Gordon Walter Model Formula

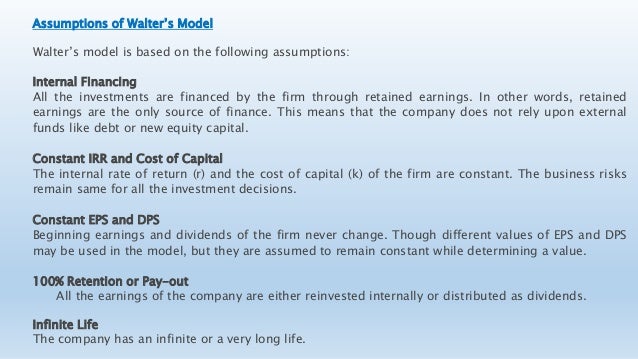

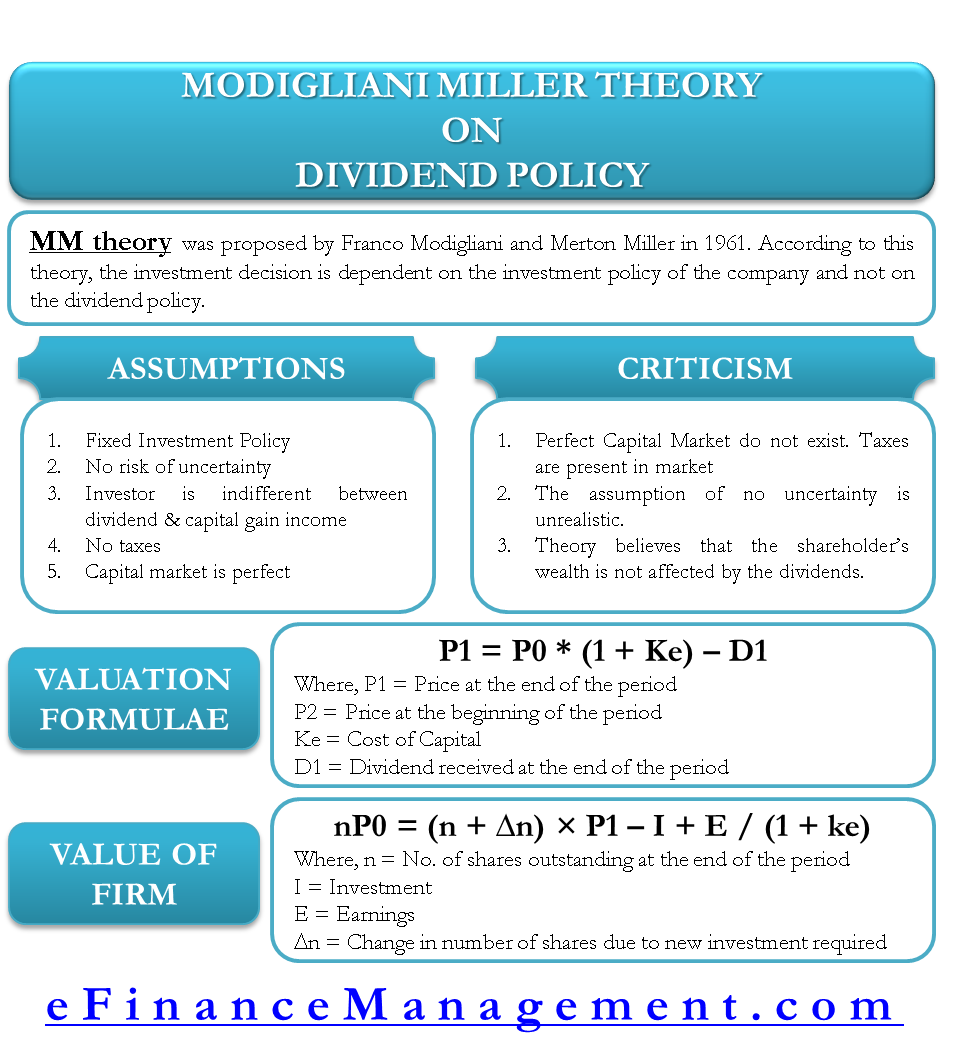

The firm has a very long or infinite life.

