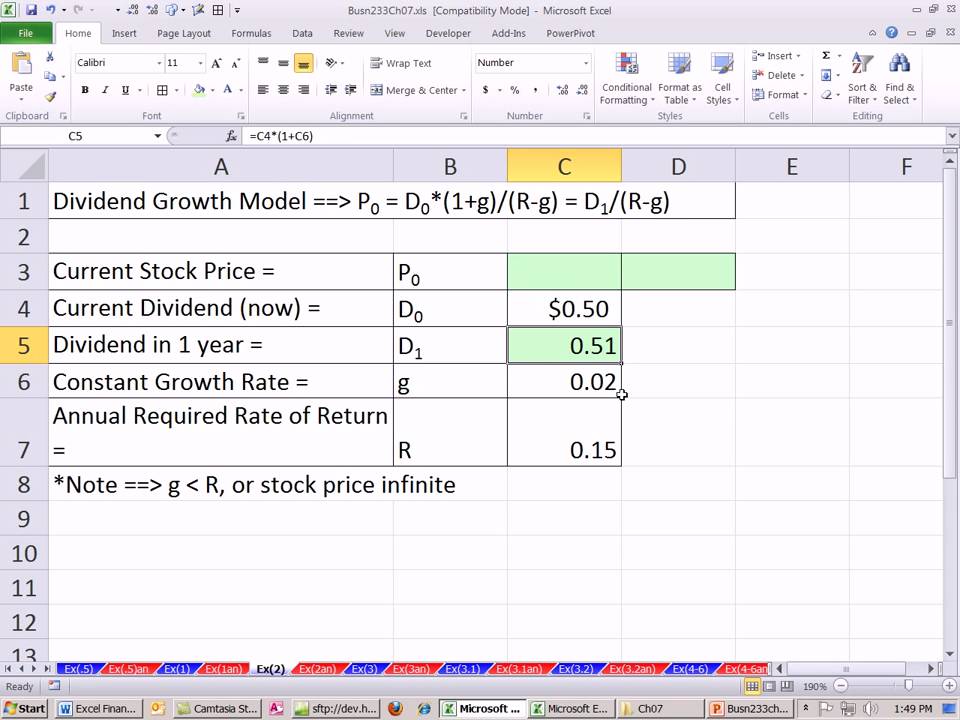

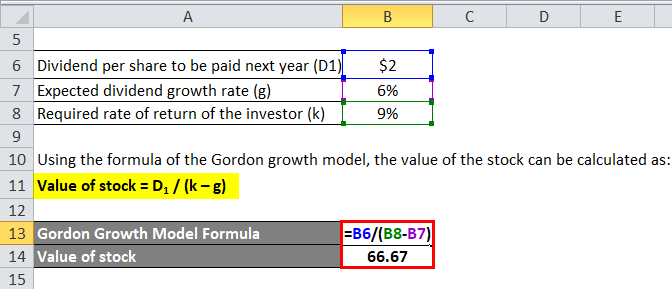

Gordon Growth Model Formula Excel

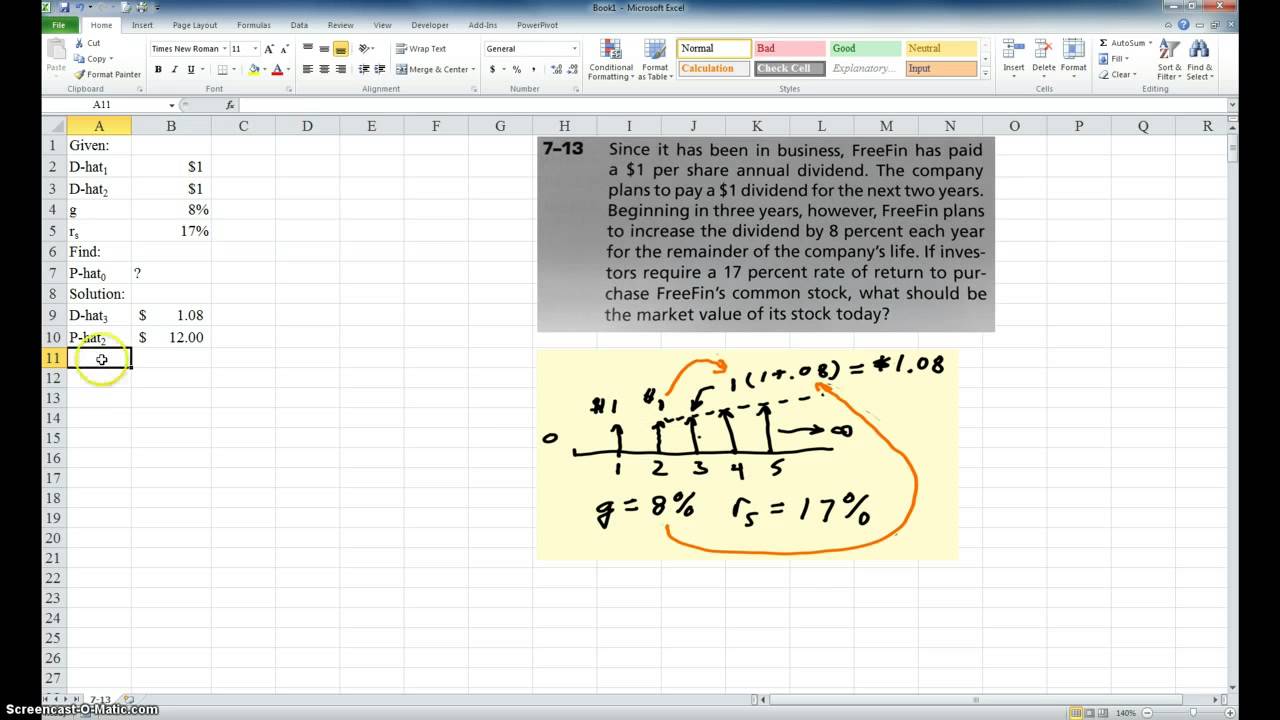

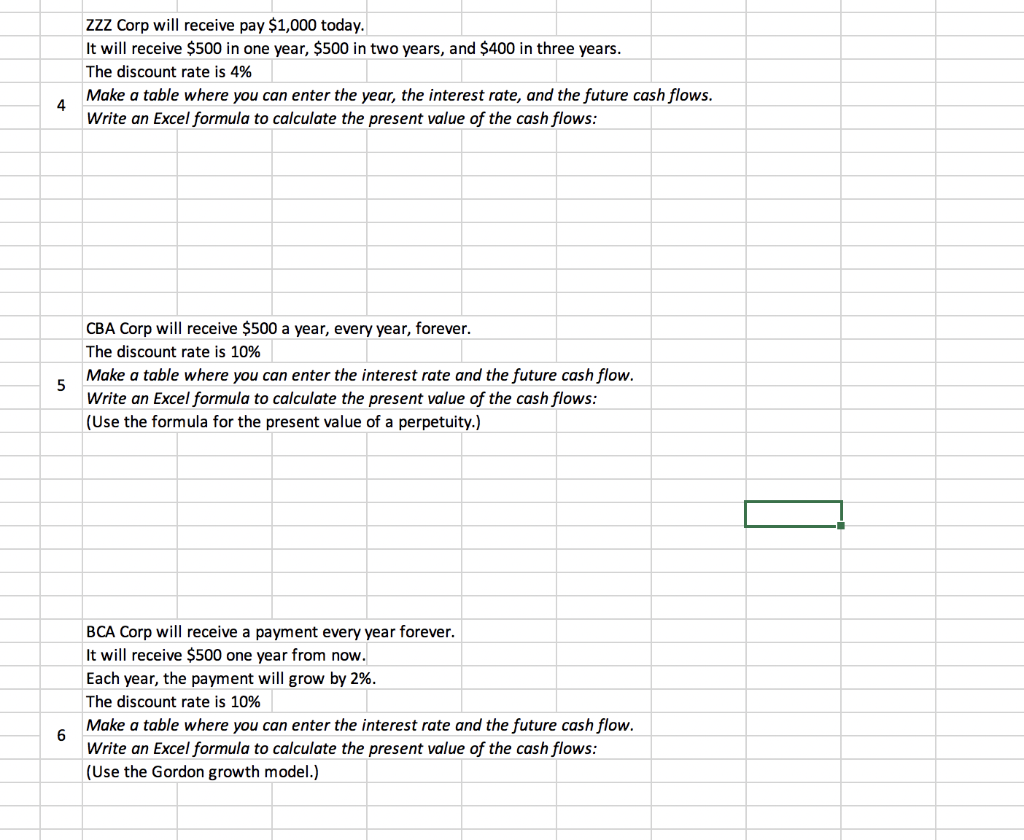

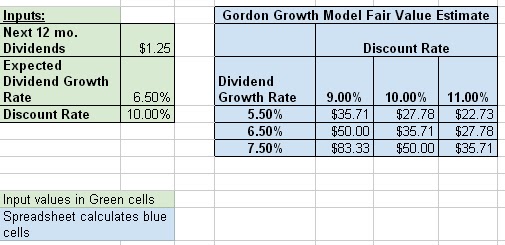

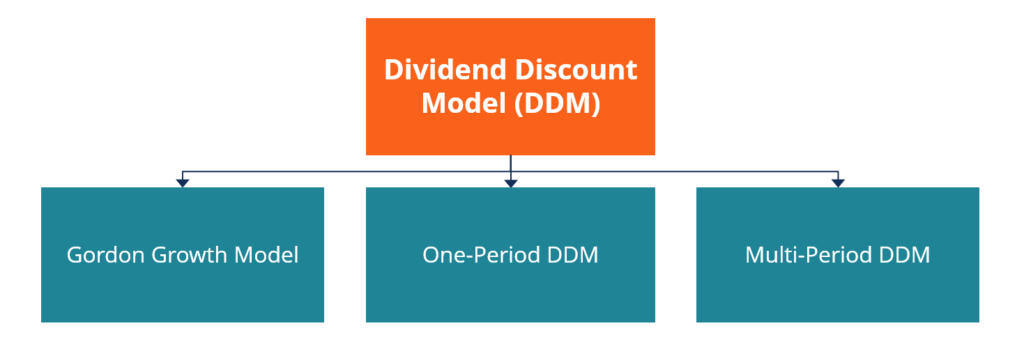

