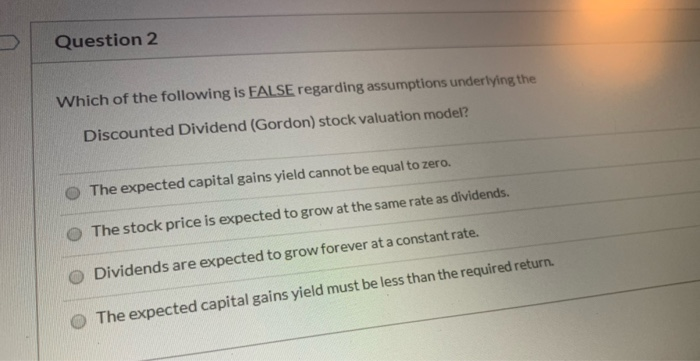

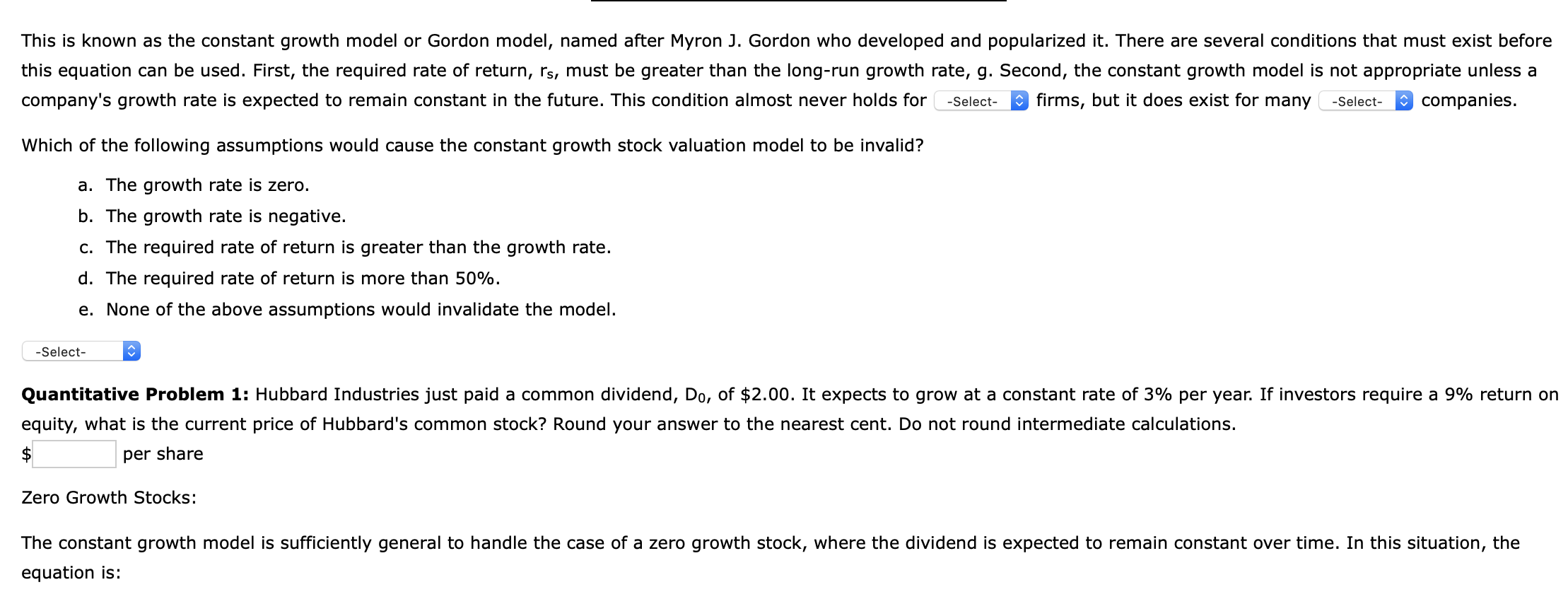

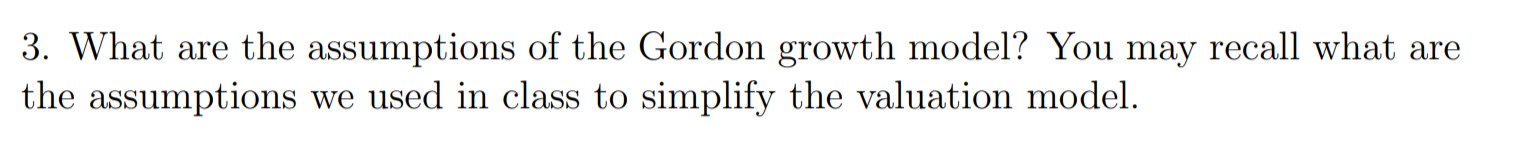

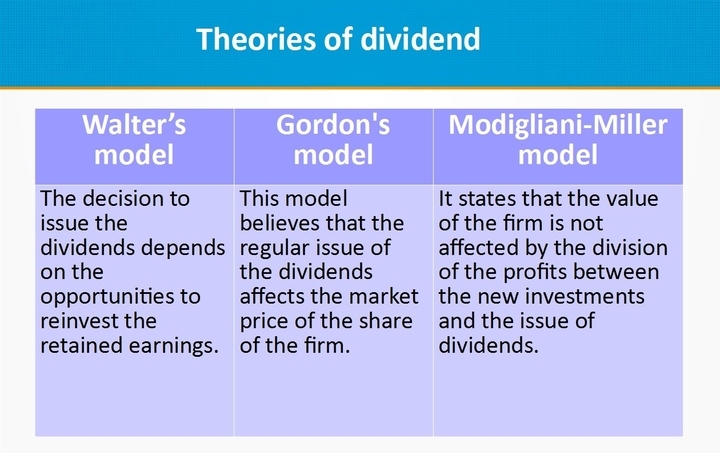

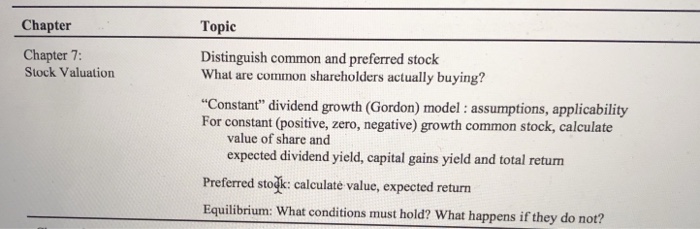

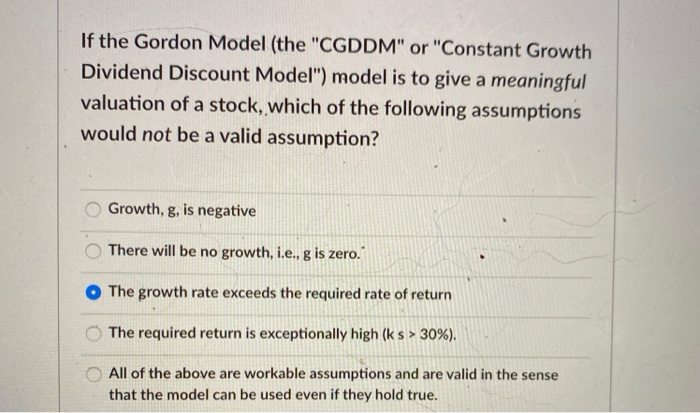

Gordon Model Assumptions

