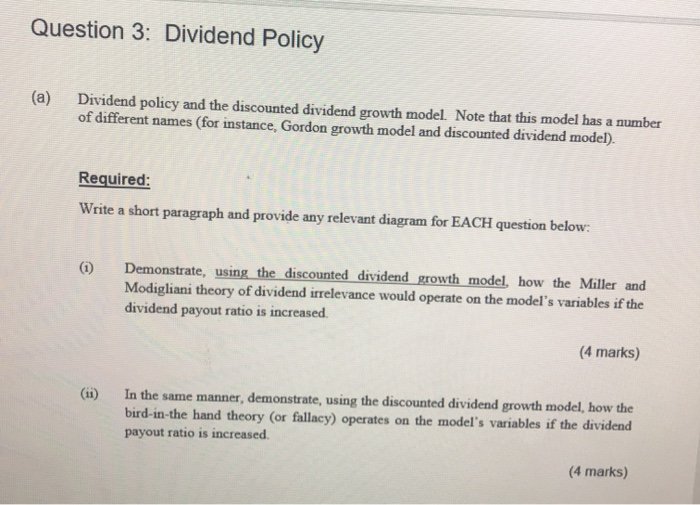

Gordon Model Of Dividend Policy

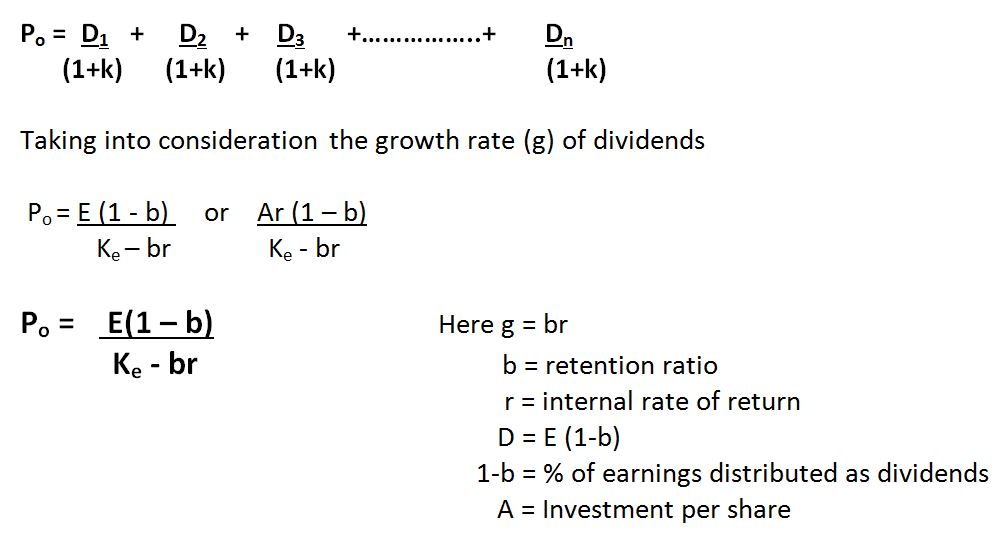

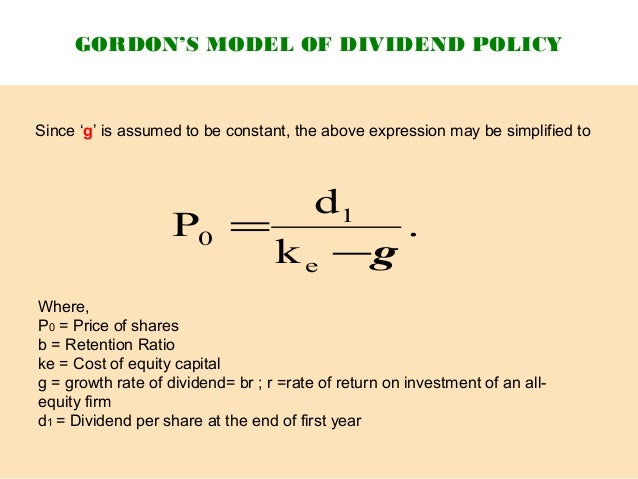

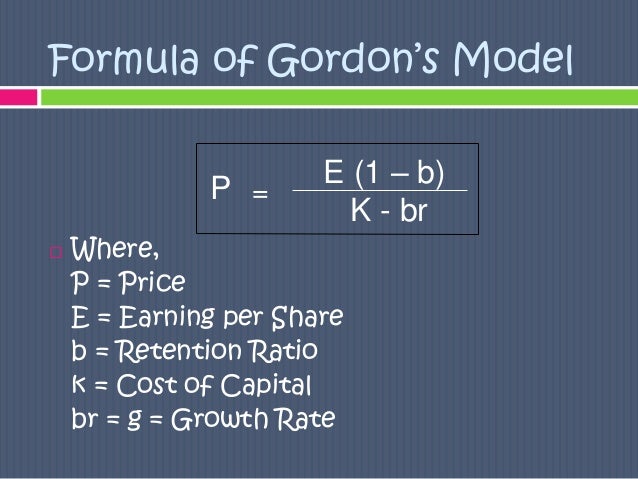

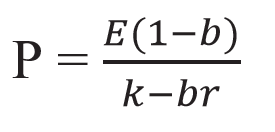

P e 1 b ke br.