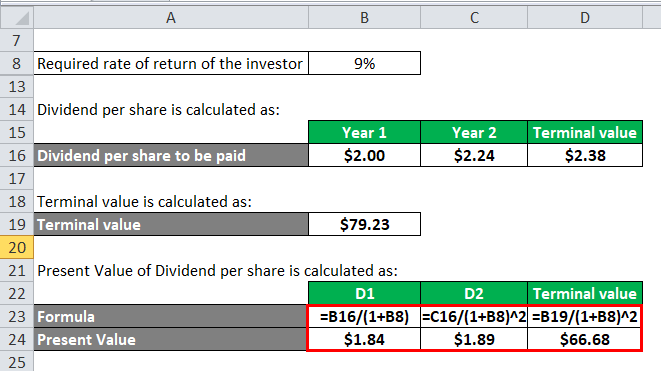

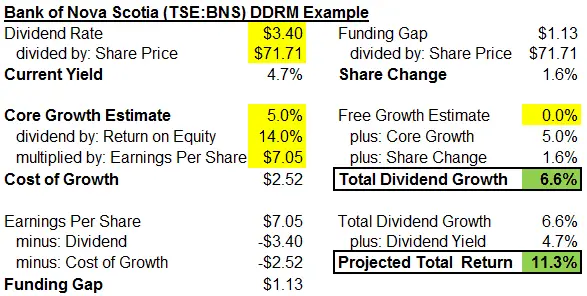

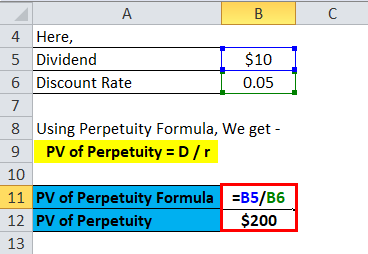

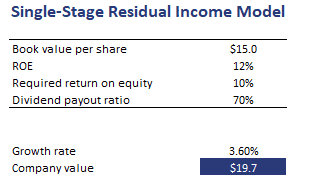

The gordon growth model also known as the dividend discount model is often applied in microsoft excel to determine the intrinsic value of a stock.