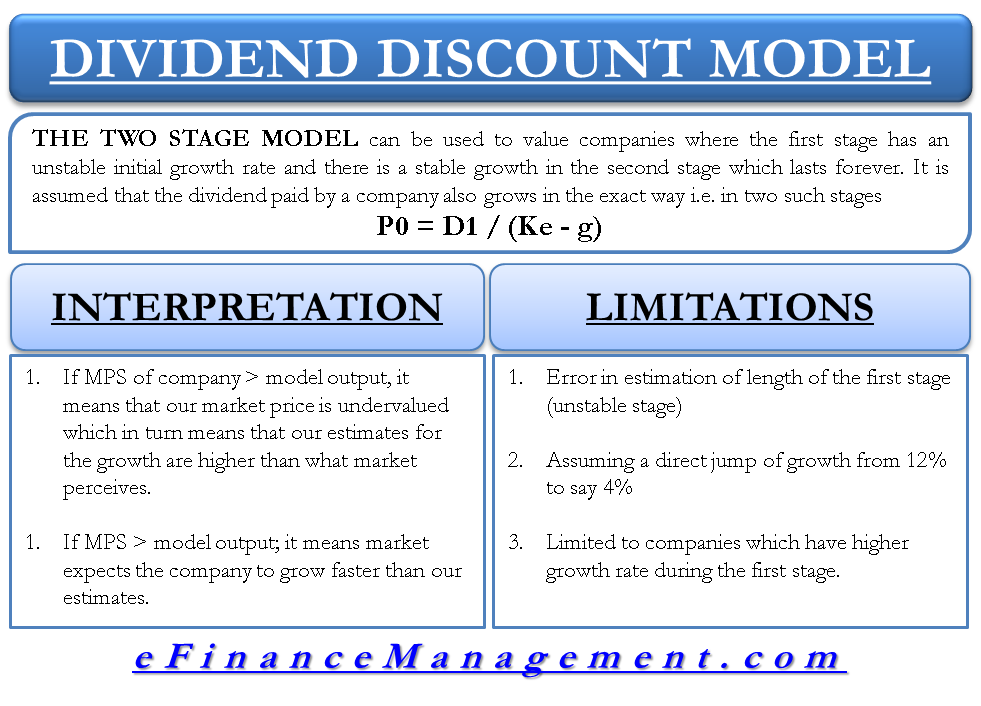

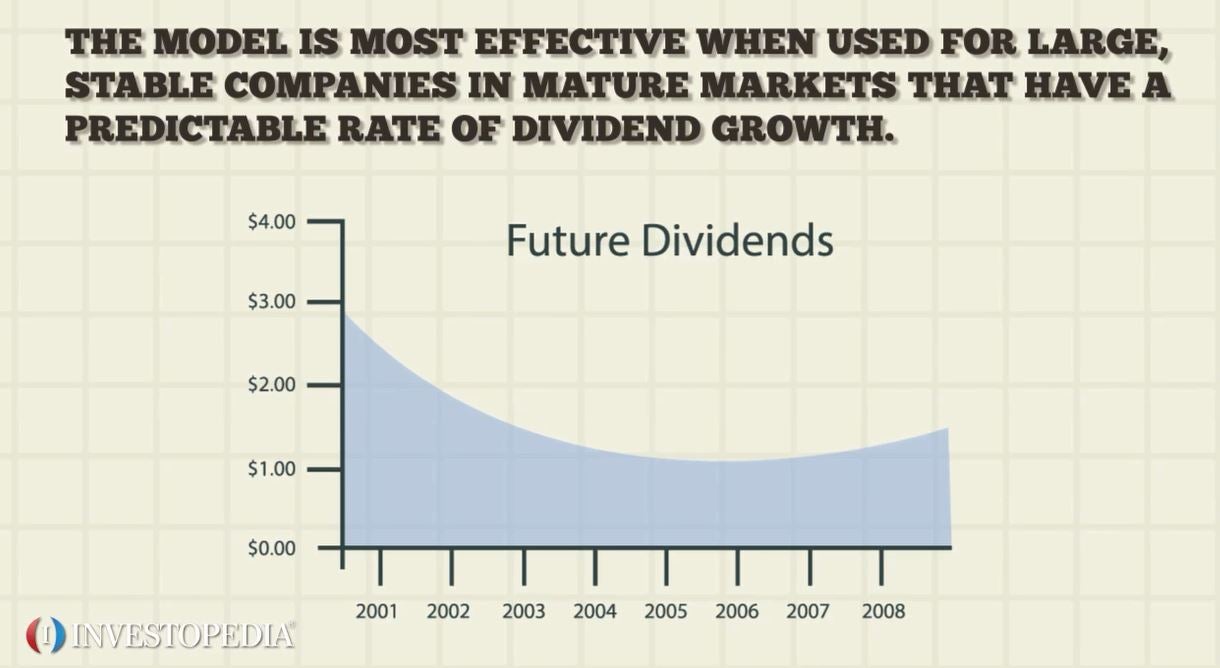

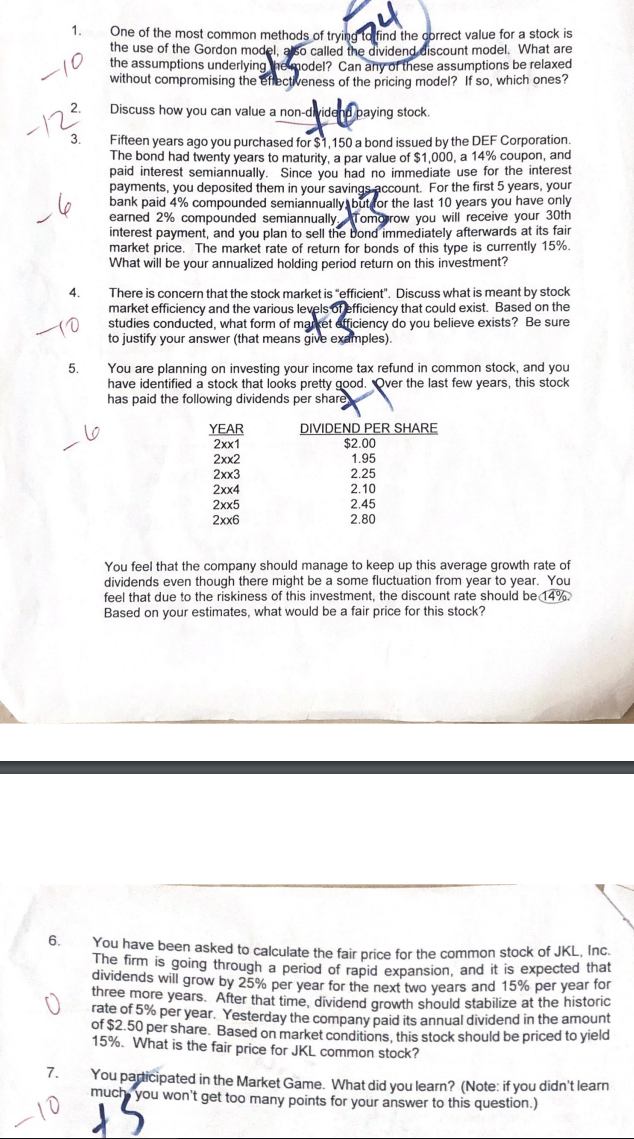

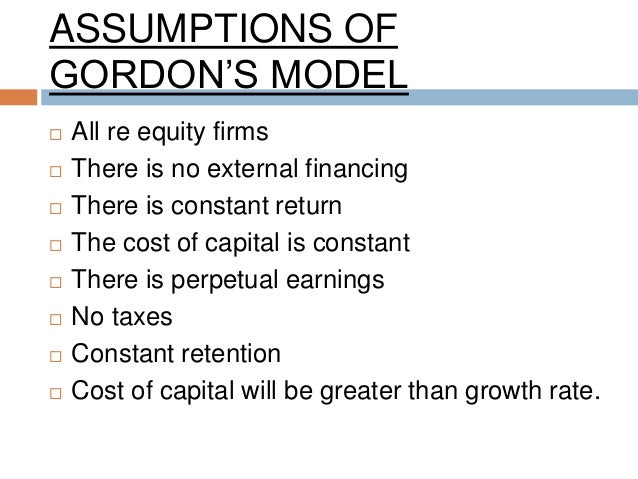

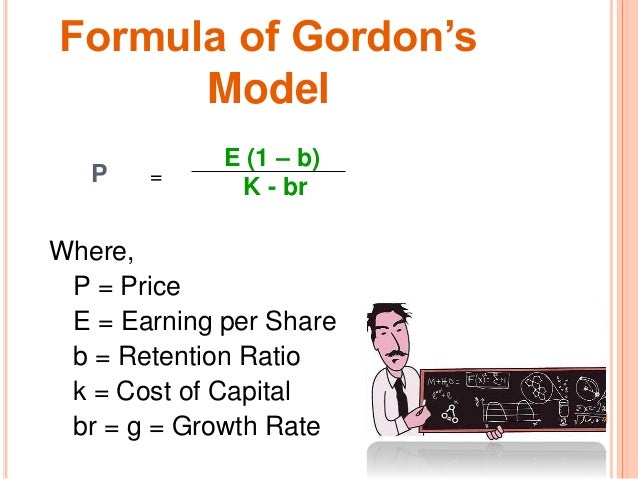

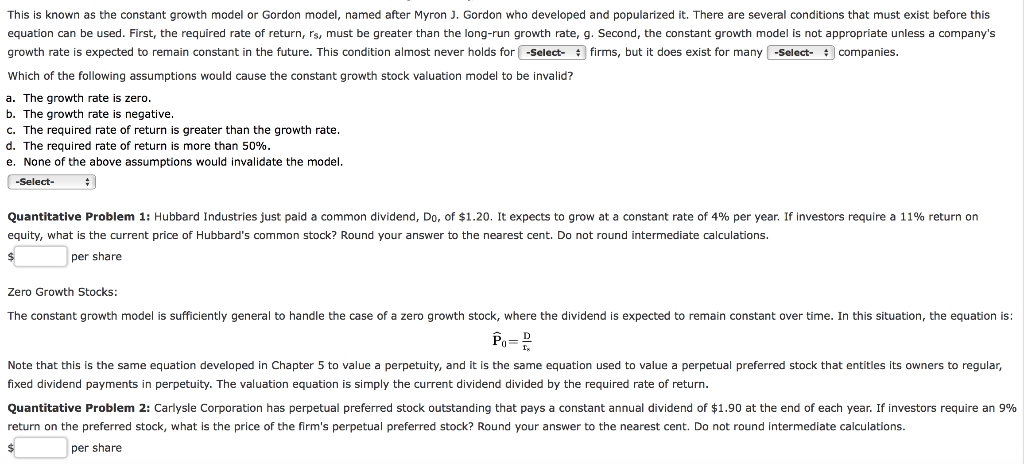

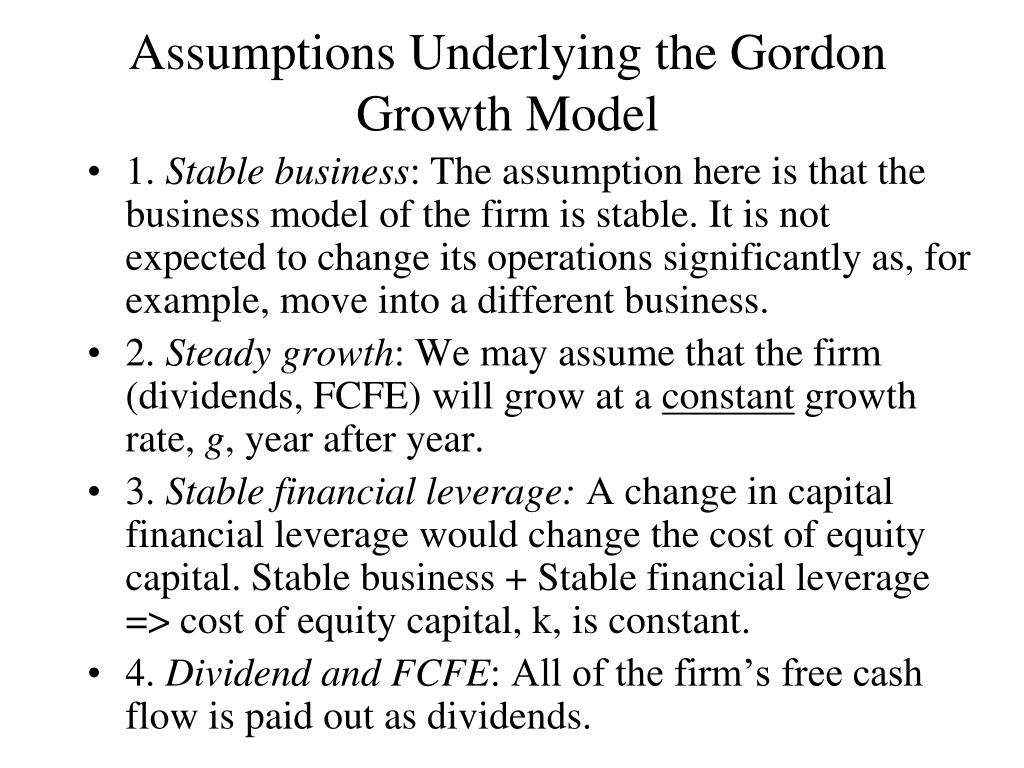

