Gordon Model Formula Calculator

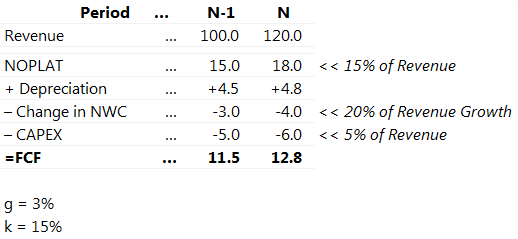

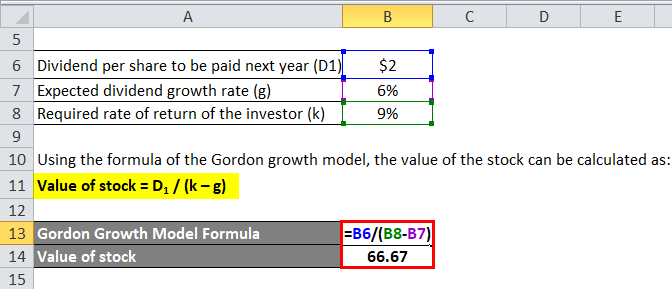

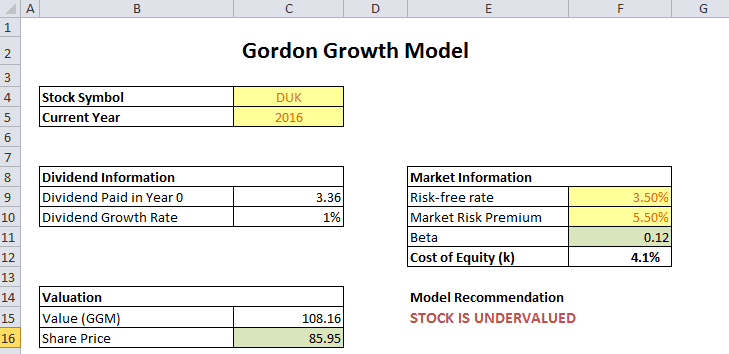

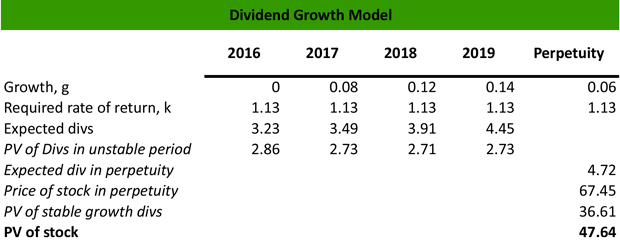

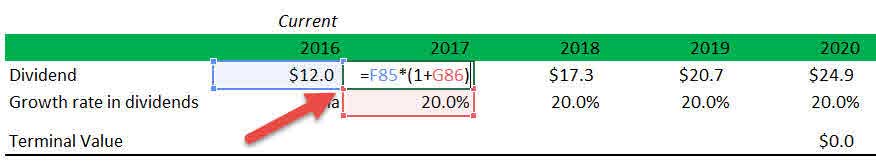

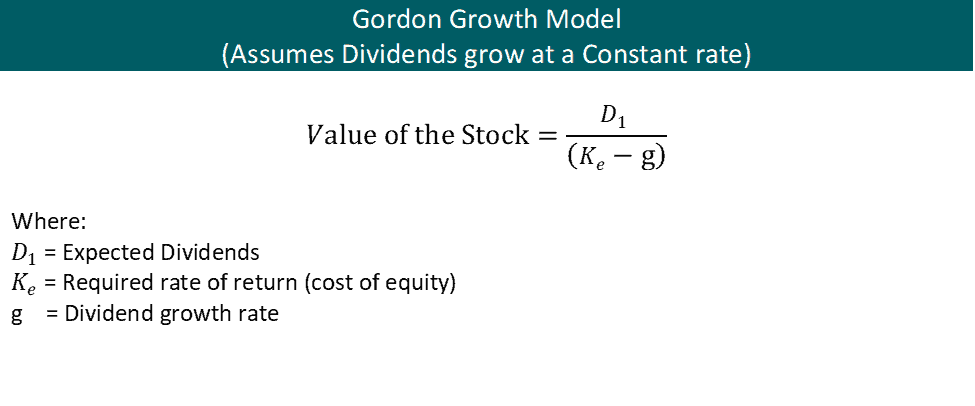

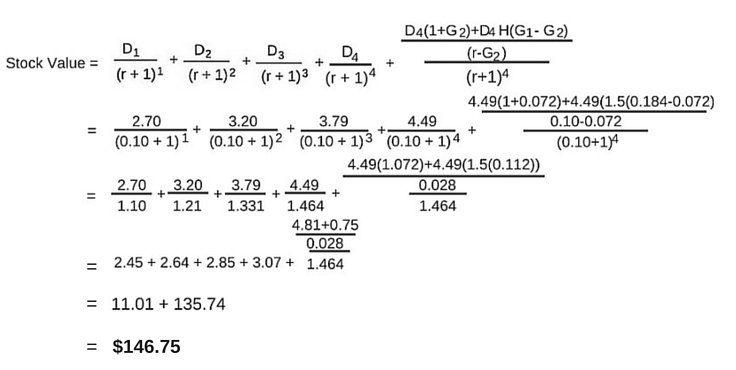

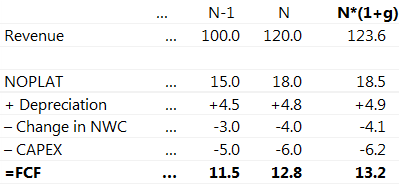

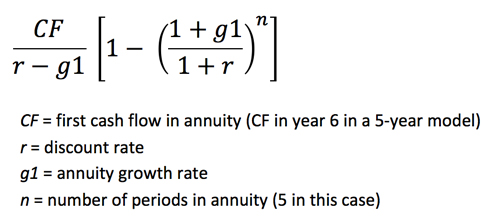

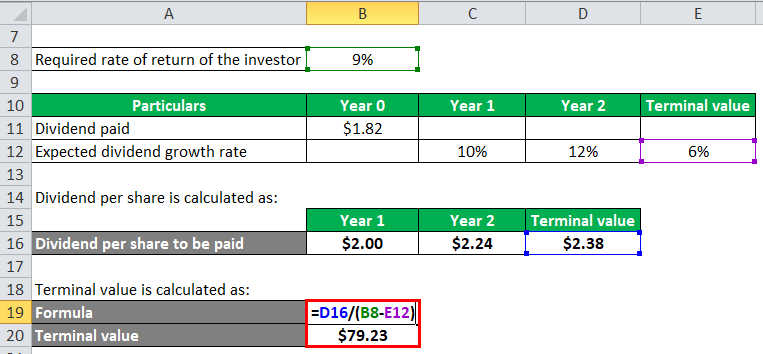