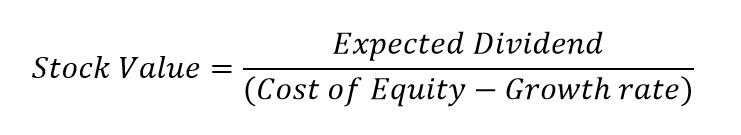

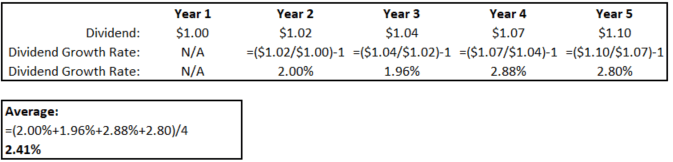

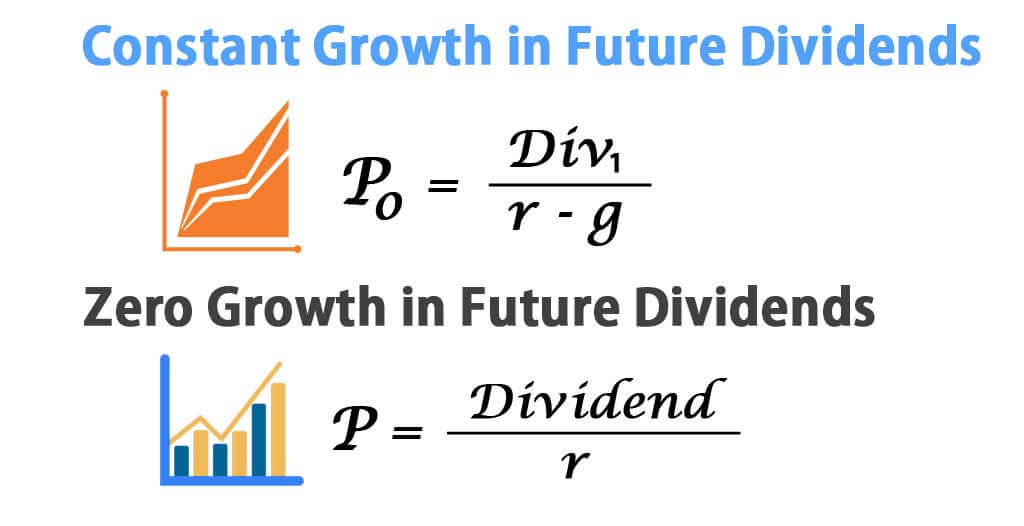

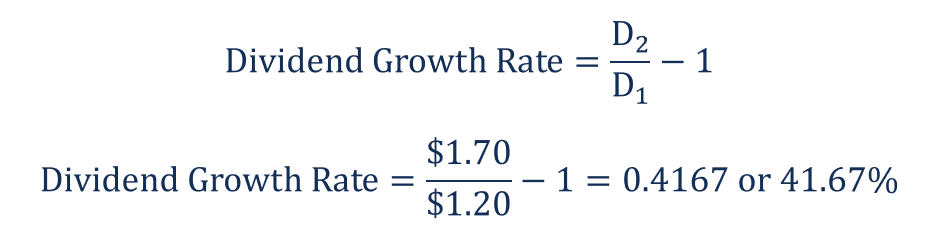

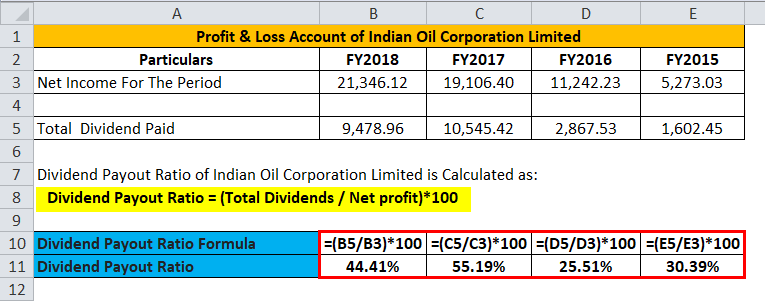

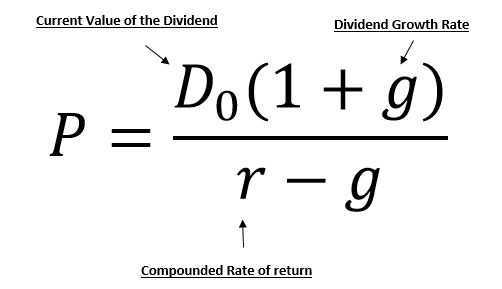

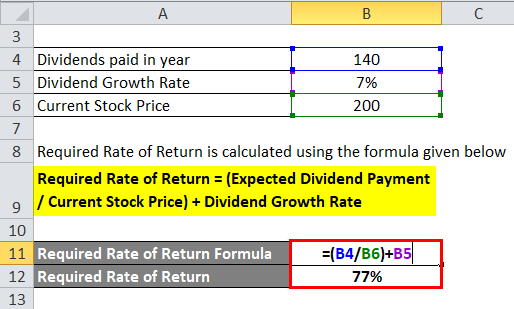

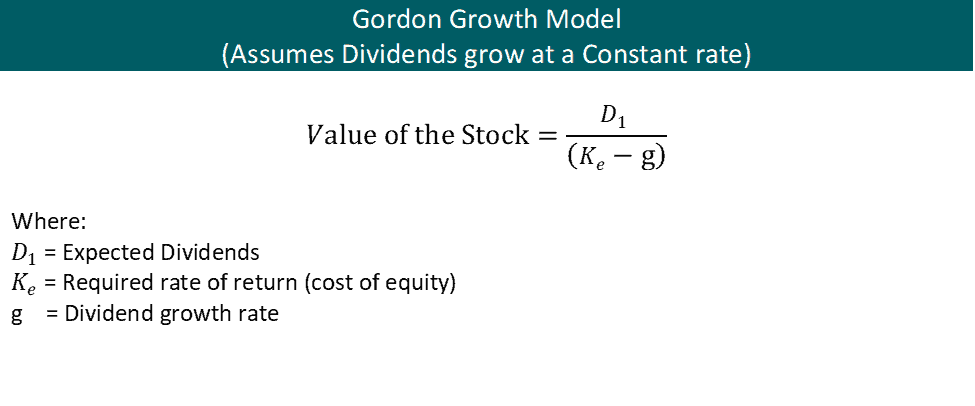

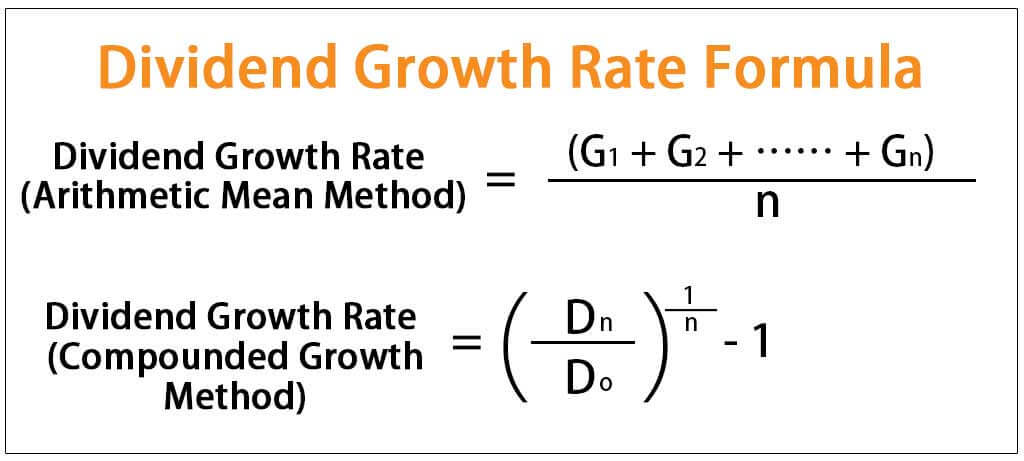

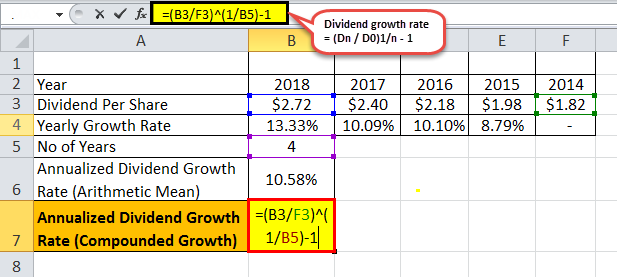

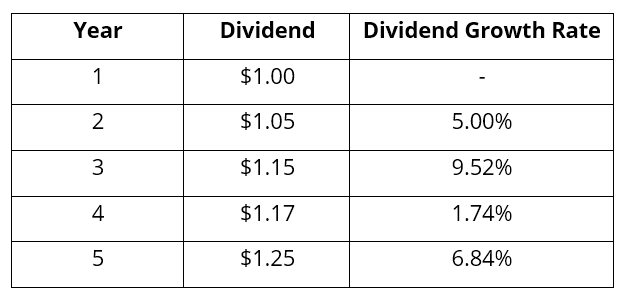

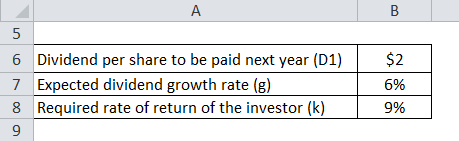

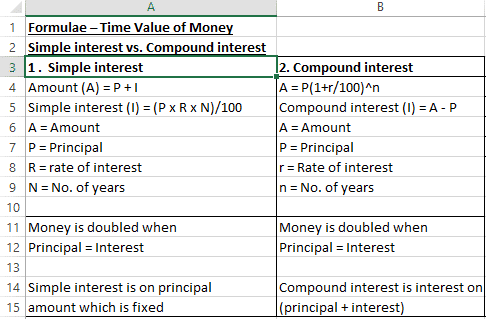

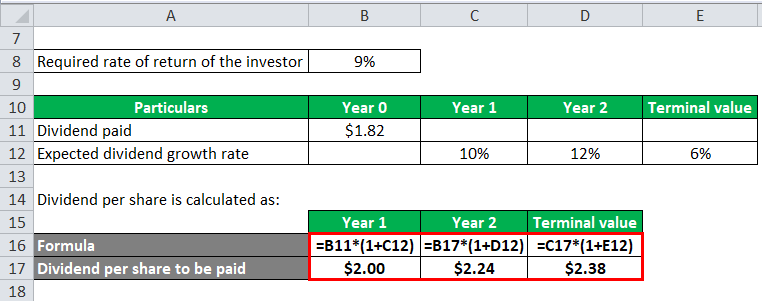