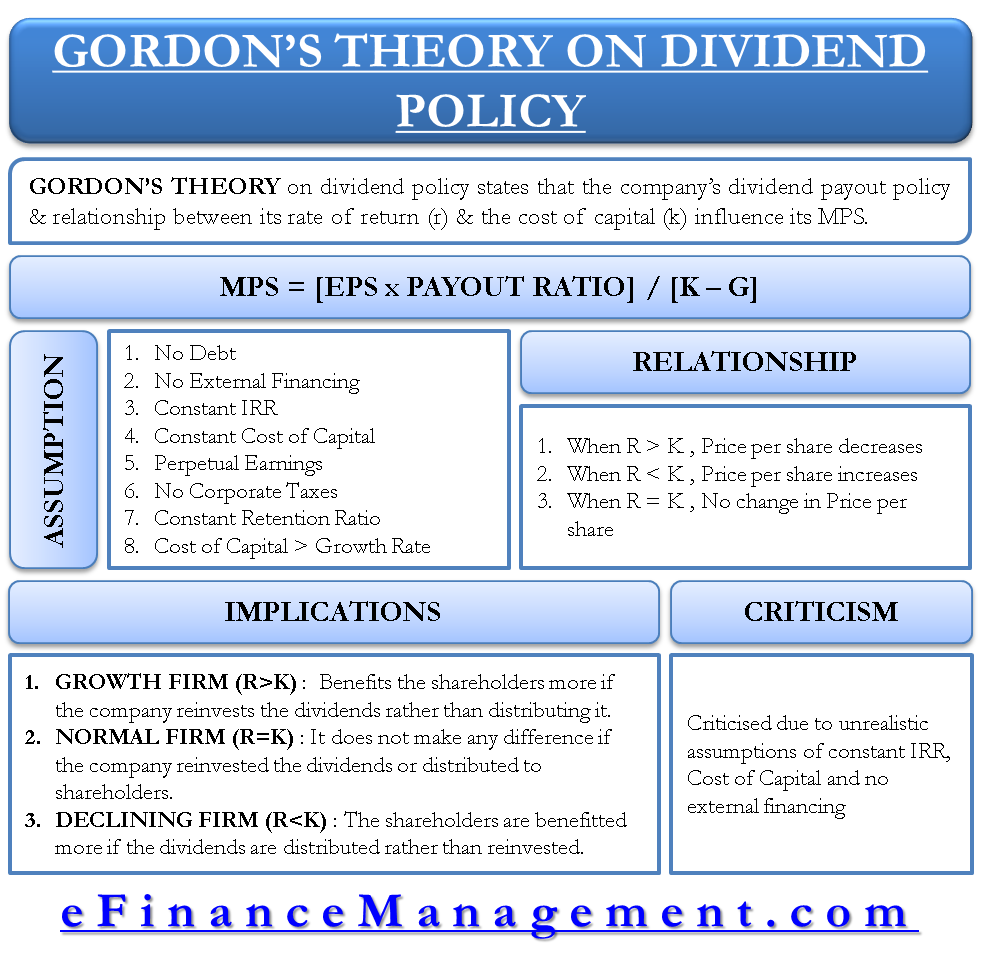

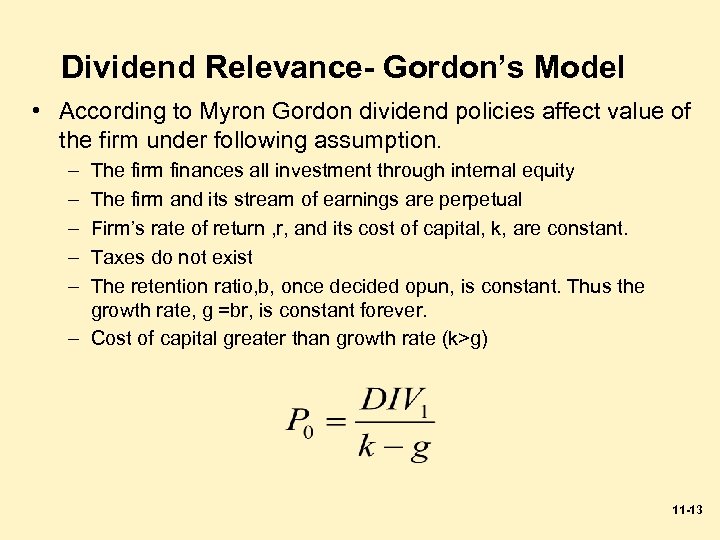

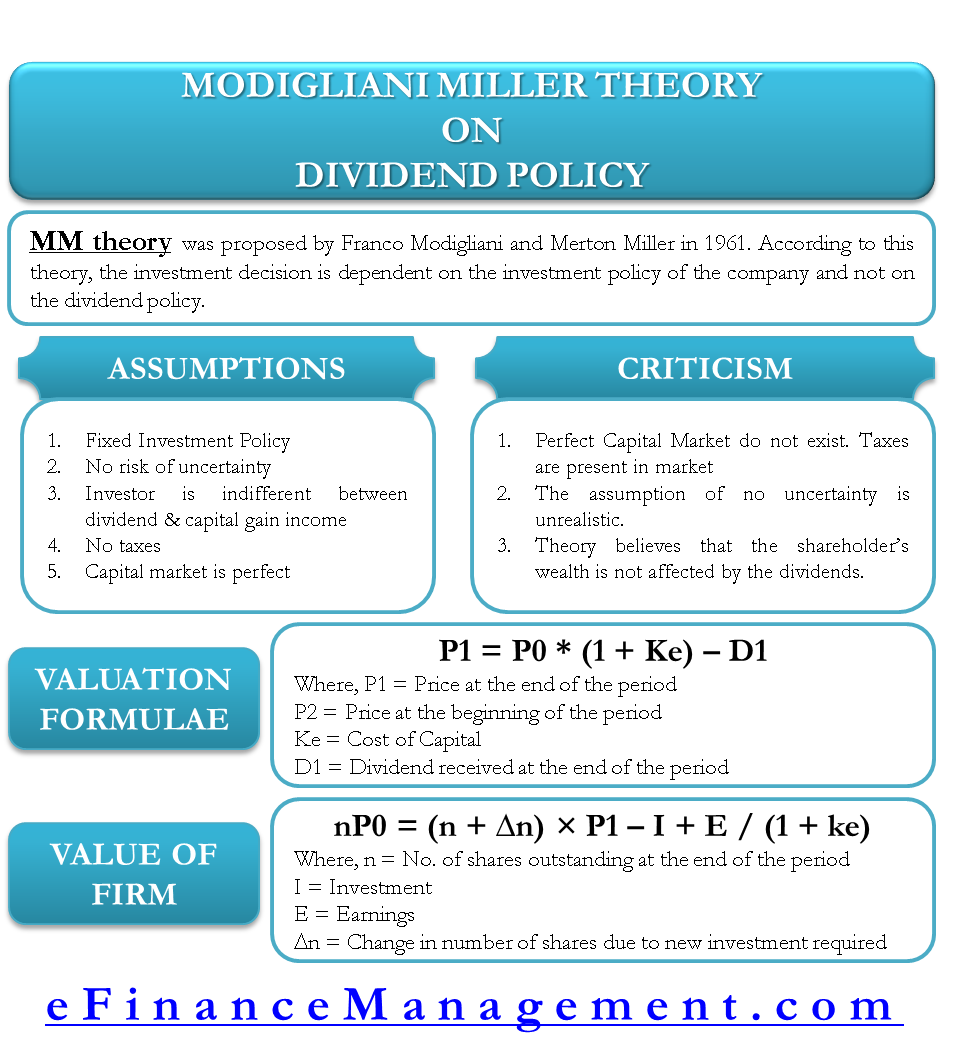

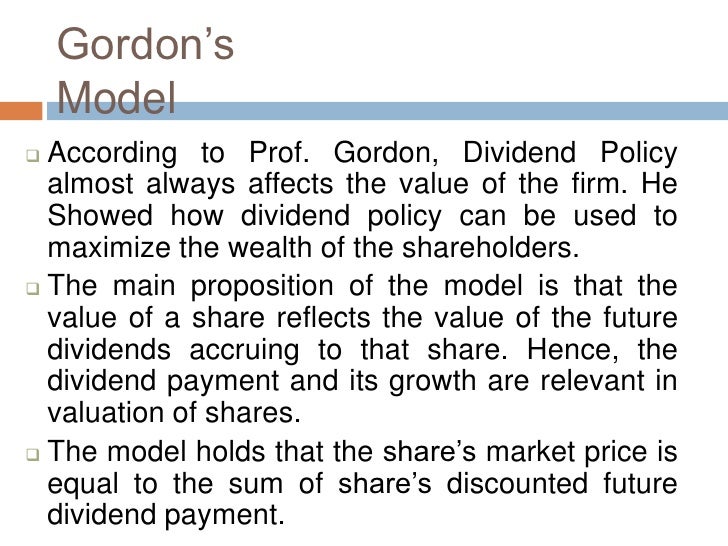

