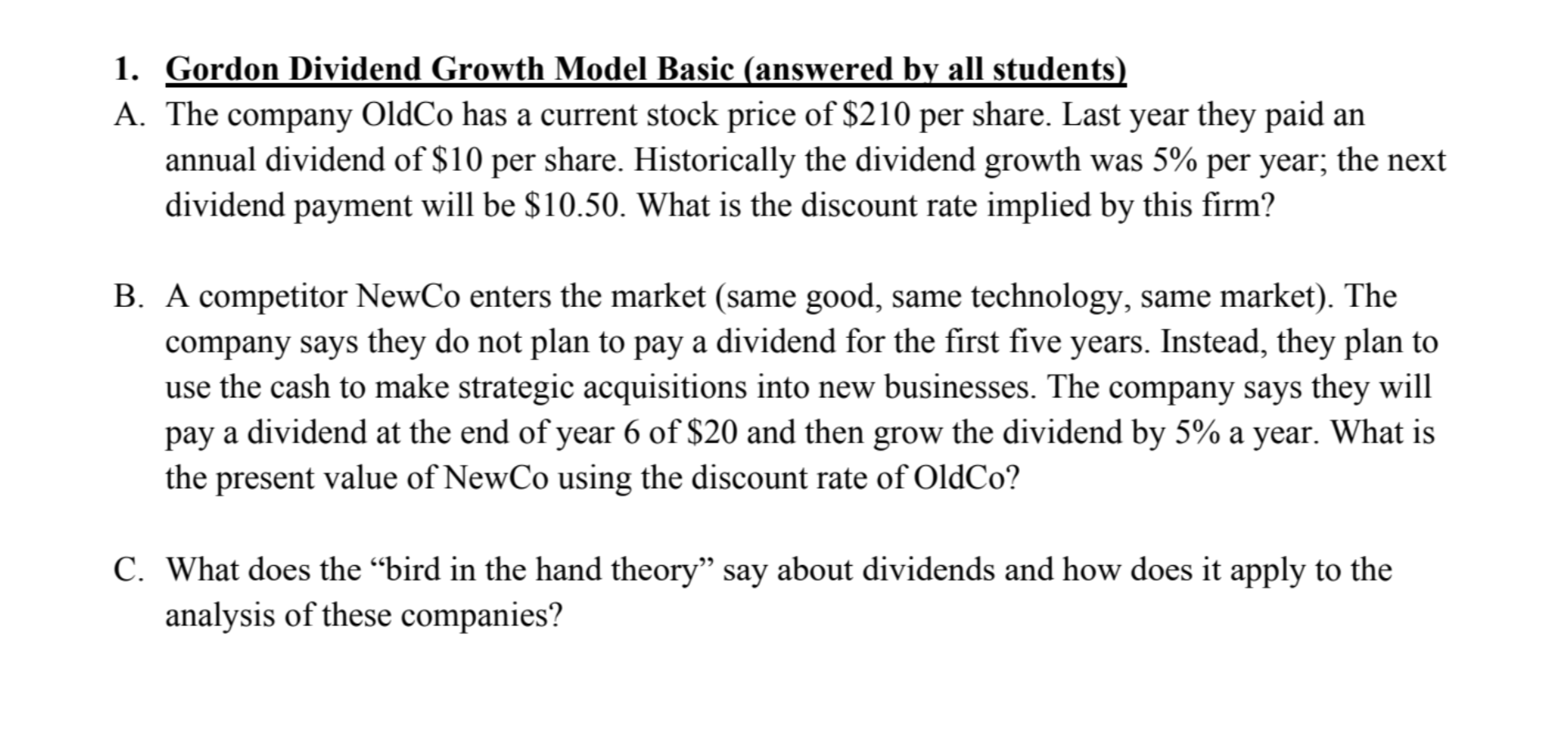

Gordon Model Formula For Dividend Policy

Calculation of market price per share bajaj steel company ltd 2013 r1895 k5 eps9235 dps4 assumption original data let r be 1595 let r be 5 part payment913 45 54 1849 100 retention 48 57 1849 100 payout 47 55 1849.