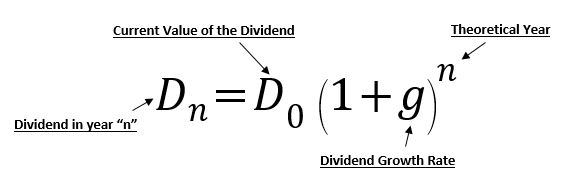

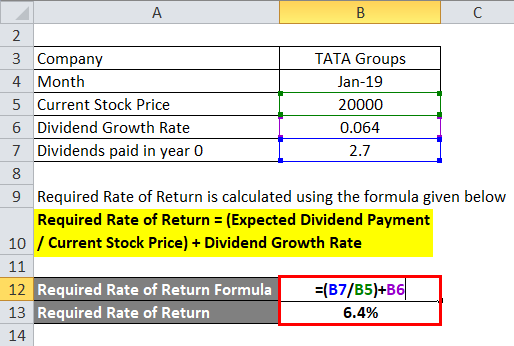

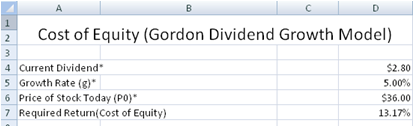

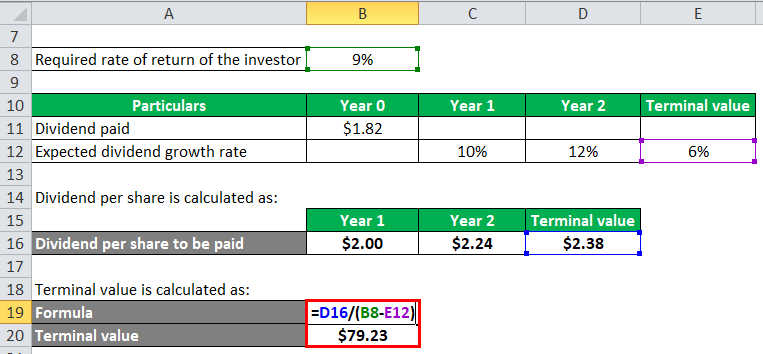

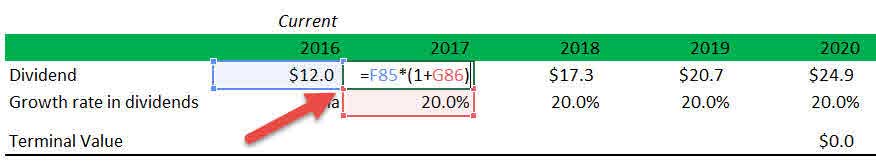

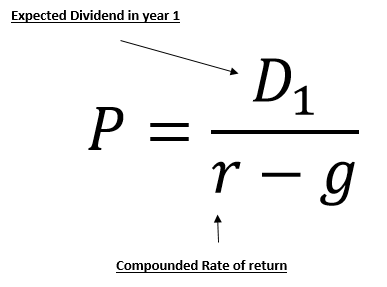

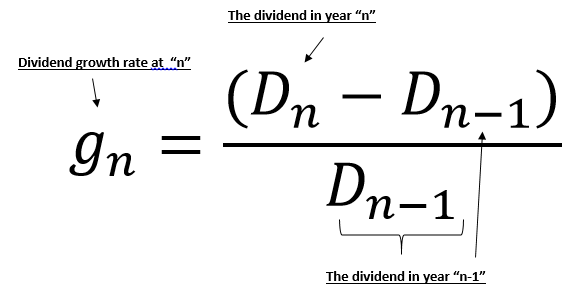

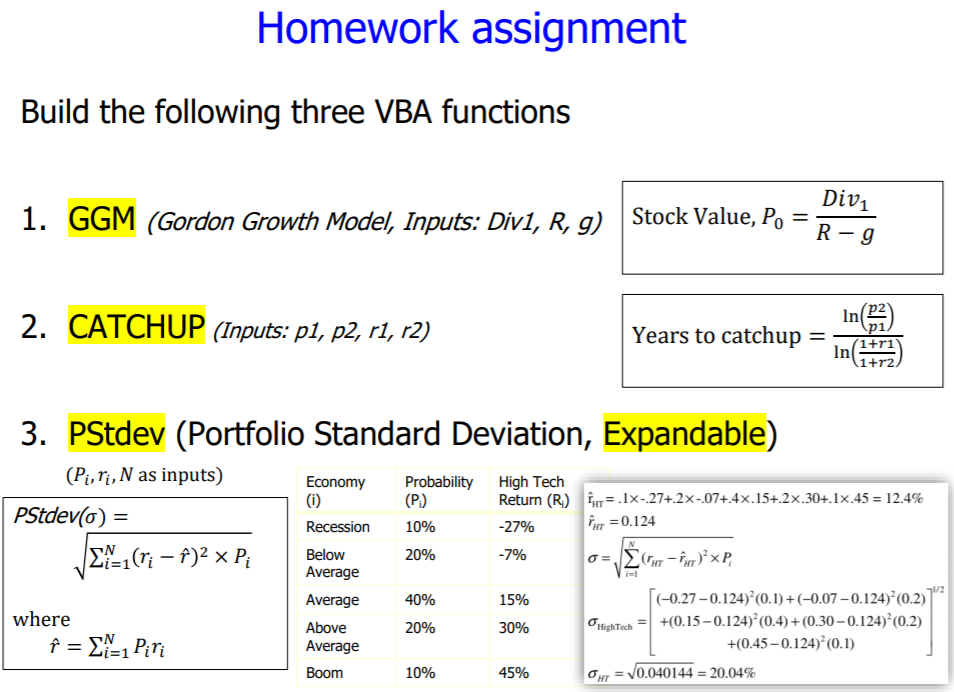

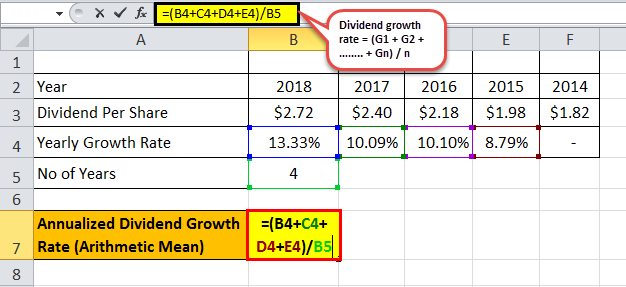

Gordon growth model formula excel. R required rate of return. The gordon growth model formula that with the constant growth rate in future dividends is as per below. G expected growth rate of dividends assumed to be constant the current dividend payout d 0 can be found in the annual report of a company.