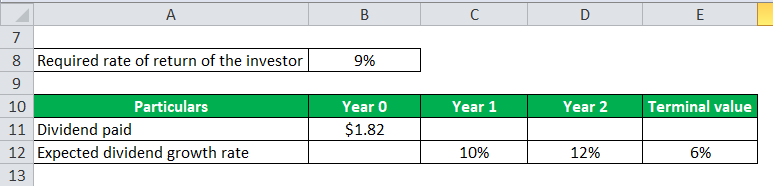

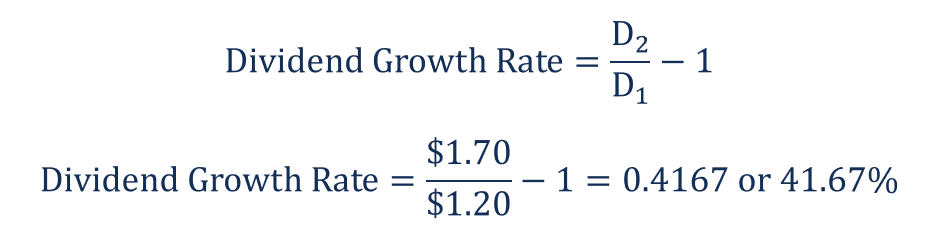

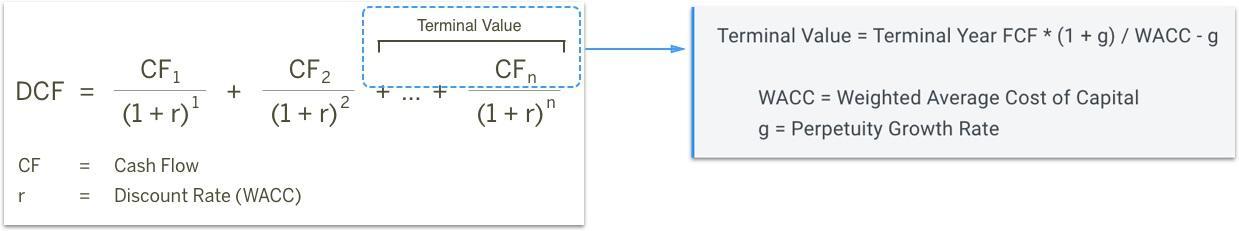

Therefore we can calculate the gordon growth model terminal value in 2020 using this model.

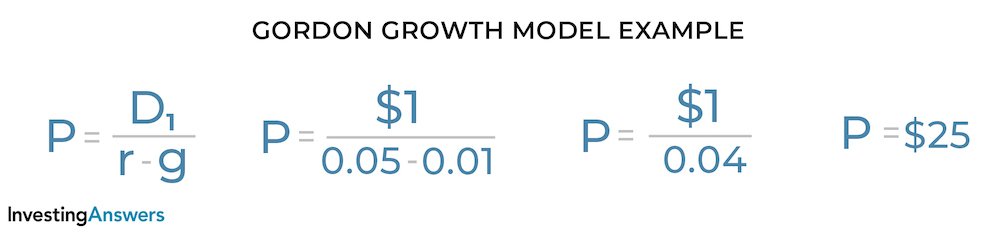

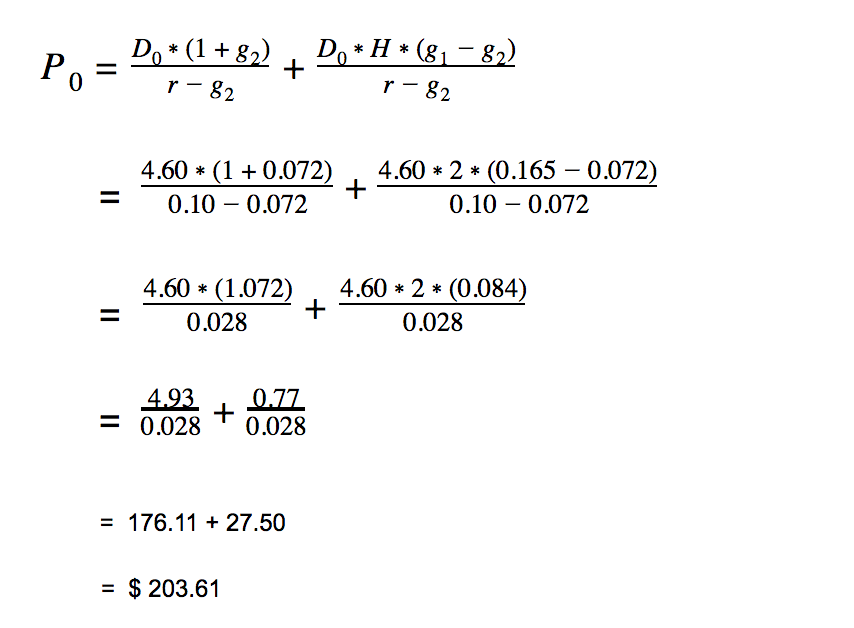

Gordon model formula calculator. And thats d times 1g. This is the numerator in the equation. Tv or terminal value at the end of the year 2020.