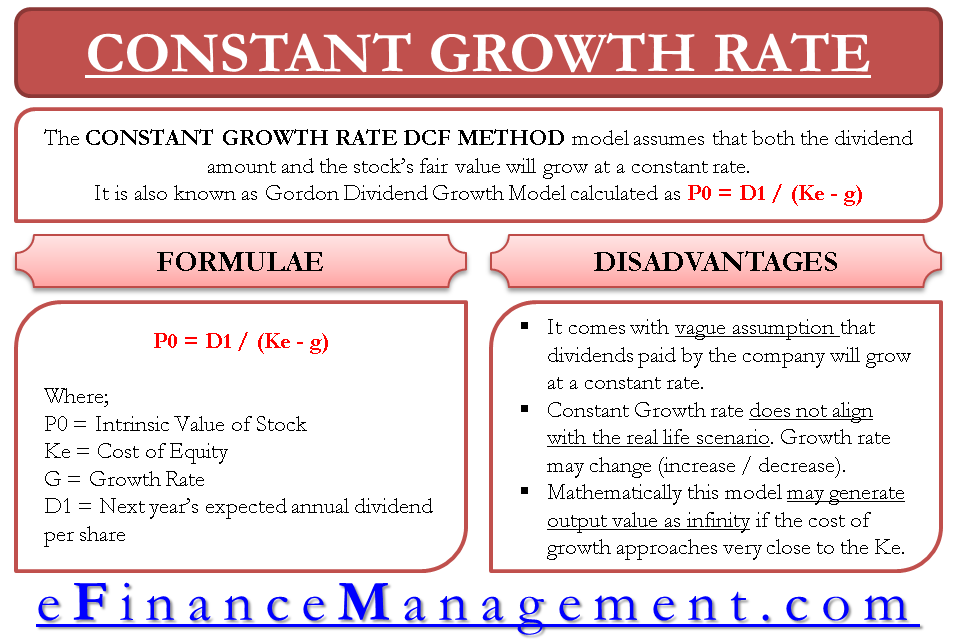

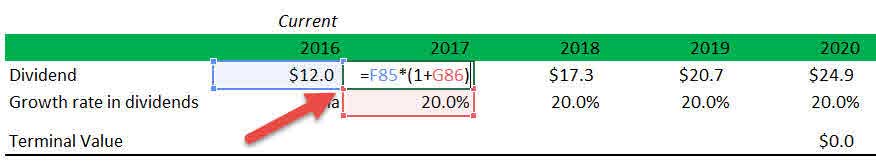

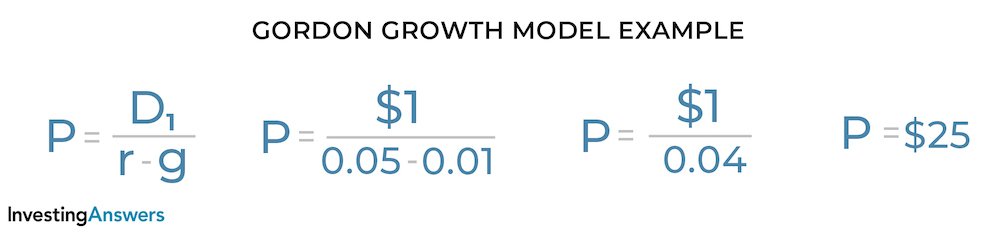

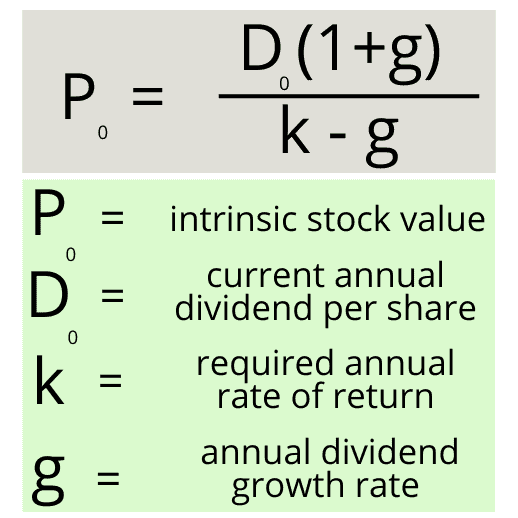

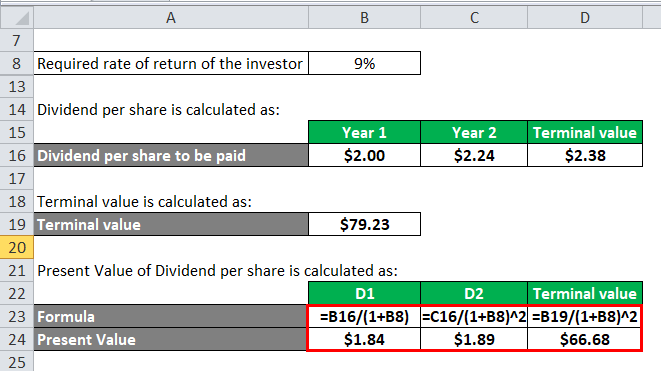

