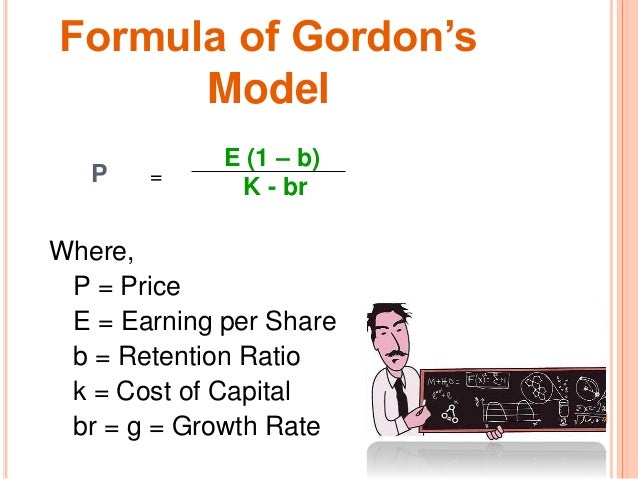

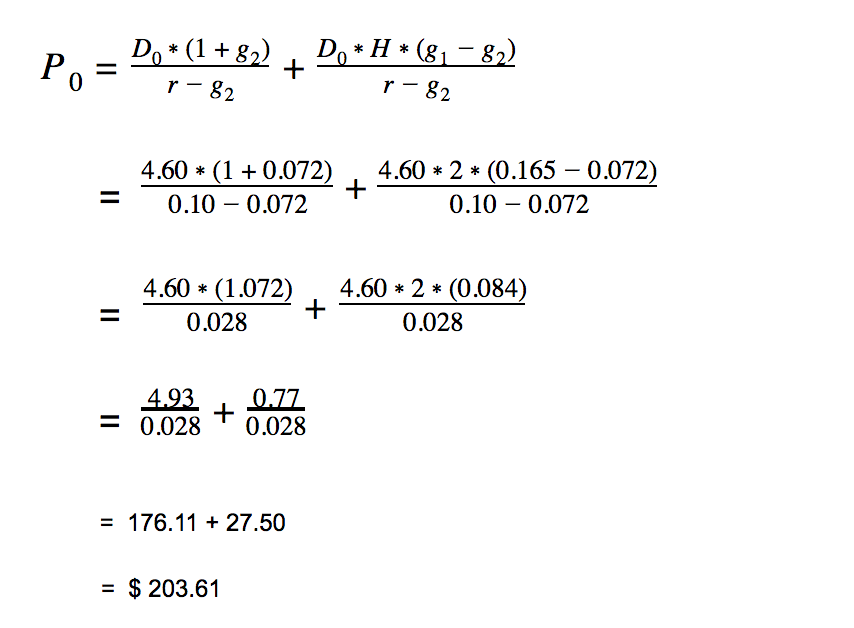

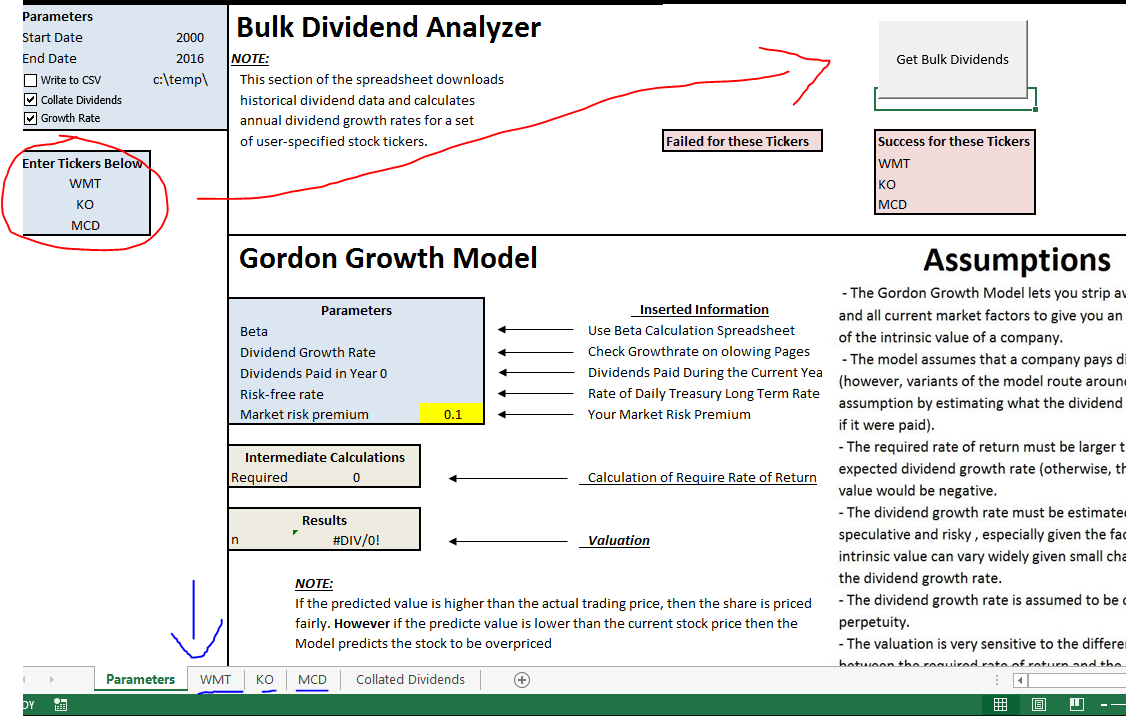

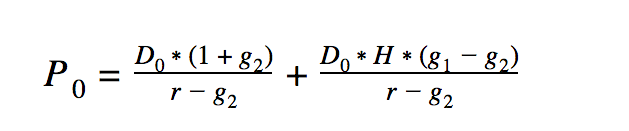

Gordon Dividend Model Formula

D 0 10.