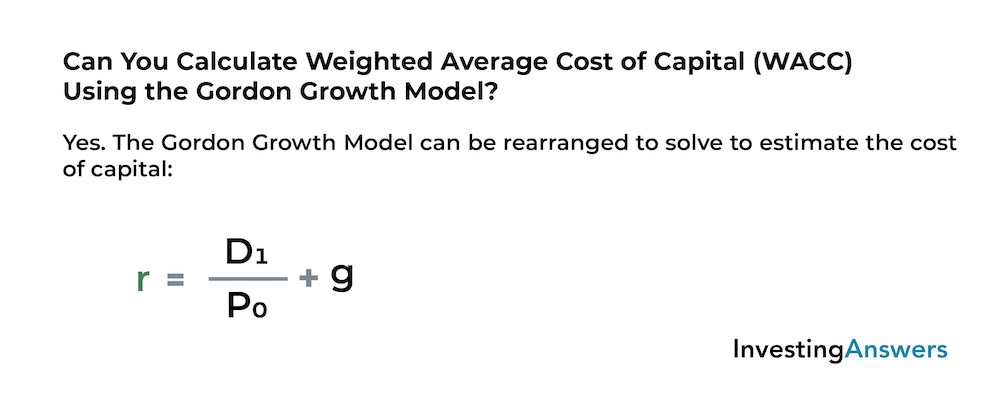

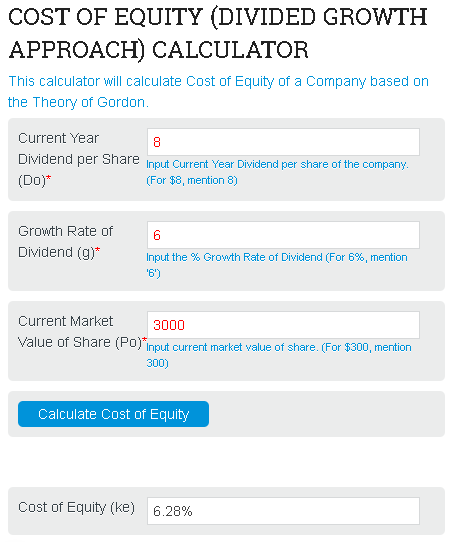

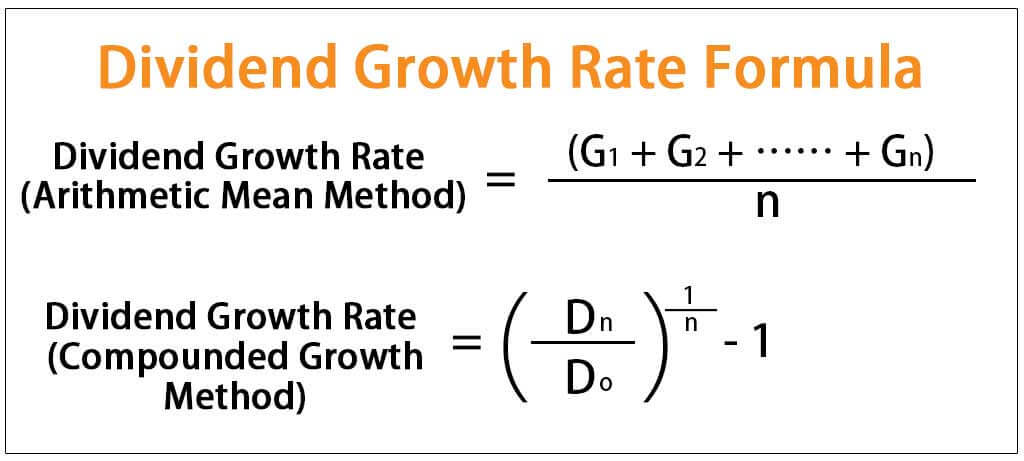

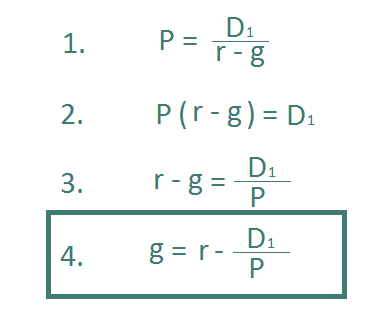

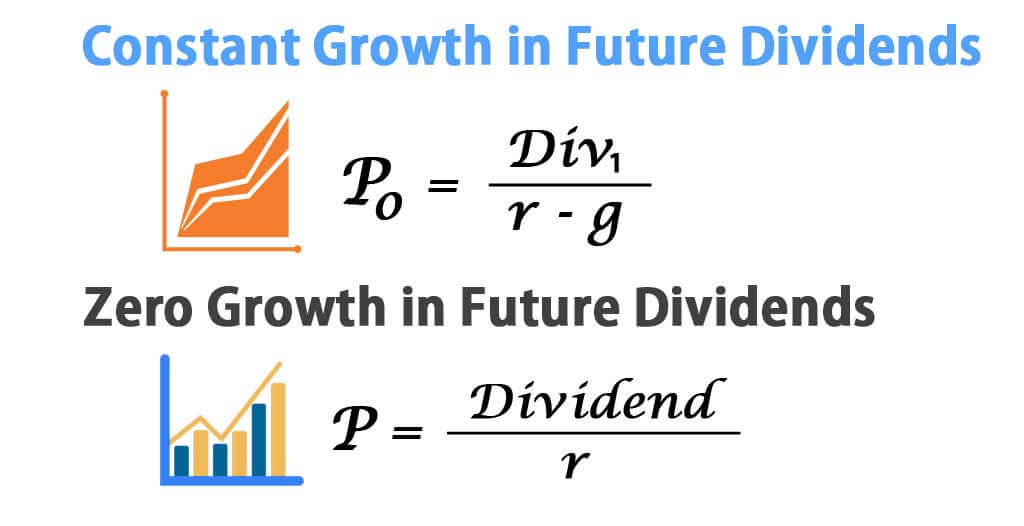

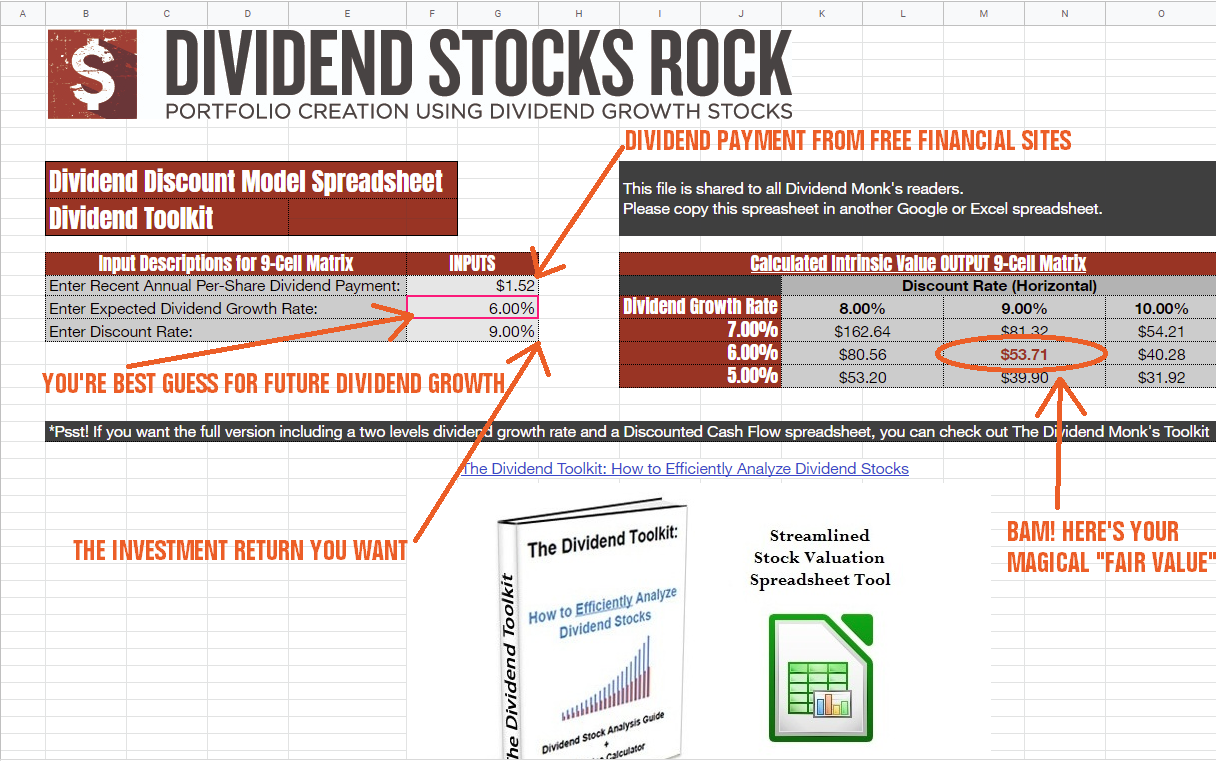

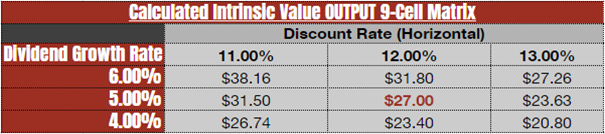

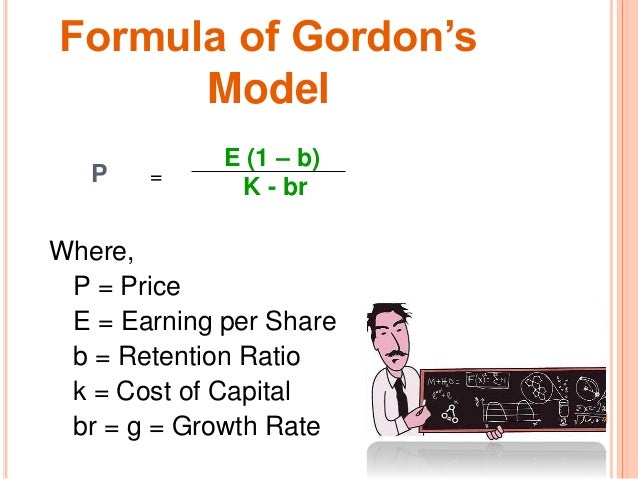

