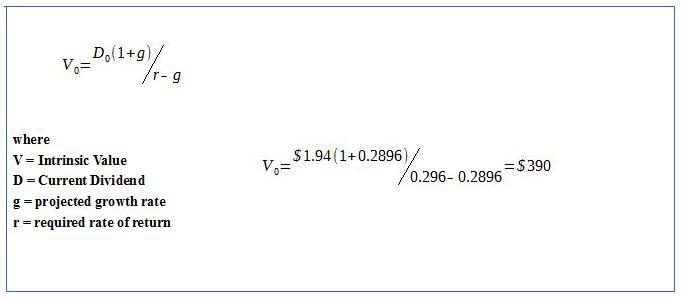

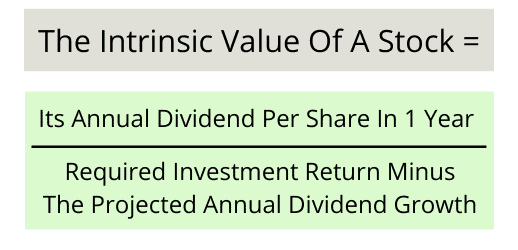

Gordon Dividend Discount Model Formula

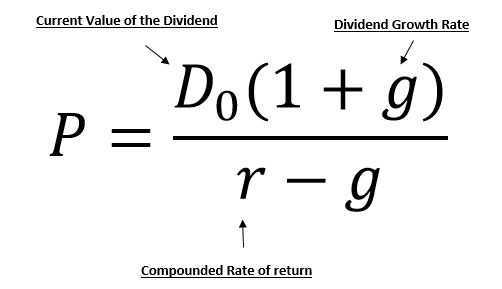

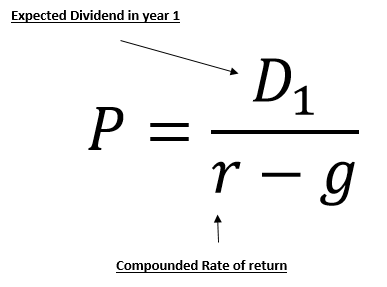

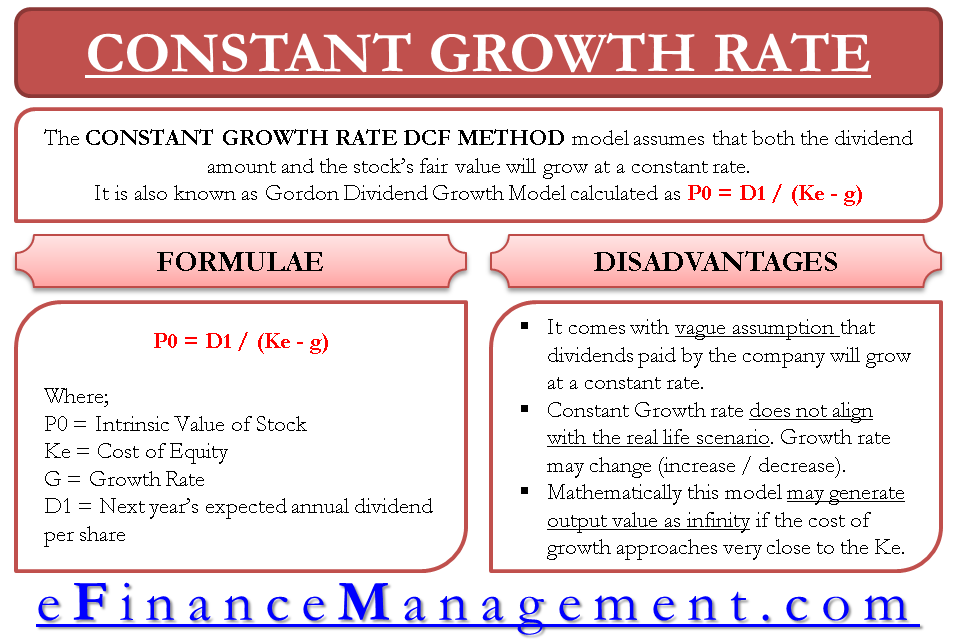

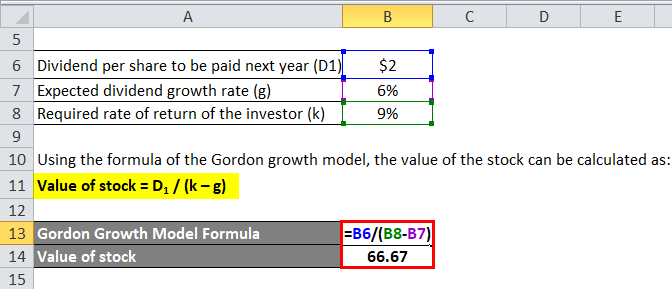

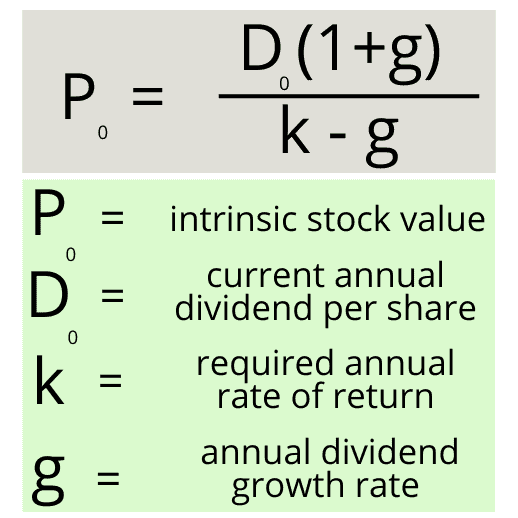

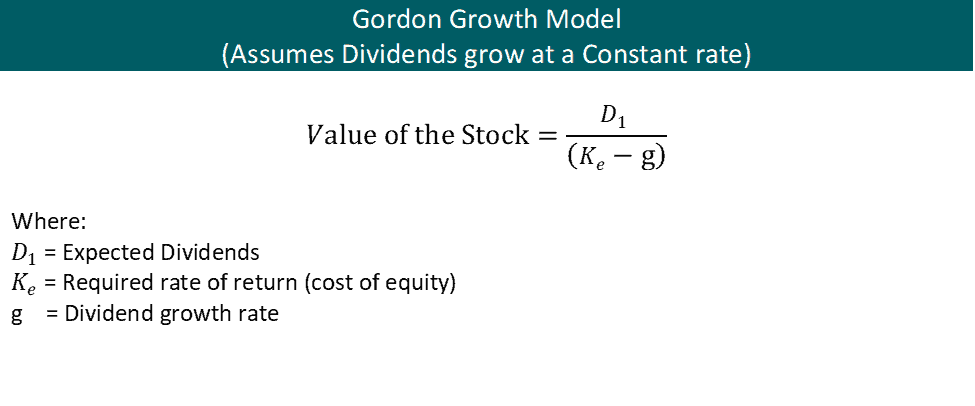

1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt.