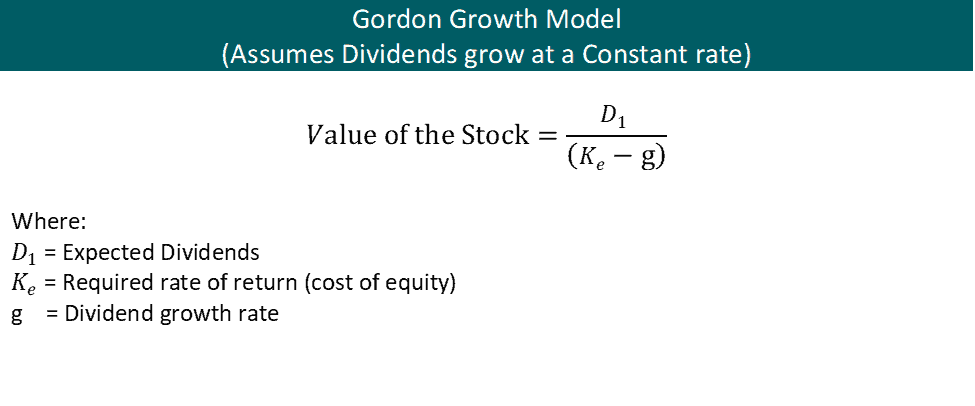

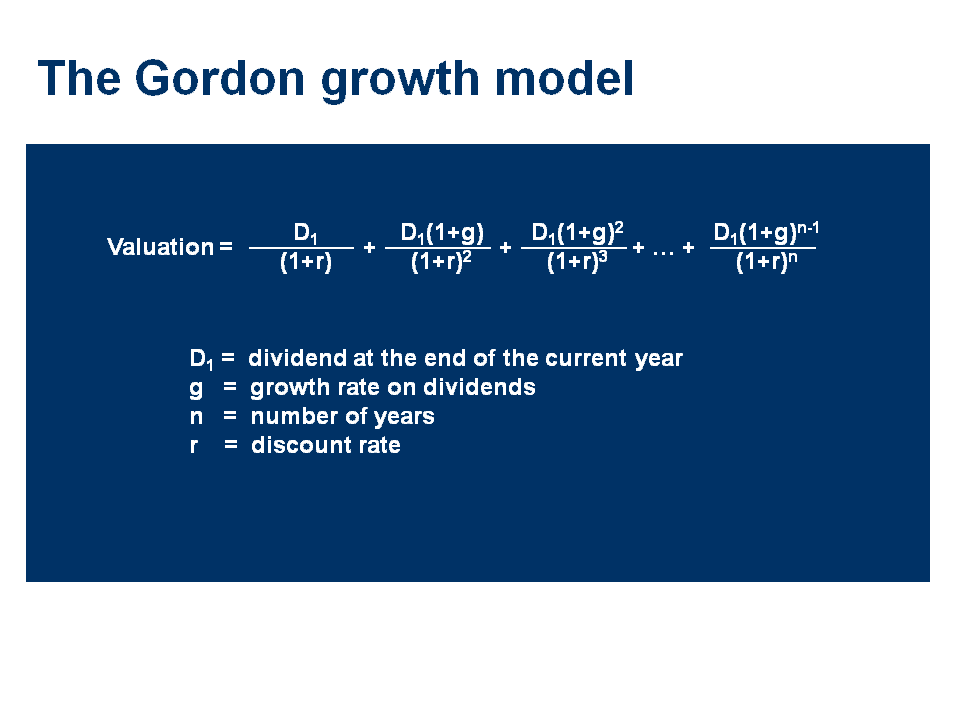

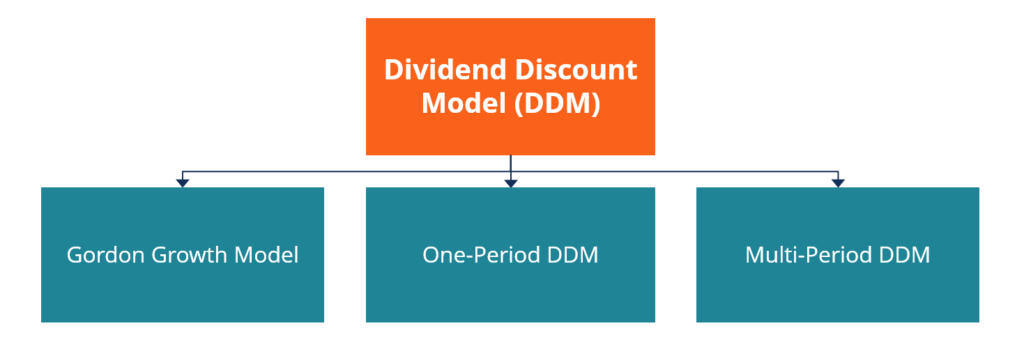

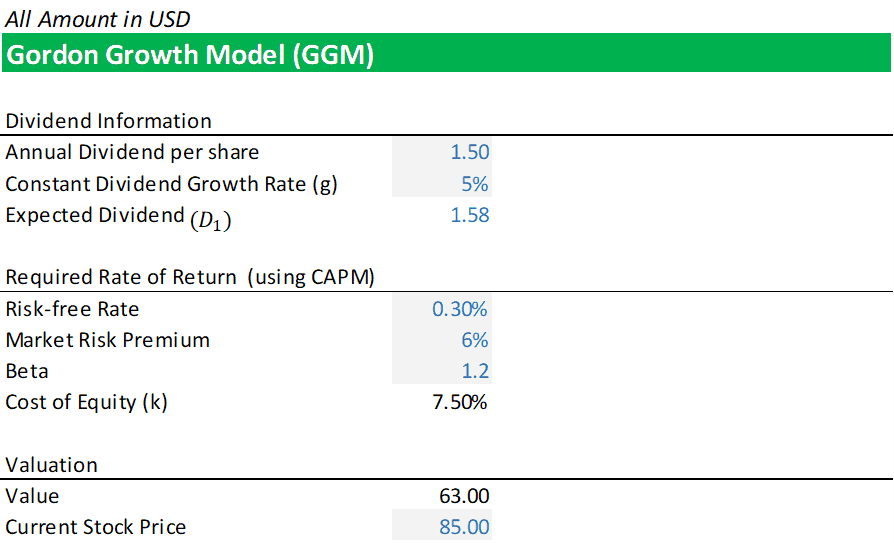

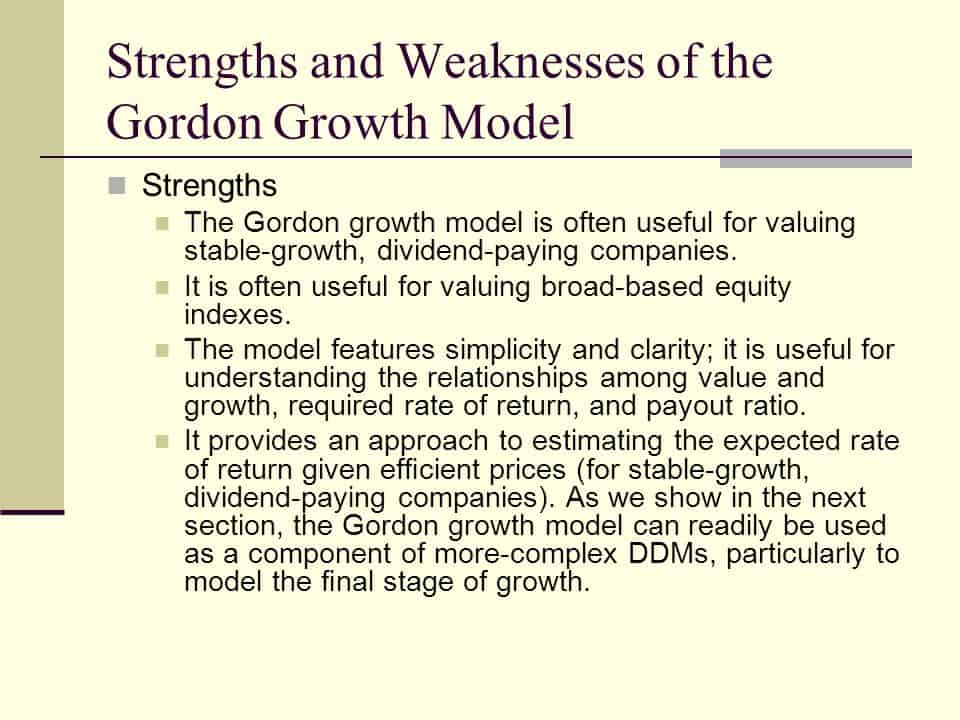