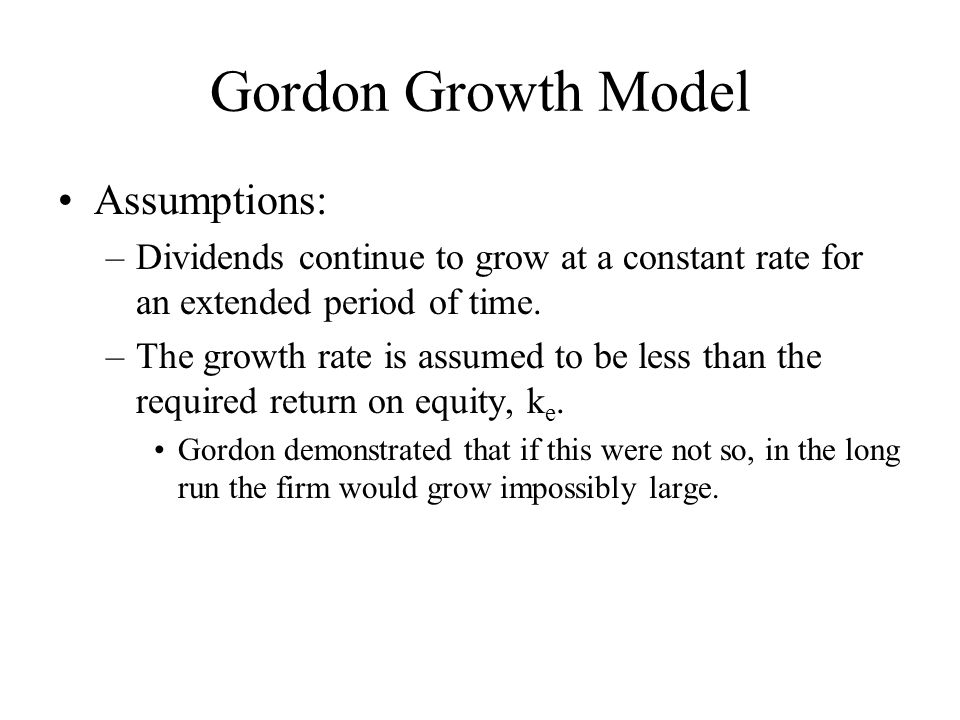

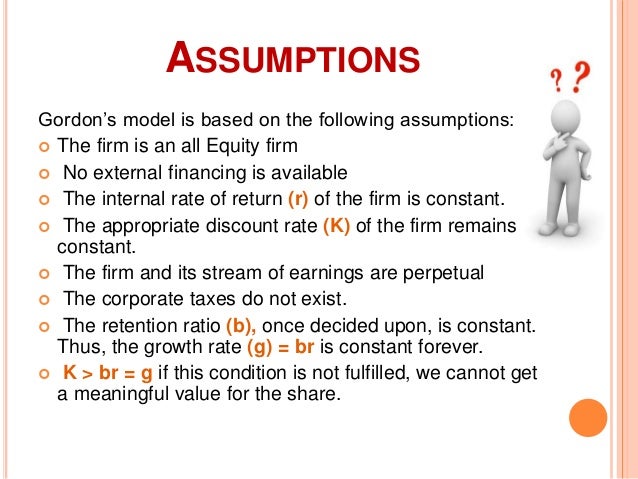

The company grows at a constant unchanging rate.

Gordon model assumptions. There are no significant changes in its operations. If a stock does not pay a current dividend such as growth