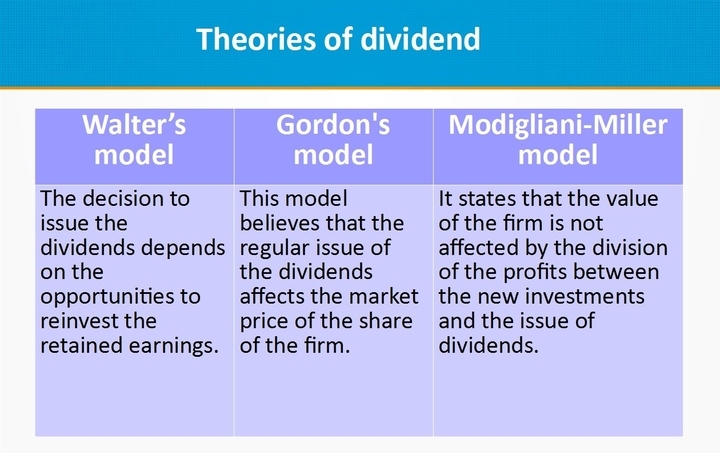

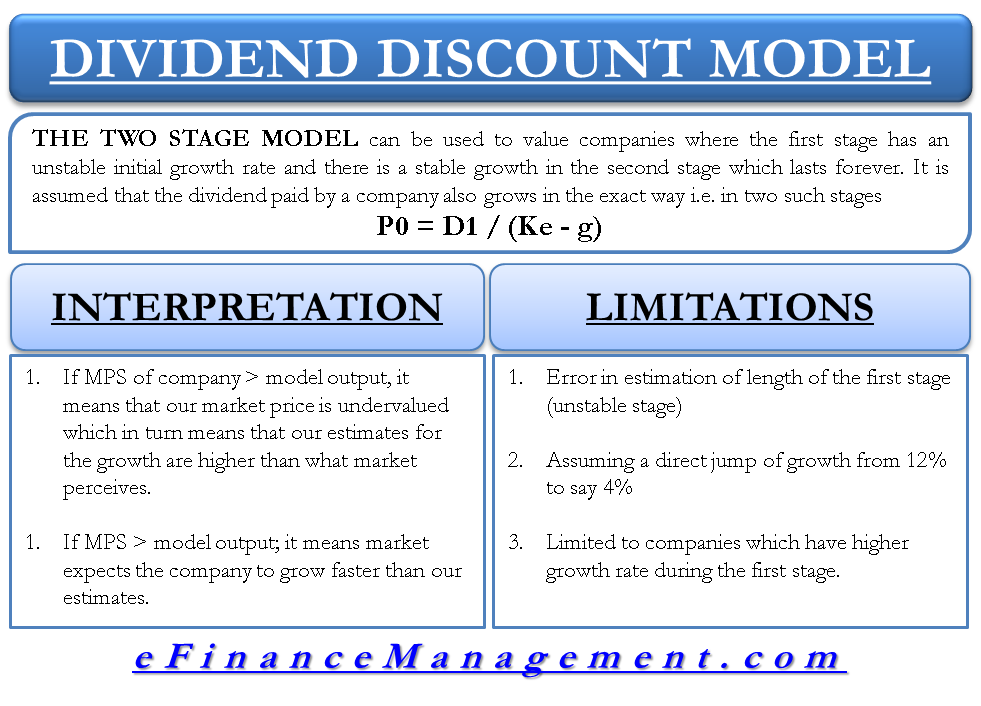

Gordon model of dividend policy. Puts less importance on it as compared to the current dividends. Thus an investor would discount the future dividends ie. Gordons model is based on the following assumptions.