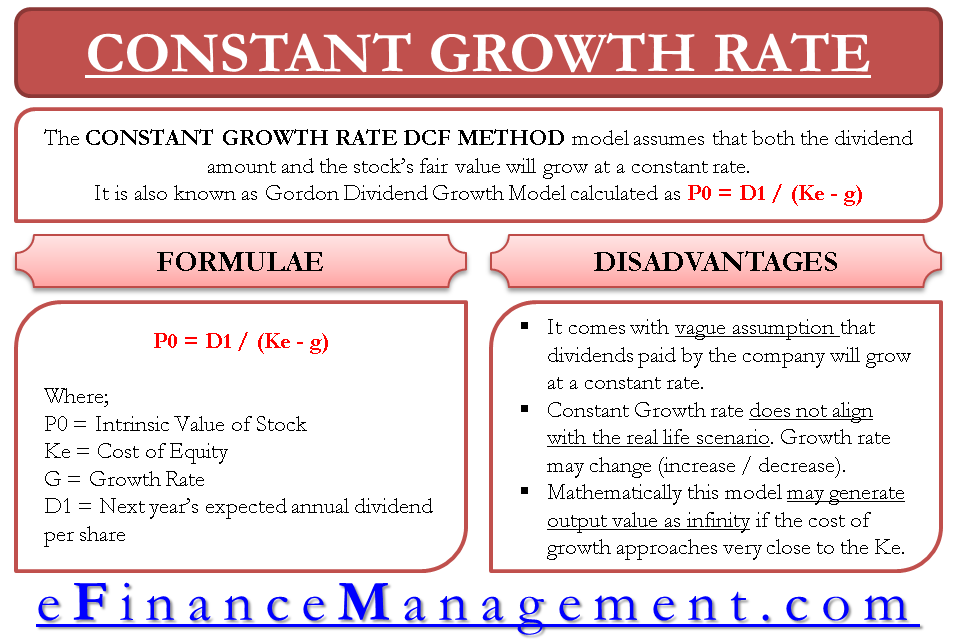

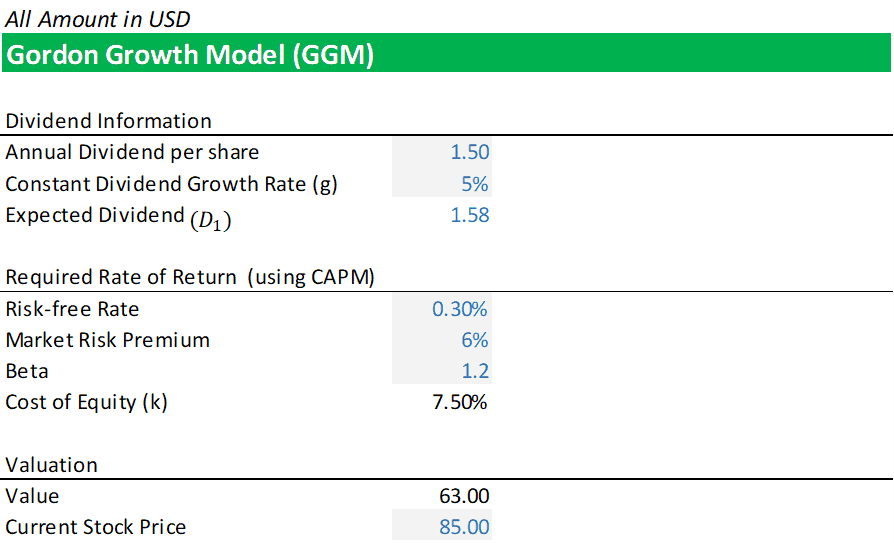

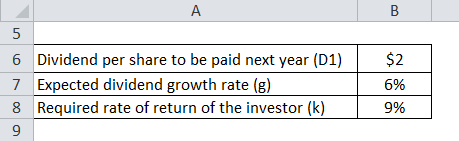

Calculator formula gordon model calculator assists to calculate the constant growth rate g using required rate of return k current price and current annual dividend. Gordon growth model calculator. Constant growth gordon model definition.