stocks an even. The companys business model is stable.

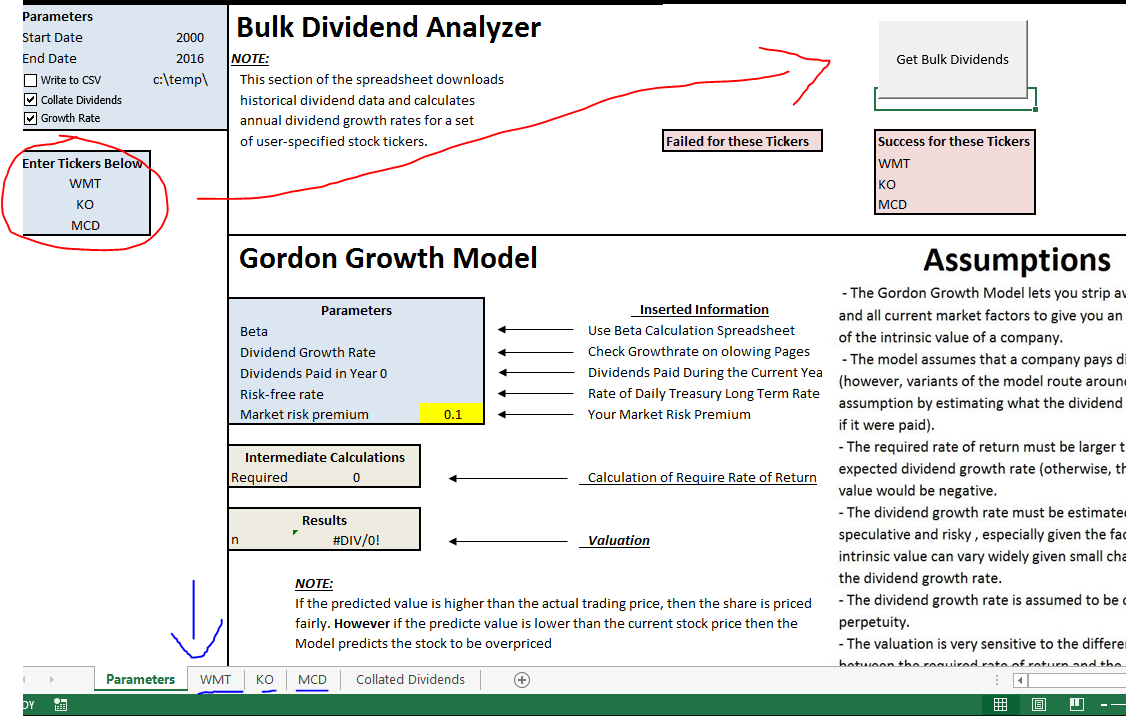

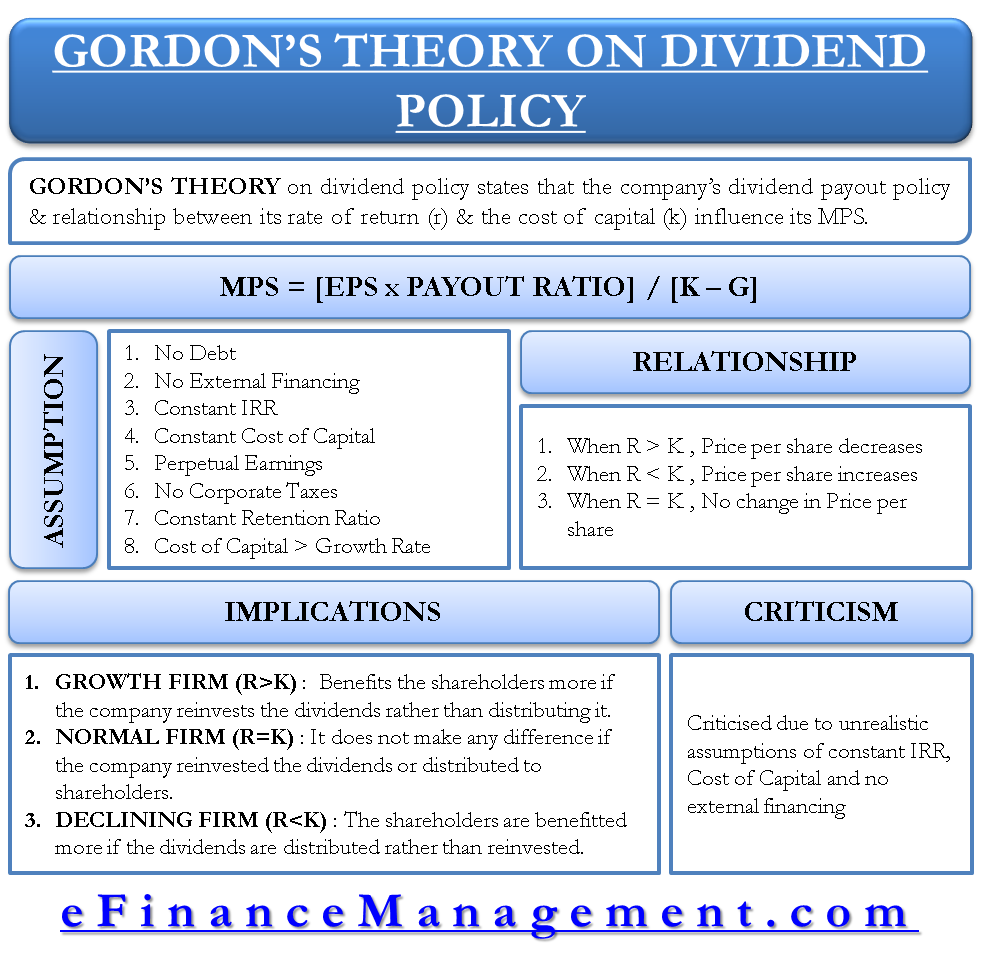

5 implications of gordons model. The companys free cash flow is paid as dividends. The gordon growth model requires the following assumptions.

