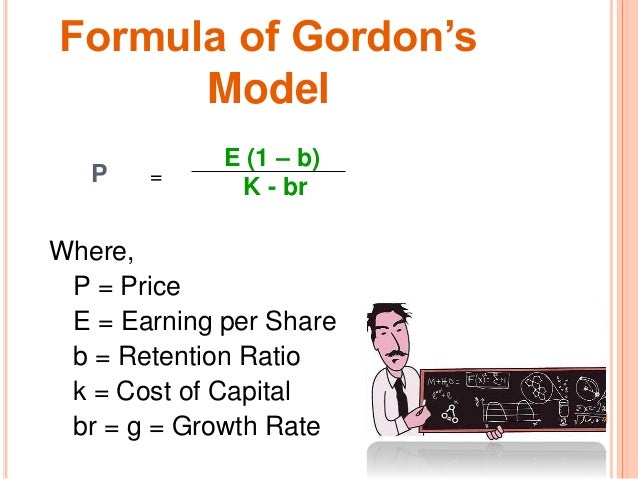

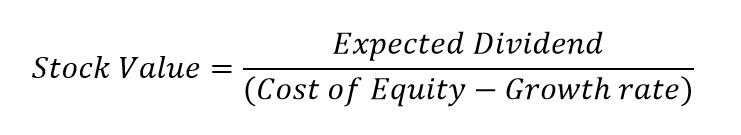

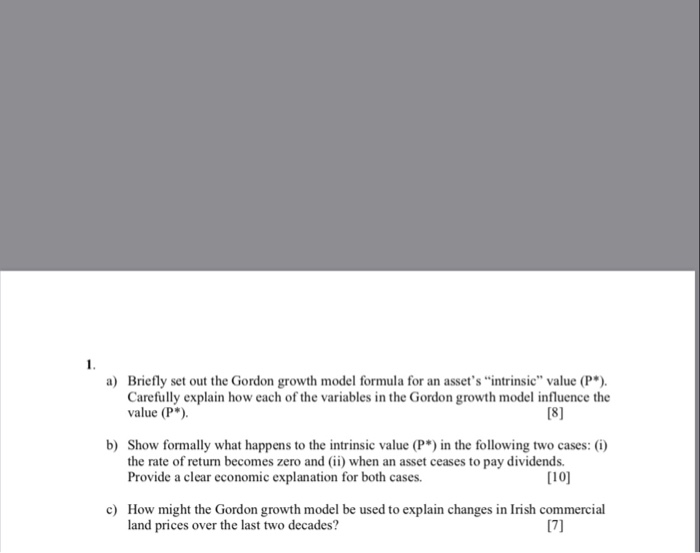

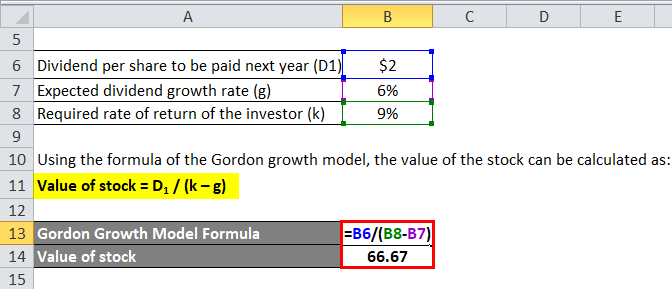

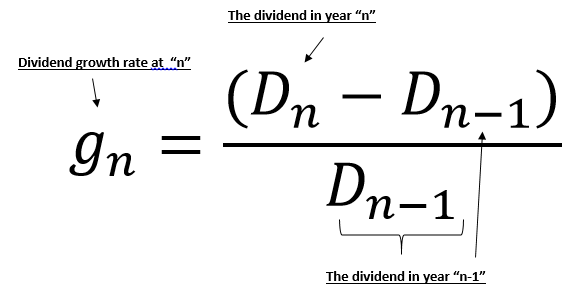

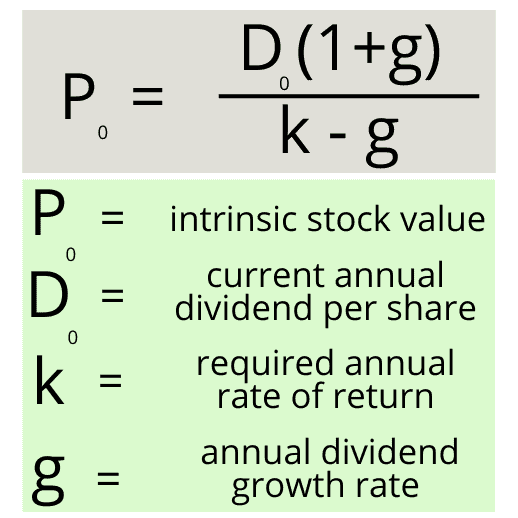

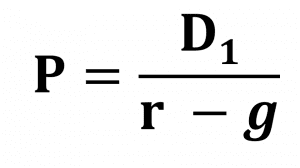

Gordon Model Formula

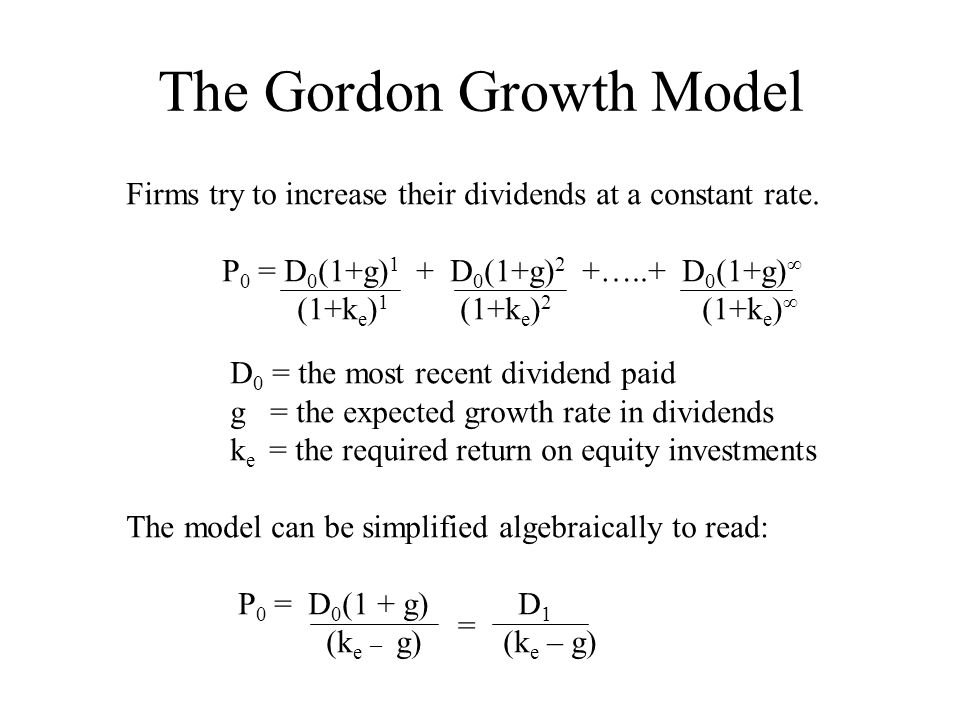

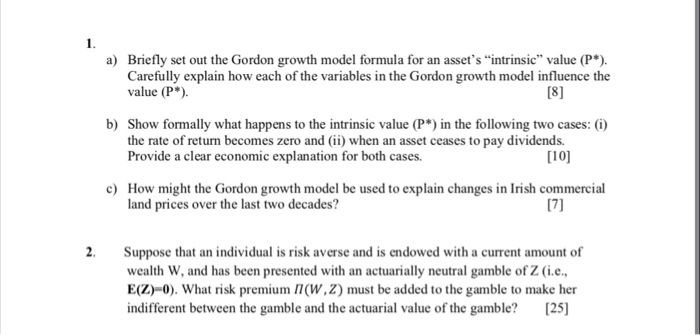

