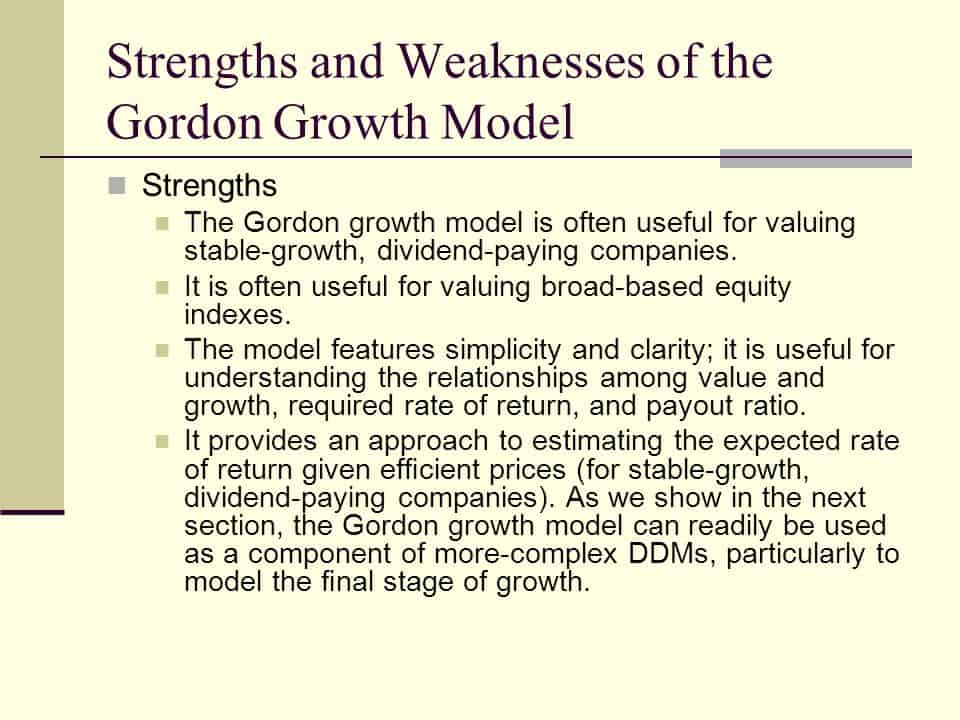

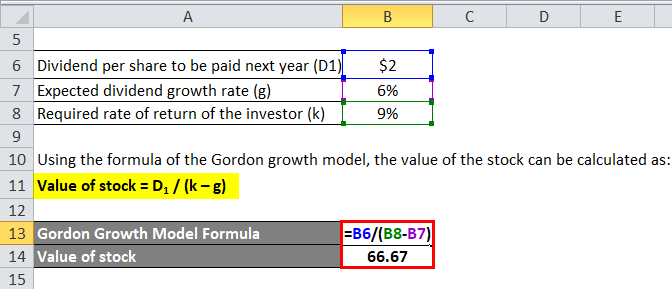

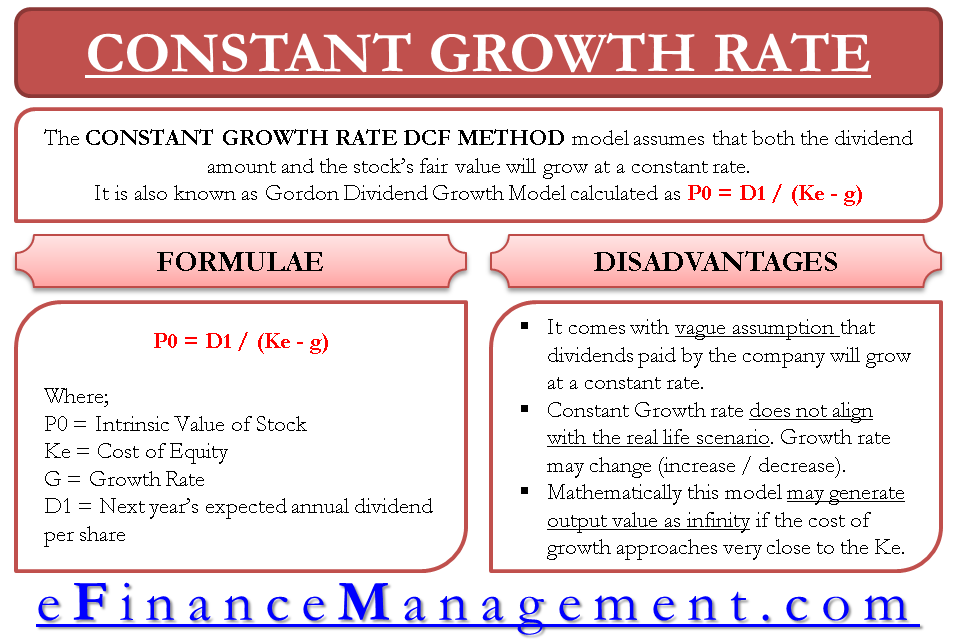

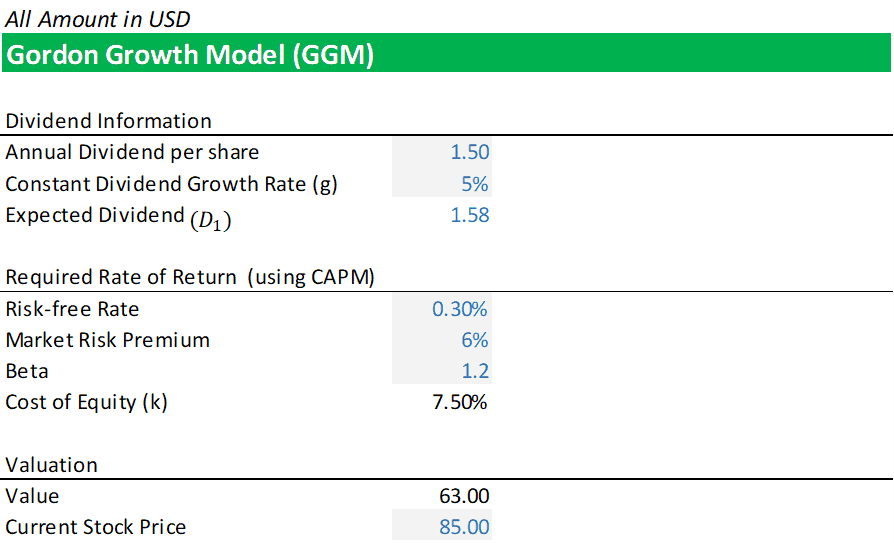

The main limitation of the gordon growth model lies in its assumption of constant growth in dividends per share. The gordon growth model also known as the dividend discount model measures the value of a publicly traded stock by summing the values of all of its expected future dividend payments discounted. The gordon growth model is a very disciplined and rational means to value a stock.