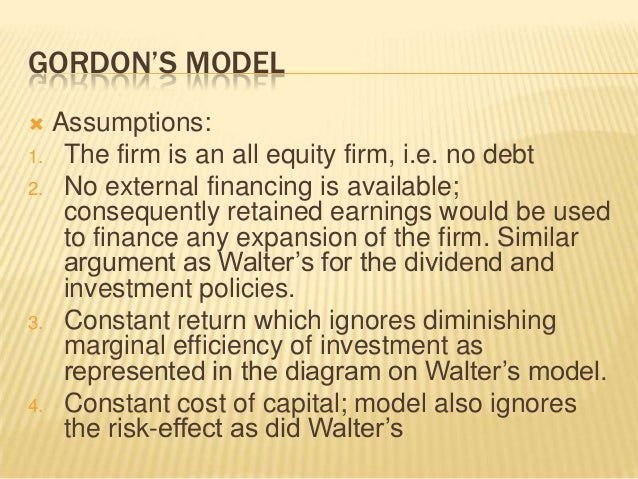

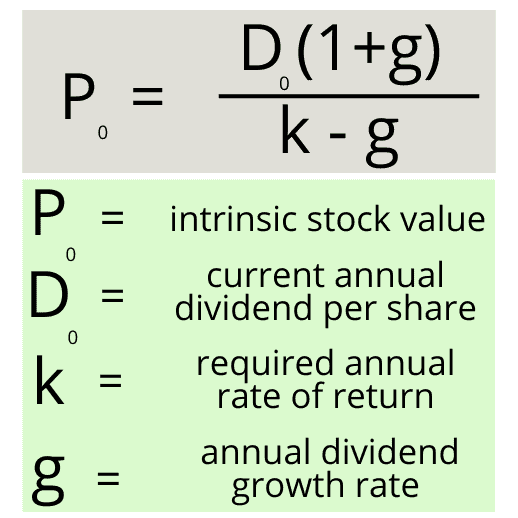

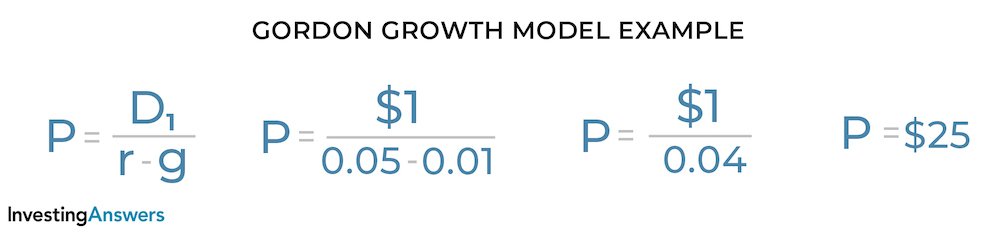

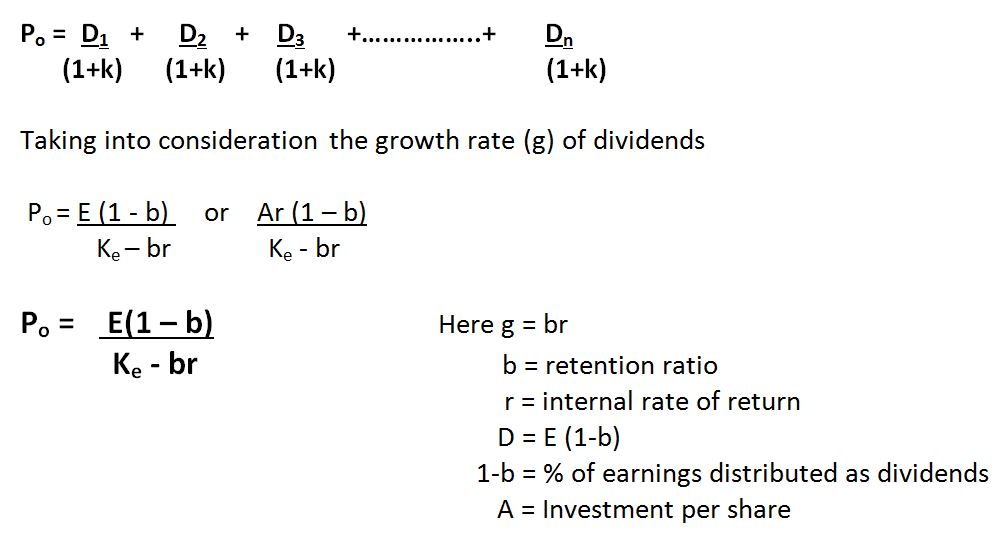

The company has stable financial leverage. What is the gordon growth model formula. The gordon growth model ggm values a companys stock using an assumption of constant growth in dividends.

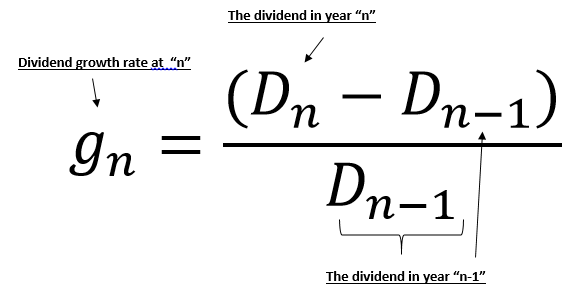

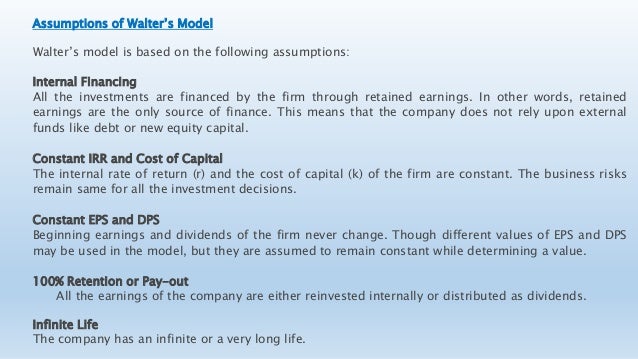

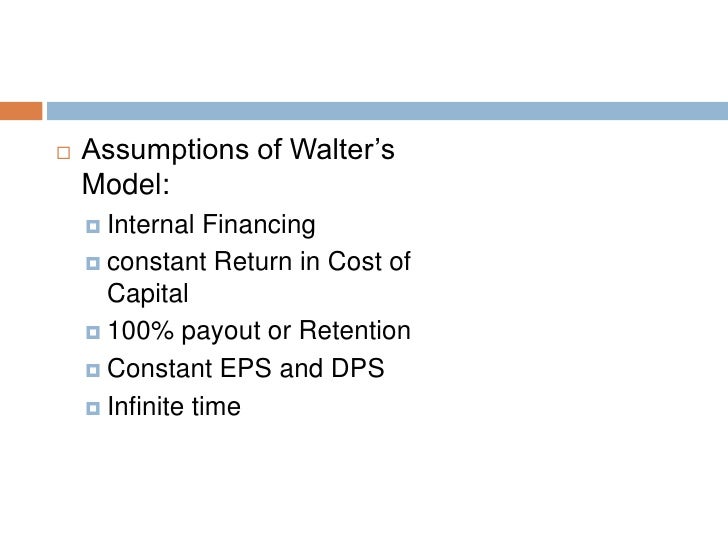

Retention ratio once decided remains constant. 3 assumptions of gordons model. 37 constant retention ratio.