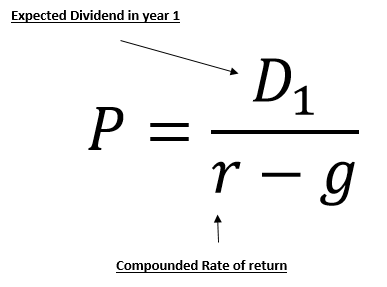

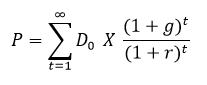

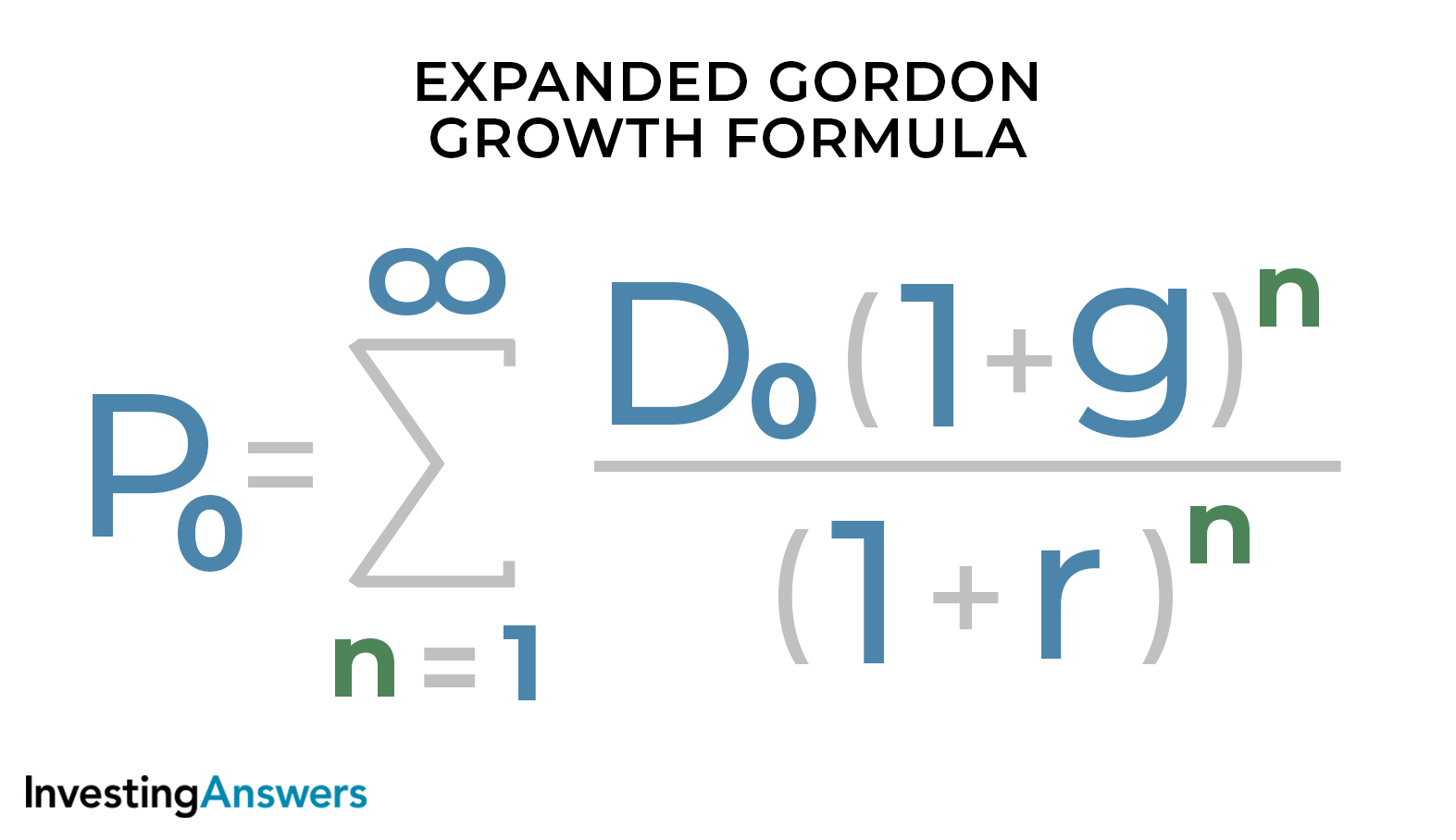

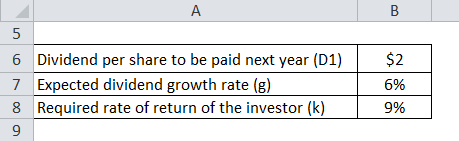

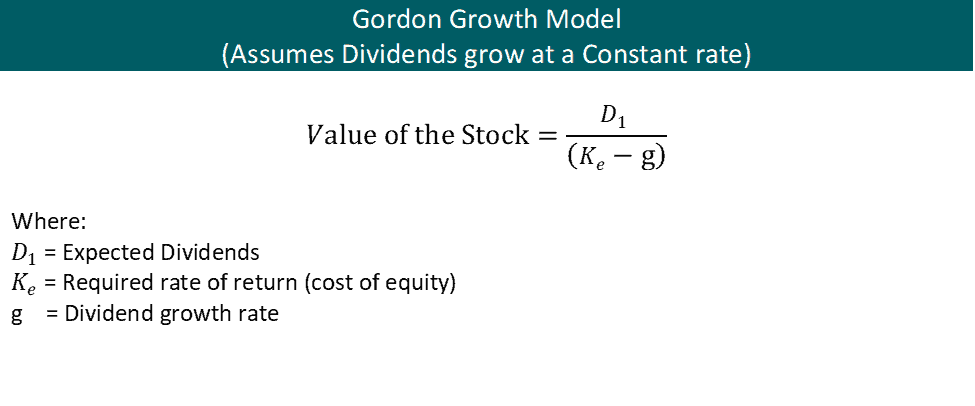

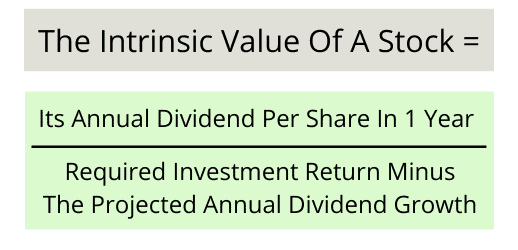

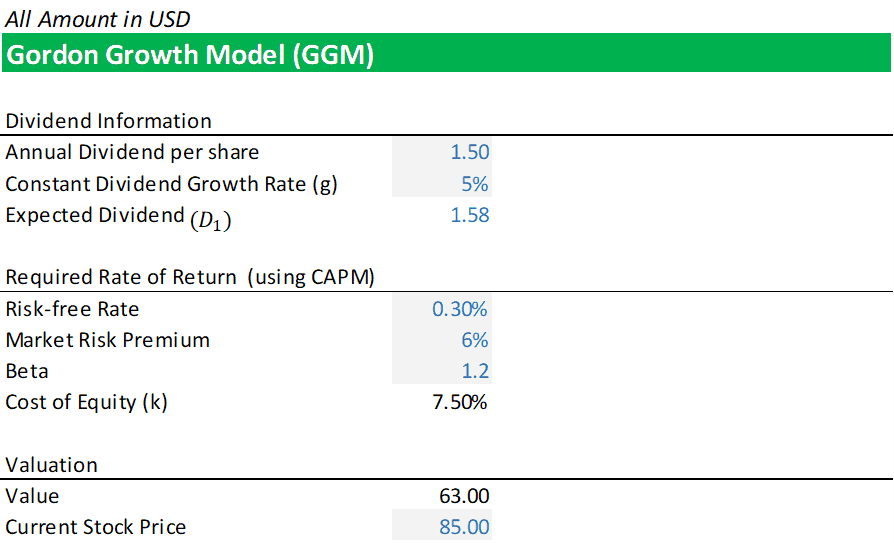

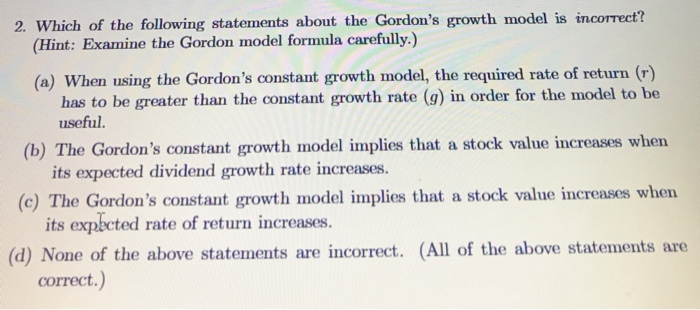

Three variables are included in the gordon growth model formula.