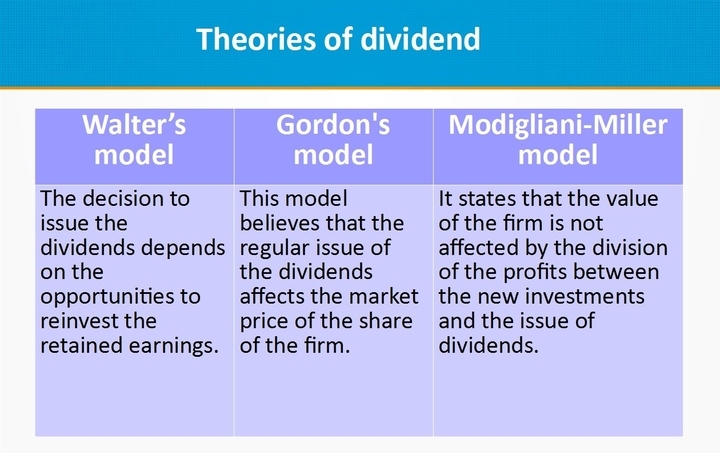

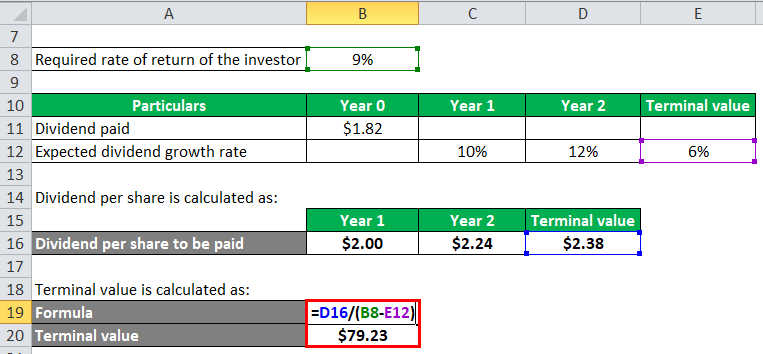

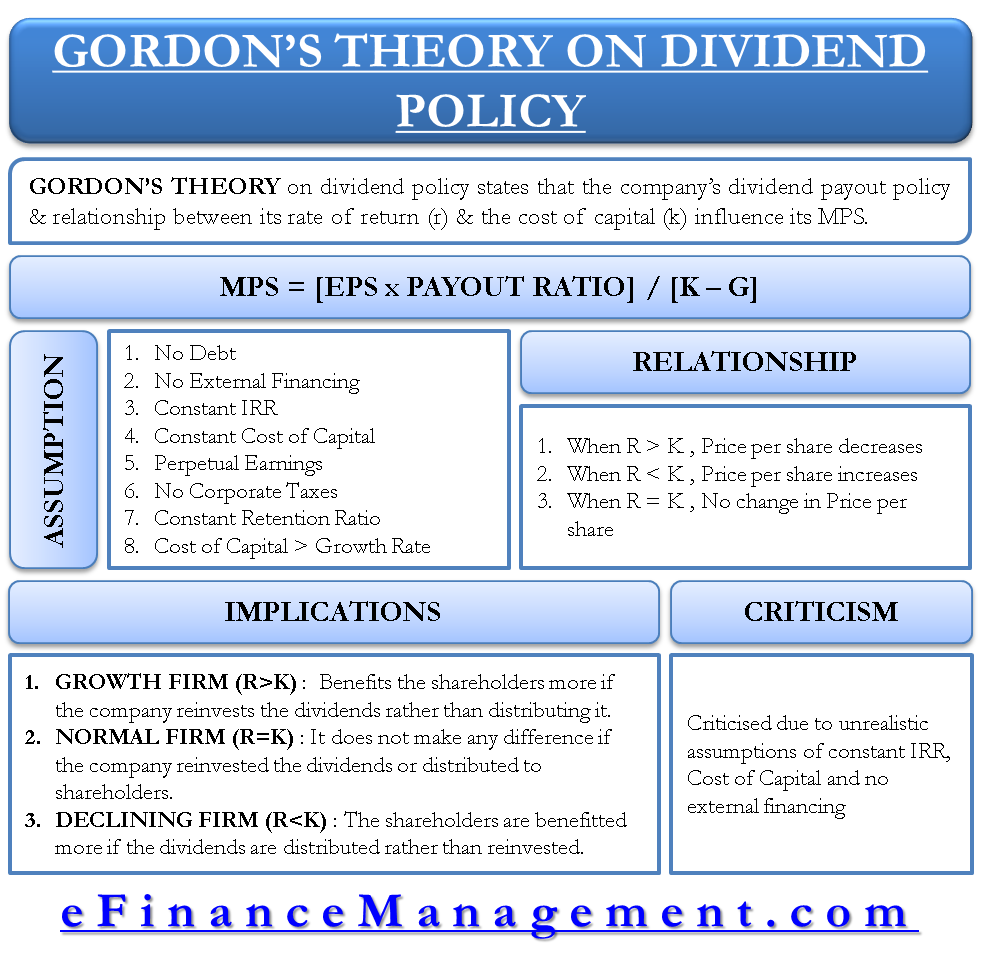

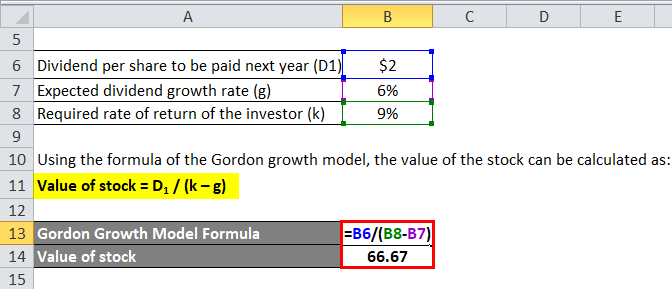

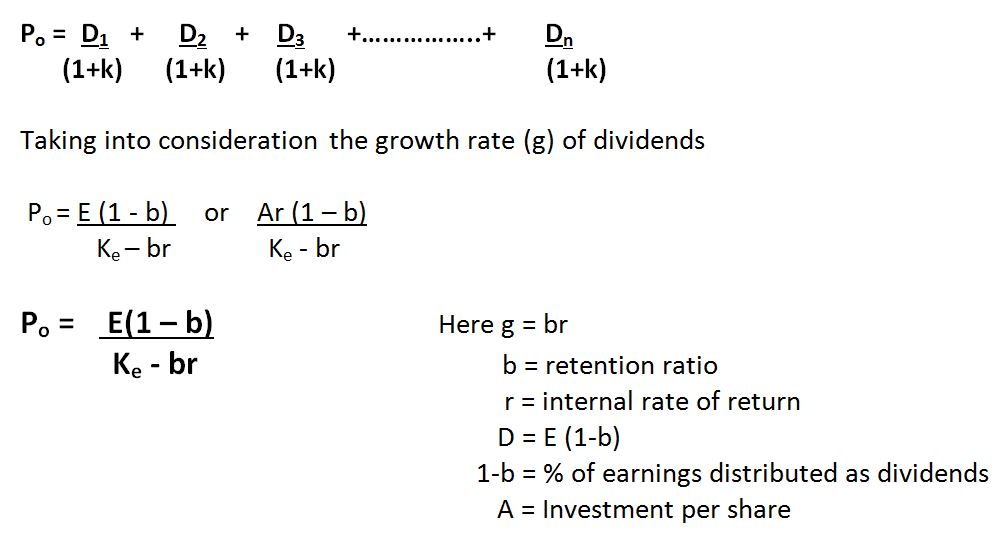