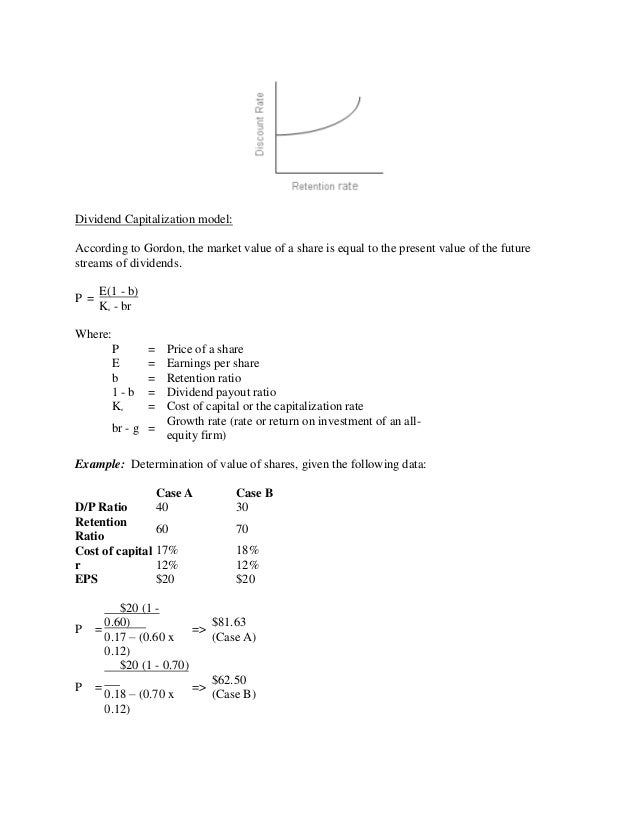

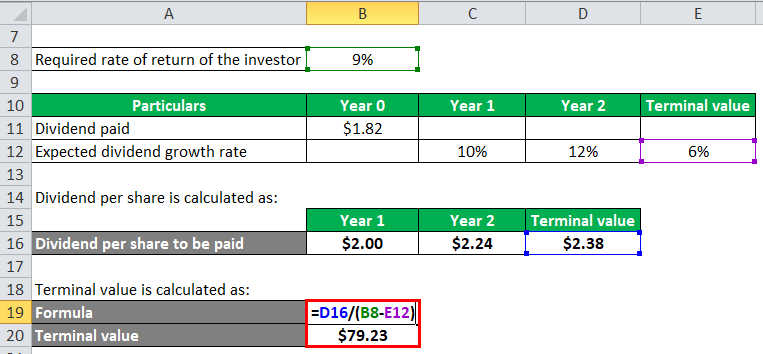

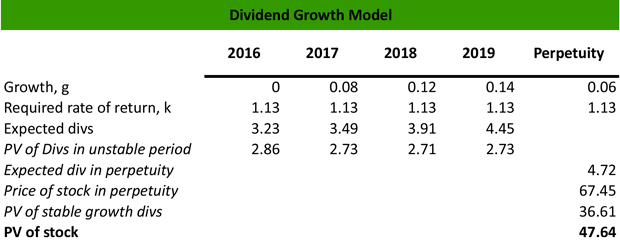

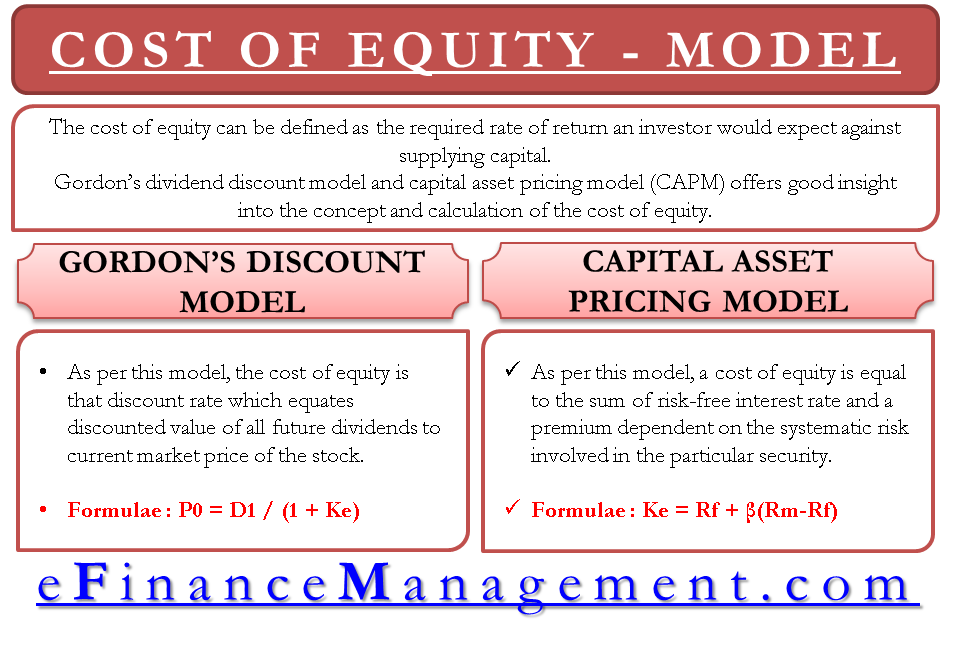

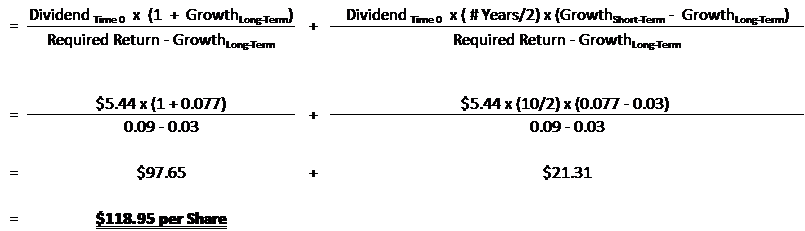

Gordon dividend model formula. R 7 or 007. 1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. The market price of company x share as per the dividend discount model with constant growth rate is rs.