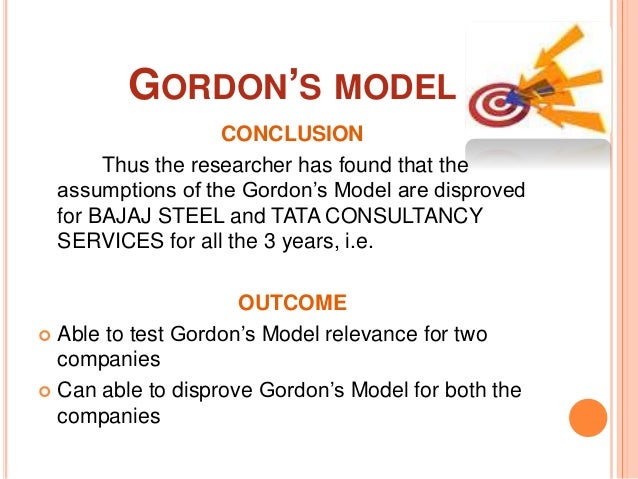

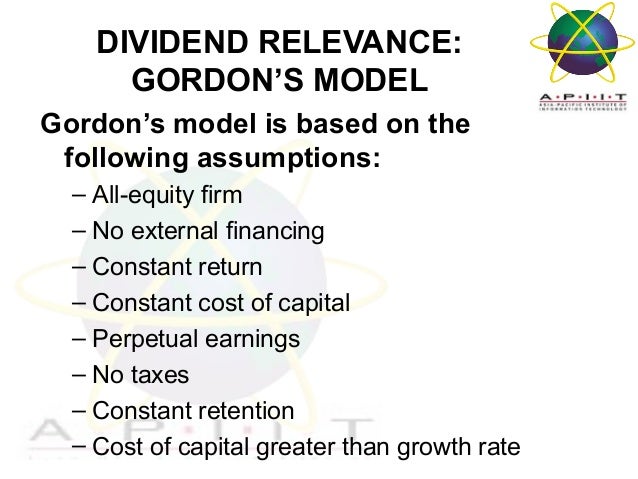

We assume that the company grows at a constant rate. The firm is an all equity firm. The gordon growth model requires that a company is stable.

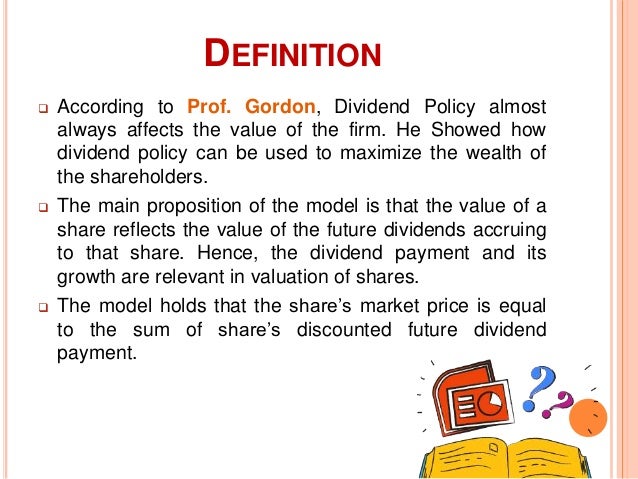

The rate of return r and cost of capital k are constant. The model states that the market value of a share is equal to the present value of an infinite stream of dividends received by the shareholders. The company has a stable business model.

The model assumes that the investment opportunities of the firm are financed by retained earnings only and no external financing debt or equity is used for the purpose when such a situation exists either the firms investment or its dividend policy or both will be sub optimum. 34 constant cost of capital. The gordon growth model also relies heavily on the assumption that a companys dividend growth rate is stable and known.

The companys dividends are expected to grow at a constant rate. The company has stable financial leverage or there is no financial leverage involved in the company. Assumptions of gordons model.