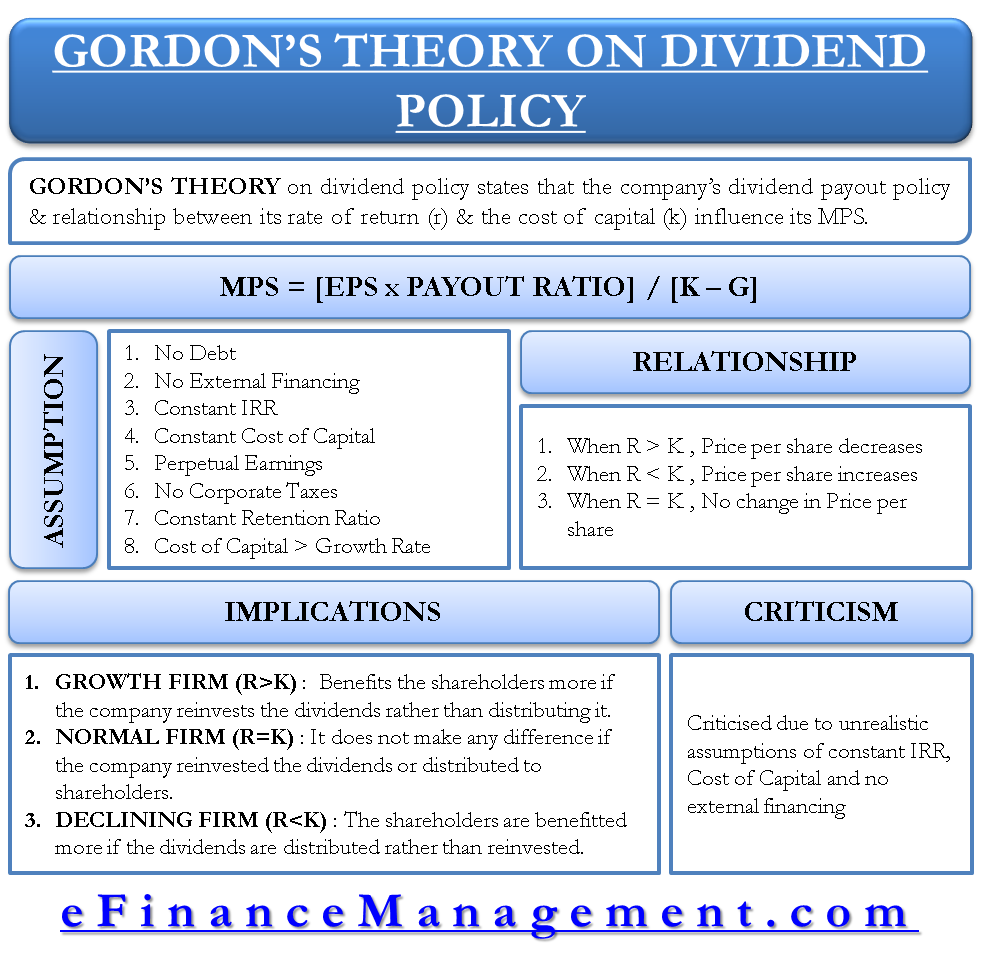

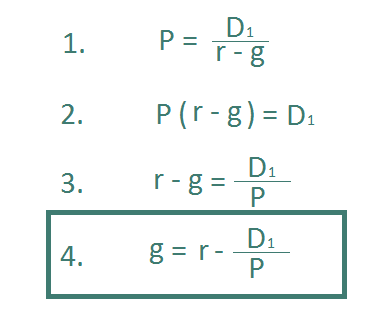

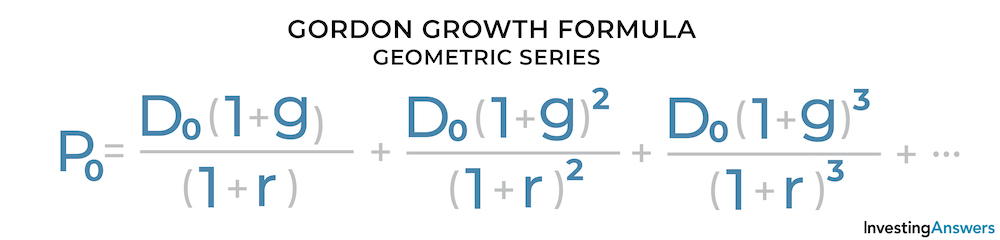

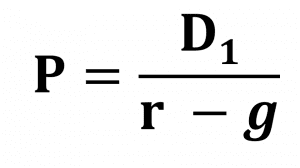

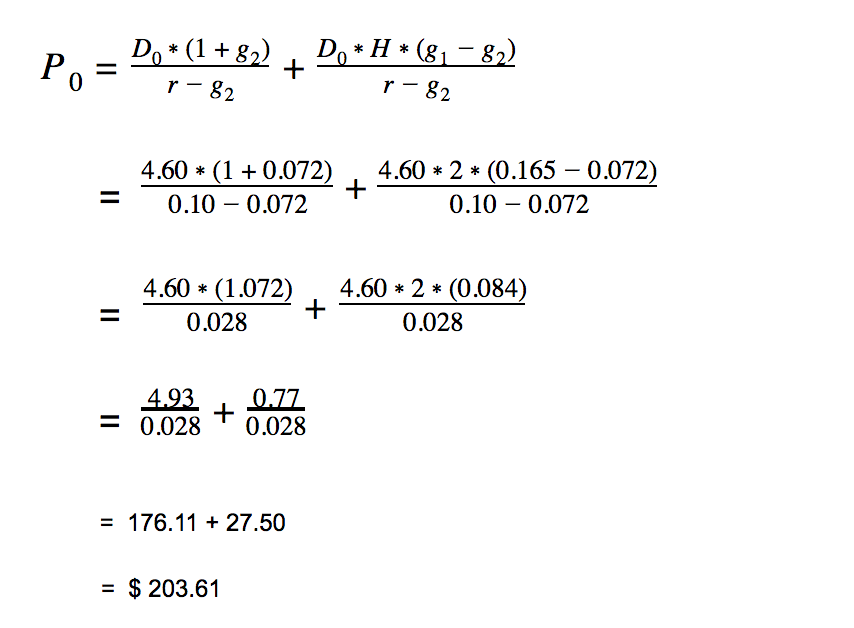

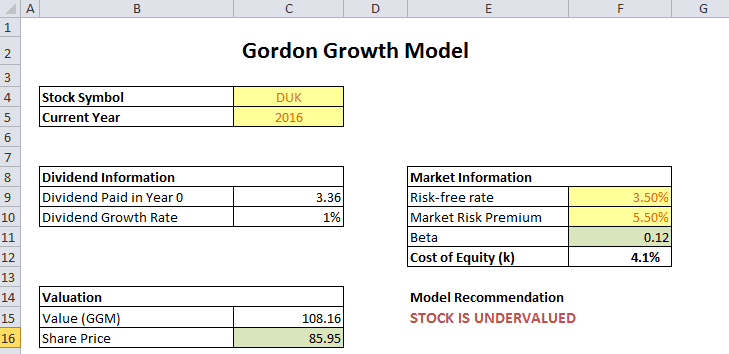

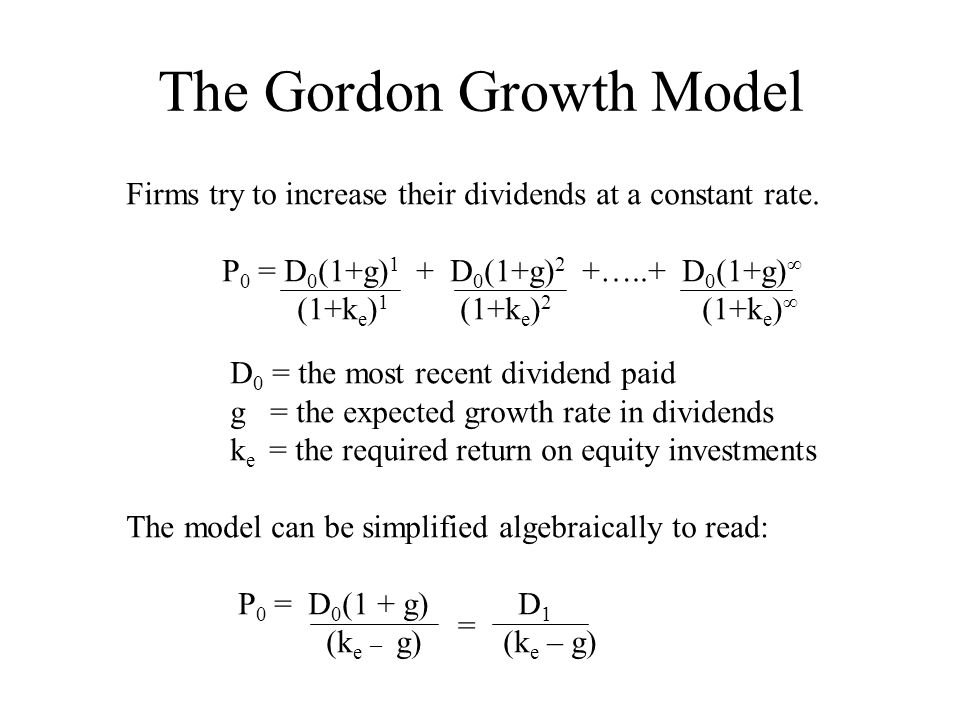

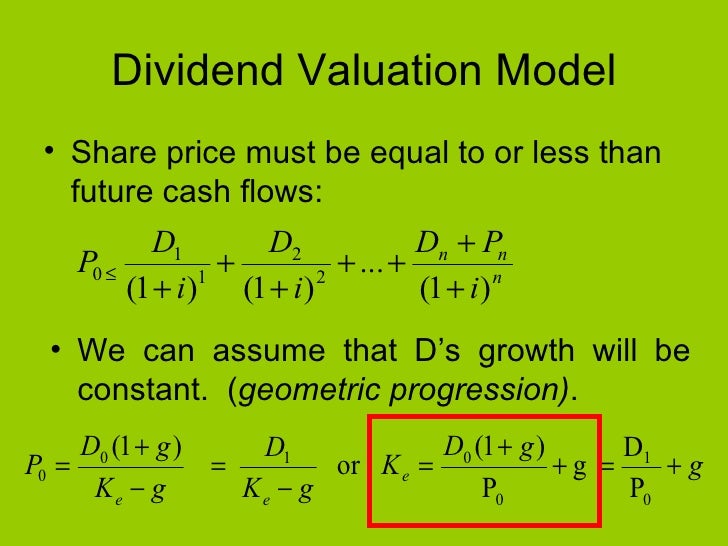

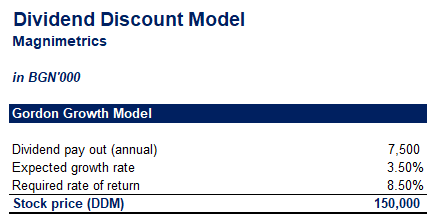

Gordon dividend discount model formula. The market price of company x share as per the dividend discount model with constant growth rate is rs. Displaystyle frac d 1 p 0gr dividend yield. As per the gordon growth formula the intrinsic value of the stock is equal to the sum of all the present value of the future.