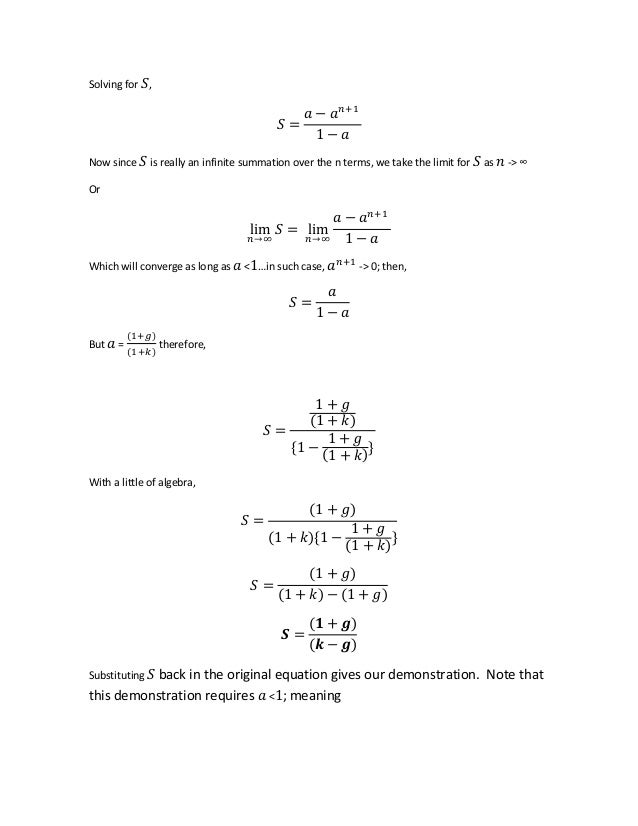

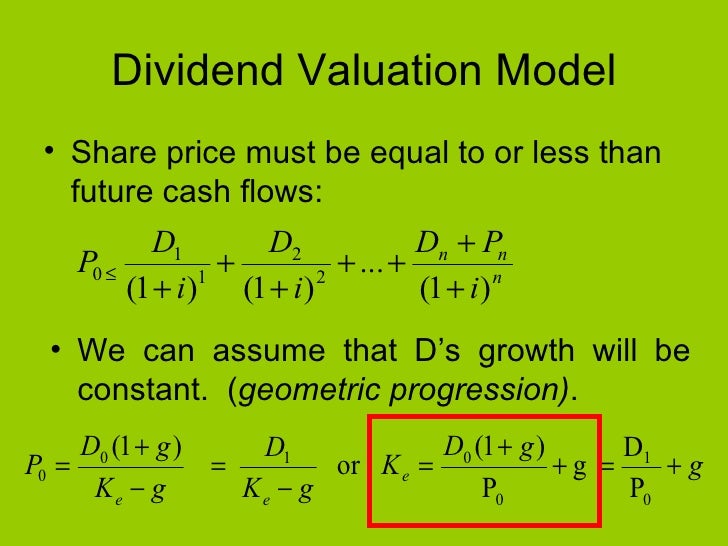

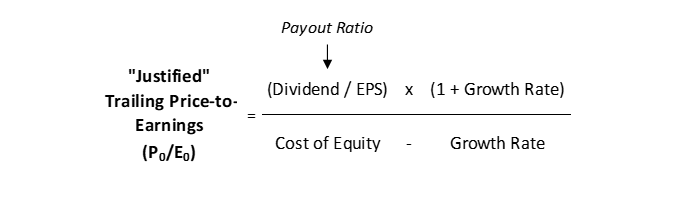

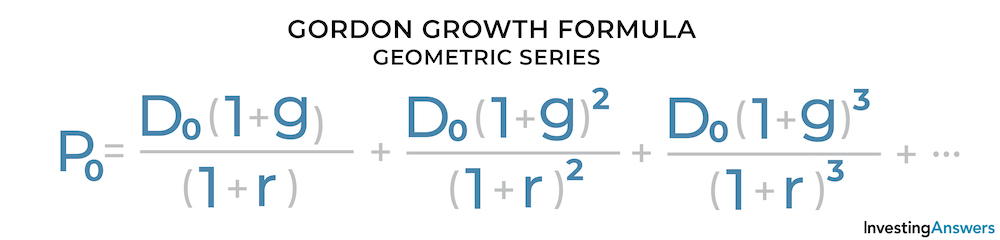

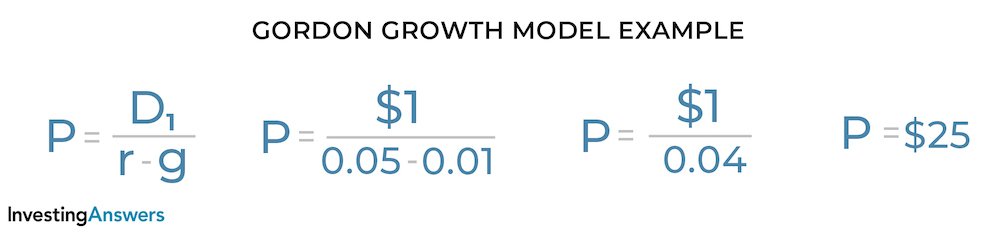

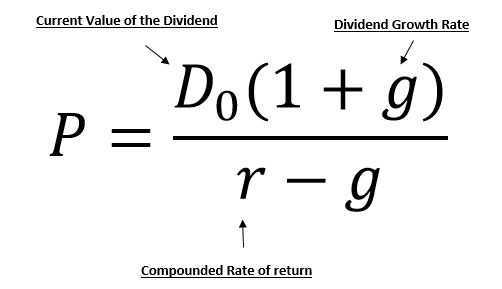

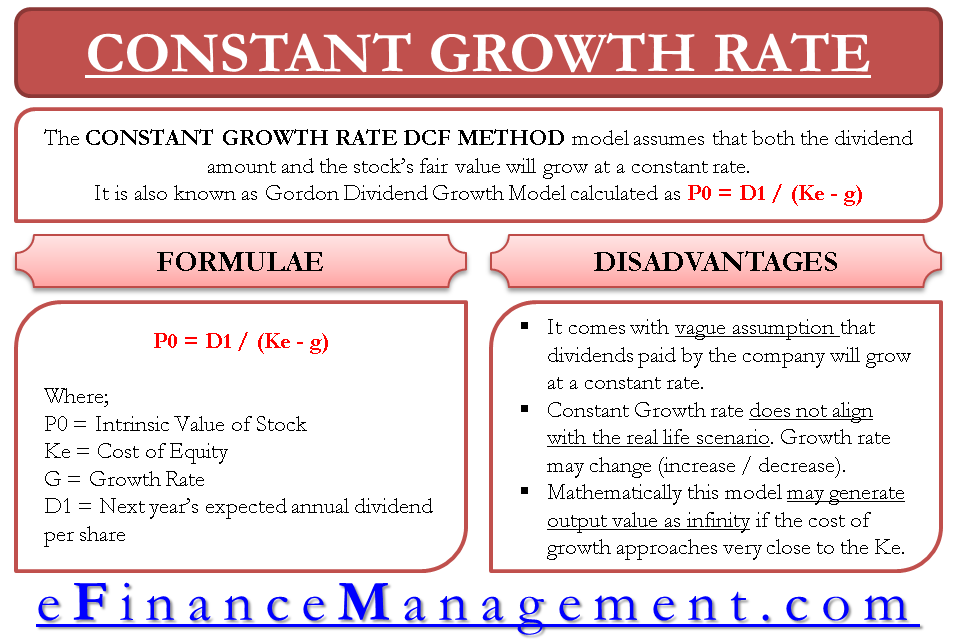

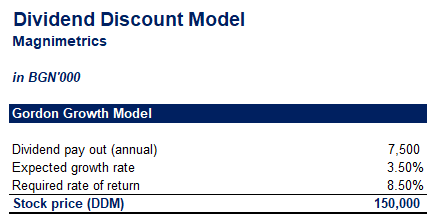

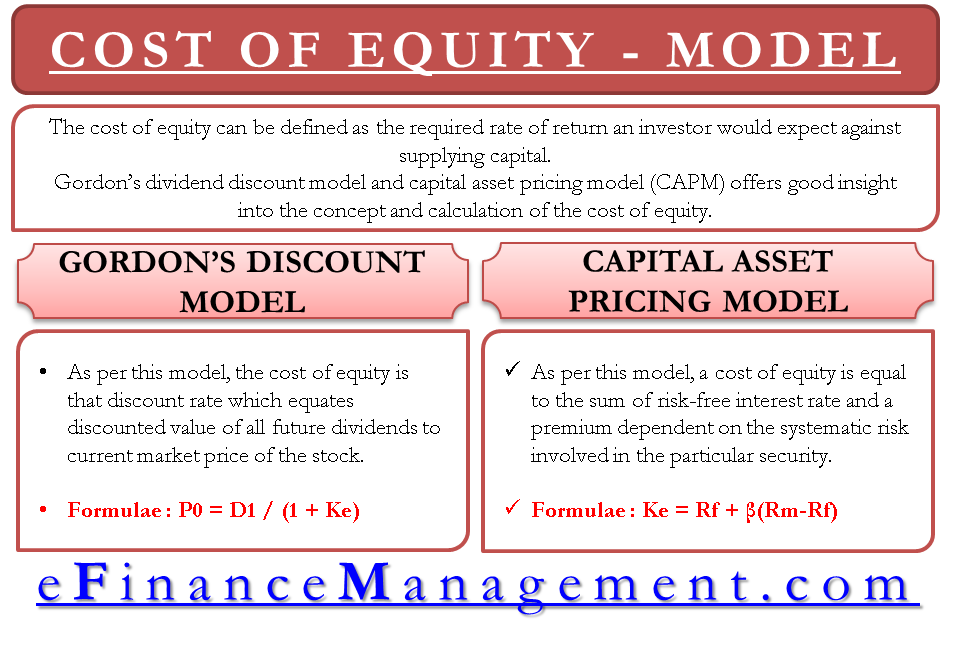