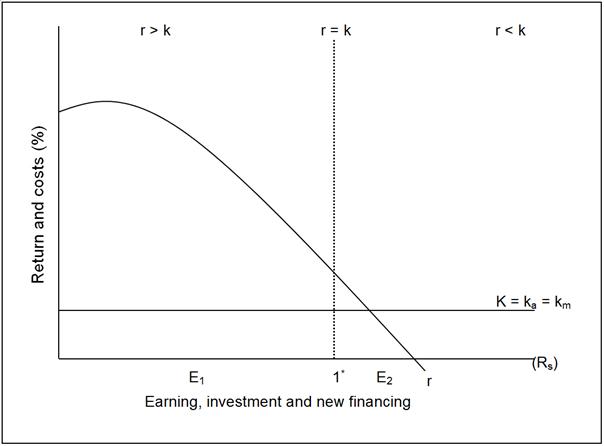

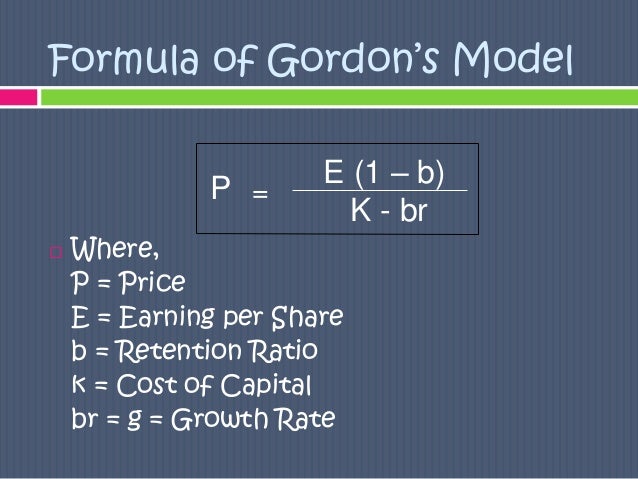

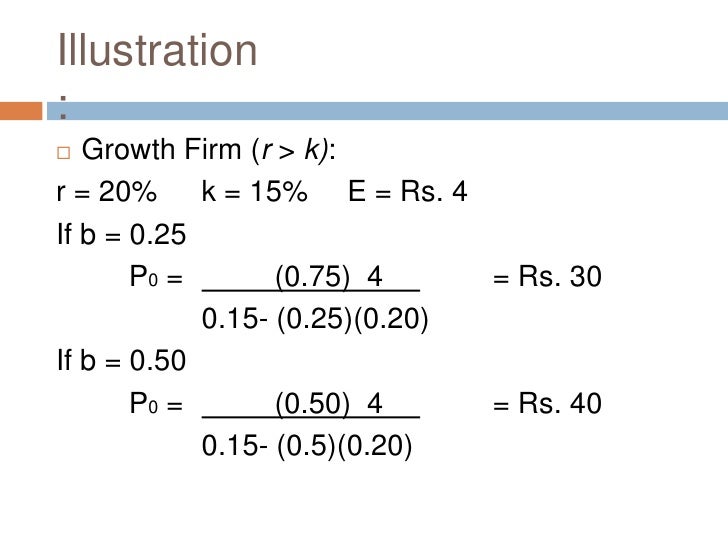

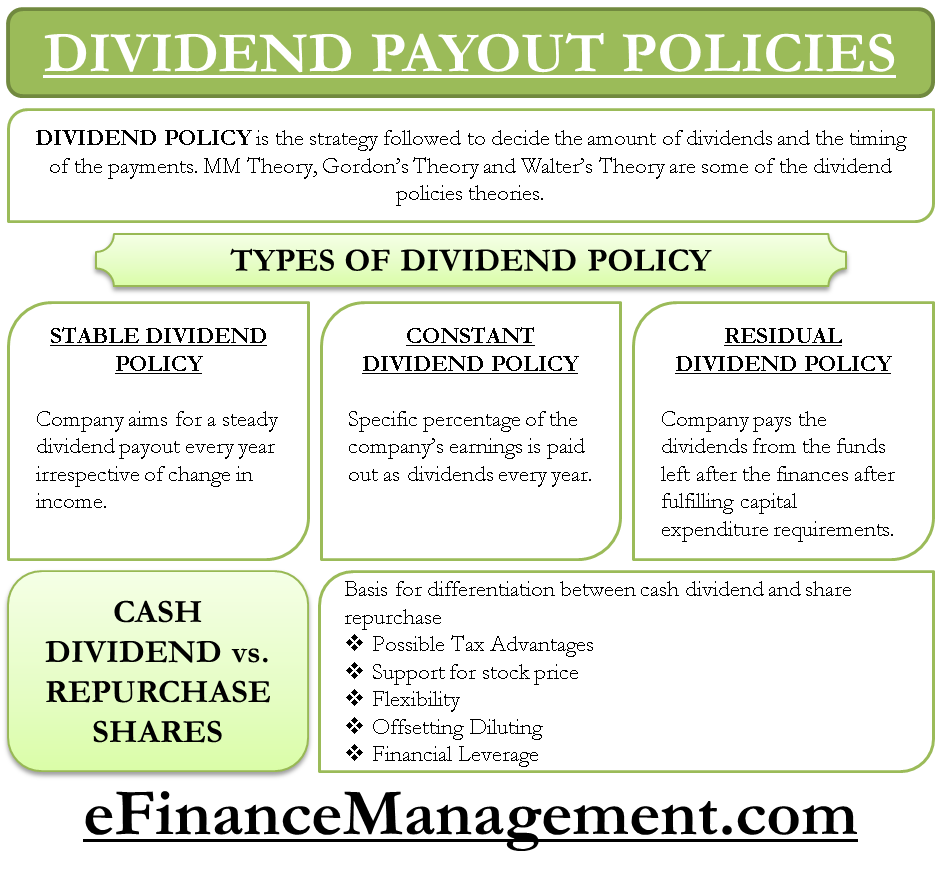

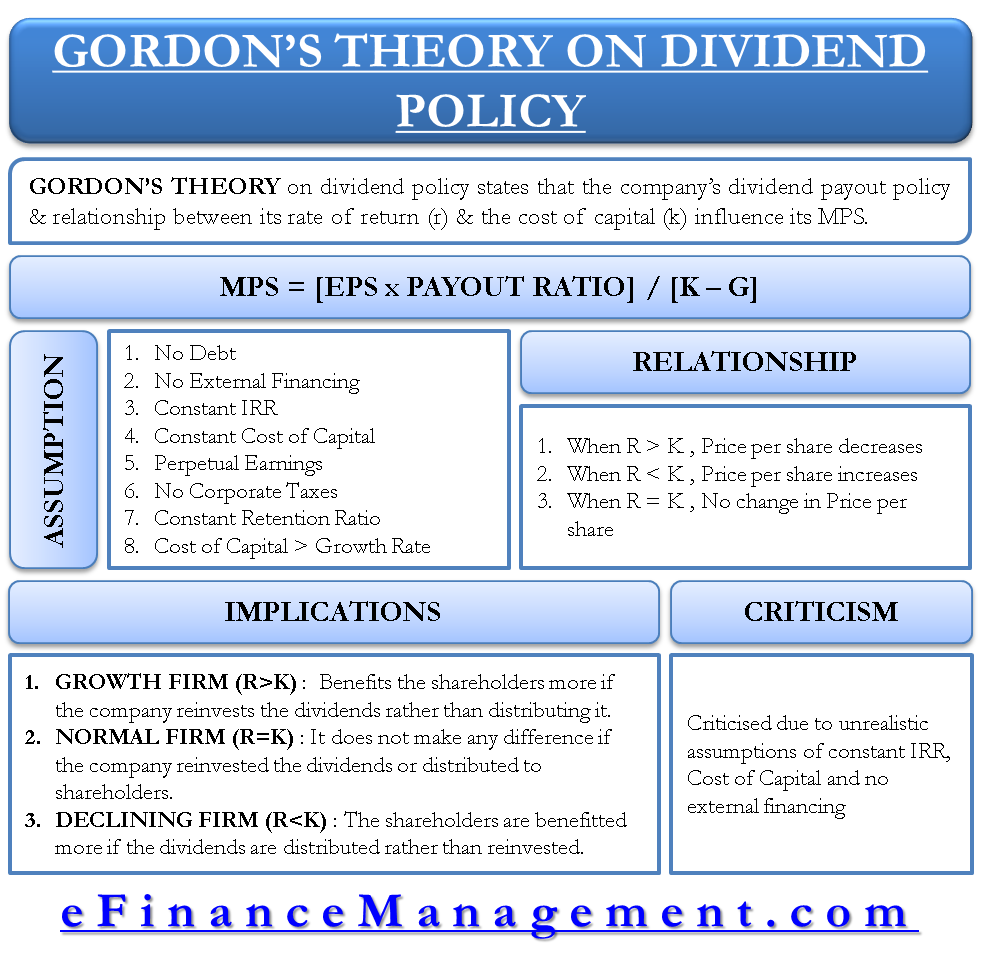

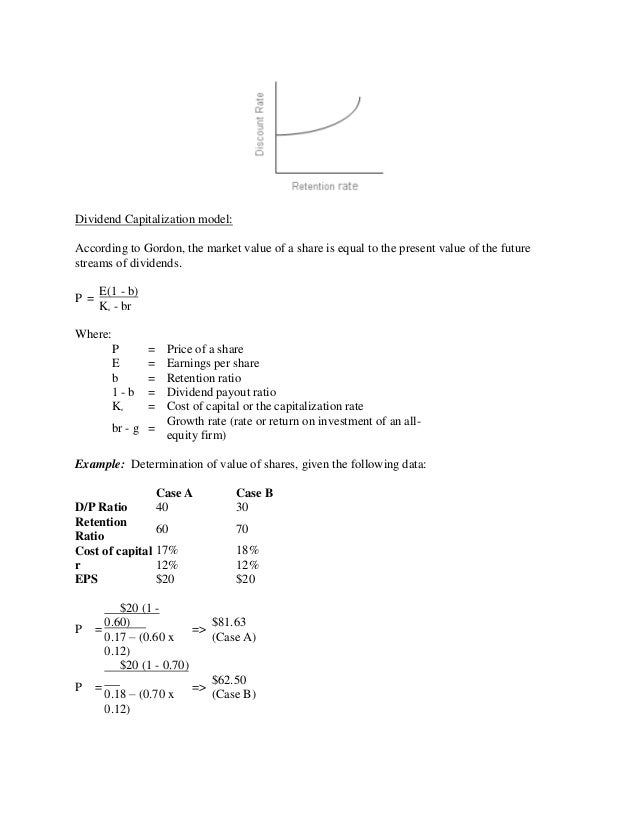

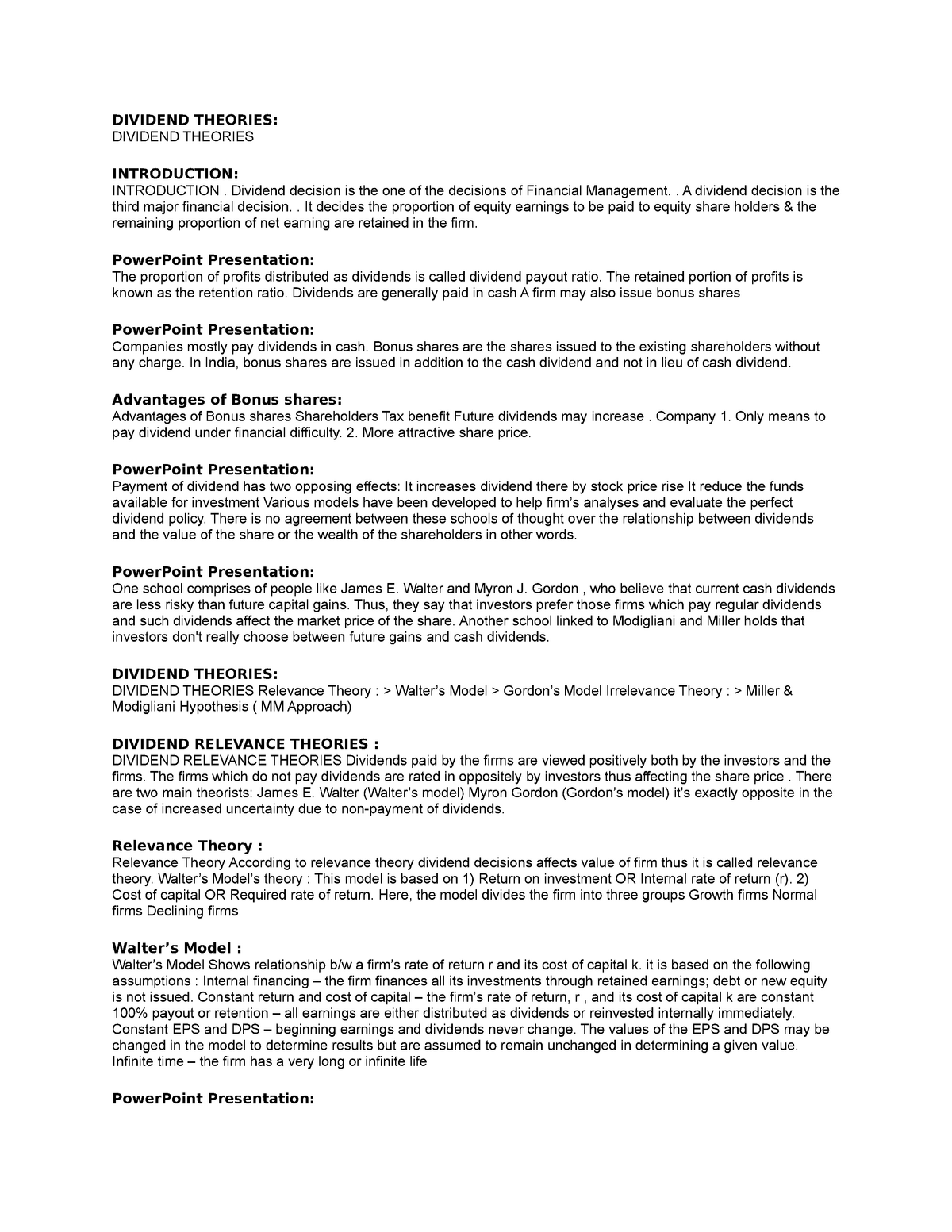

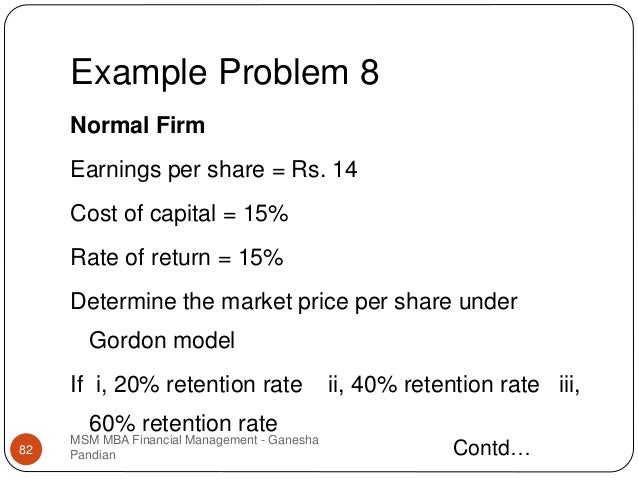