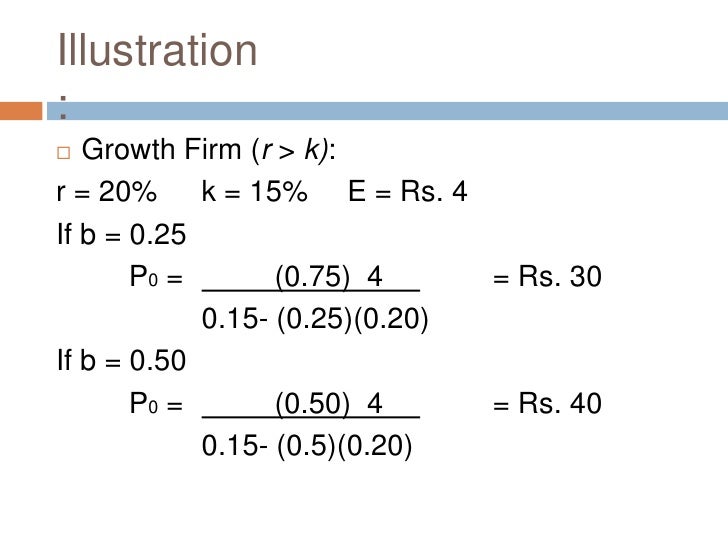

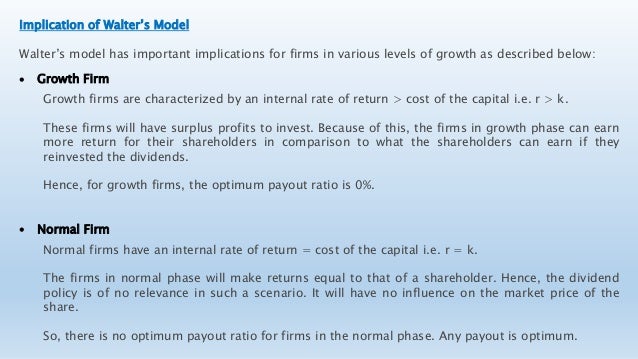

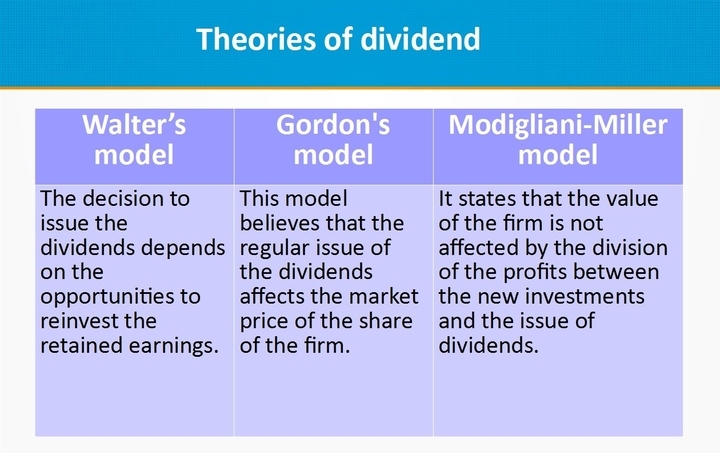

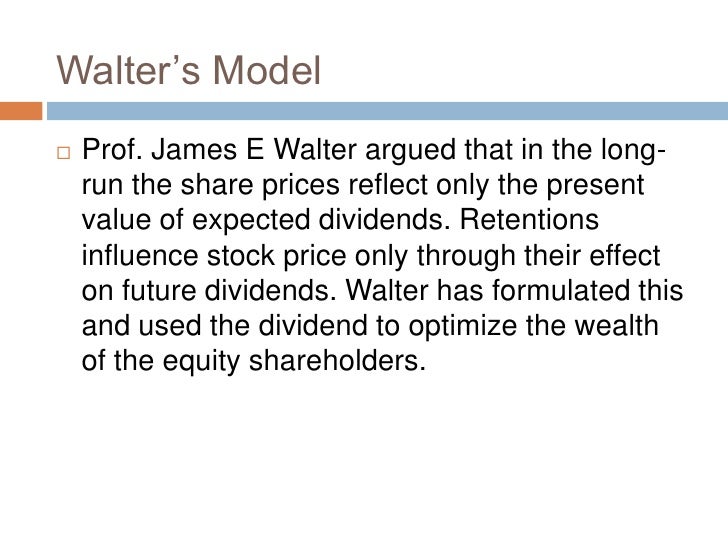

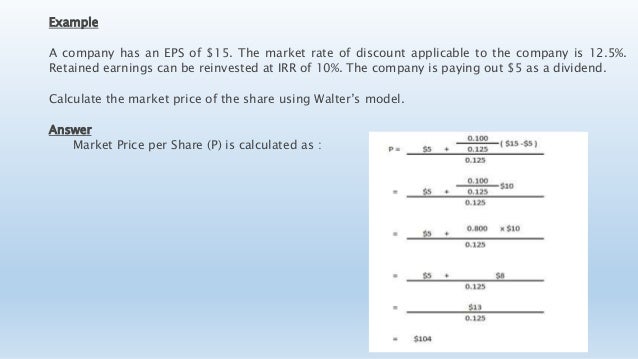

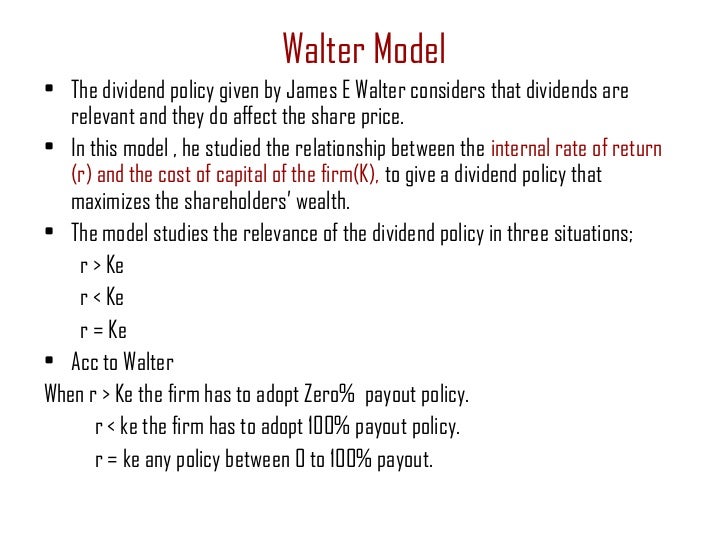

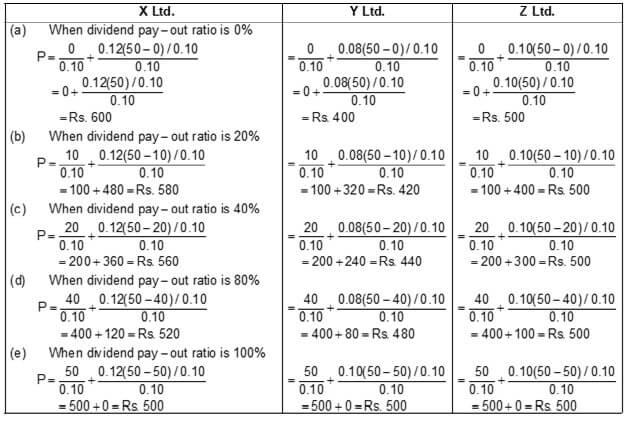

Gordon walter model formula. P market price per share. R rate of return on investment of the firm. By assuming that the discount rate k is constant walters model abstracts from the effect of risk on the value of the firm.