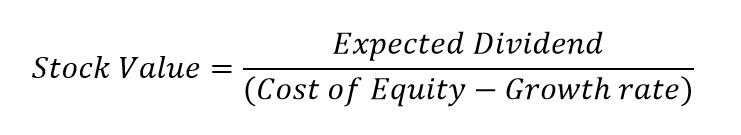

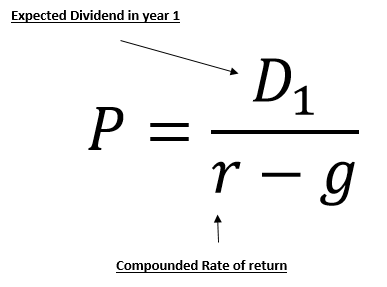

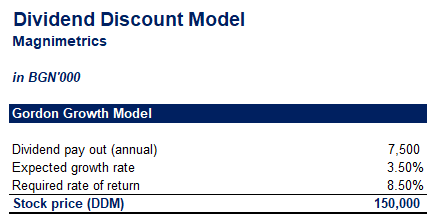

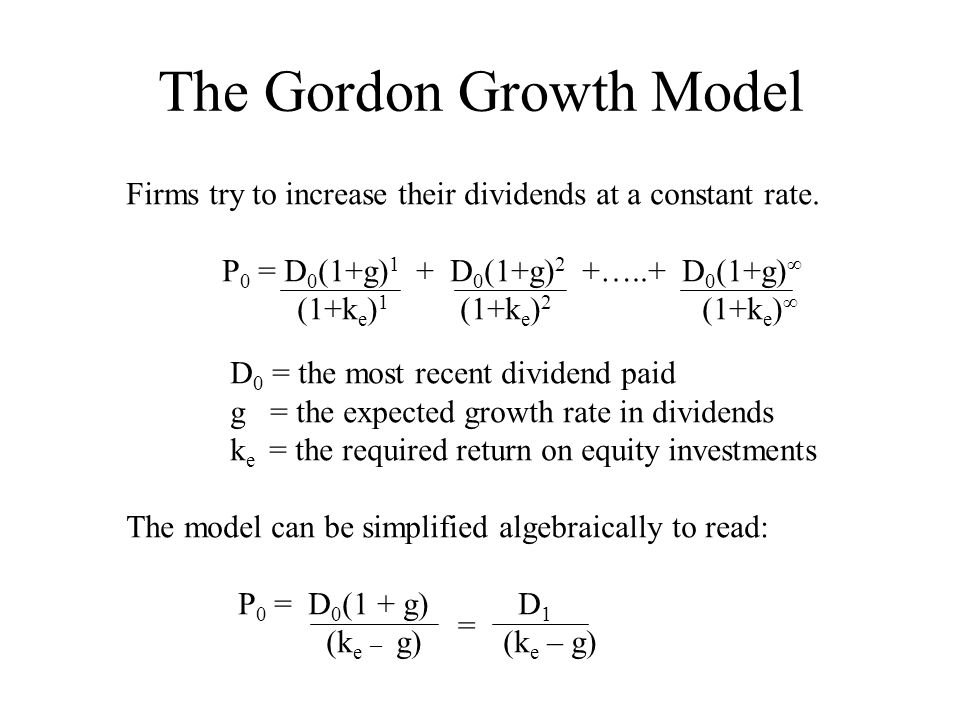

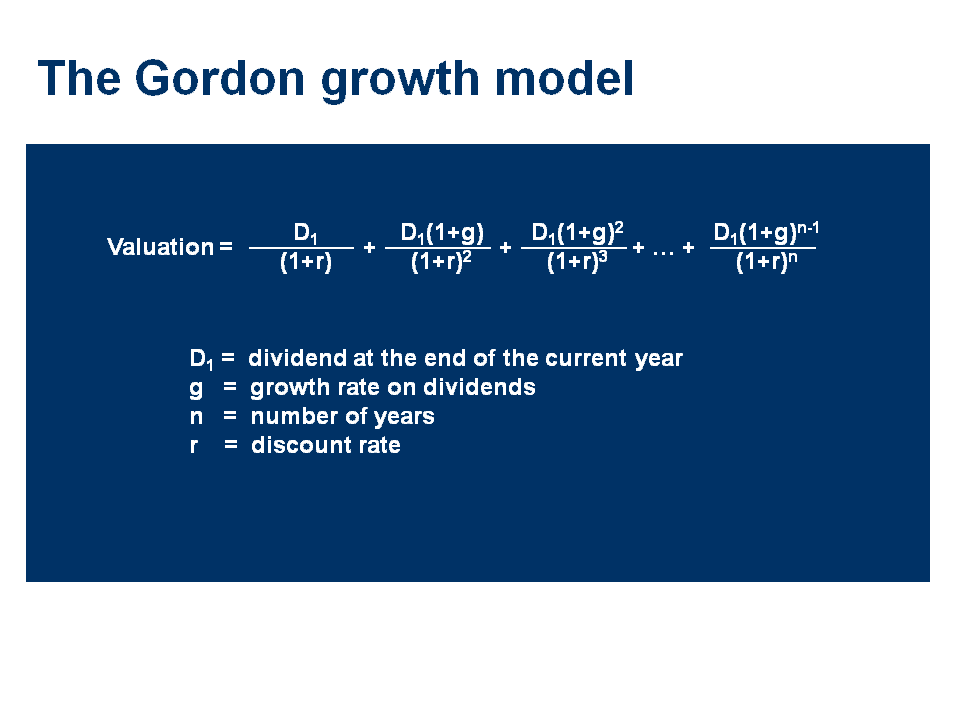

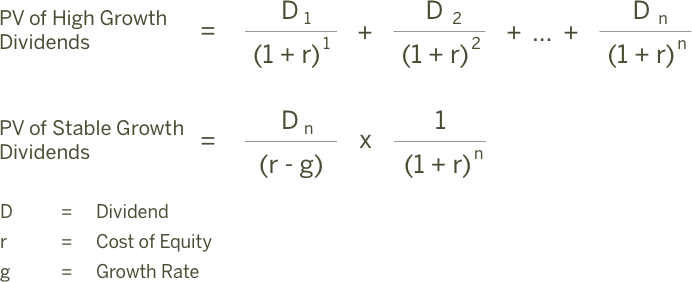

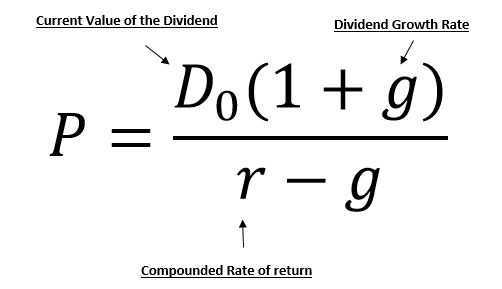

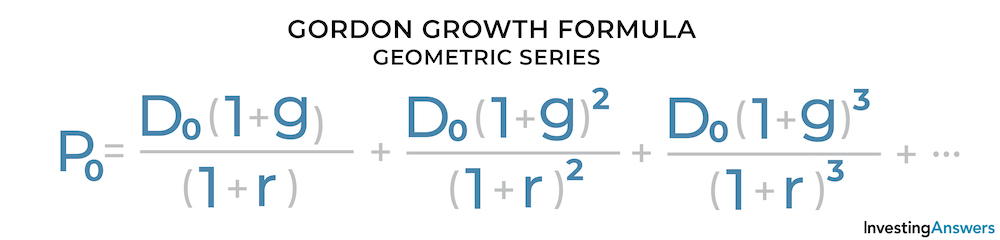

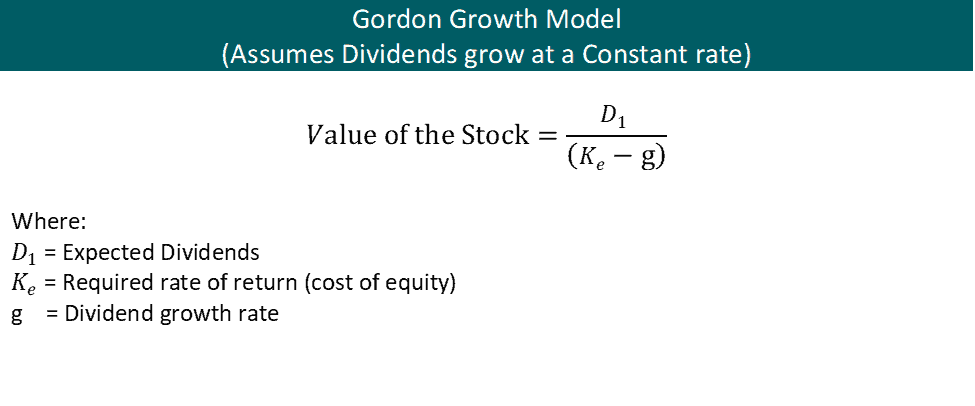

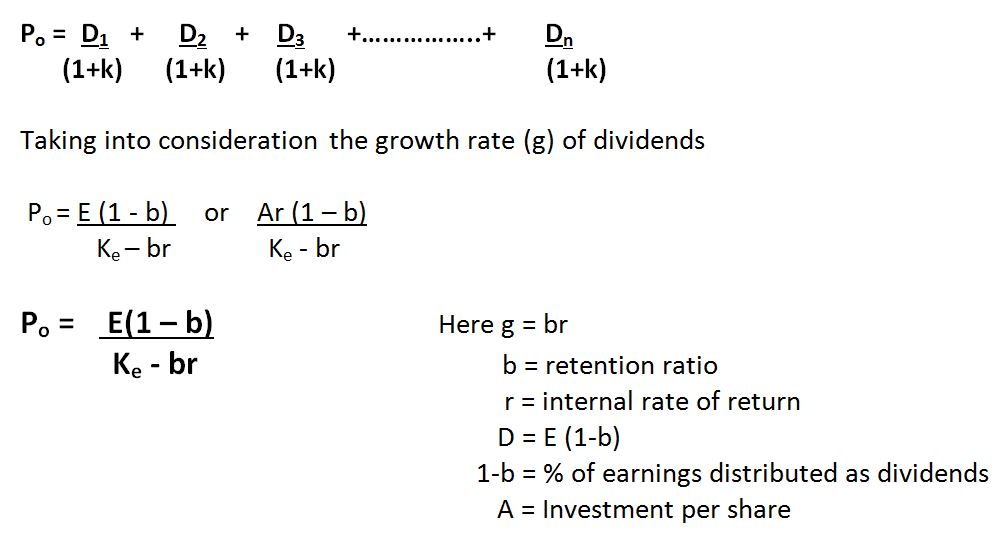