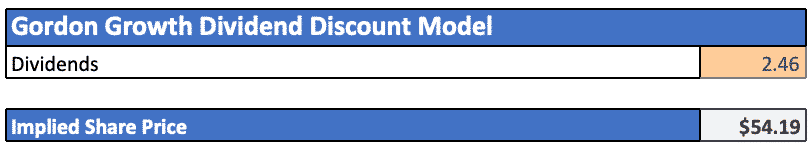

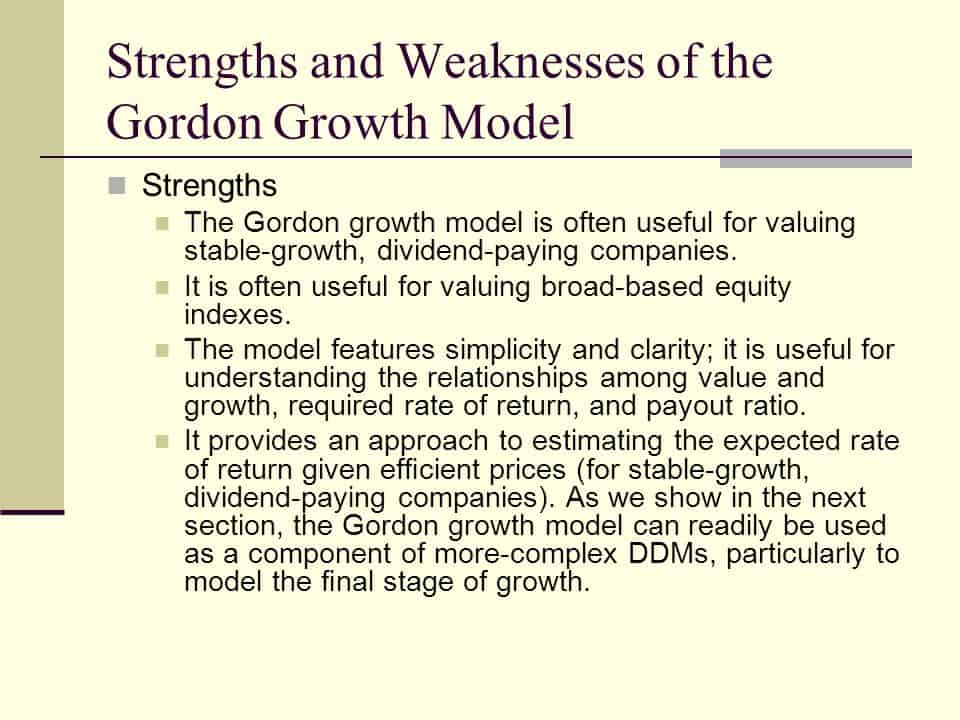

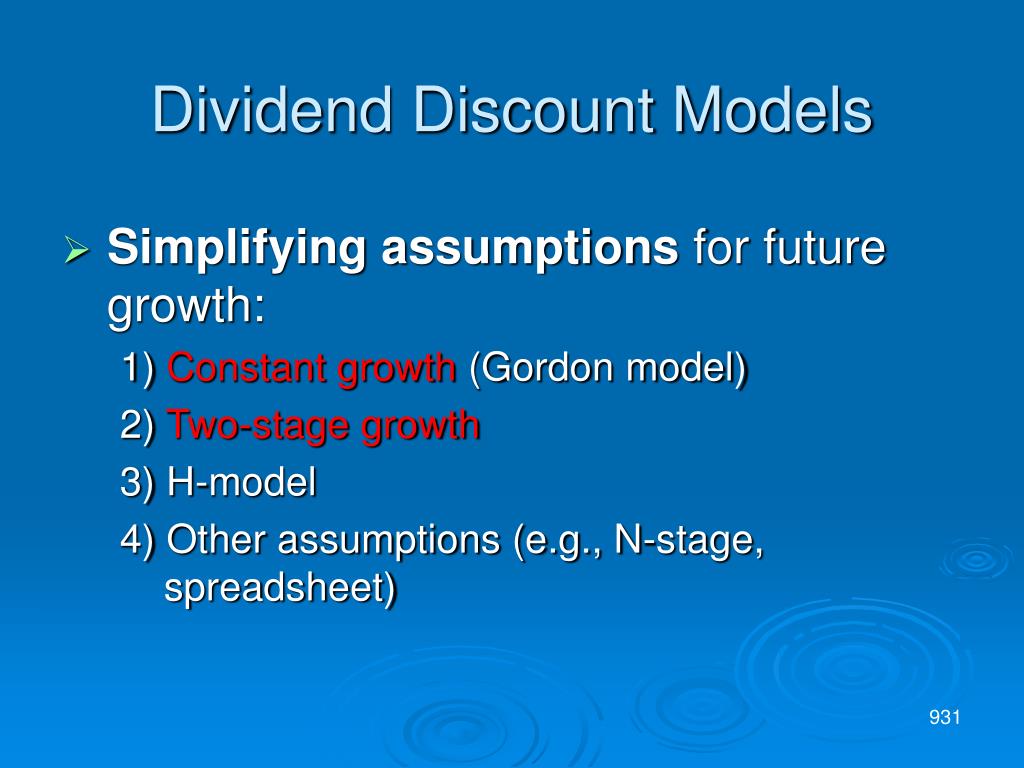

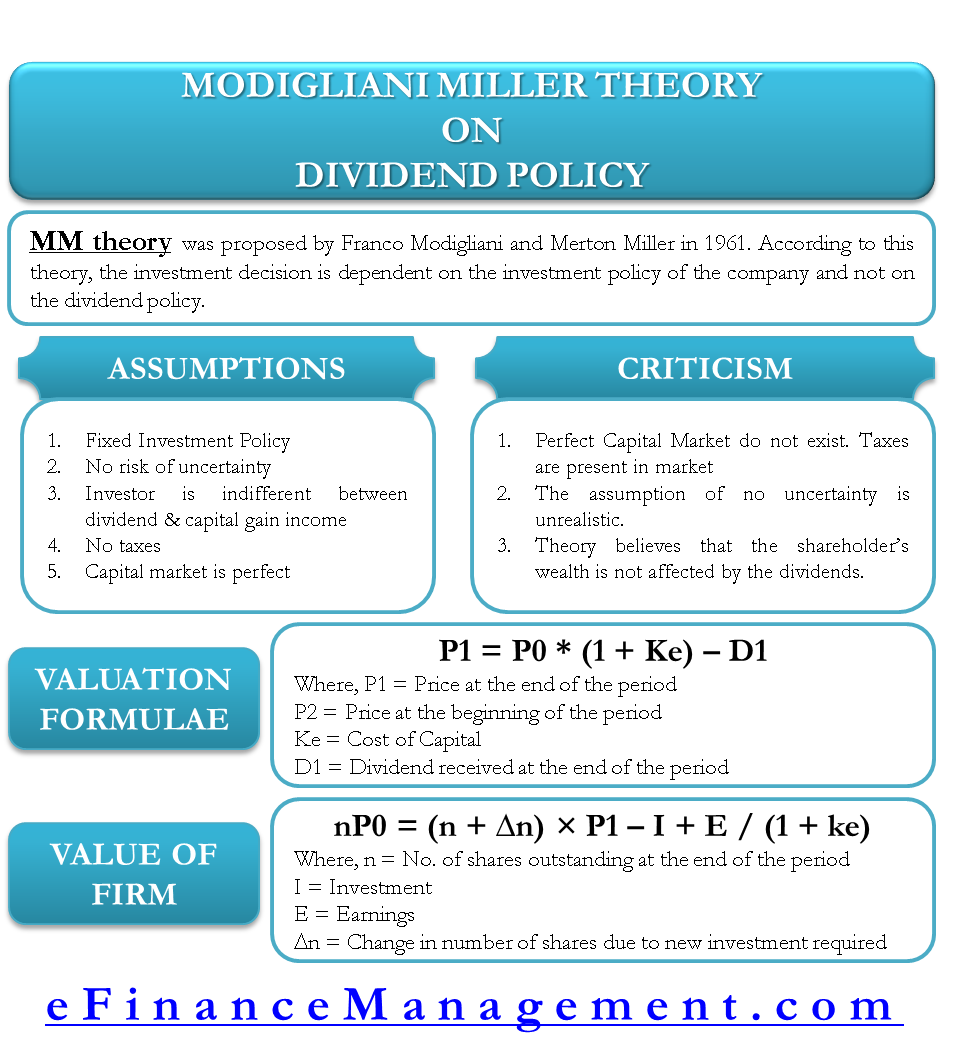

Gordon growth dividend model assumptions and criticism gordon growth dividend model. The gordon growth model assumes the following conditions. Common analysis the process of comparing the the current year to.

The life of the firm is indefinite. The company uses all of its free cash flow to pay dividends at regular intervals. 6 criticism of gordons model.