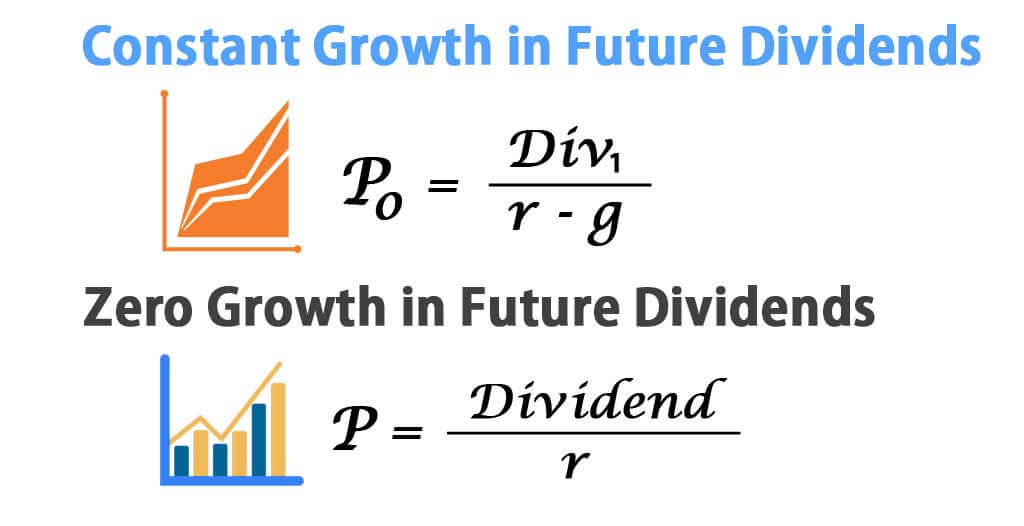

Gordon model formula for dividend policy. Where p price of a share e earnings per share b retention ratio. 1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. The gordon growth model sometimes referred to as the dividend growth model uses the investors required rate of return and the dividend growth rate to determine the value of the stock.