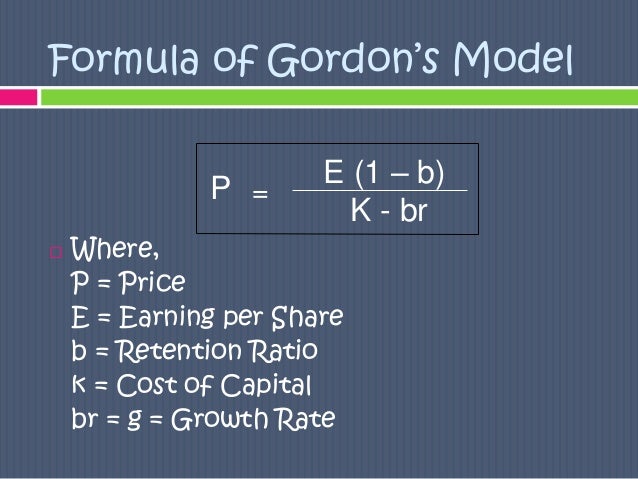

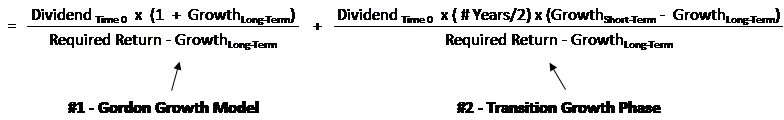

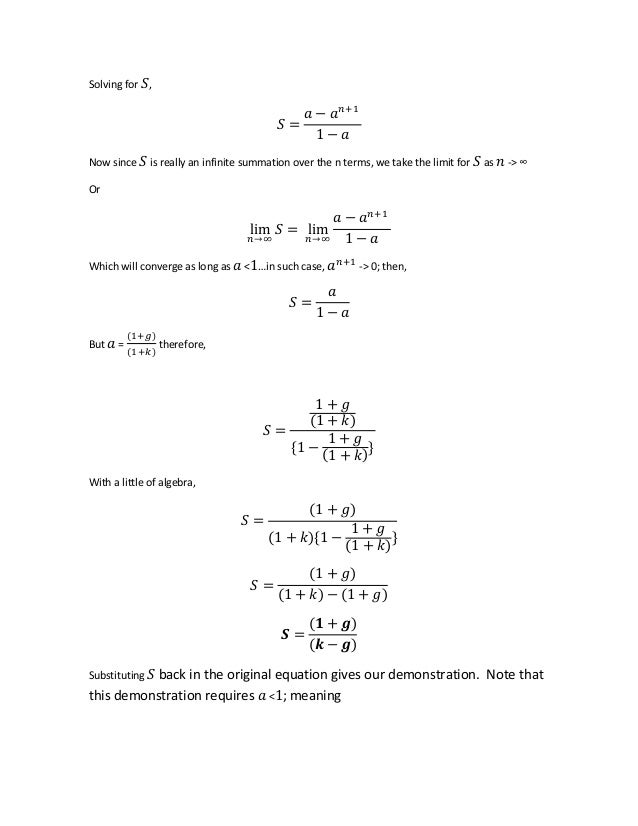

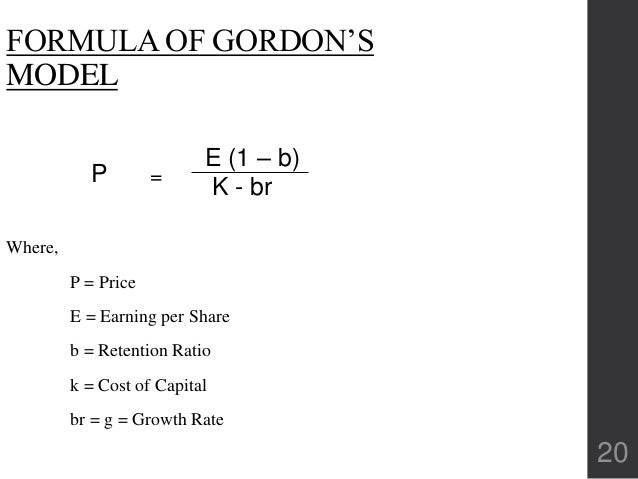

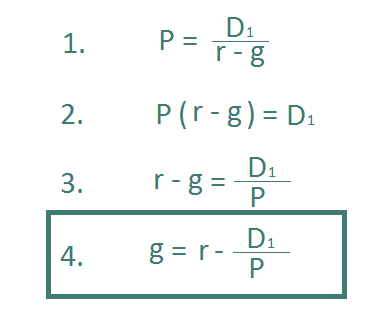

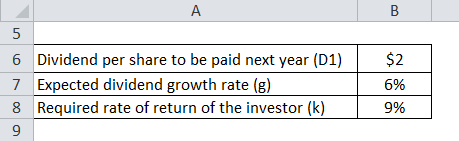

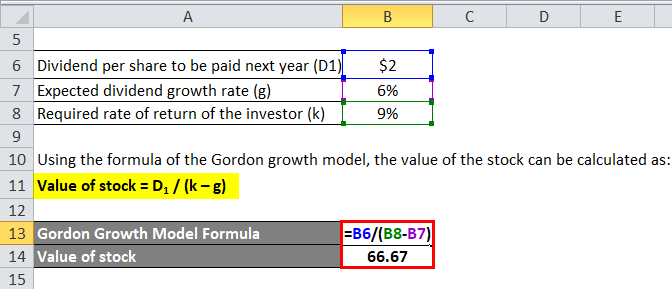

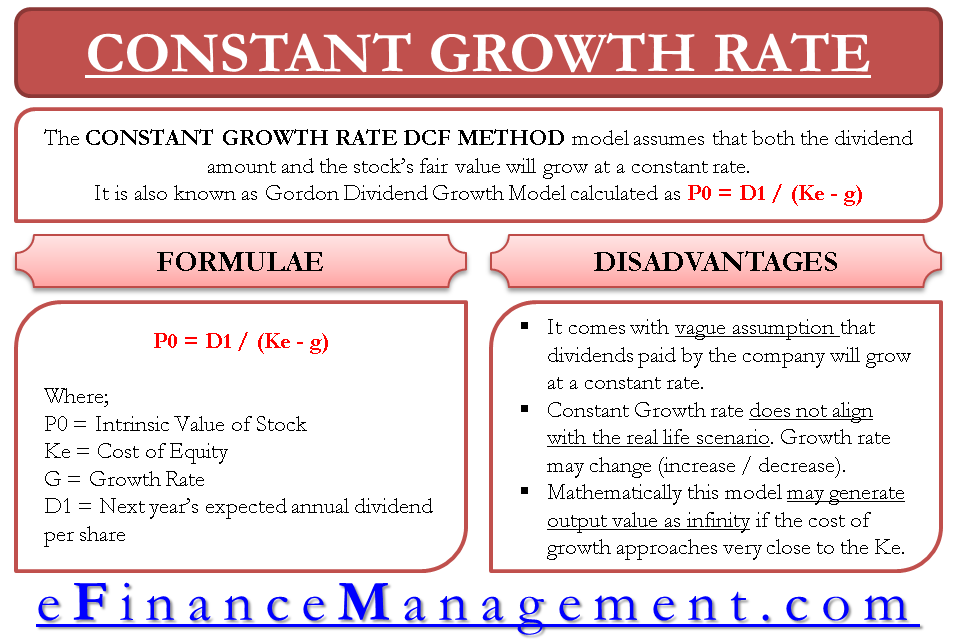

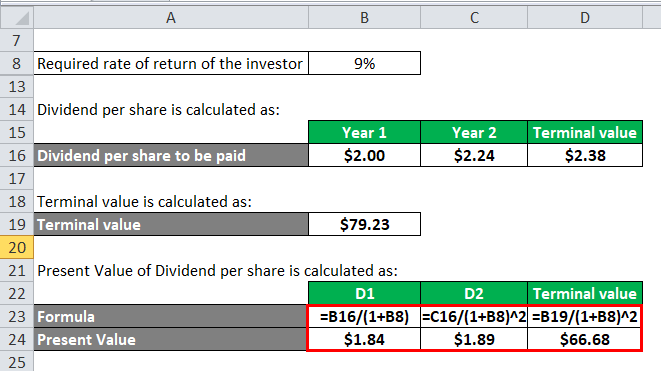

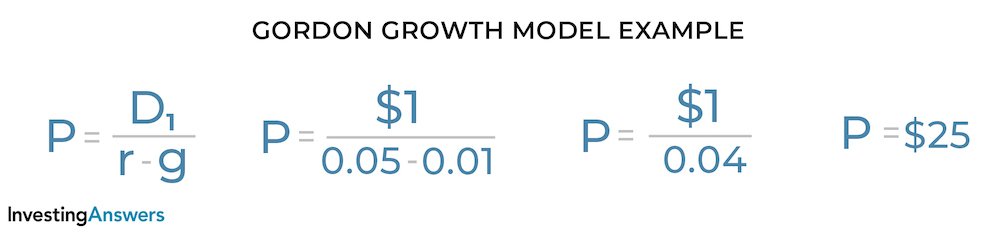