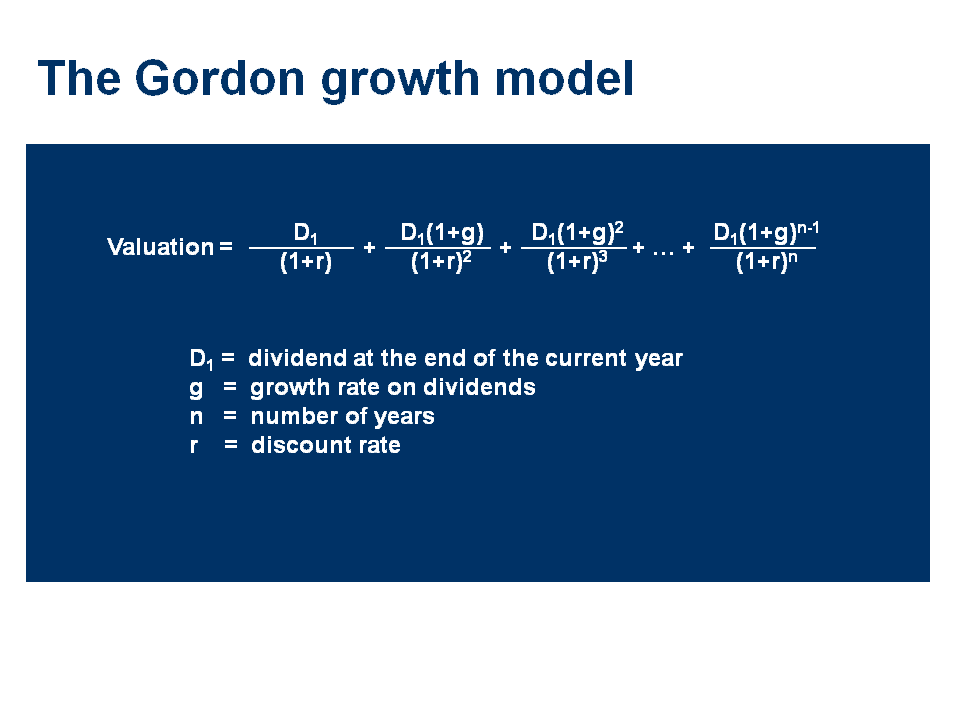

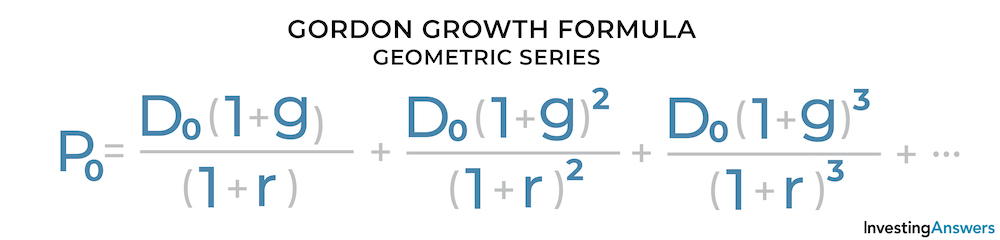

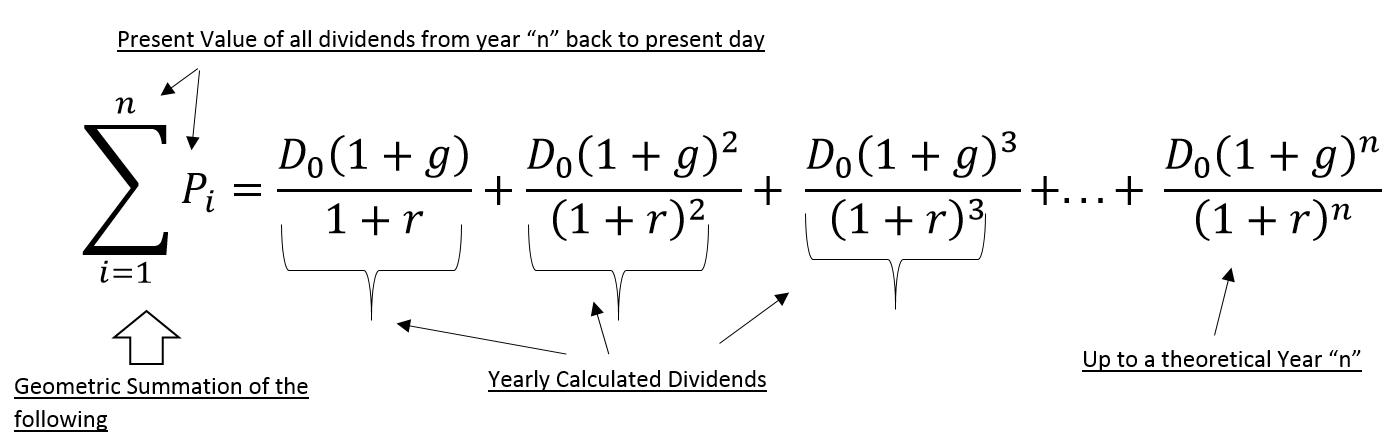

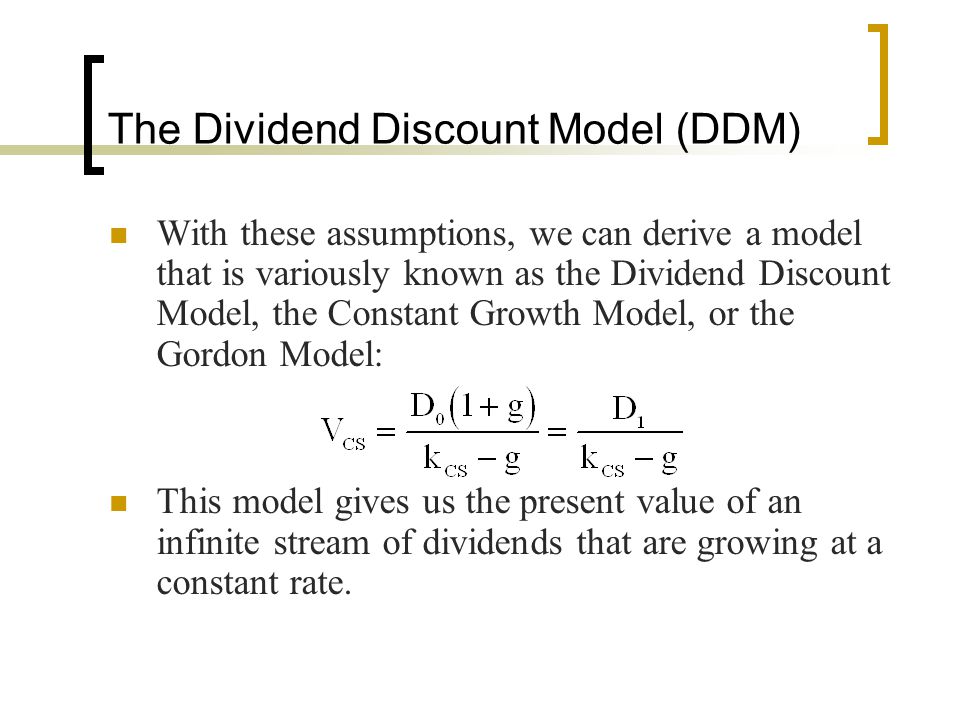

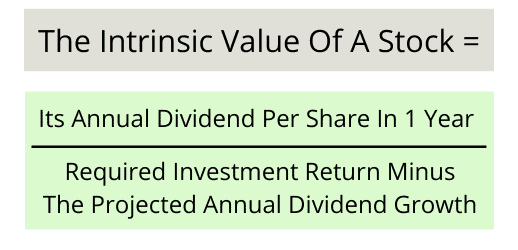

What are the assumptions of the gordon growth model. Expected dividend growth rate assumed to be constant other assumptions of the gordon growth formula are as follows. P div1 1k div2 1k2 s divt 1k to the power t.

The model takes the infinite series of dividends per share and discounts them back into. You should evaluate the stability of the company before using the model. 4 valuation formula of gordons model and its denotations.

:max_bytes(150000):strip_icc()/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)