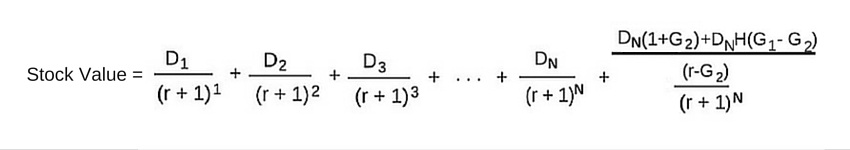

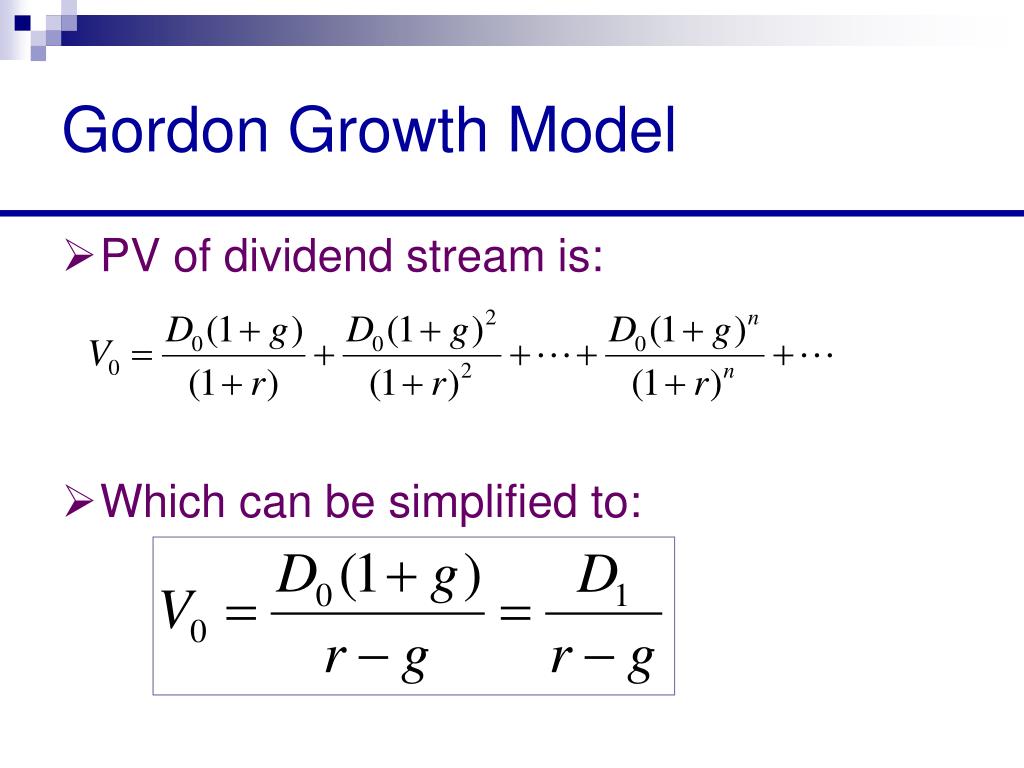

Gordon model formula. Formula and calculation of the gordon growth model p d 1 r g where. The wacc formula is ev x re dv x rd x 1 t. G expected growth rate of dividends assumed to be constant the current dividend payout d 0 can be found in the annual report of a company.