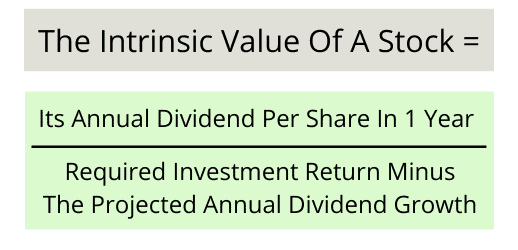

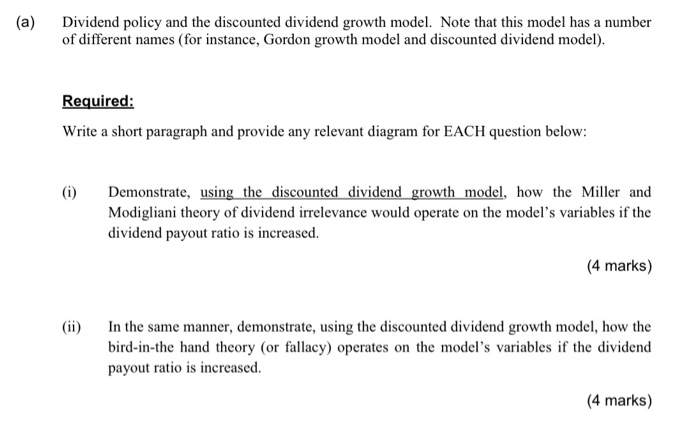

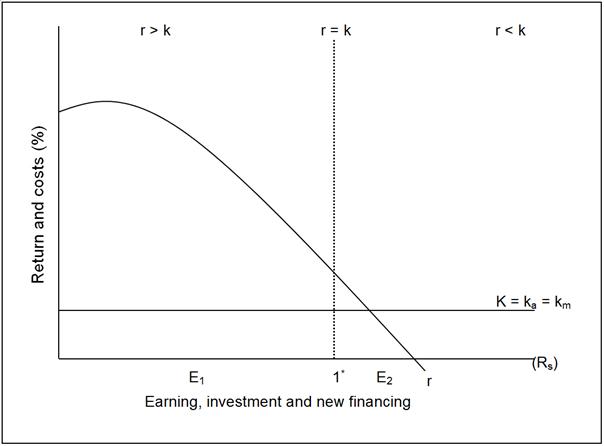

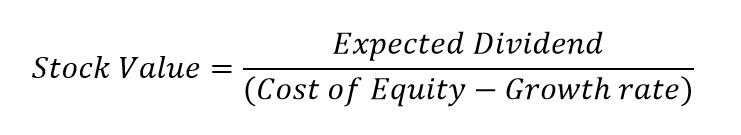

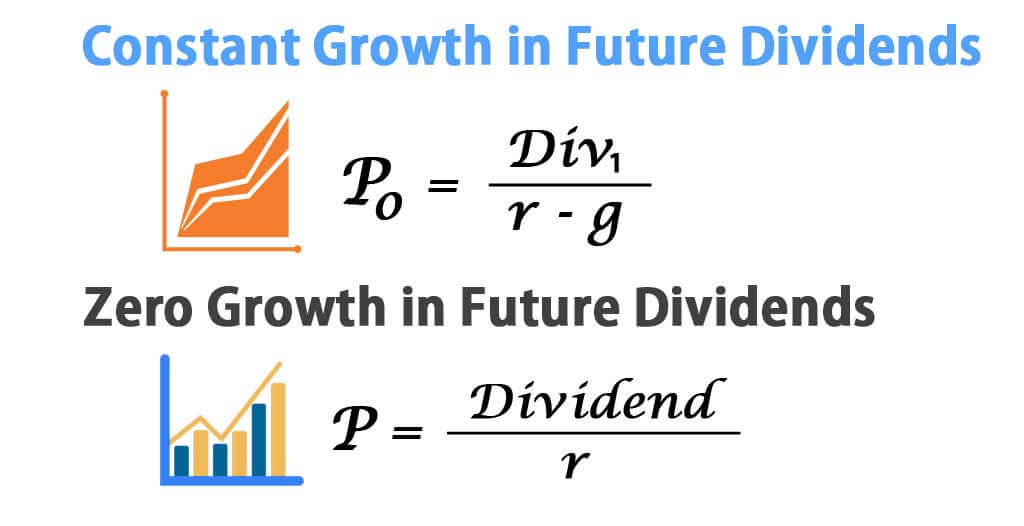

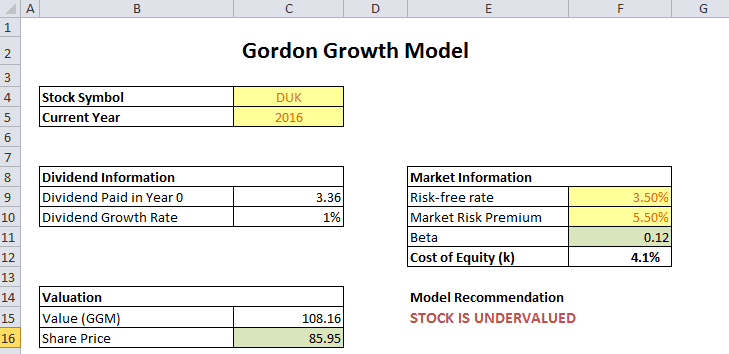

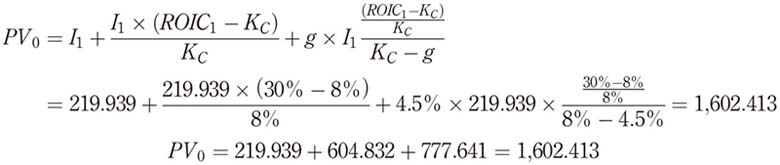

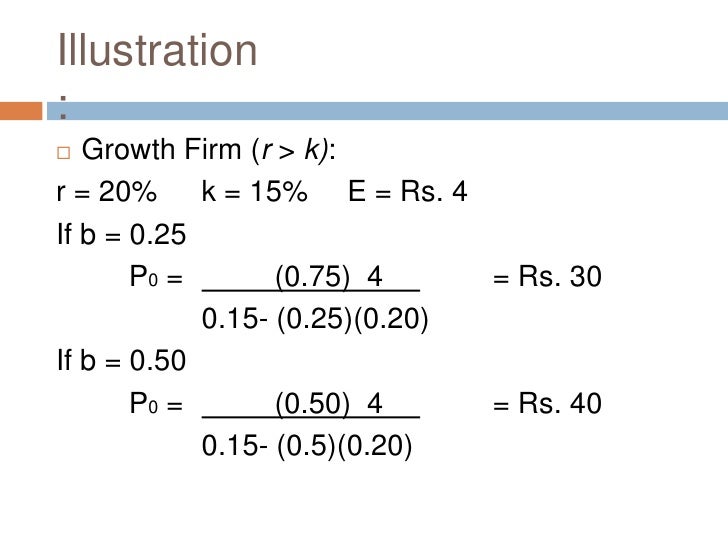

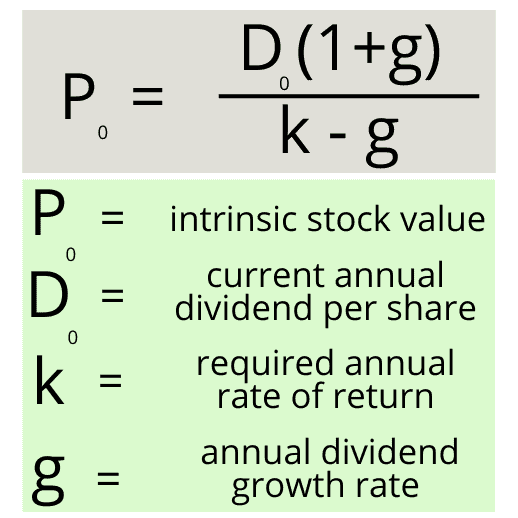