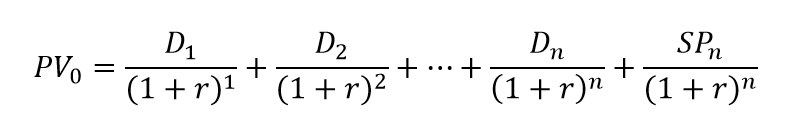

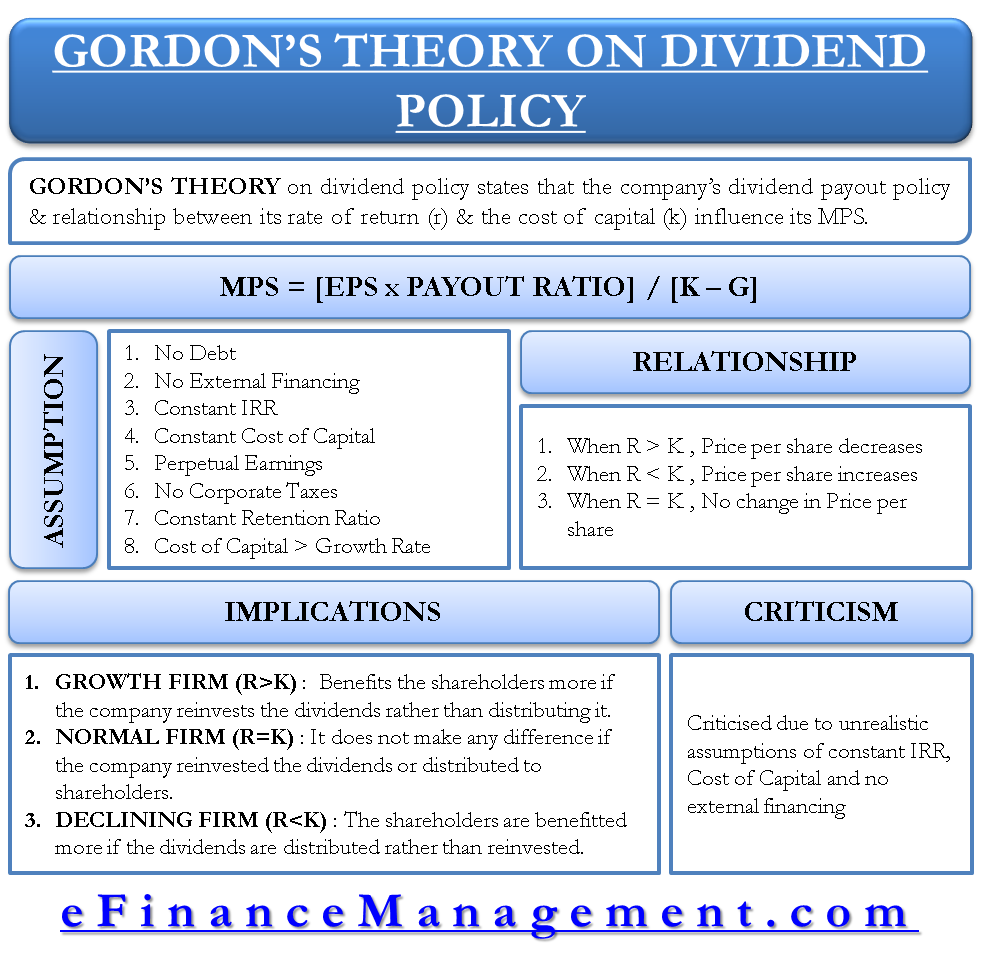

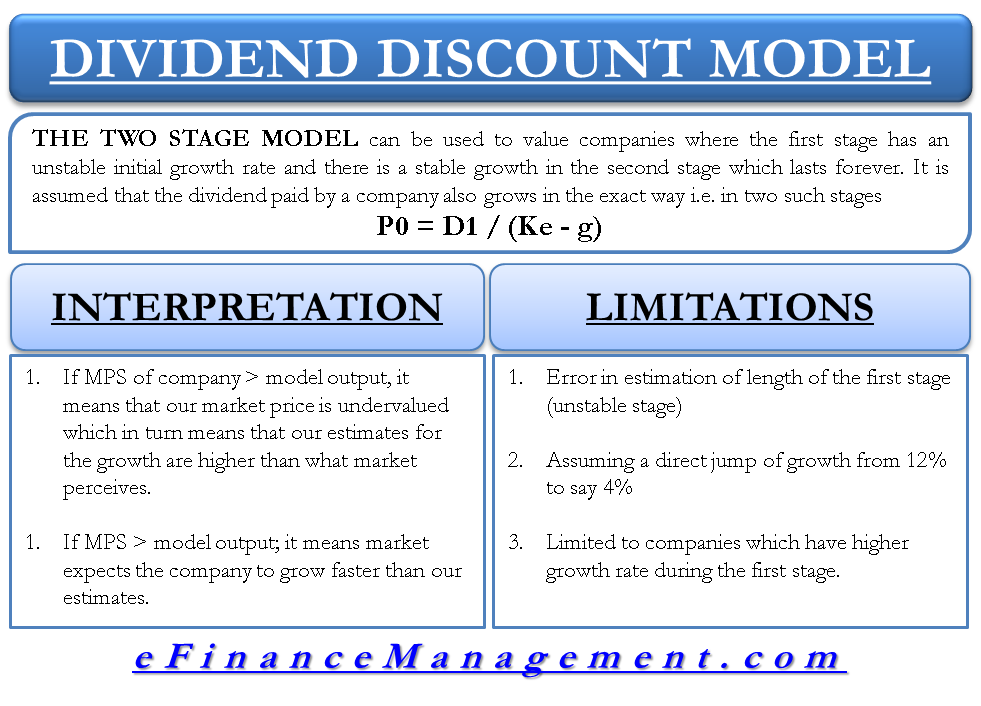

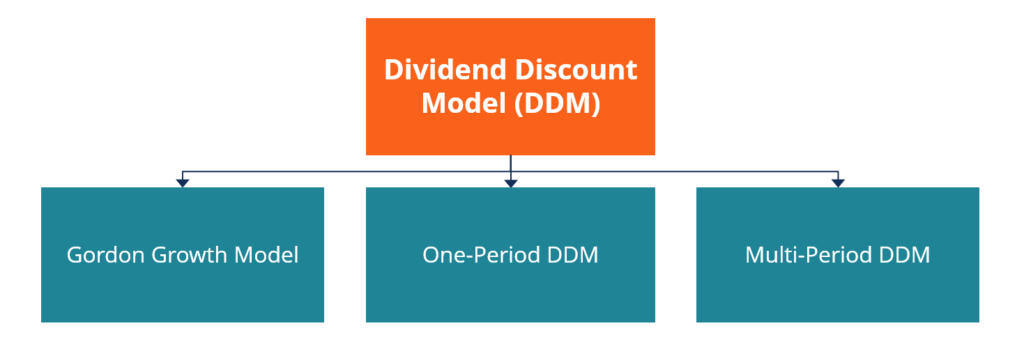

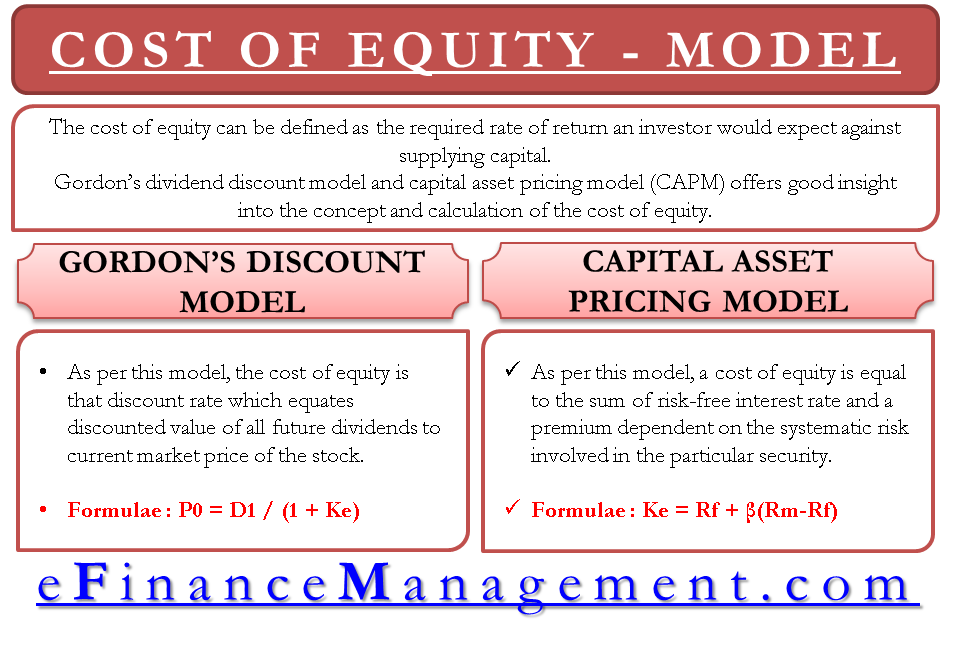

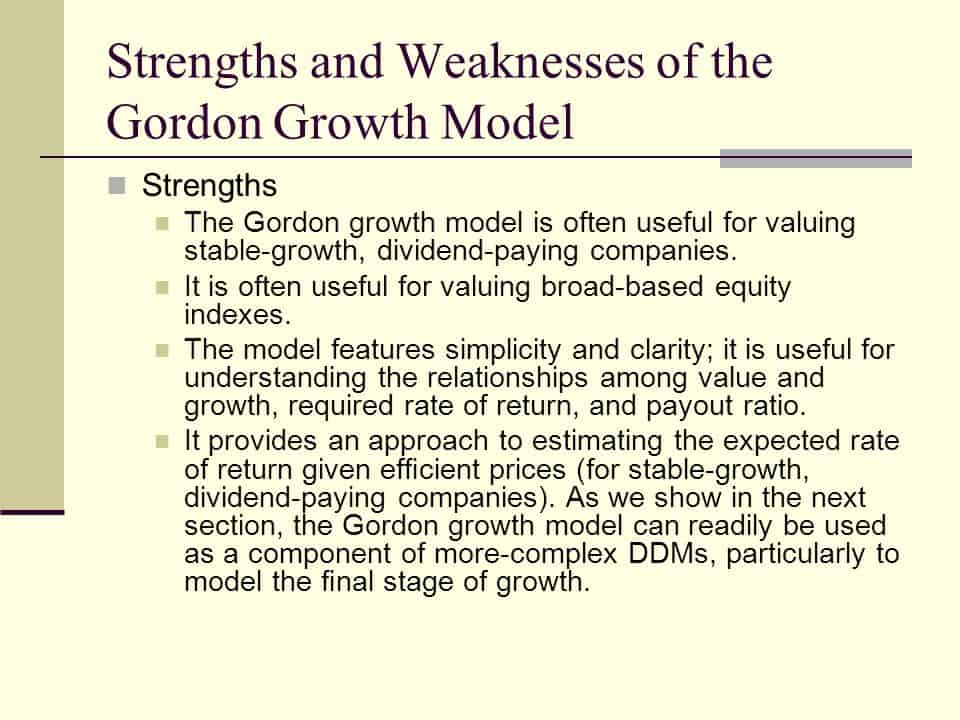

Gordon growth model is based on the dividend discount model ddm and was developed by professor myron j. The gordon growth model is also referred to as the dividend discount model. Under the ddm estimating the future dividends of a company could be a complex task since dividend payouts of companies may vary due to other factors such as market conditions profitability and so on.