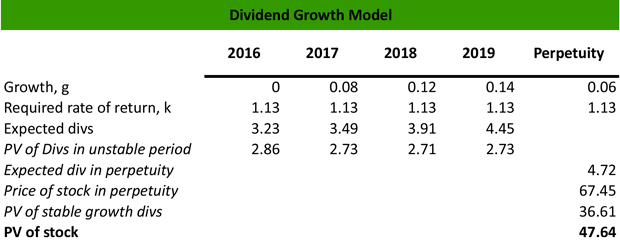

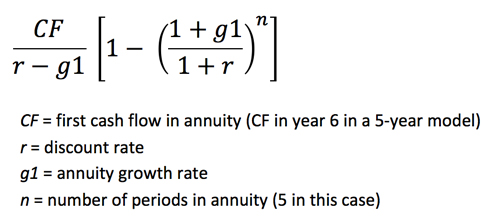

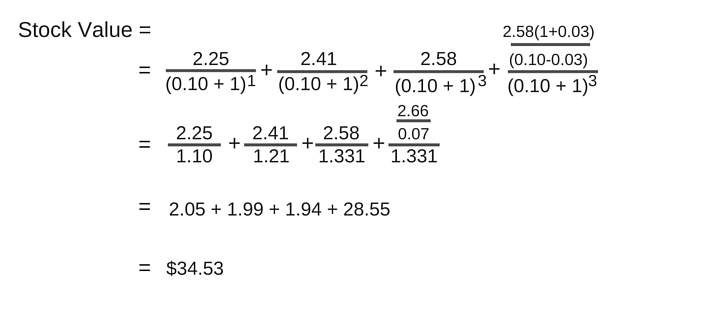

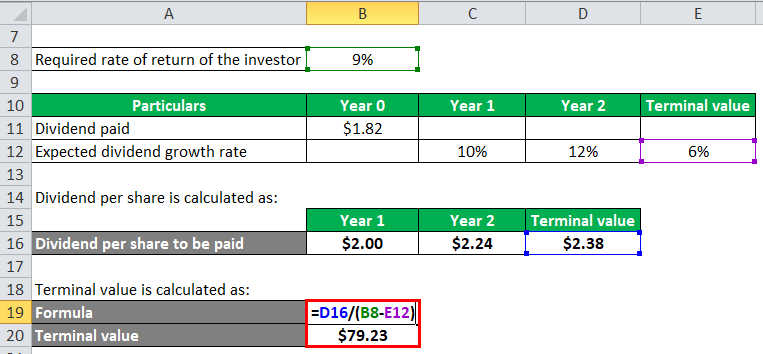

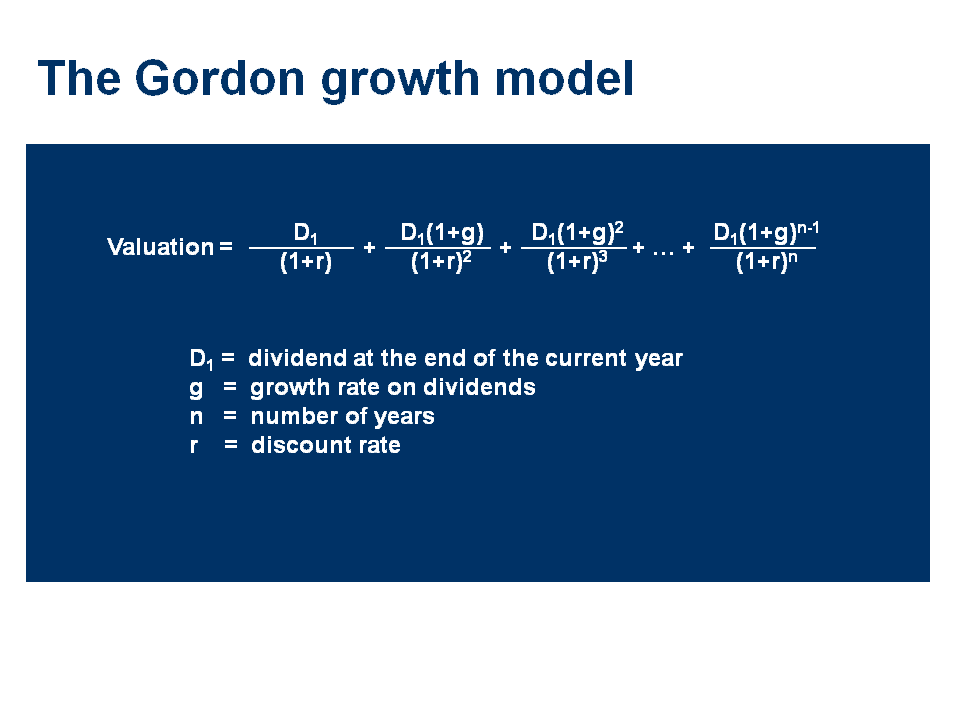

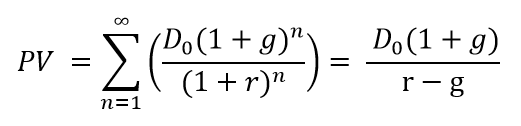

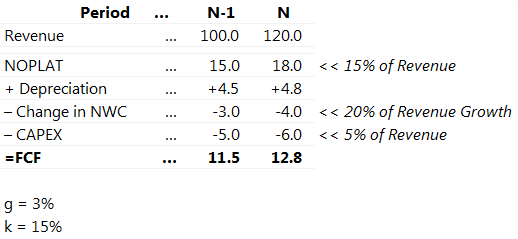

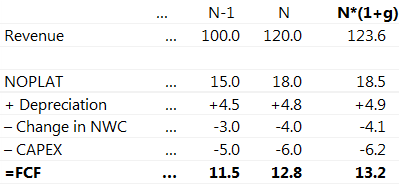

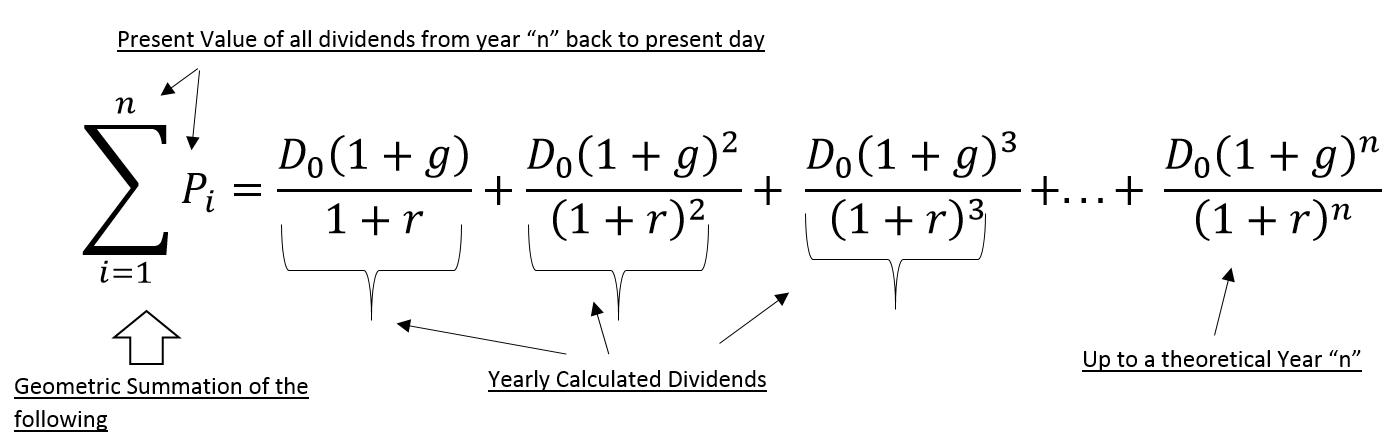

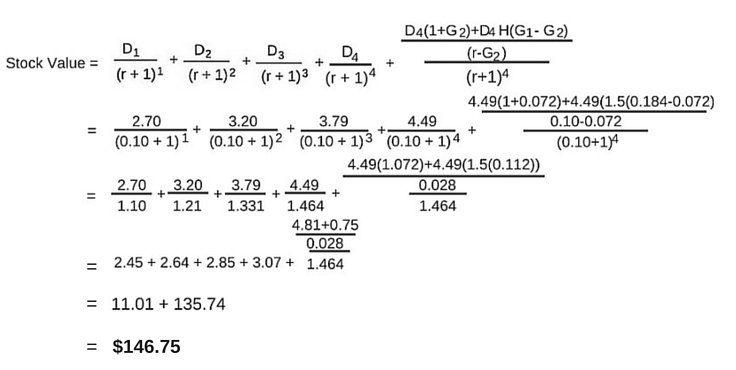