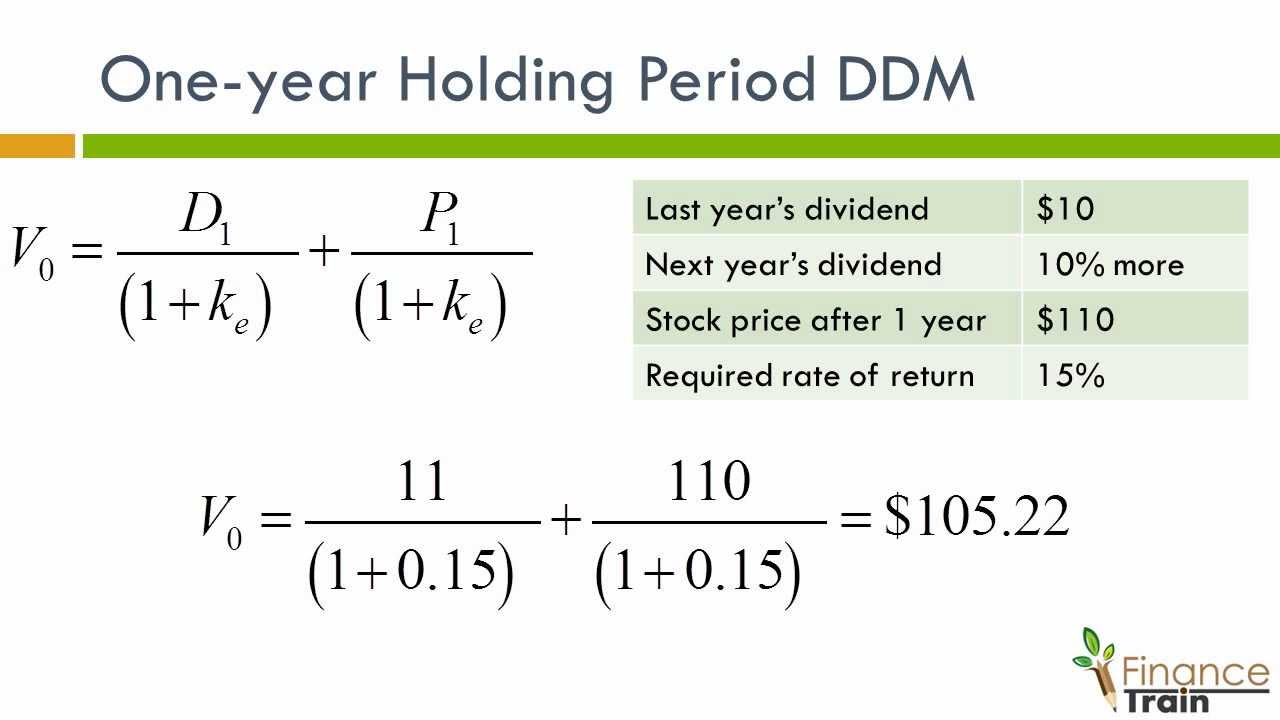

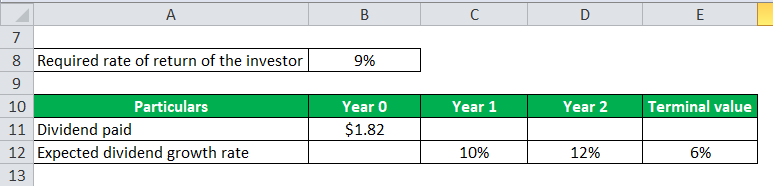

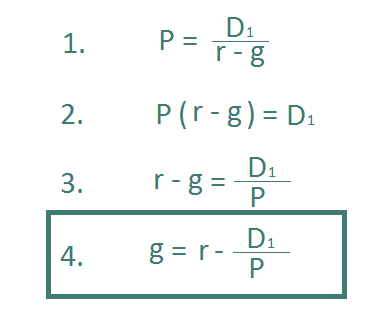

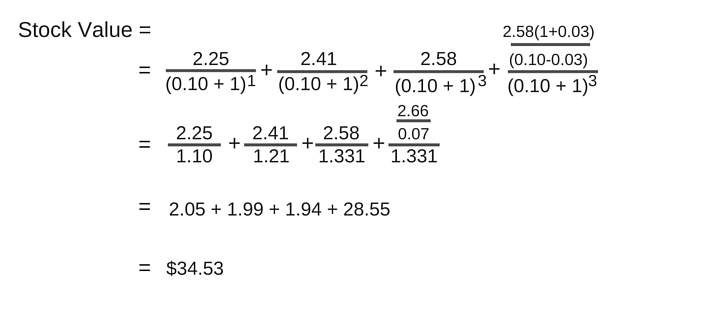

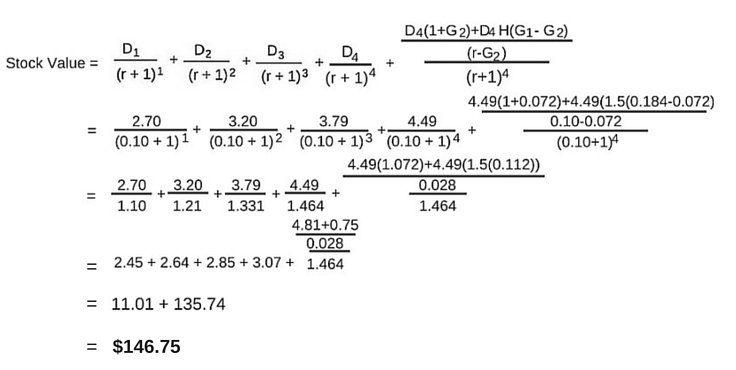

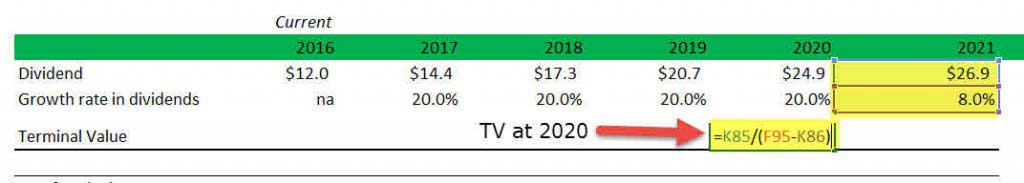

R cost of equity or the required rate of return. Lets have a look at the formula first. Finally the formula for gordon growth model is computed by dividing the next years dividend per share by the difference between the investors required rate of return and dividend growth rate as shown below.