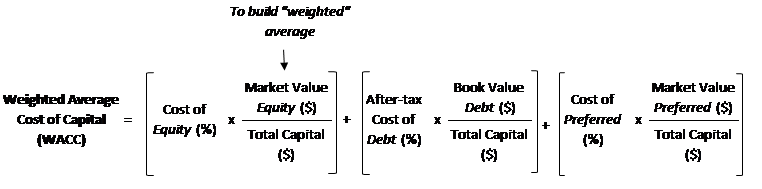

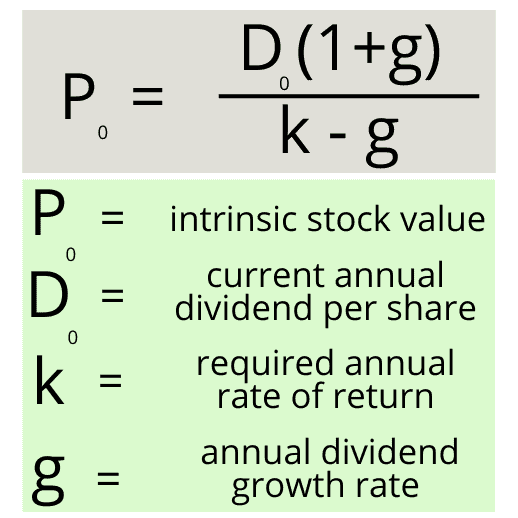

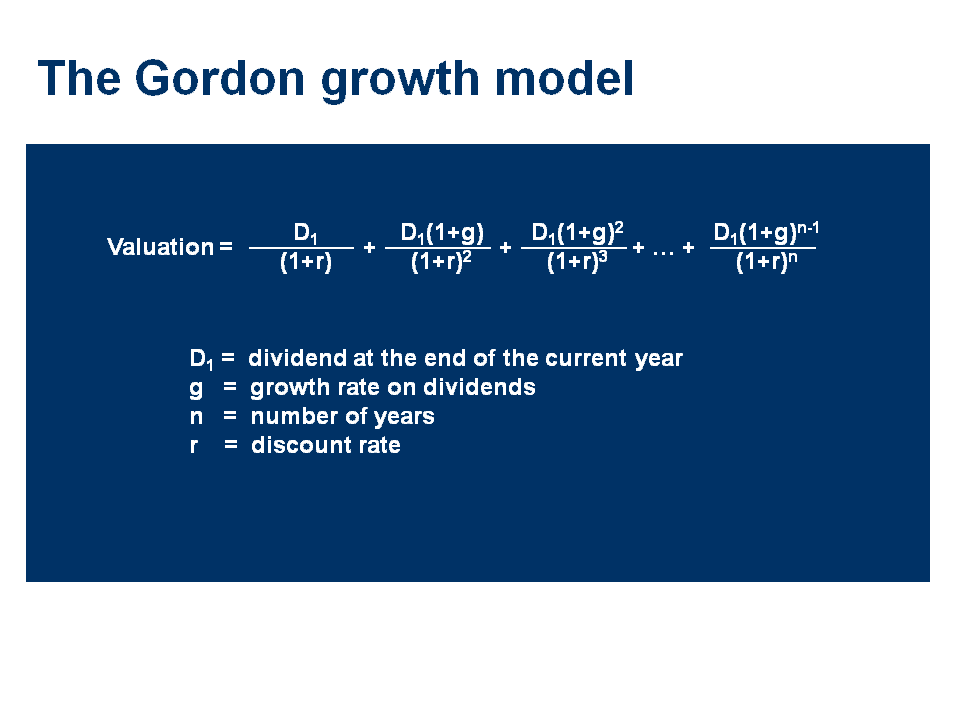

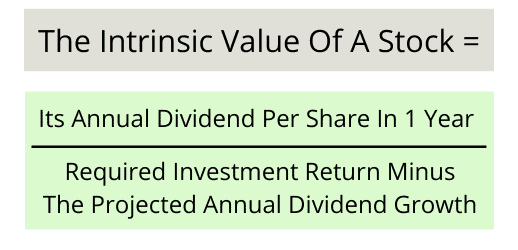

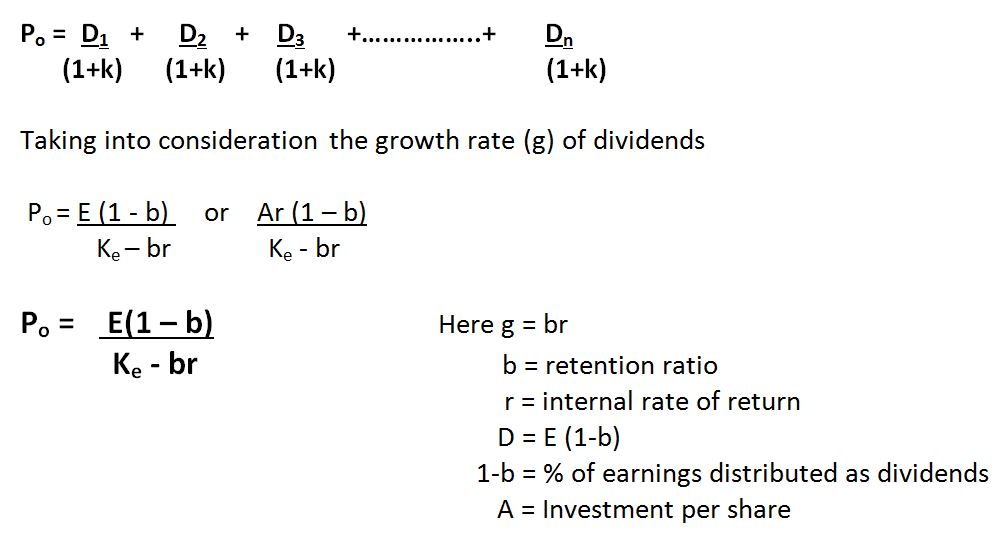