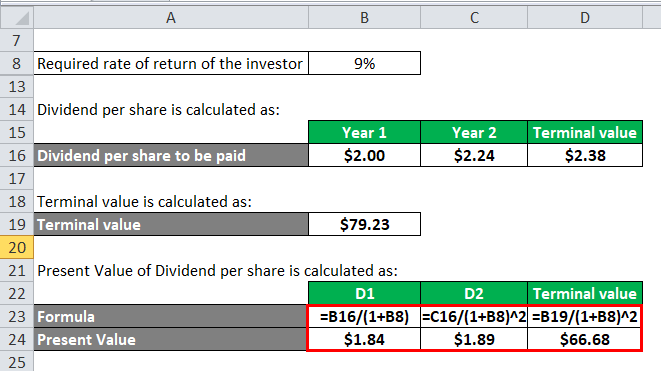

The present value of the stable period dividends are then calculated. Gordon growth model formula p dfracd1r g p fair value of the stock. R required rate of return.

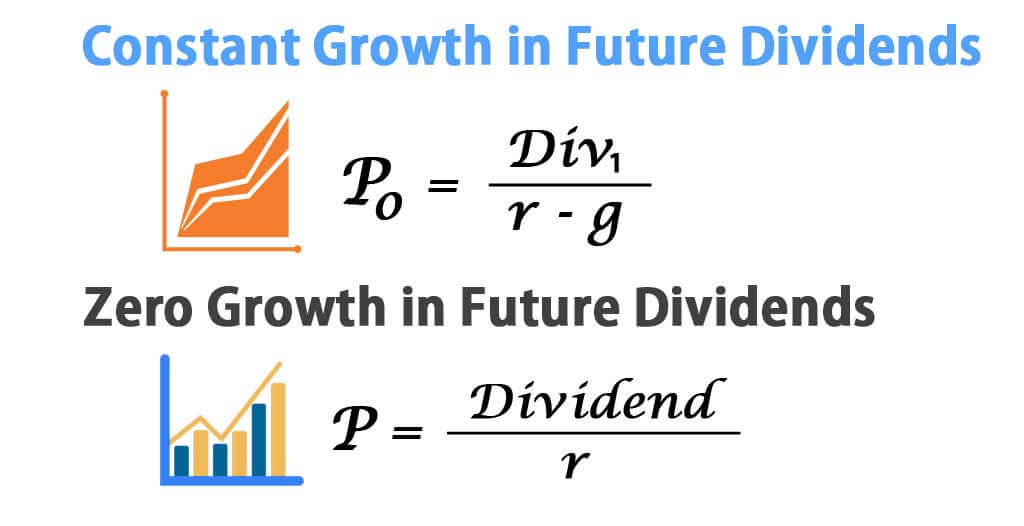

G growth rate. The gordon growth model formula that with the constant growth rate in future dividends is as per below. What is the gordon growth model formula.