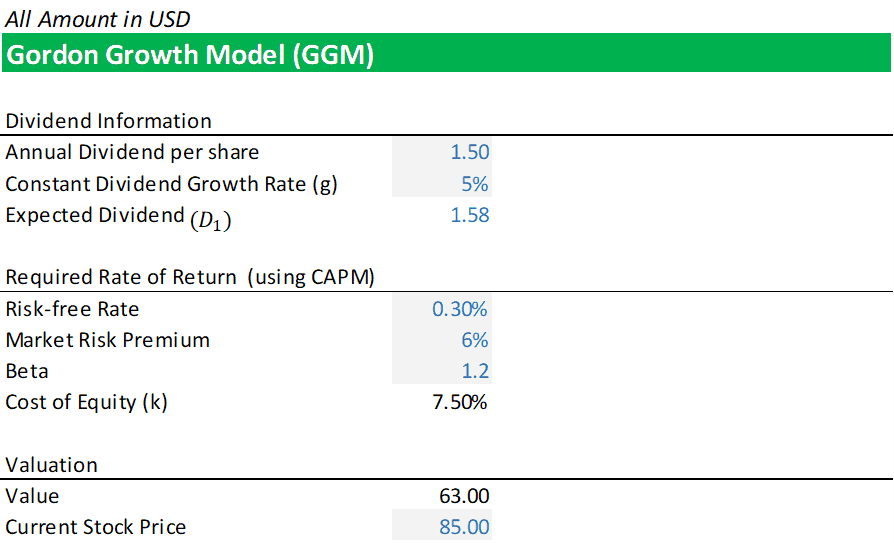

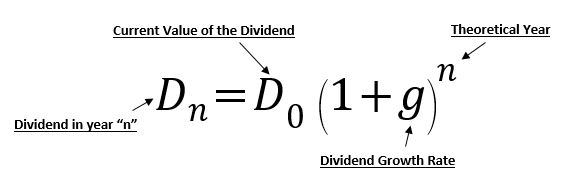

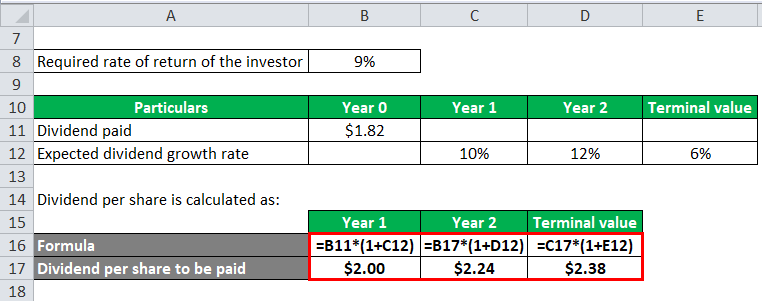

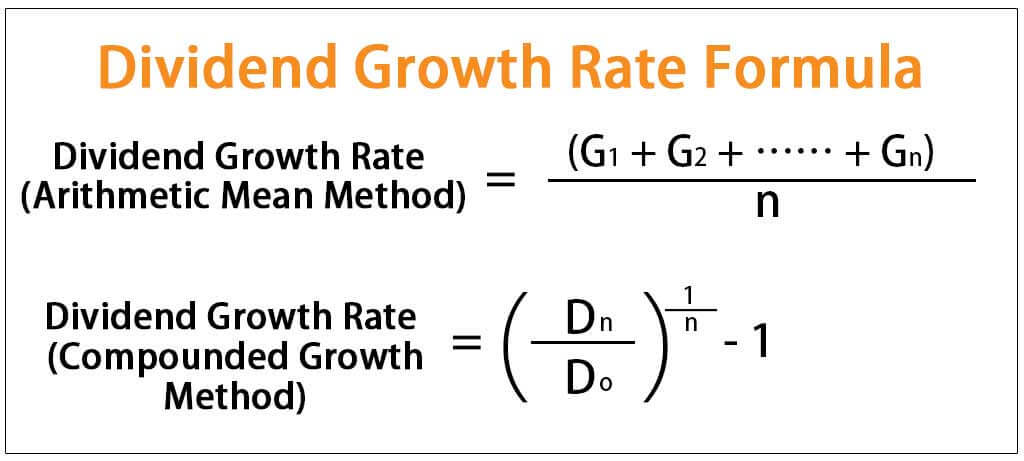

D 1 d 0 1 g 10 105 1050. R 7 or 007. What is the gordon growth model.

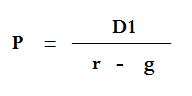

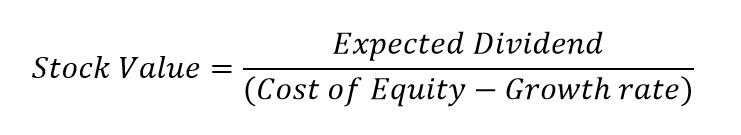

D 1 expected dividend amount for next year. Three variables are included in the gordon growth model formula. R the estimated cost of equity capital.

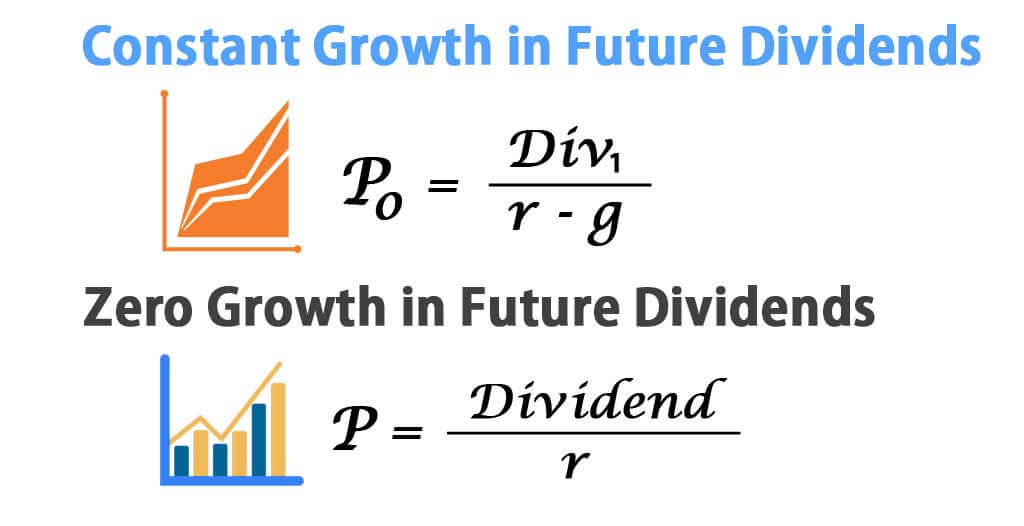

If the stock pays no dividends then the expected future cash flow will be the sale price of the stock. D 1 the dividend payment in one period from now. Displaystyle frac d 1 r gp 0 is rearranged to give.