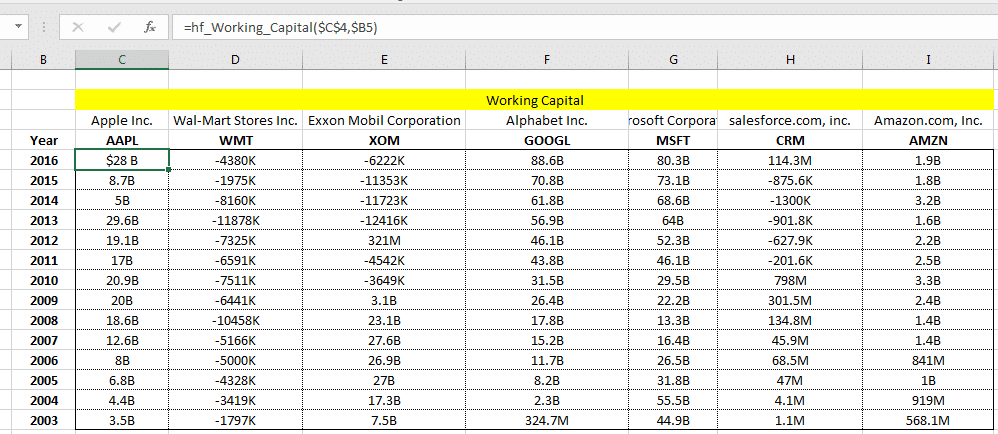

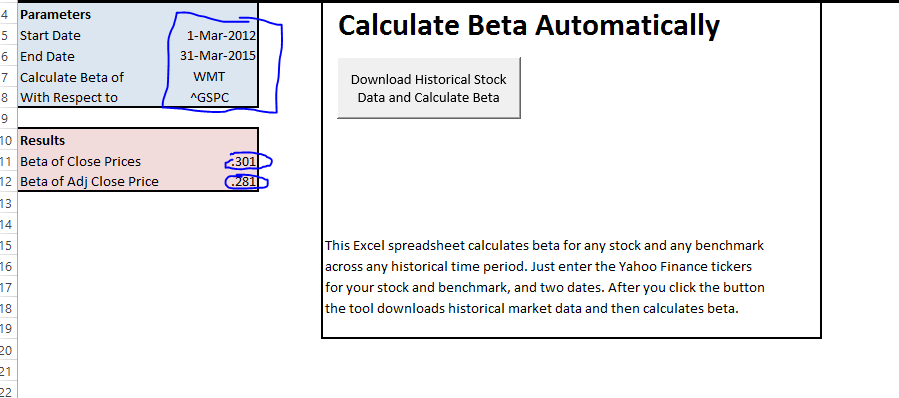

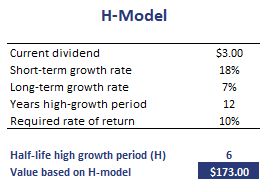

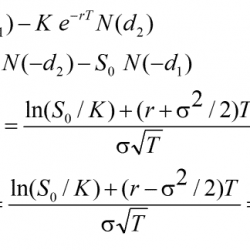

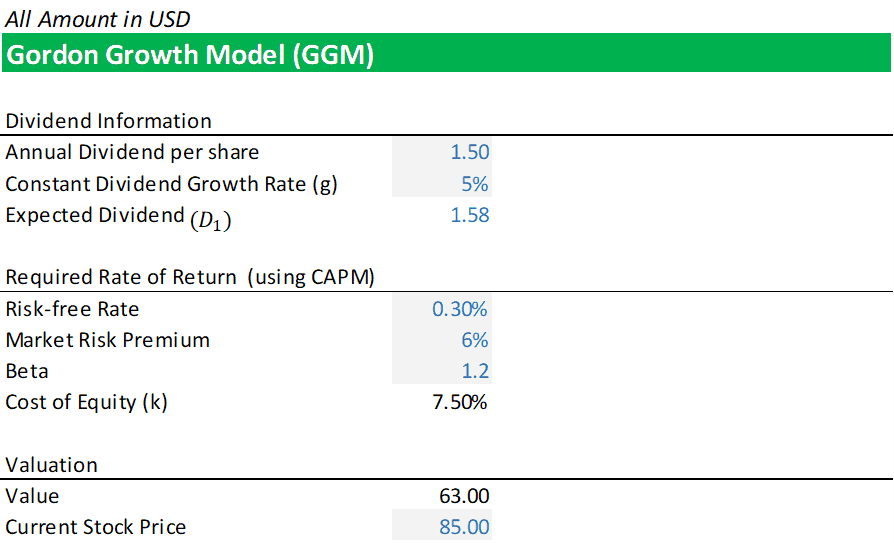

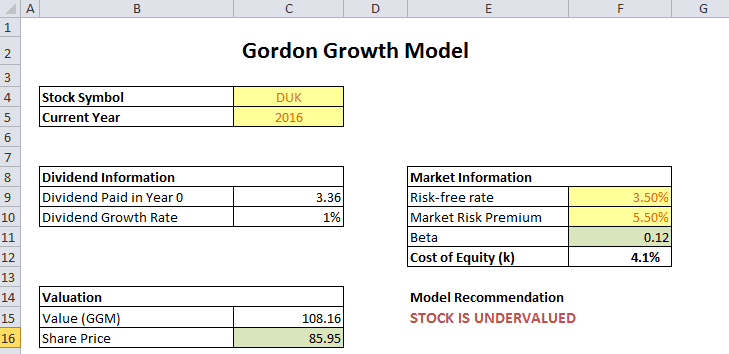

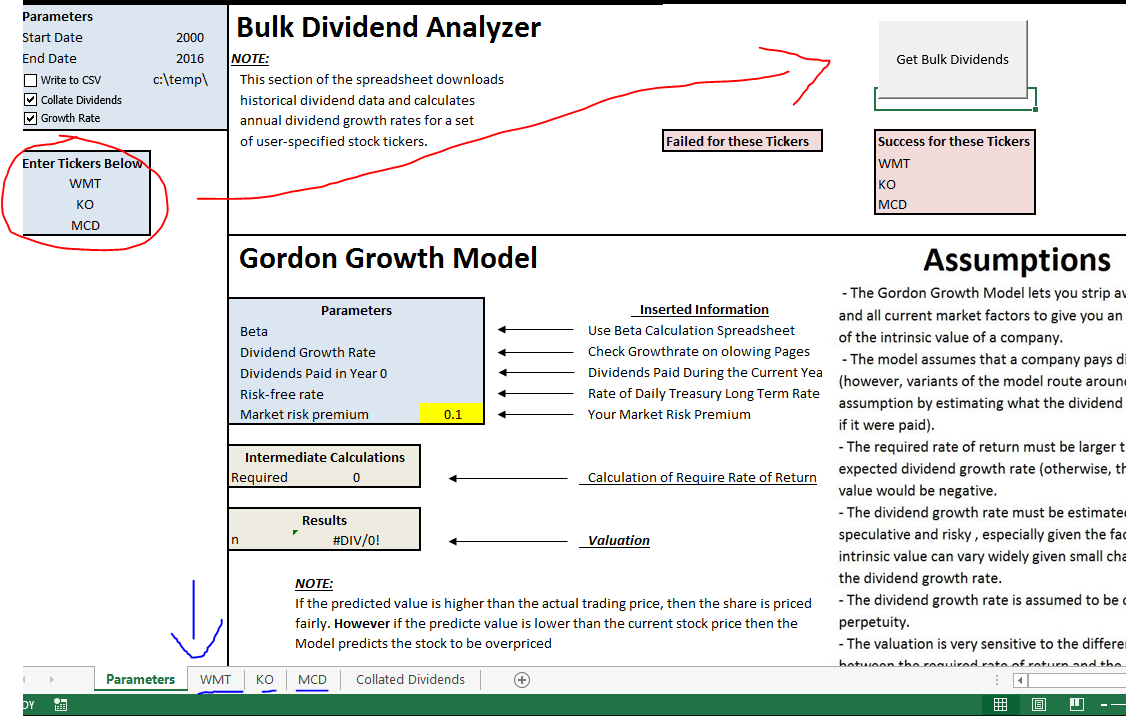

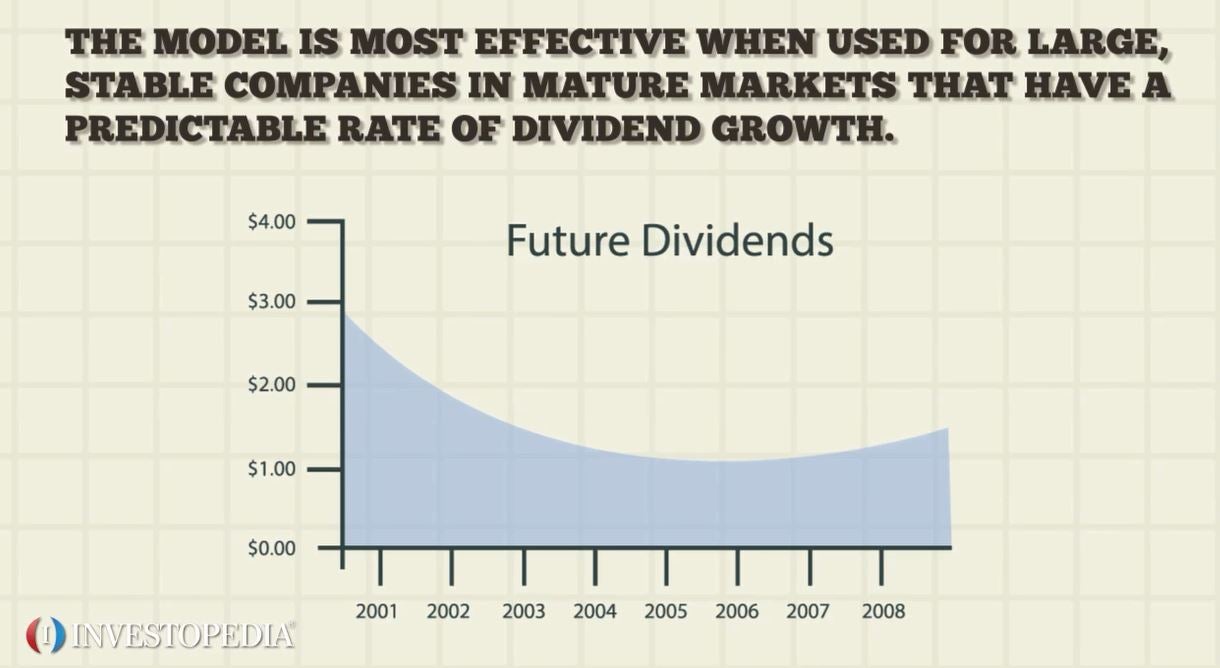

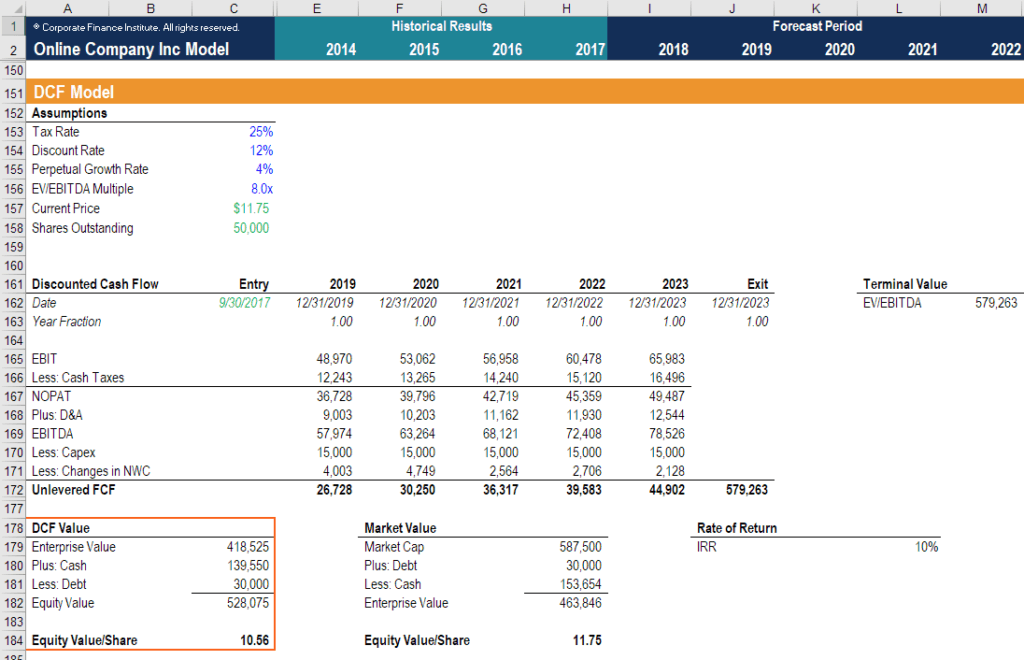

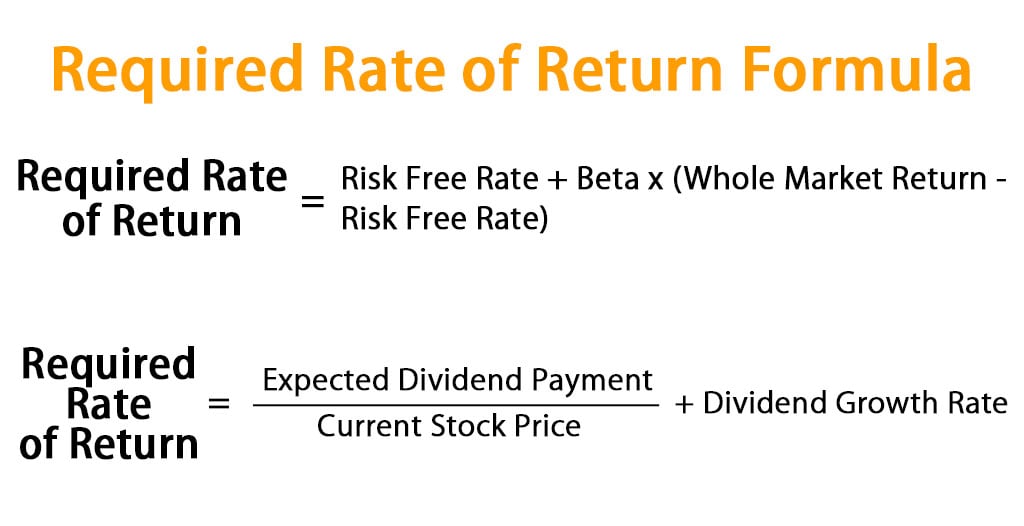

The gordon growth model lets you strip away any and all current market factors to give you an estimate of the intrinsic value of a company. The excel template makes use of the marketxls