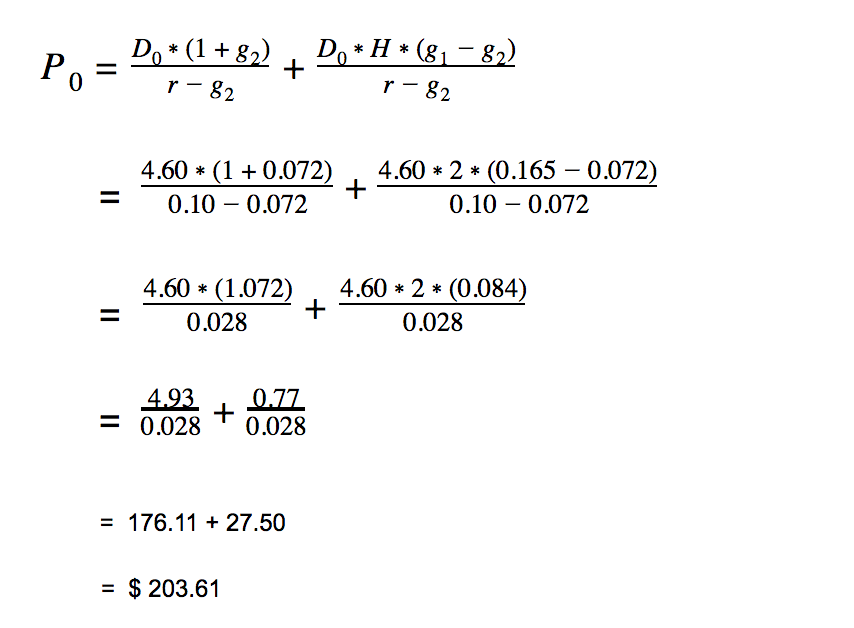

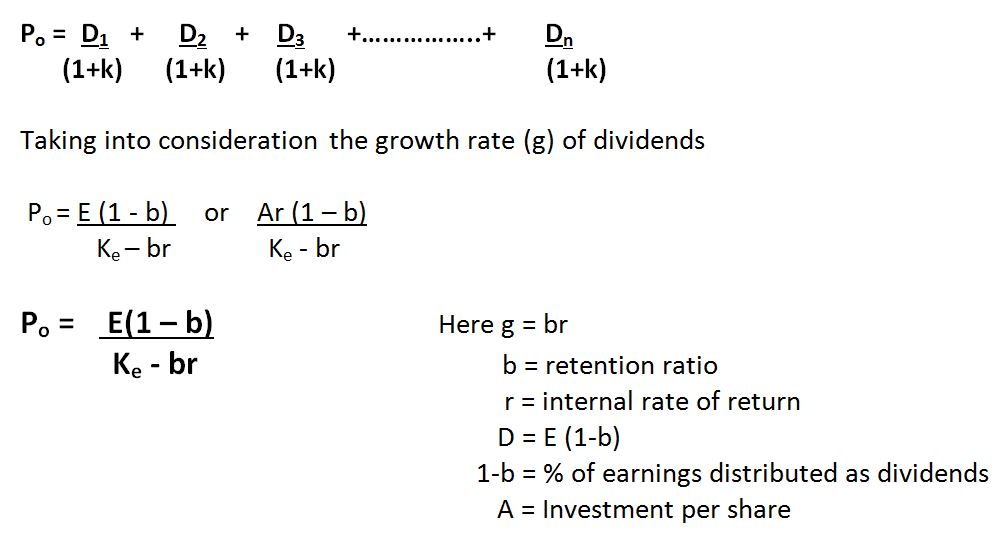

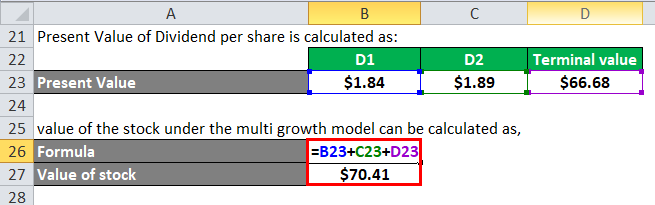

Lets have a look at the formula first here p 0 stock price. In the above formula we have two different components. 2780 110 5 1726.

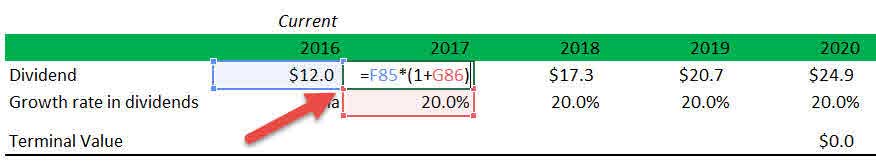

Div 1 estimated dividends for the next period. 1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. And after that we apply the gordon growth model formula to determine the value in the fifth year.