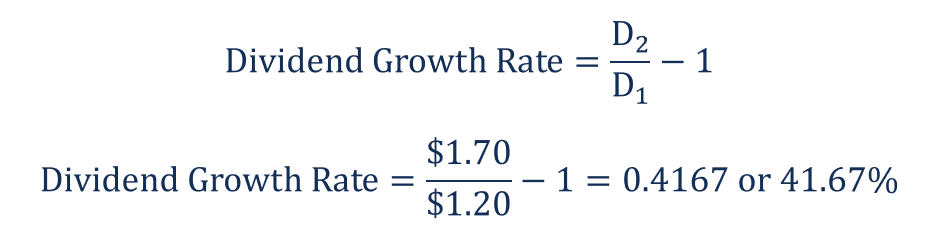

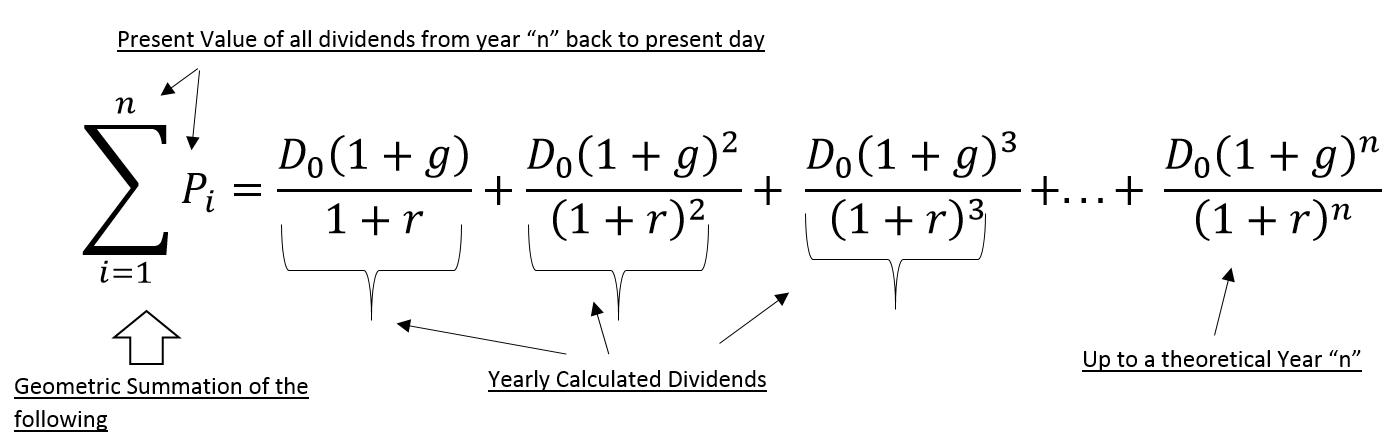

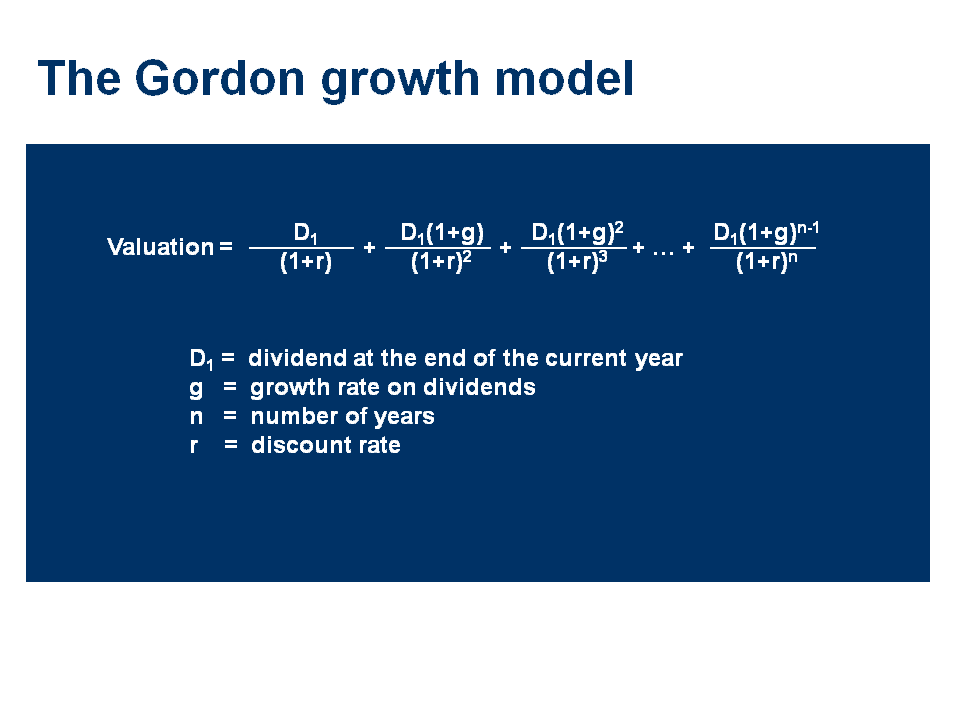

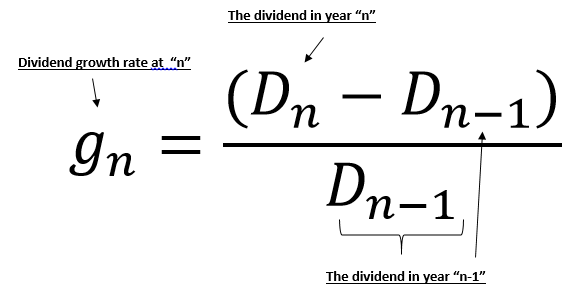

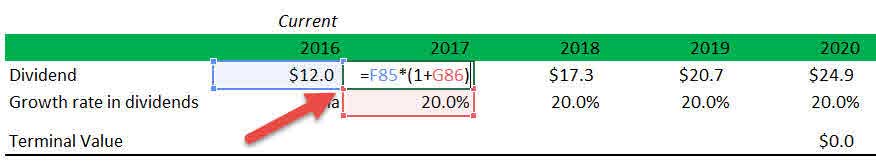

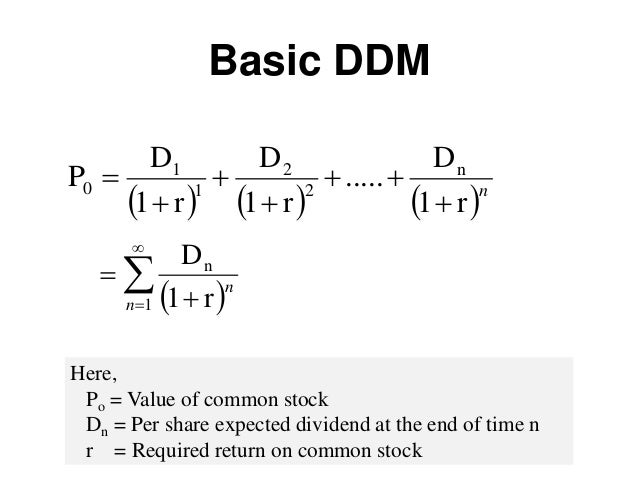

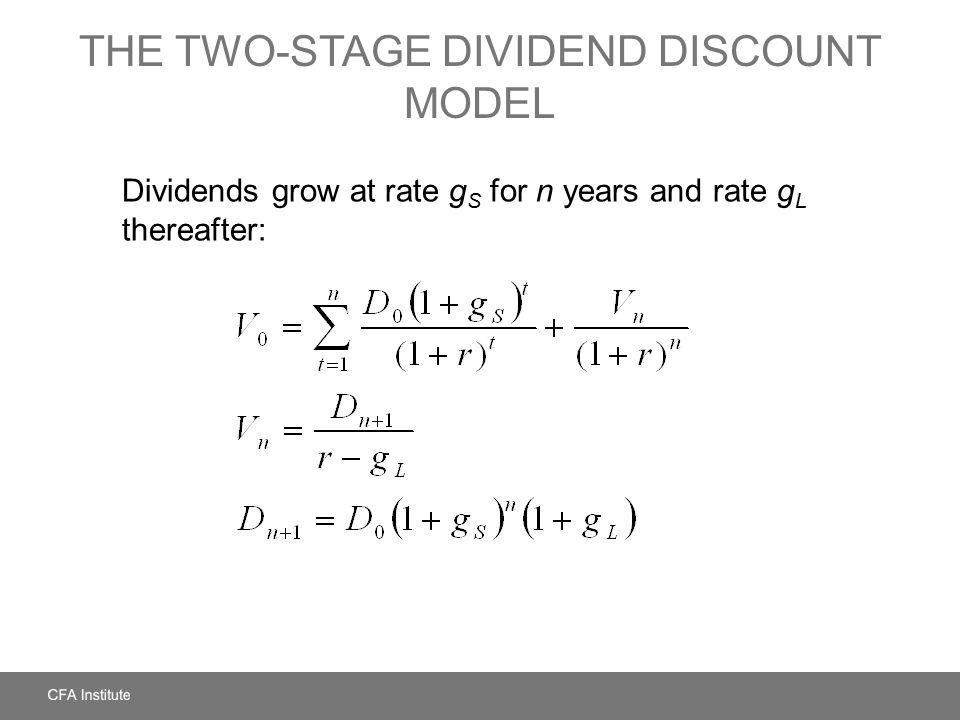

In a general sense a dividend discount model values a share of stock as the sum of all expected future dividend payments. Or just dividend models for short. G expected growth rate of dividends assumed to be constant the current dividend payout d 0 can be found in the annual.