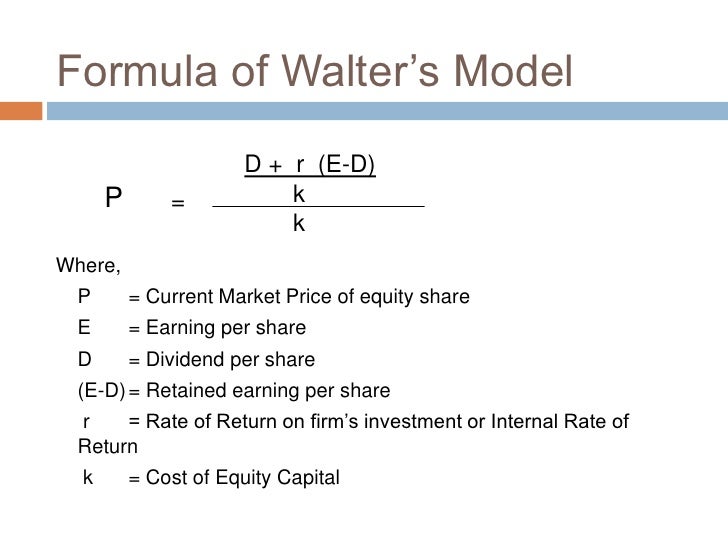

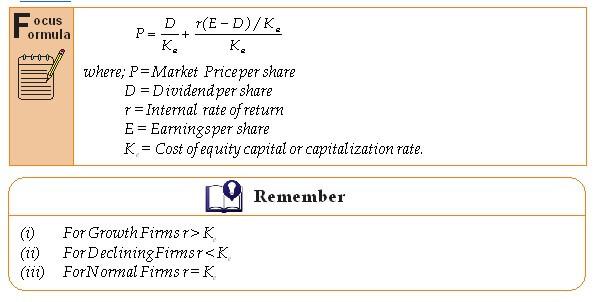

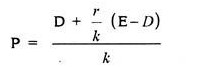

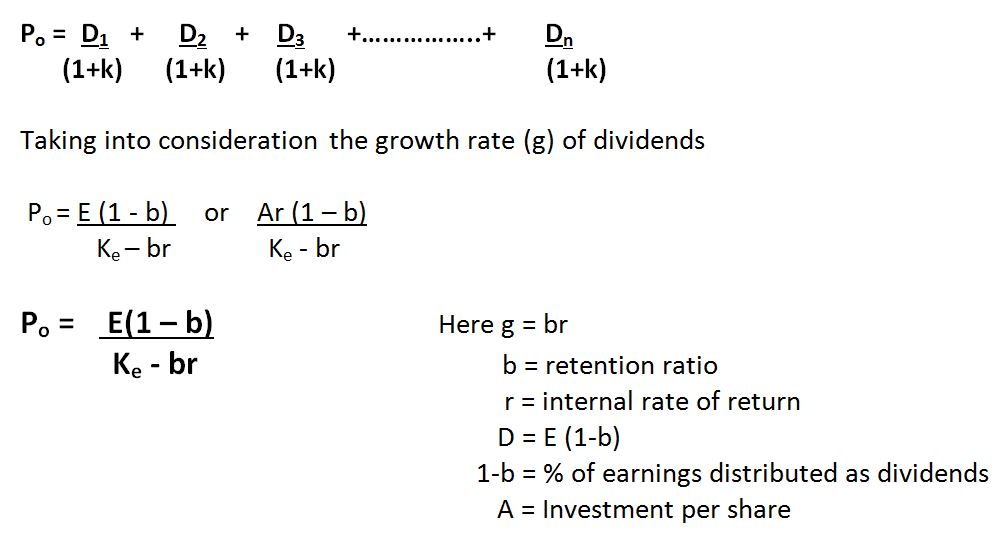

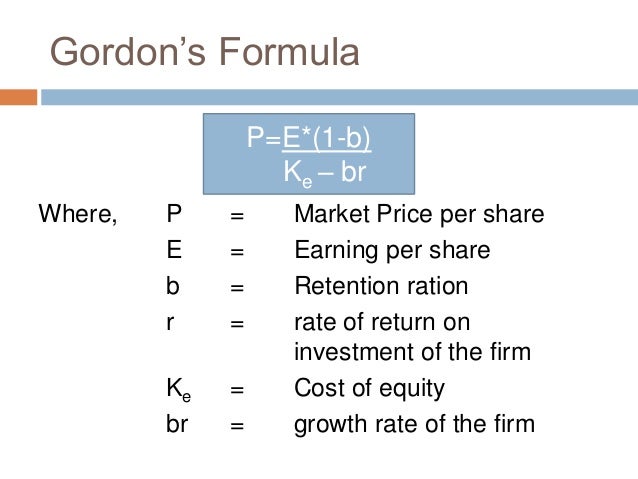

G growth rate. D dividend per share paid by the firm. P dk re dkk where.