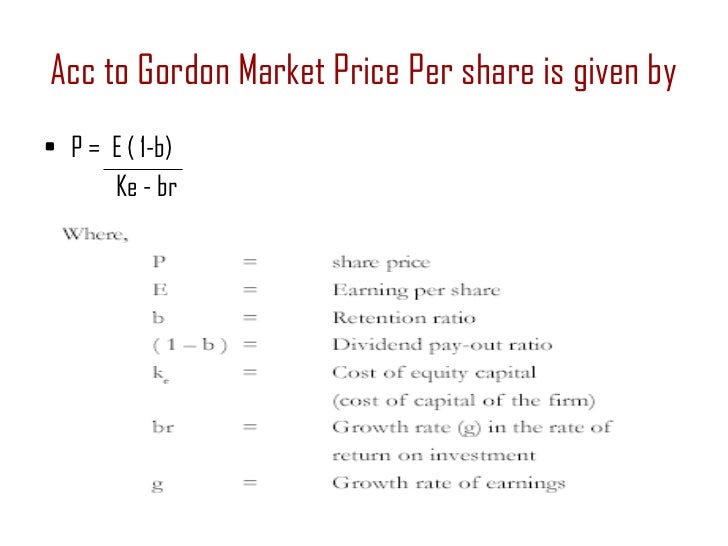

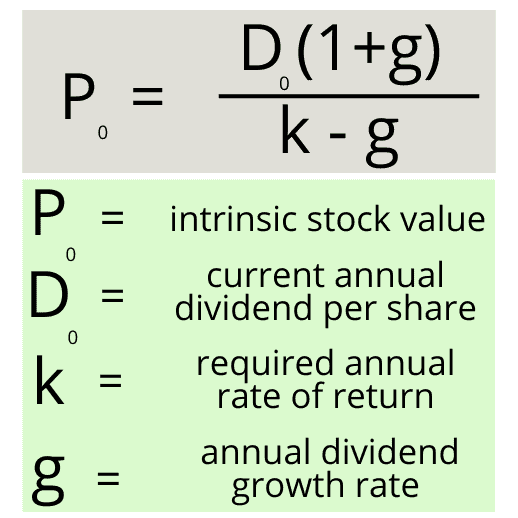

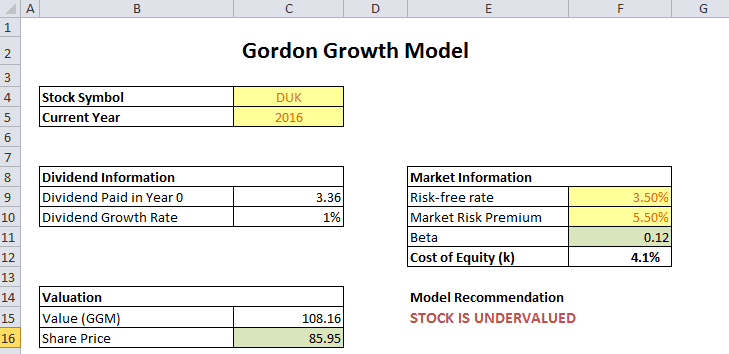

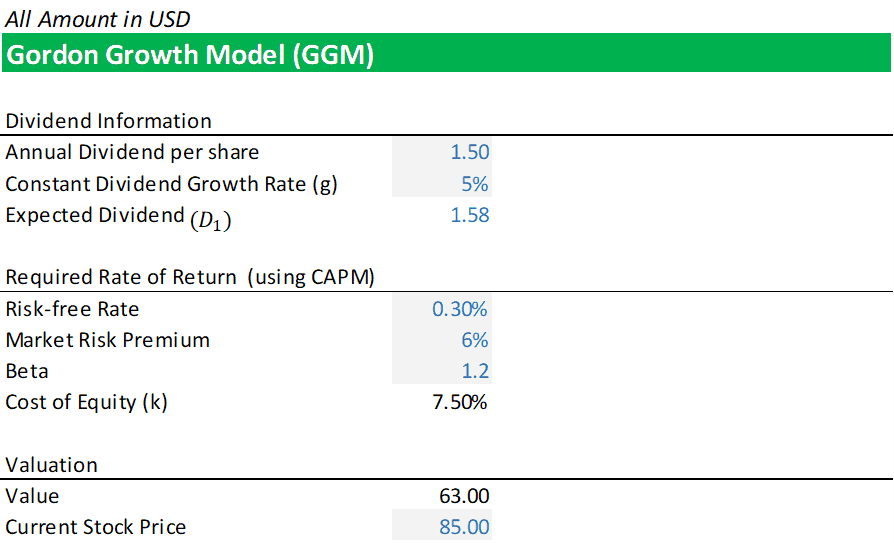

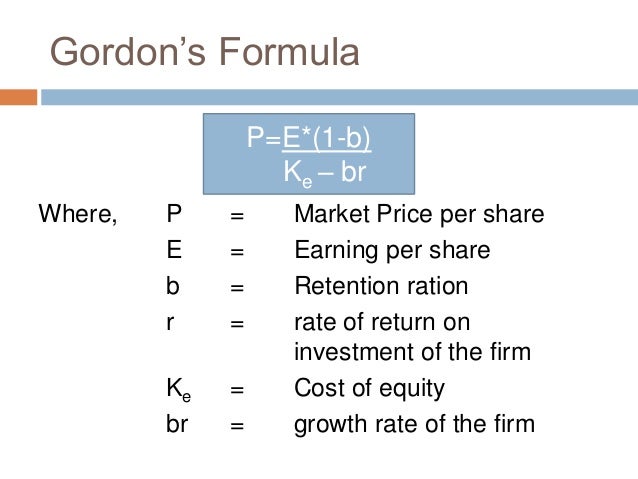

Three variables are included in the gordon growth model formula. P d 1 r g where. P current stock price g constant growth rate expected for dividends in perpetuity r constant cost of equity capital for the company or rate of return d 1.