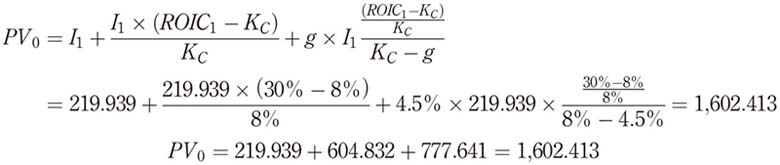

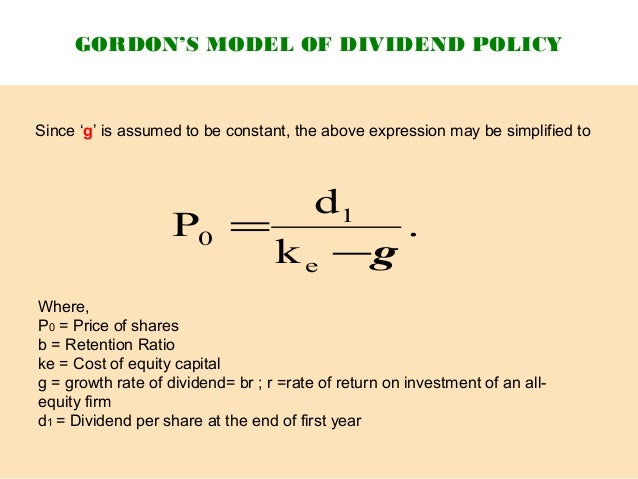

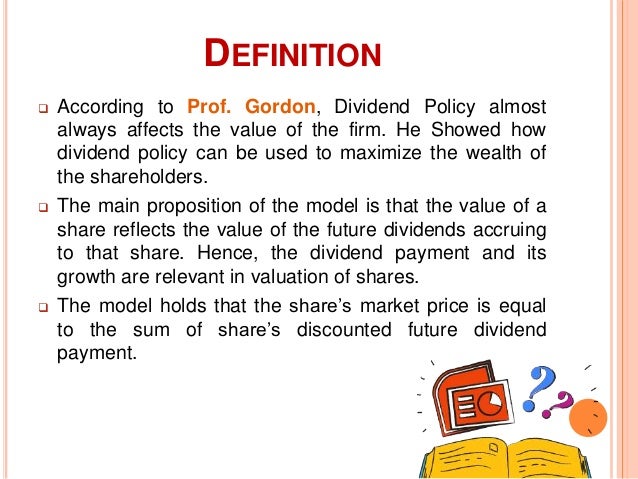

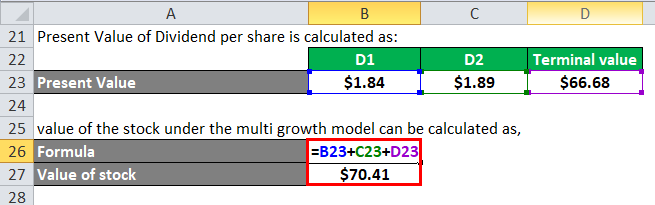

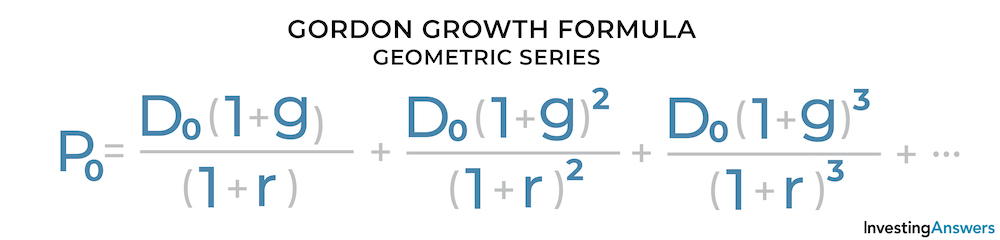

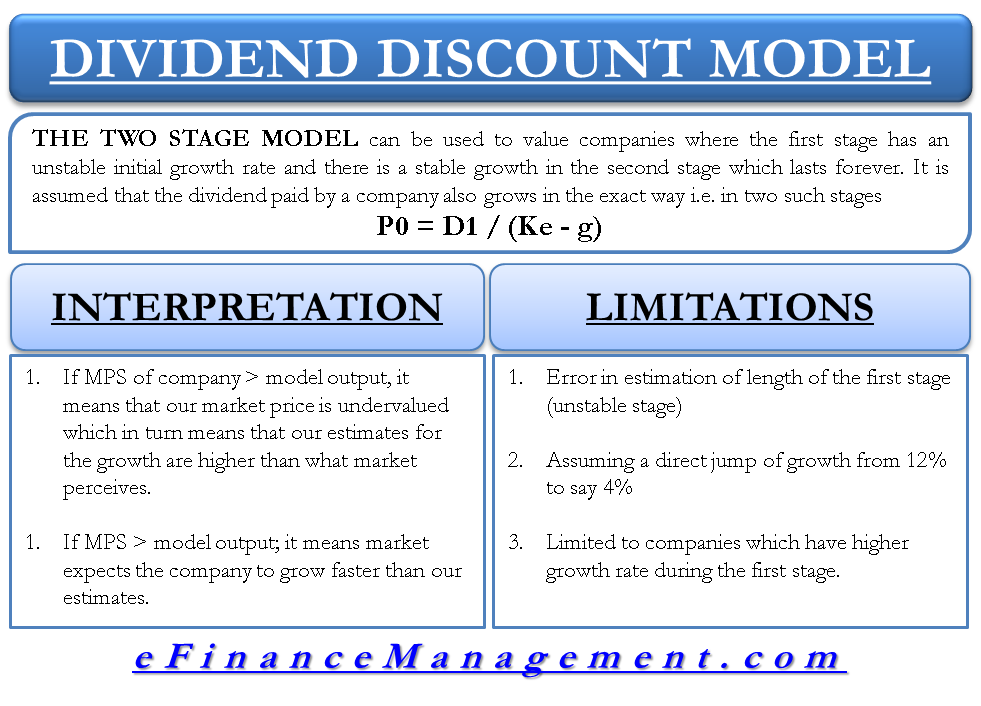

Using an estimated dividend of 212 at the beginning of 2019 the investor would use the dividend discount model to calculate a per share value of 212 05 02 7067. As a formula the gordon growth model is quite simple. According to the gordons model the market value of the share is equal to the present value of future dividends.

The first number is your desired annual return on investment. Calculate the market value of the share using gordons model. Here e 15.