The gordon growth model is a tool to calculate the intrinsic value of a stock. Or at times just the constant growth model. Where p price of a share e earnings per share b retention ratio.

Sometimes you will hear this tool referred to as a constant perpetual growth model. No external financing is available. The internal rate of return r of the firm is constant.

According to the gordons model the market value of the share is equal to the present value of future dividends. And more specifically the value of a dividend growth stock. The gordon growth model ggm values a companys stock using an assumption of constant growth in dividends.

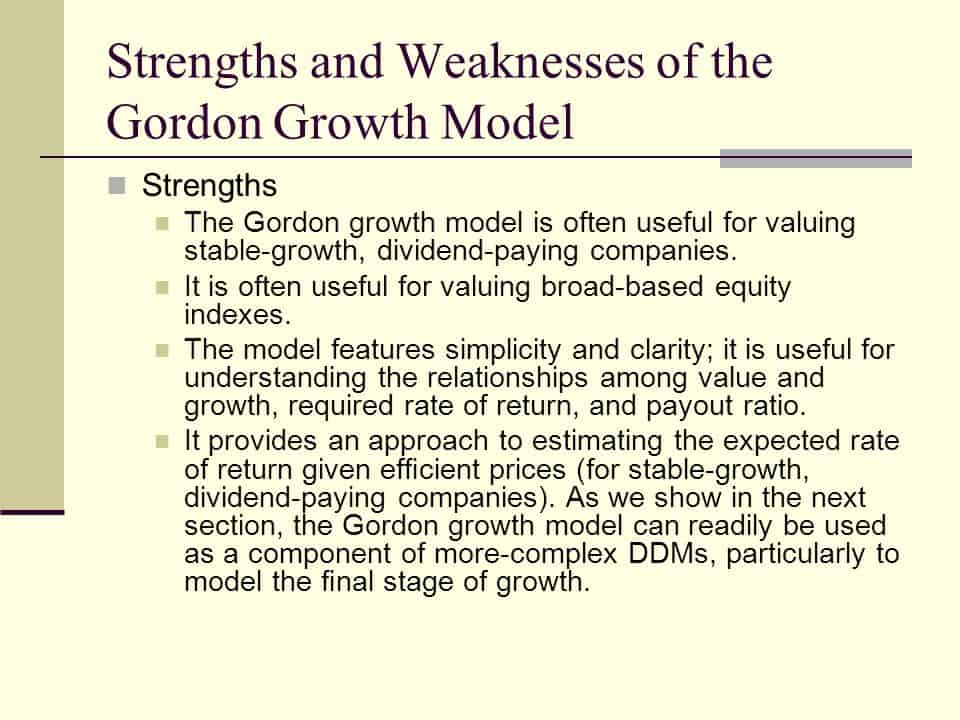

Though it comes with its own limitations it is a widely accepted model to determine the market price of the share using the forecasted dividends. The firm is an all equity firm. The model takes the infinite series of dividends per share and discounts them back into.