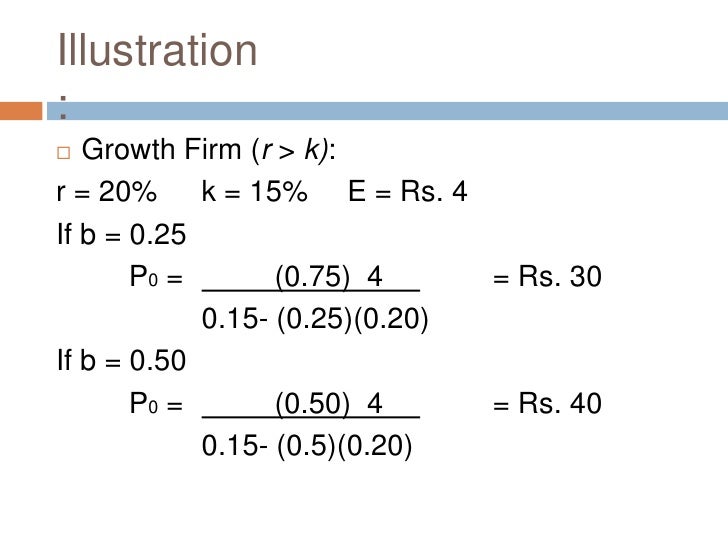

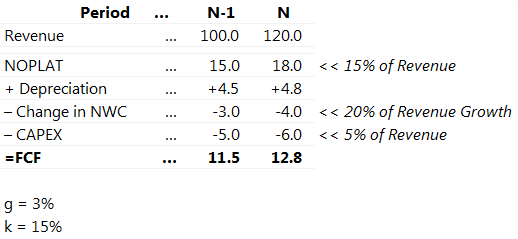

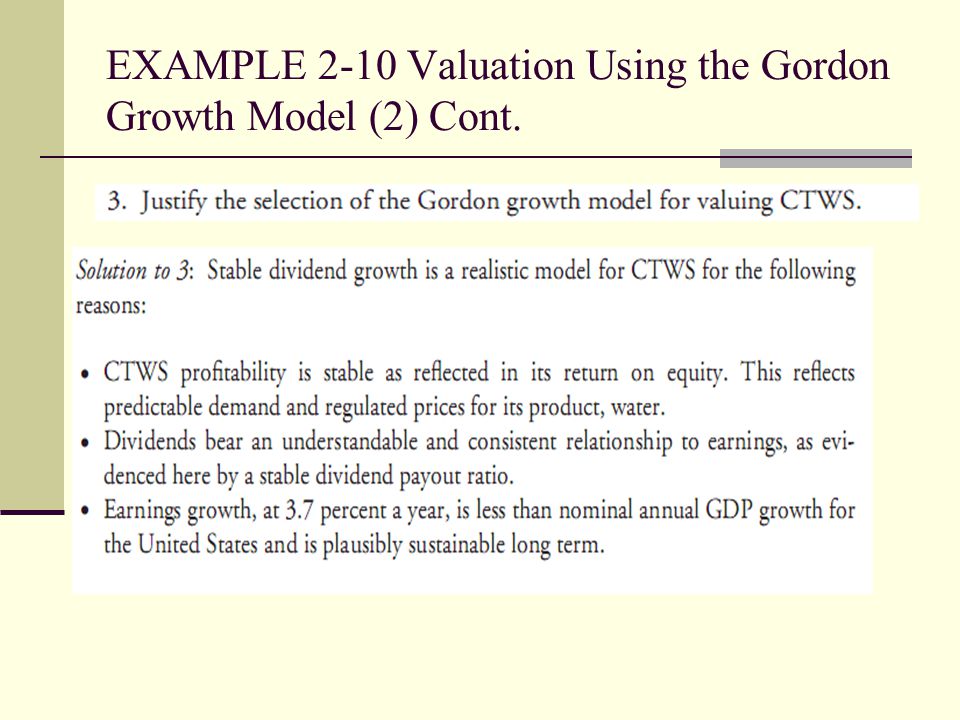

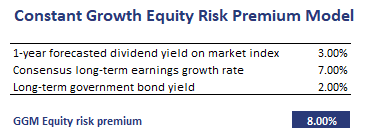

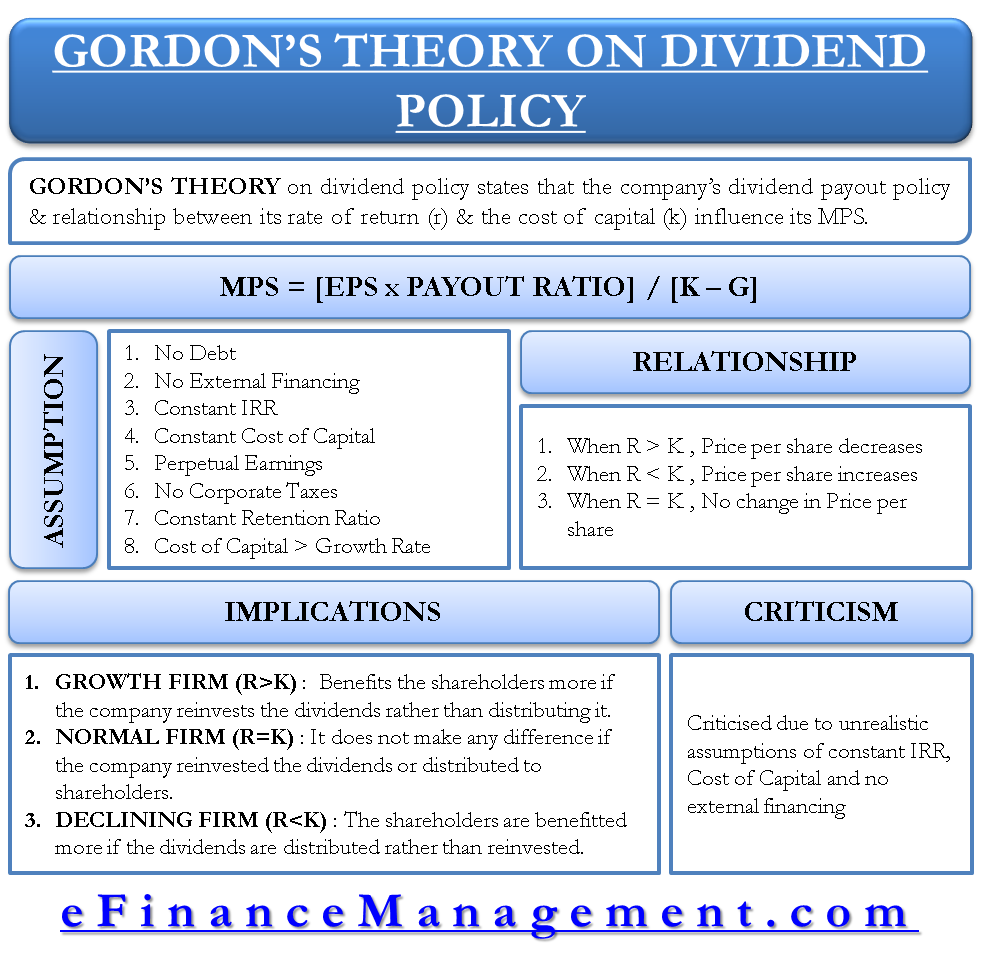

The gordon growth model ggm gordon growth model the gordon growth model also known as the gordon dividend model or dividend discount model is a stock valuation method that calculates a stocks intrinsic value regardless of current market conditions. The wacc formula is ev x re dv x rd x 1 t. G 5 or 005.