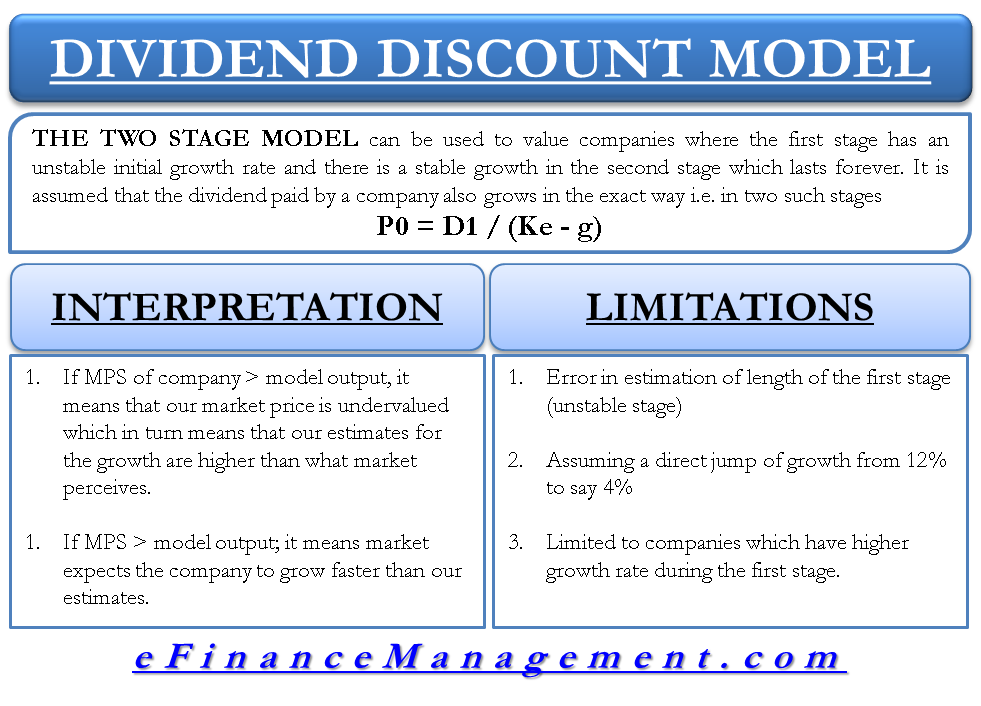

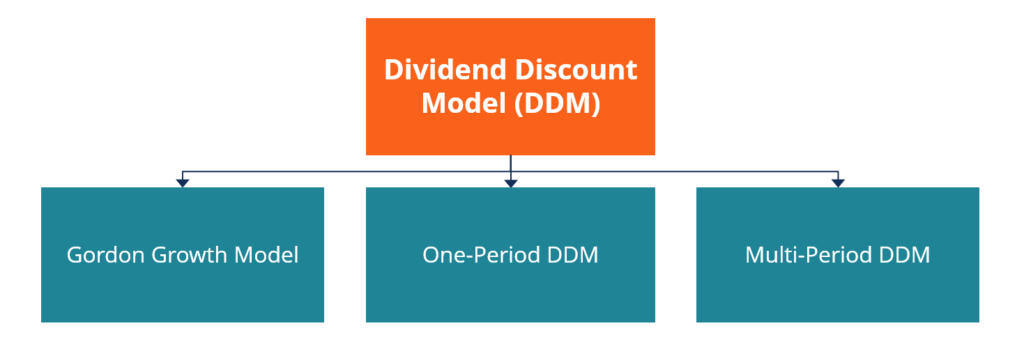

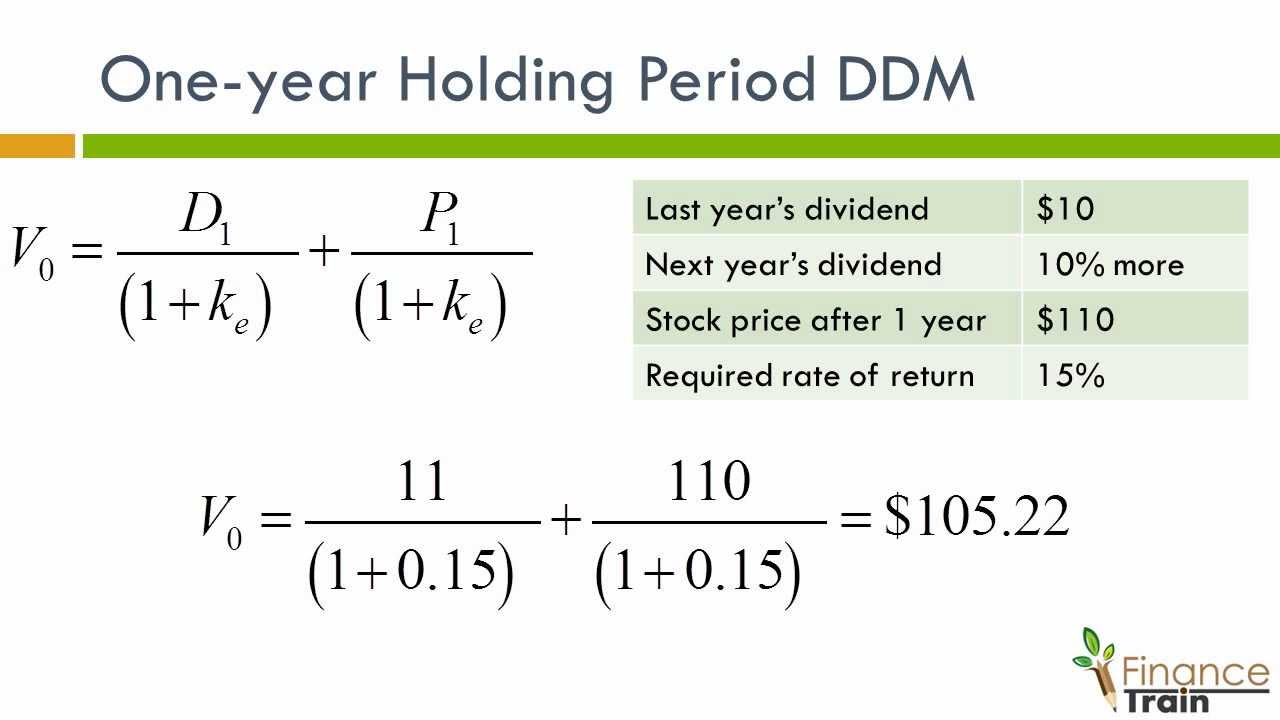

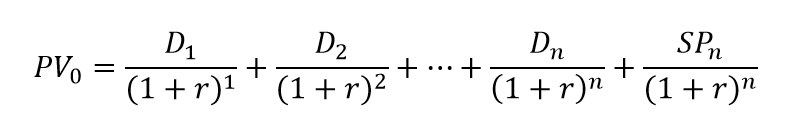

The gordon growth model is one version of what is more broadly known as dividend discount models. Dividend discount model intrinsic value sum of present value of dividends present value of stock sale price. P 1 the stock price in one period from now.

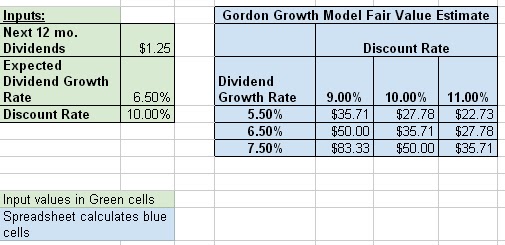

Let us take an example. D 1 p 0 g r. Gordon growth model formula p dfracd1r g p fair value of the stock.