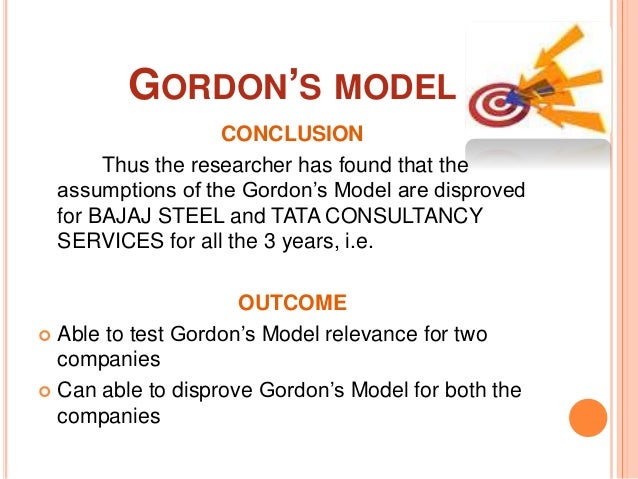

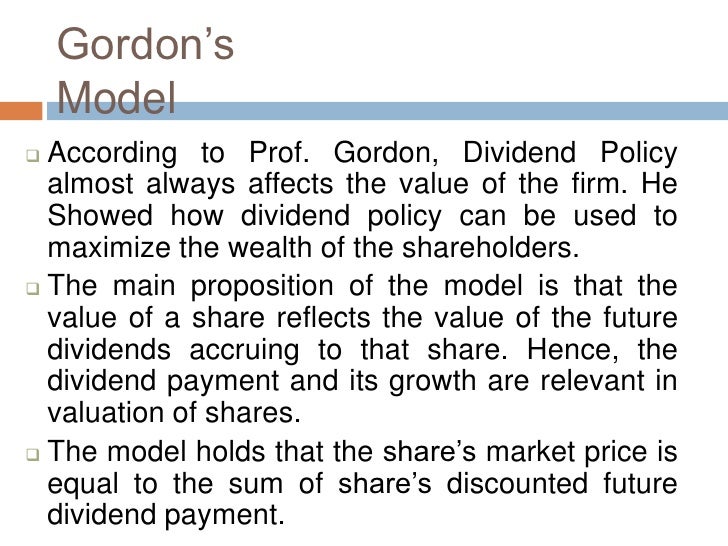

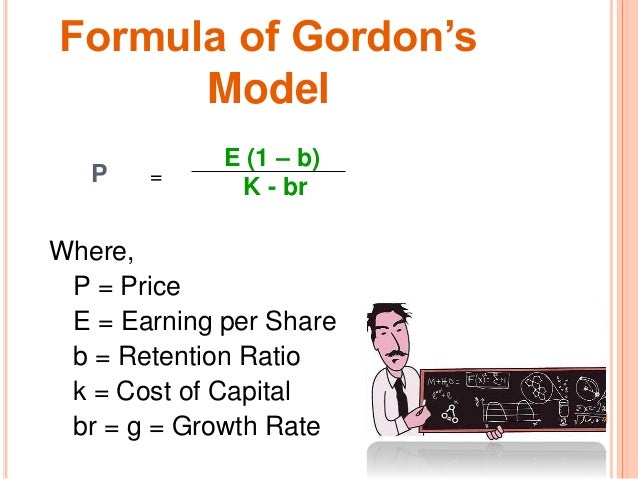

The model is inaccurate in assuming that r and k always remain constant. Gordon dividend policy almost always affects the value of the firm. The main proposition of the model is that the value of a share reflects the value of the future dividends accruing to.

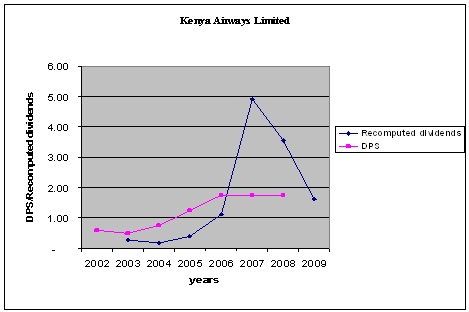

Unfortunately the stock market is rarely rational. Another issue is the high sensitivity of the model to the growth rate and discount factor used. Definition according to prof.

The gordon growth model sometimes referred to as the dividend growth model uses the investors required rate of return and the dividend growth rate to determine the value of the stock. Criticism of gordons model. In reality it is highly unlikely that companies will have their dividends increase at a constant rate.

Constant internal rate of return and cost of capital. The assumption that a company grows at a constant rate is a major problem with the gordon growth model. Gordons theory on dividend policy is criticized mainly for the unrealistic assumptions made in the model.

He showed how dividend policy can be used to maximize the wealth of the shareholders. 2 it is very rare for companies to show constant growth in their dividends due to.