hf functions to fetch all market data. The capital asset pricing model is often used to estimate r.

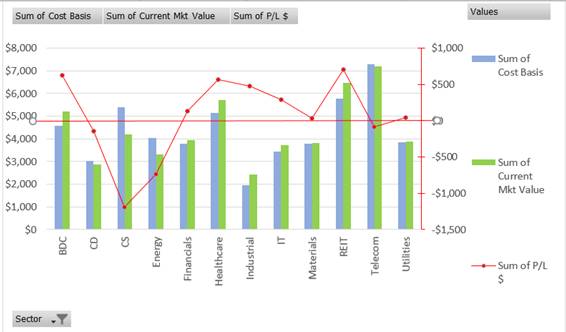

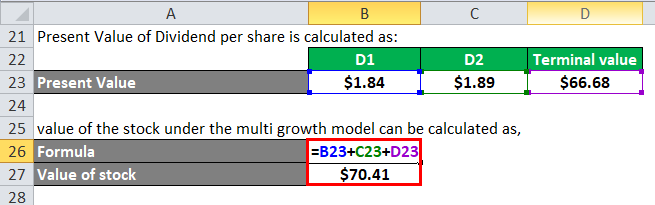

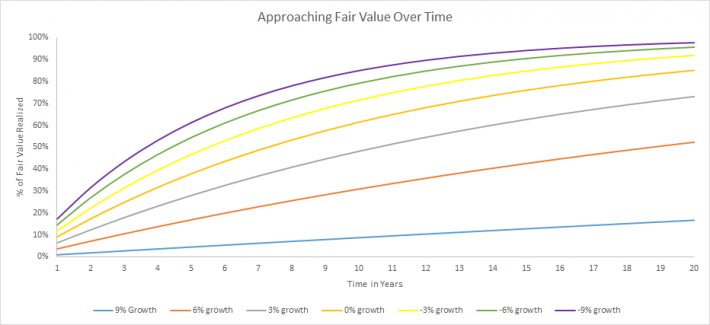

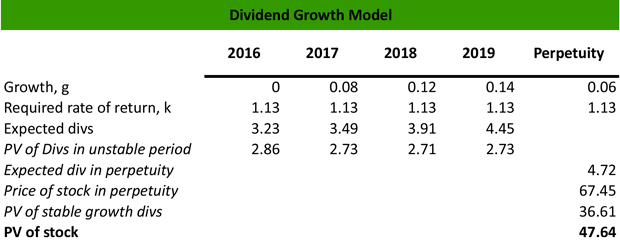

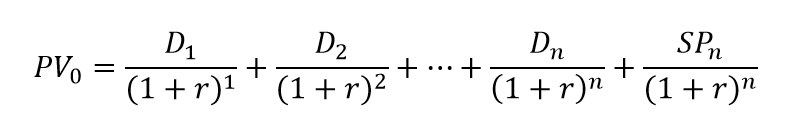

Value of stock d 1 k g relevance and uses of the gordon growth model formula. We note from the above graph companies like mcdonalds procter gamble kimberly clark pepsico 3m cocacola johnson johnson att walmart pay regular dividends and we can use gordon growth model to value such companies. Here p 0 stock price.