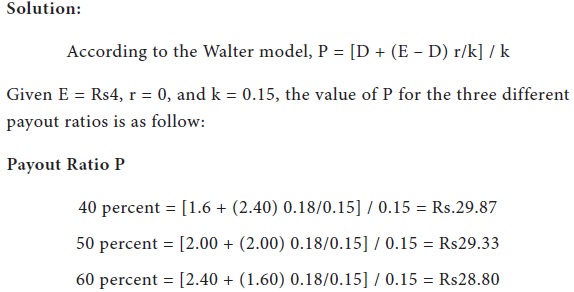

1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. Walters model valuation formula and its denotations. Where p market price of equity share.

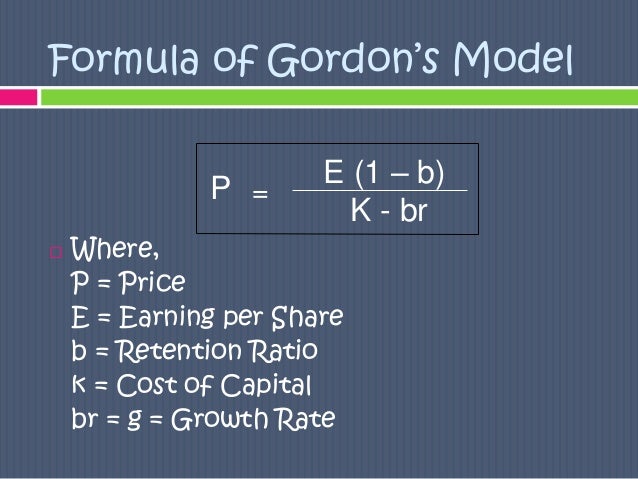

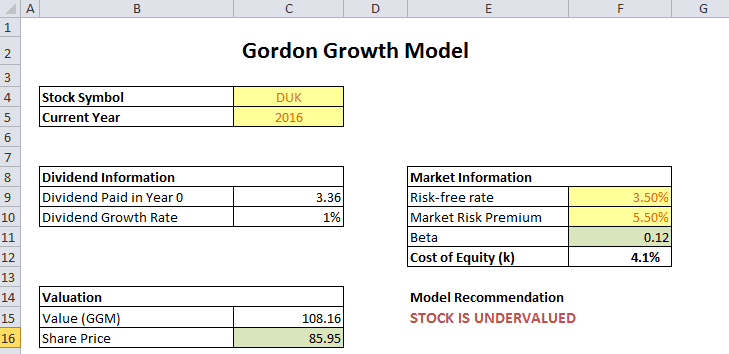

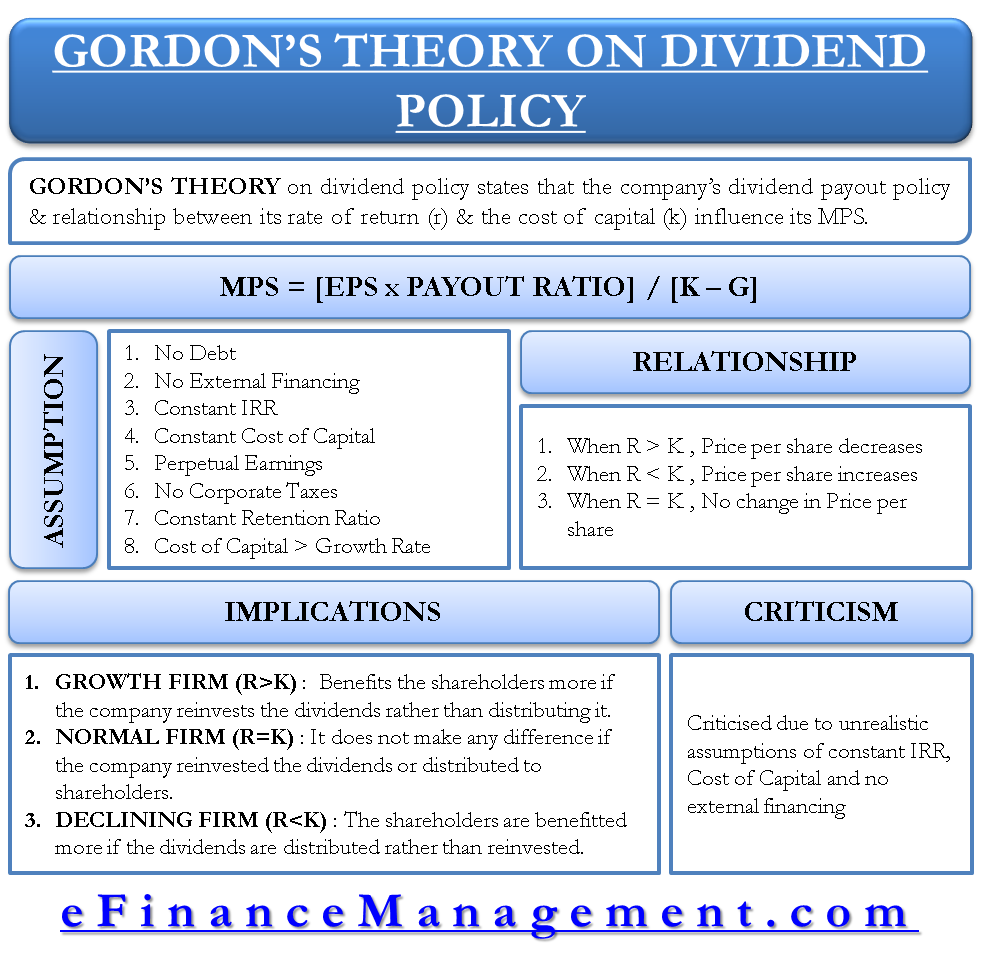

The gordon growth model ggm values a companys stock using an assumption of constant growth in dividends. Gordons model is based on the following assumptions. E earnings per share of the firm.

One very popular model explicitly relating the market value of the firm to dividend policy is developed by myron gordon. E earnings per share. D dividend per share.

Walter the dividends are relevant and have a bearing on the firms share pricesalso the investment policy cannot be separated from the dividend policy since both are interlinked. According to the walters model given by prof. In order to testify the above walter has suggested a mathematical valuation model ie p d rke e d ke ke.