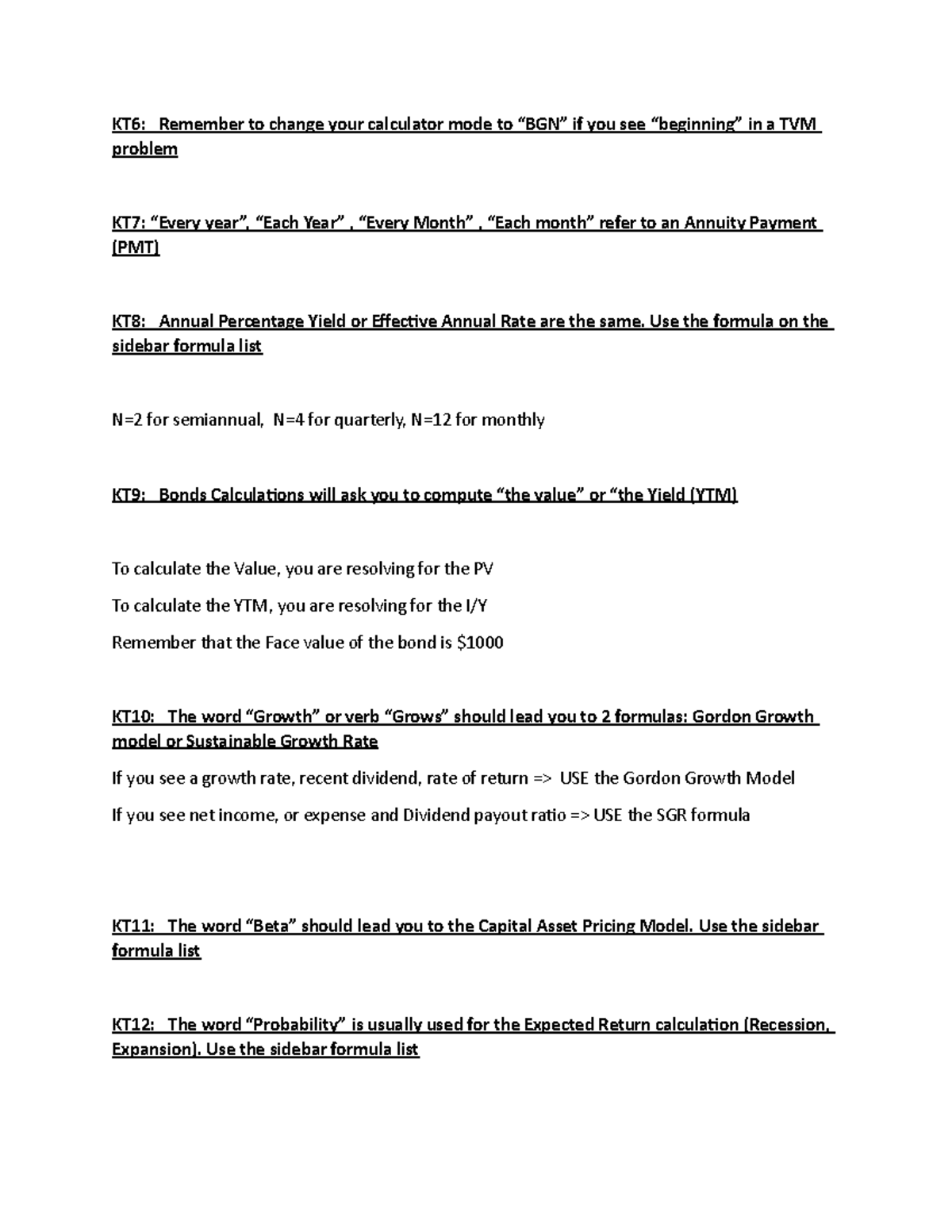

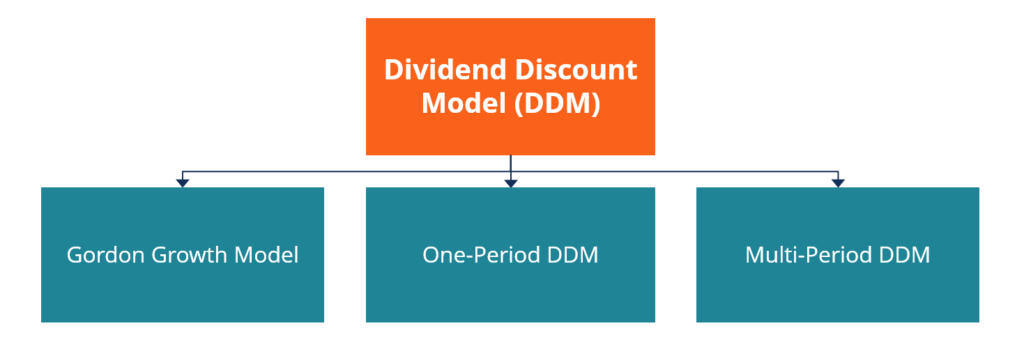

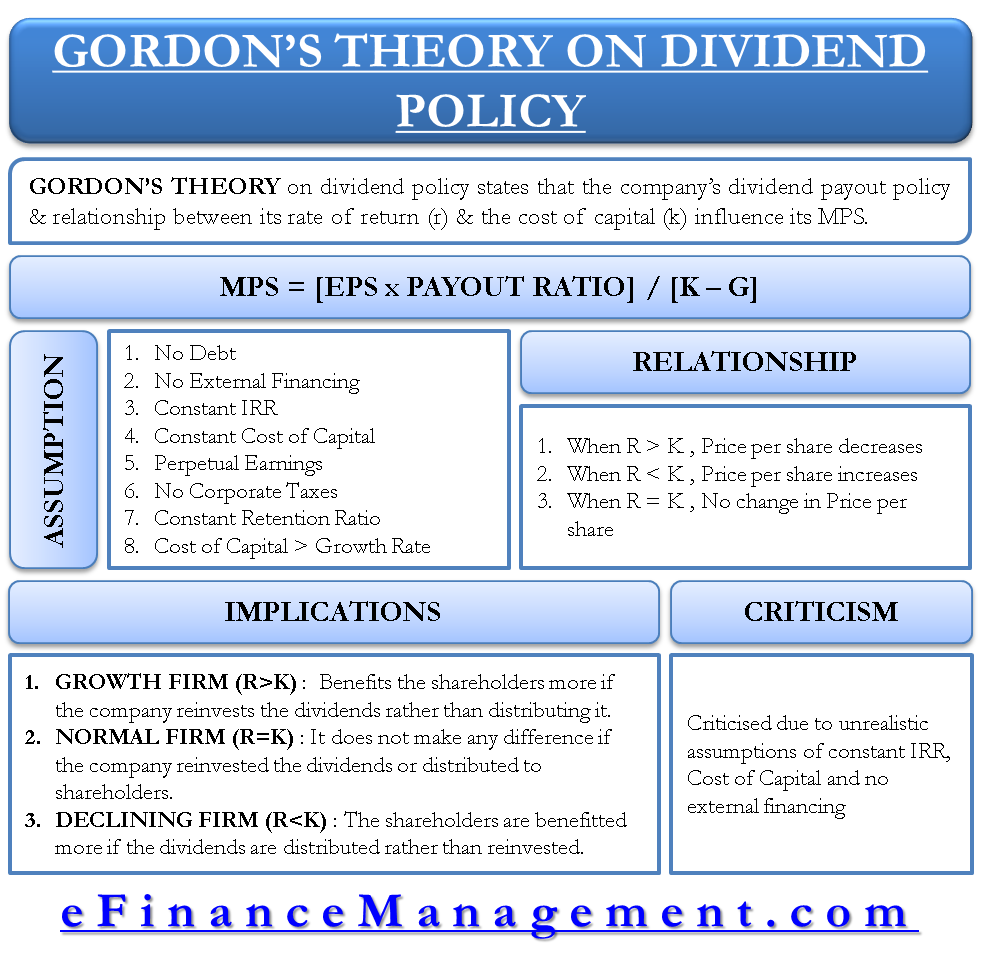

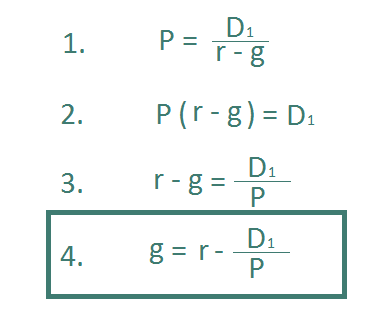

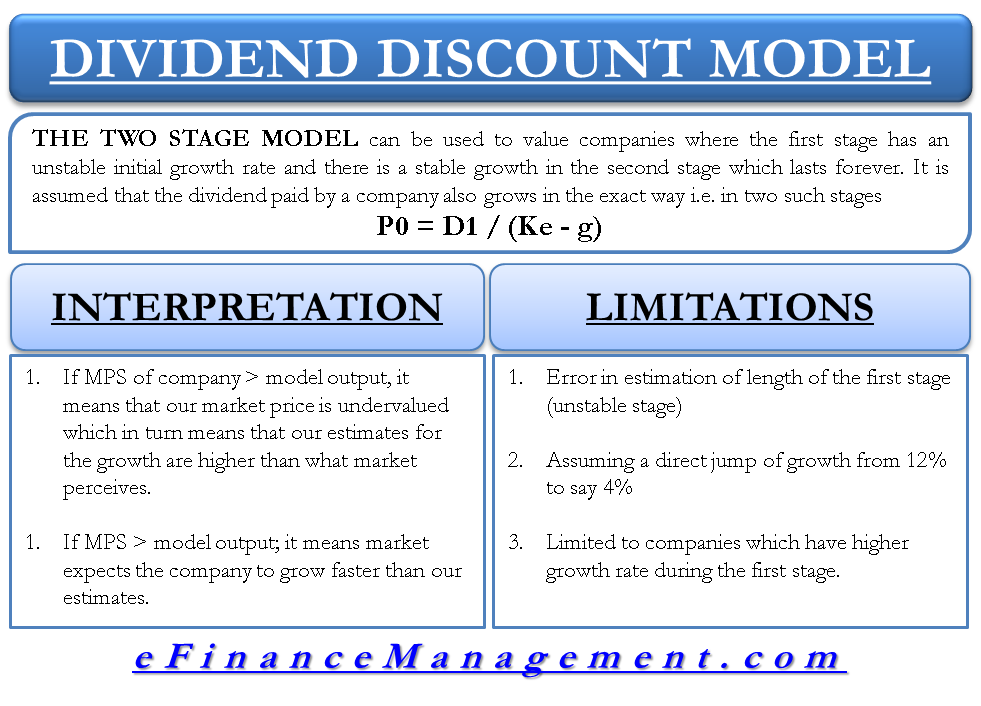

Finally the formula for gordon growth model is computed by dividing the next years dividend per share by the difference between the investors required rate of return and dividend growth rate as shown below. The gordon growth model sometimes referred to as the dividend growth model uses the investors required rate of return and the dividend growth rate to determine the value of the stock. R cost of equity or the required rate of return.

D 1 expected dividend amount for next year.

:max_bytes(150000):strip_icc()/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)

.png)