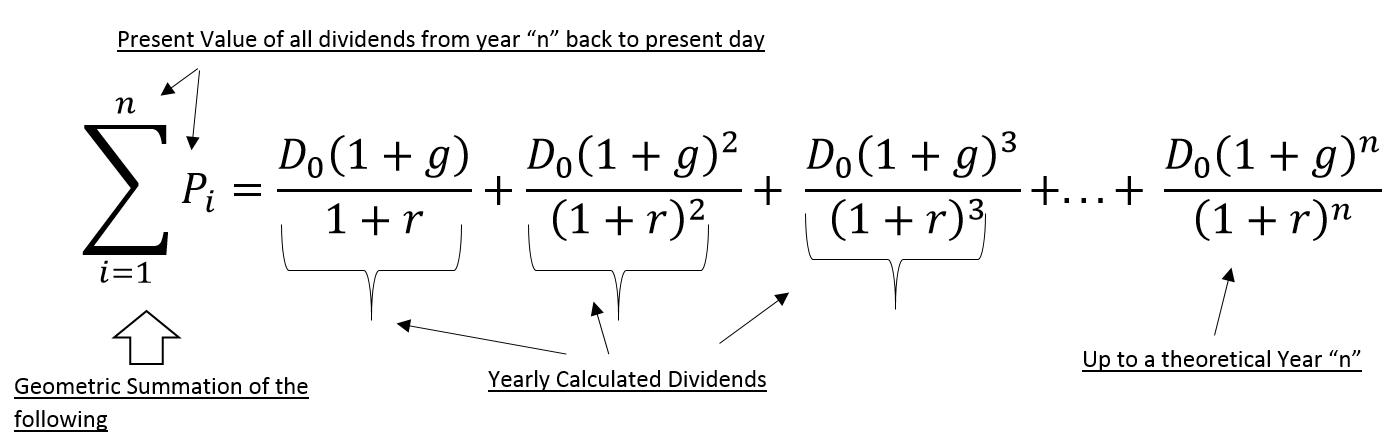

As per the gordon growth formula the intrinsic value of the stock is equal to the sum of all the present value of the future dividend. R f is the risk free rate. Div 1 estimated dividends for the next period.

G growth rate. The excel template also showcases the duke energy example as shown above. Gordon growth model in excel we have developed gordon growth model in excel template that you can use to value any stock using this model.

B is the stock beta relative to a benchmark.

/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)