According to walter model of dividend decision market value of share is the sum of the market value of two sources of income. Ke cost of equity share capital and. Div 1 estimated dividends for the next period.

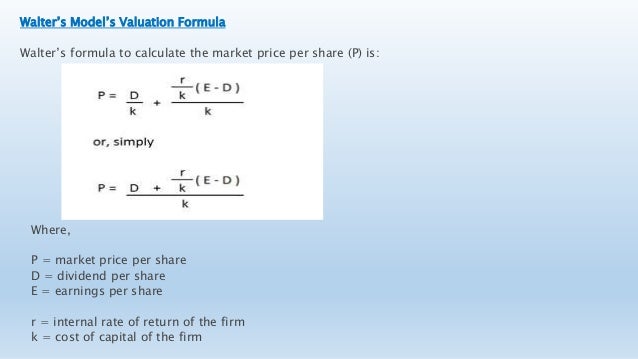

Walters formula to calculate the market price per share p is. R required rate of return. As per the gordon growth formula the intrinsic value of the stock is equal to the sum of all the present value of the future dividend.

What is the gordon growth model formula. The wacc formula is ev x re dv x rd x 1 t. Lets have a look at the formula first.

The model takes the infinite series of dividends per share and discounts them back into. Three variables are included in the gordon growth model formula. Walters formula to determine the market price per share p is as follows.

Present value of all dividends dke and present value of all capital gains r e dkeke. P dk r e dkk. The gordon growth model formula that with the constant growth rate in future dividends is as per below.

R internal rate of return of the firm. Here p 0 stock price.