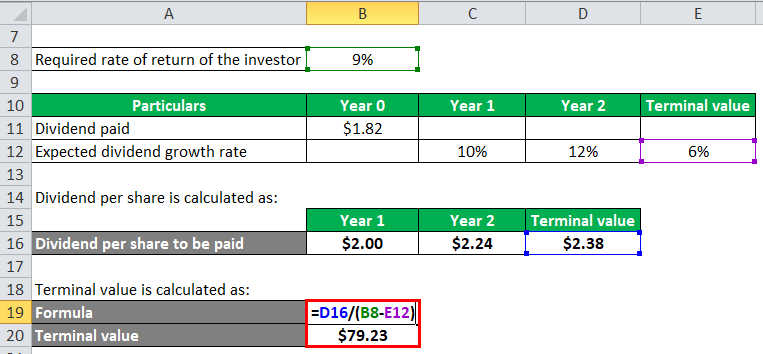

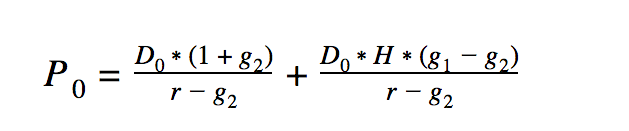

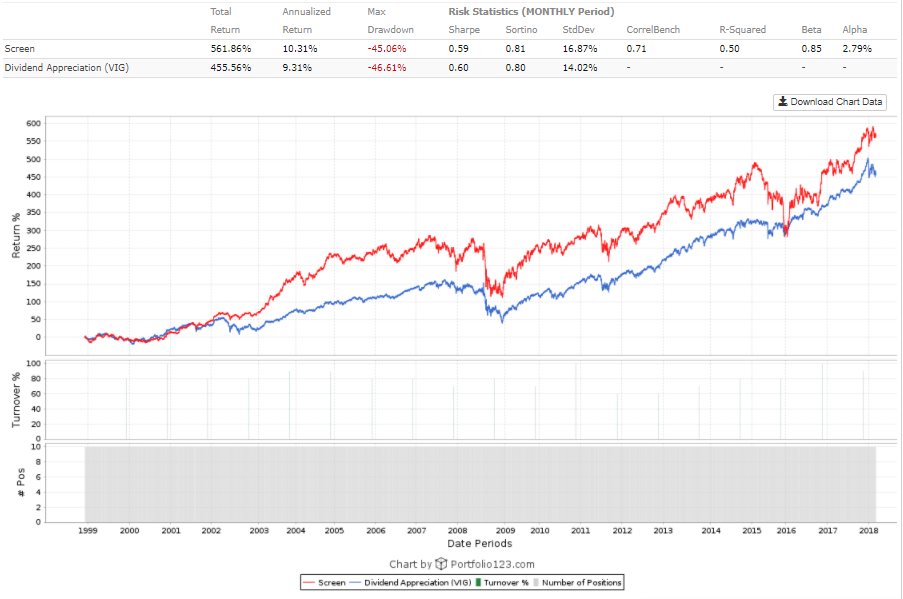

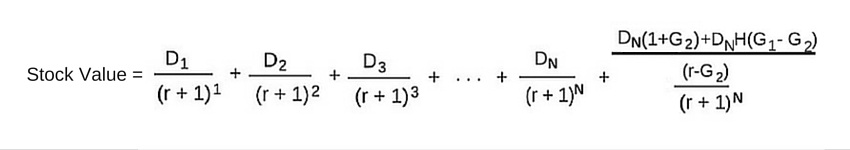

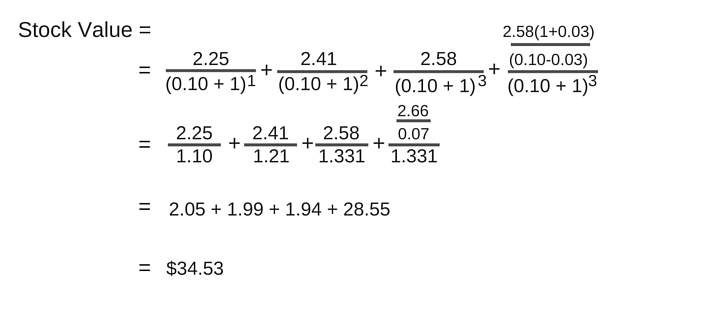

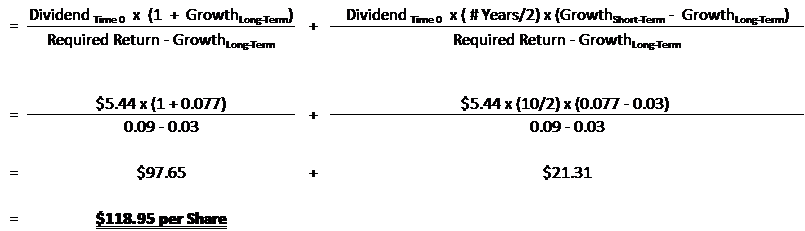

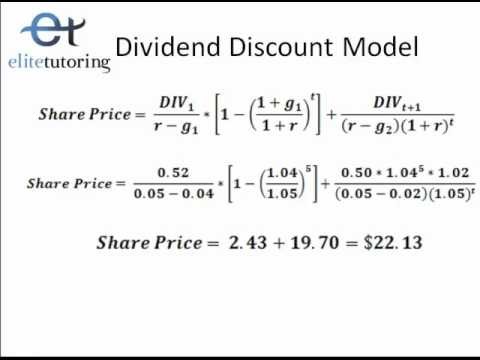

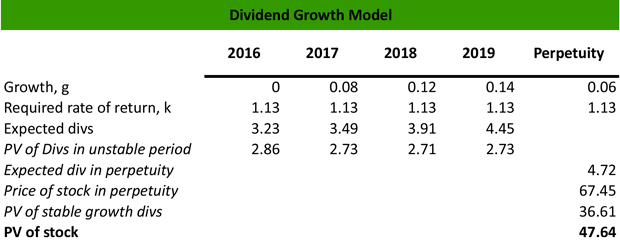

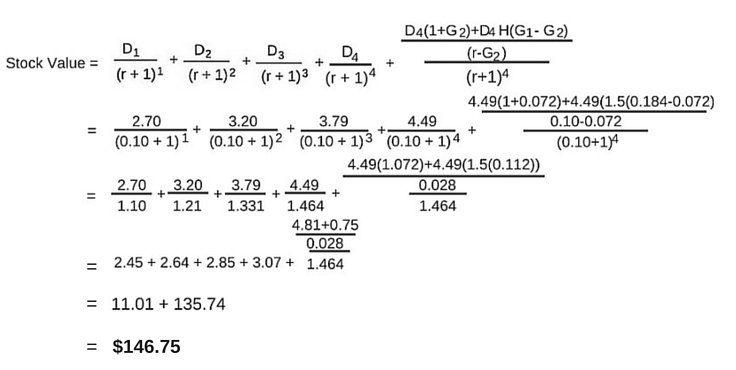

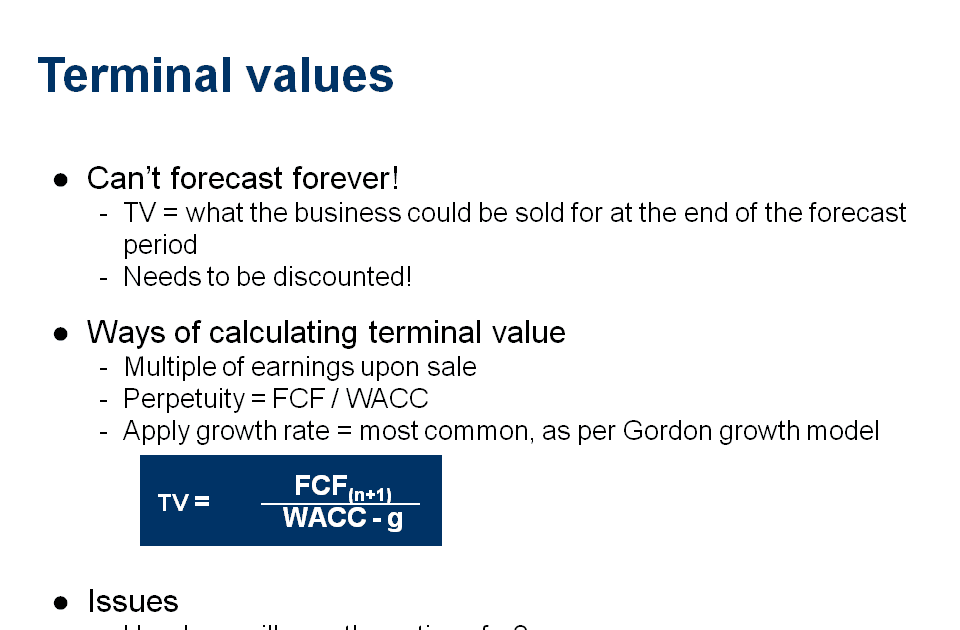

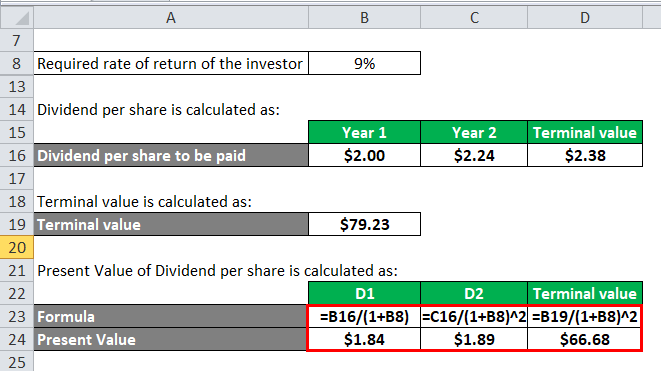

Multi period dividend discount model. The multistage dividend discount model is an equity valuation model that builds on the gordon growth model by applying varying growth rates to the calculation. More understanding free cash flow to.

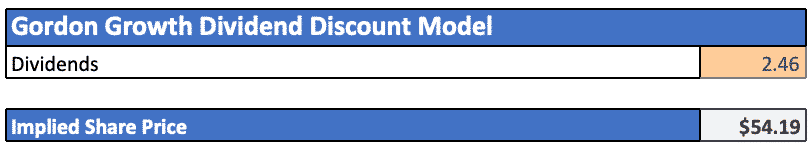

G 5 or 005. The wacc formula is ev x re dv x rd x 1 t. Using an estimated dividend of 212 at the beginning of 2019 the investor would use the dividend discount model to calculate a per share value of 212 05 02 7067.

D 0 10. Gordon growth model is a type of dividend discount model in which not only the dividends are factored in and discounted but also a growth rate for the dividends is factored in and the stock price is calculated based on that. D 1 r g p 0.

The one period dividend discount model uses the following equation. R cost of equity or the required rate of return.

:max_bytes(150000):strip_icc()/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)