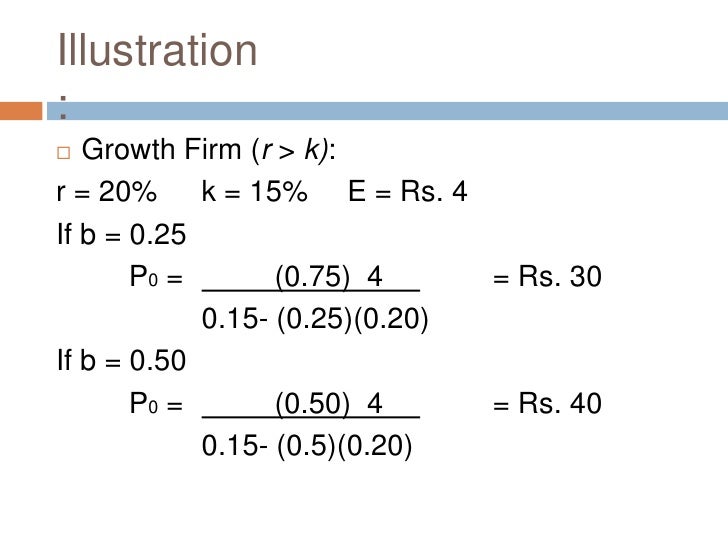

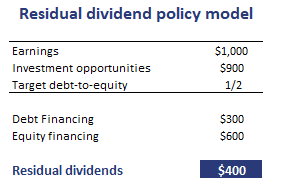

Implications of gordons model. D 1 d 0 1 g 10 105 1050. First i will describe it with words.

Three variables are included in the gordon growth model formula. D 0 10. What is the gordon growth model formula.

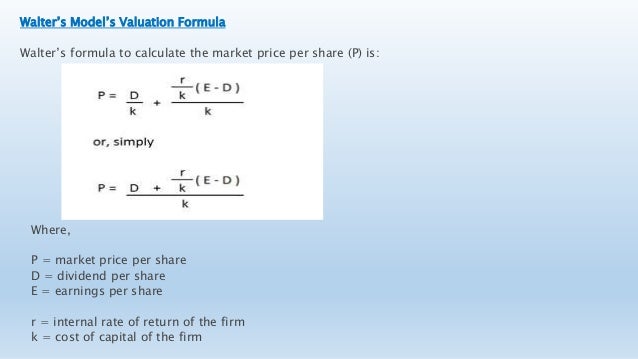

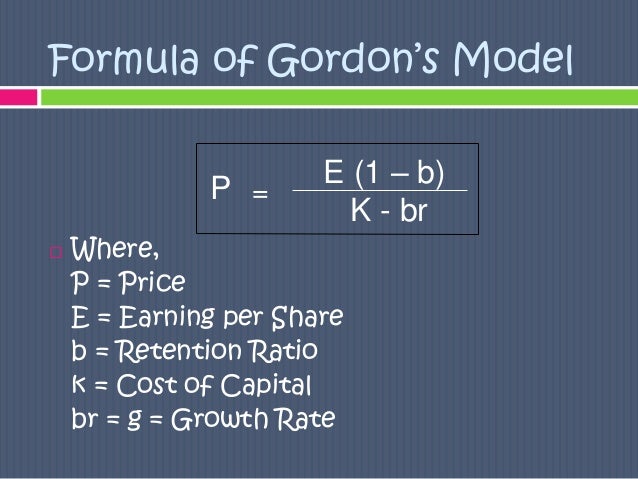

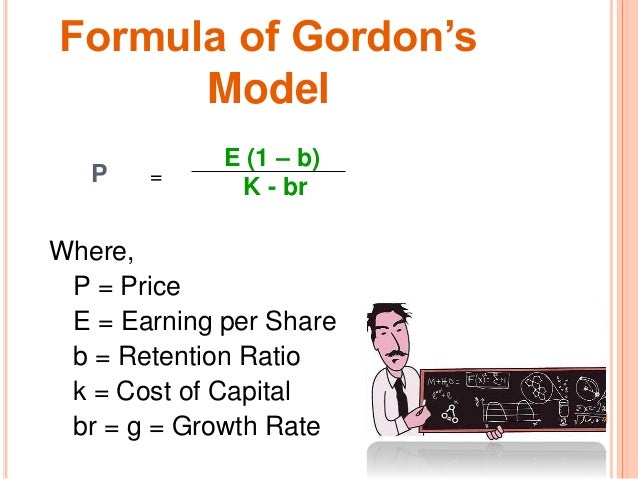

Formula of gordons model where p price e earning per share b retention ratio k cost of capital br g growth rate p e 1 b k br 5. P d 1 r g where. G 5 or 005.

It is represented as. P current stock price g constant growth rate expected for dividends in perpetuity r constant cost of equity capital for the company or rate of return d 1. R 7 or 007.

The market price of company x share as per the dividend discount model with constant growth rate is rs. Thus an investor would discount the future dividends ie. The company retains 70 of its earnings.

Gordons model believes that the dividend policy impacts the company in various scenarios as follows. The wacc formula is ev x re dv x rd x 1 t. Market price of the share p 15 1 70 12 10 1530 02 225.

Divided by the difference between 2 numbers.