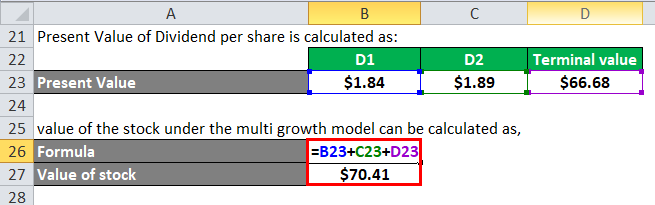

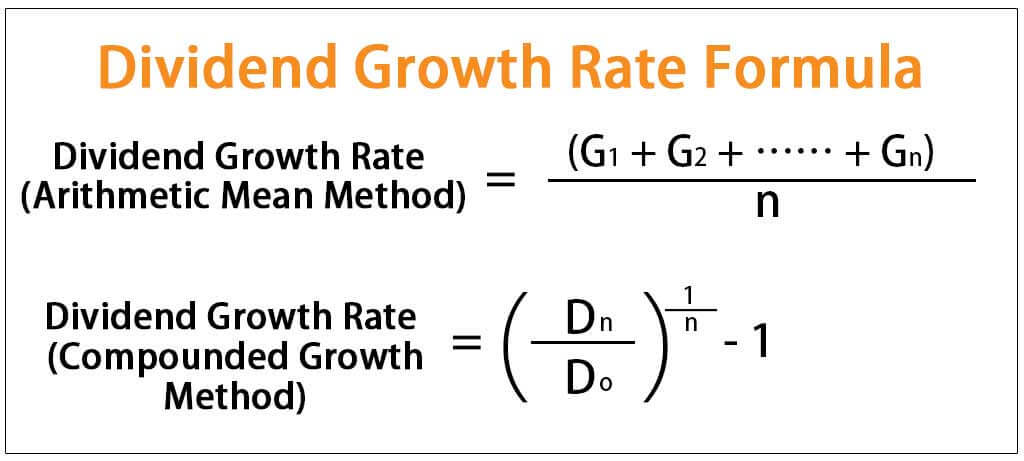

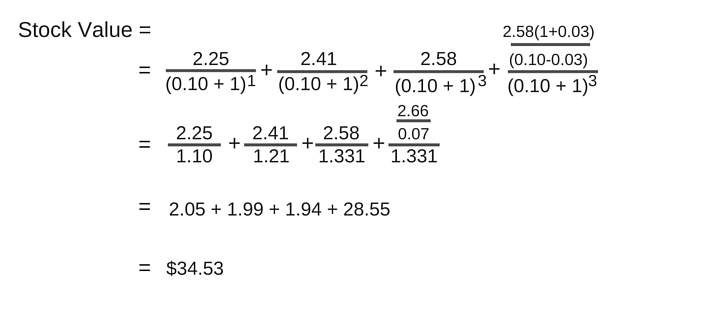

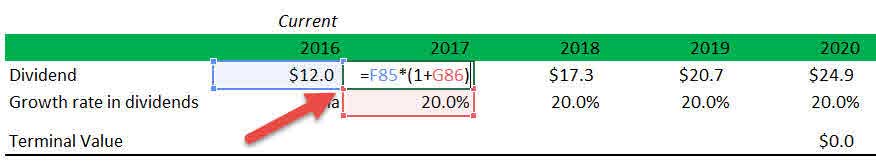

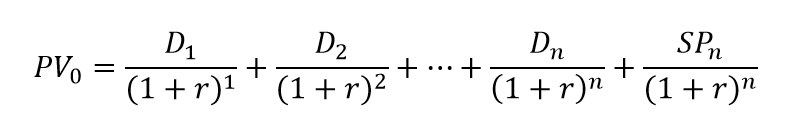

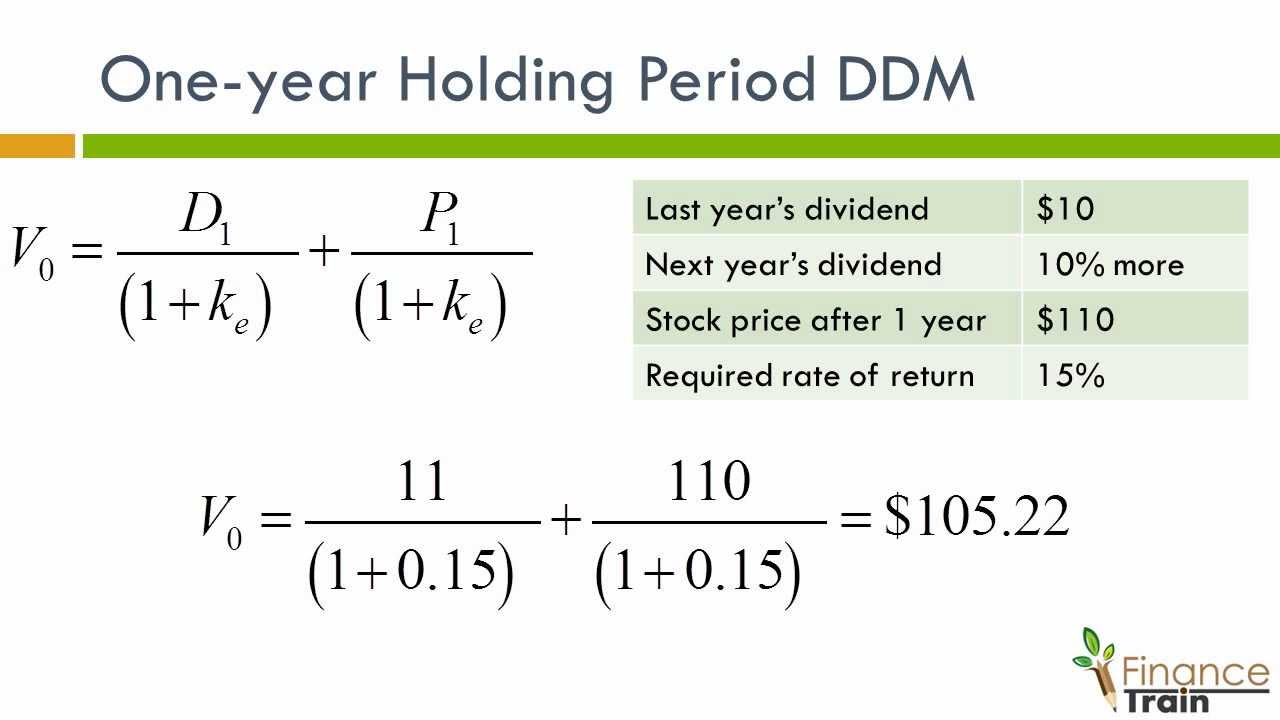

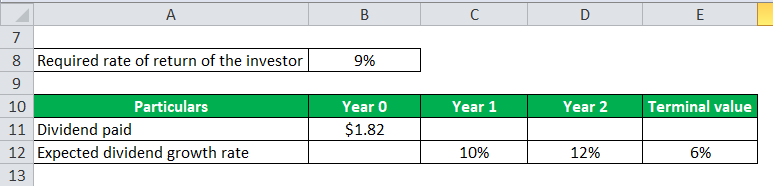

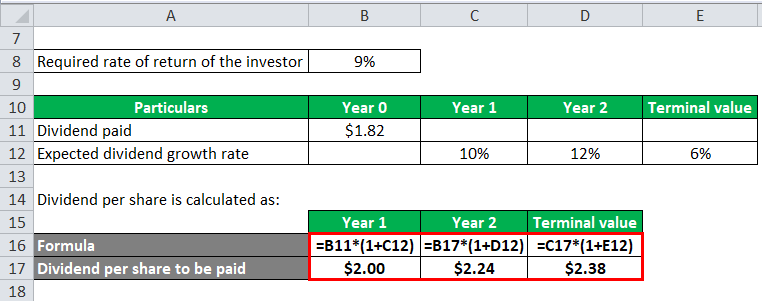

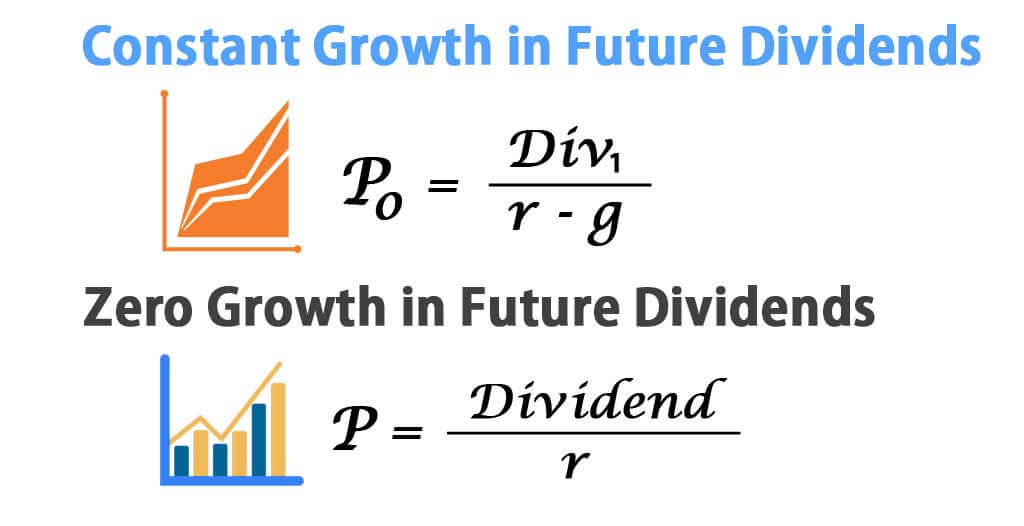

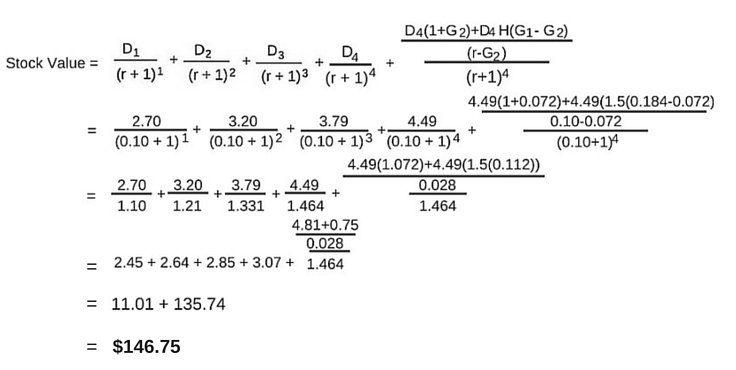

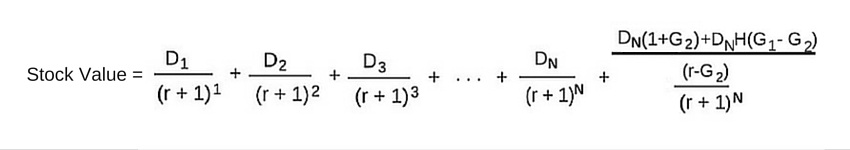

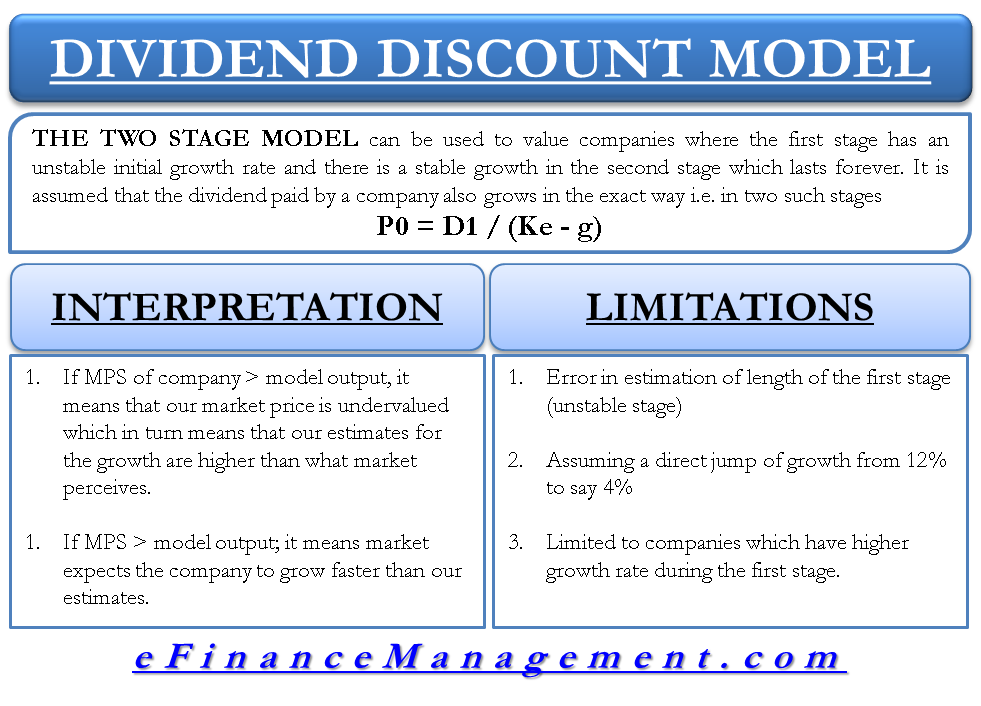

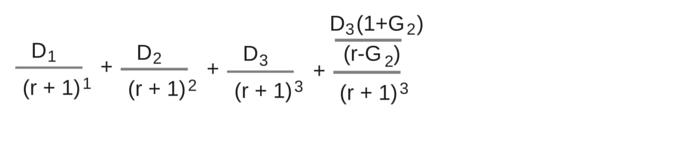

D 1 d 0 1 g 210 d1. It is simply a companys expected annual dividend payment 1 year from now. There are two formulas of growth growth model 1 gordon growth in future dividends 2 zero growth in future dividends.

Lets start by calculating the dividend for next year d 1. D 1 d 0 1 g 10 105 1050. First i will describe it with words.

We know that the current years dividend d 0 is 2 and the expected dividend growth rate g is 5. Using an estimated dividend of 212 at the beginning of 2019 the investor would use the dividend discount model to calculate a per share value of 212 05 02 7067. What is the gordon growth model formula.

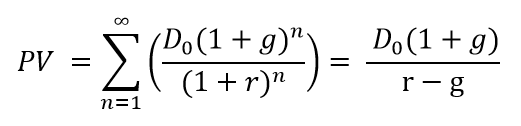

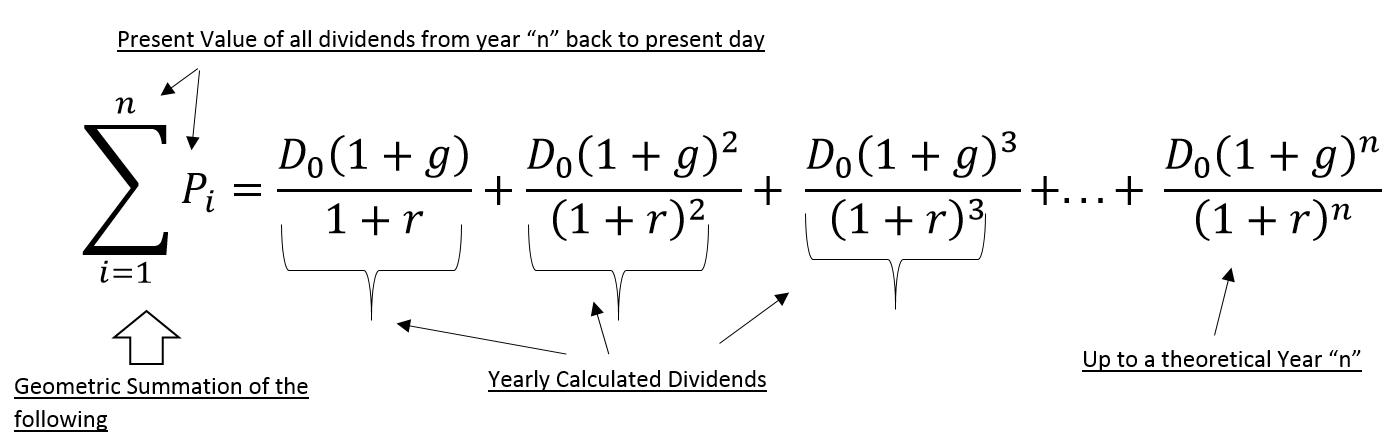

Gordon growth model formula is used to find the intrinsic value of the company by discounting the future dividend payouts of the company. As per the gordon growth formula the intrinsic value of the stock is equal to the sum of all the present value of the future dividend. Calculate the intrinsic value of company as stock using the gordon growth model.

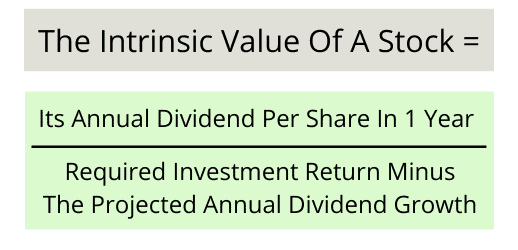

Finally the formula for gordon growth model is computed by dividing the next years dividend per share by the difference between the investors required rate of return and dividend growth rate as shown below. Value of stock d1 k g relevance and uses of the gordon growth model formula. D 1 d 0 1 g 2.

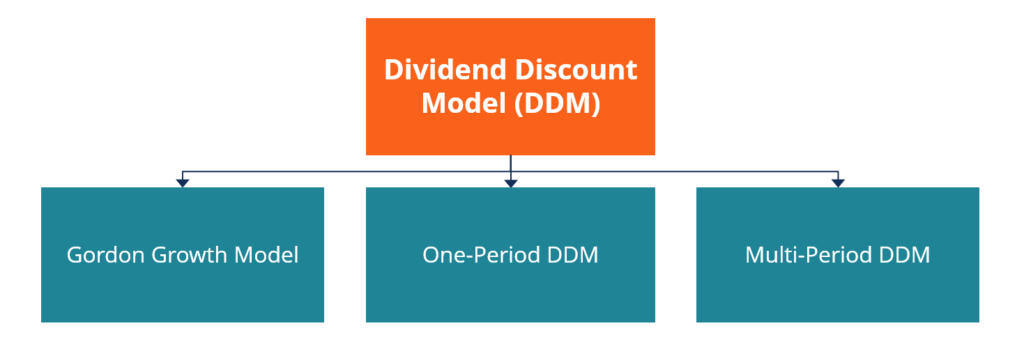

Formula for the dividend discount model.