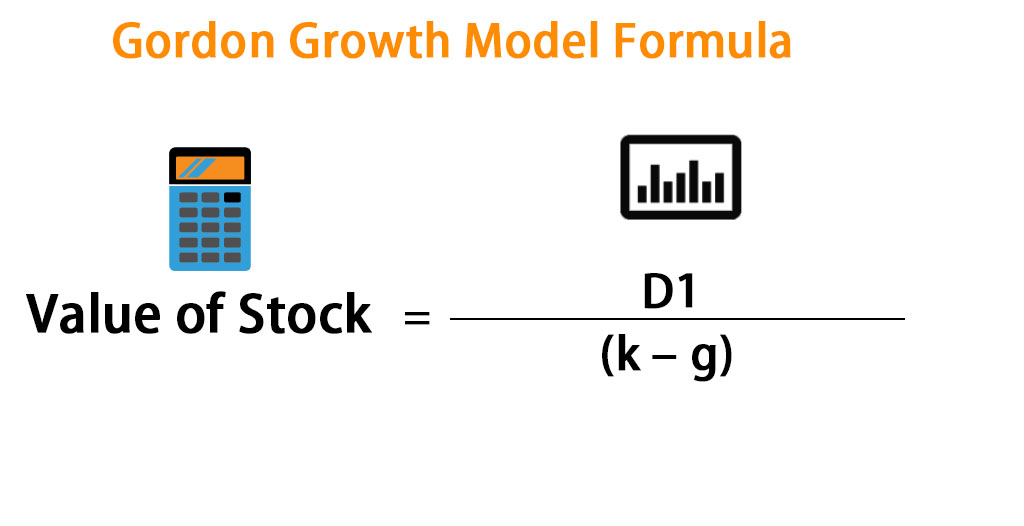

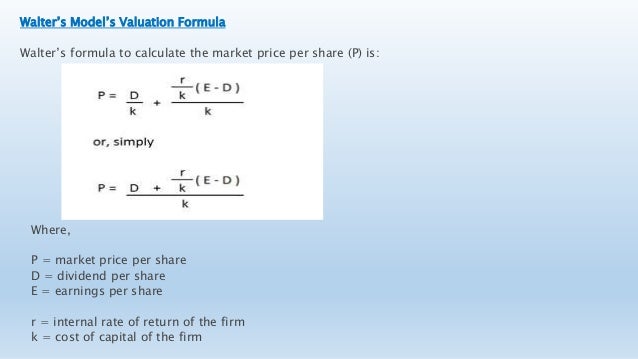

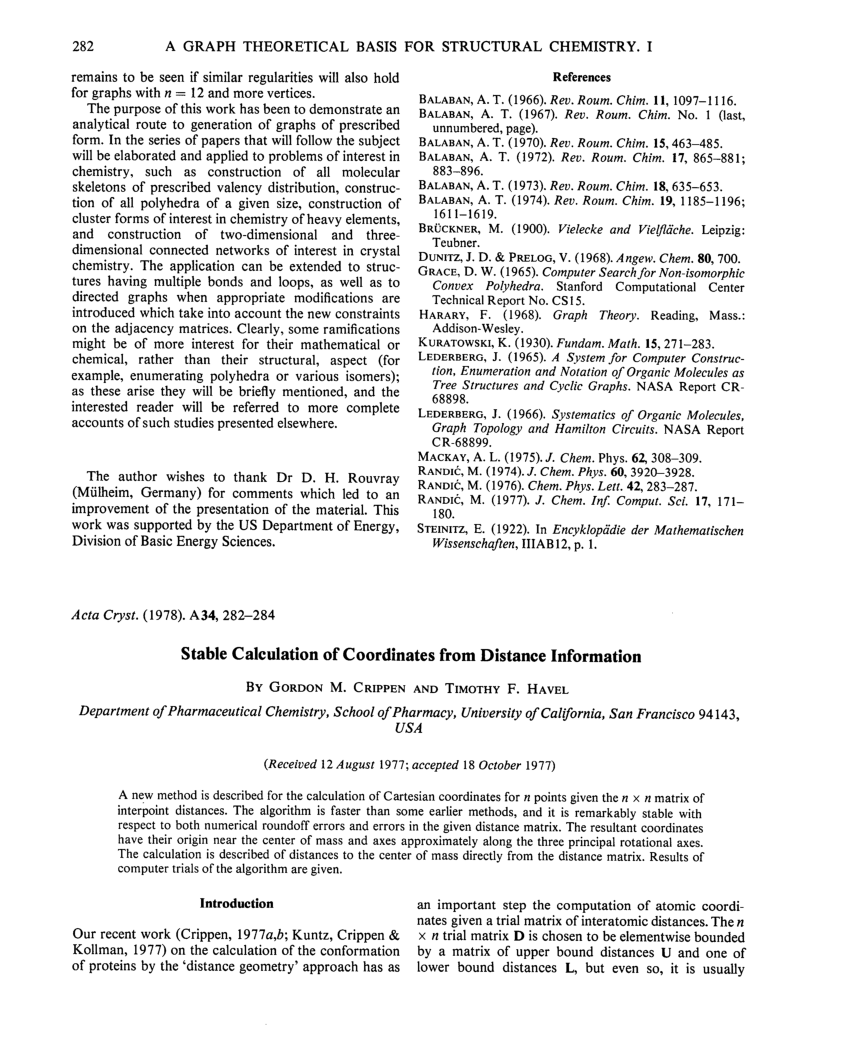

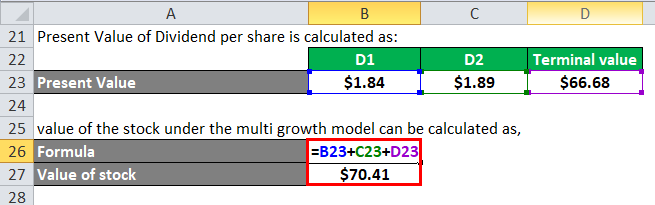

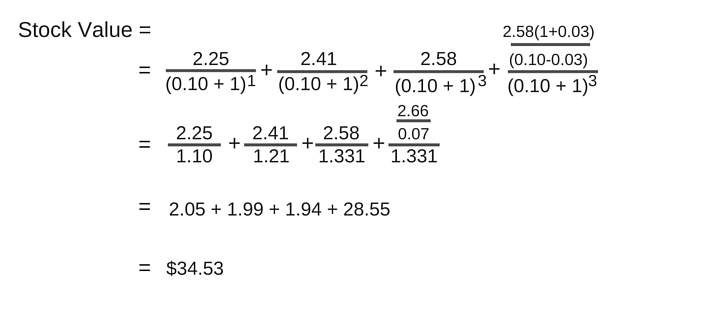

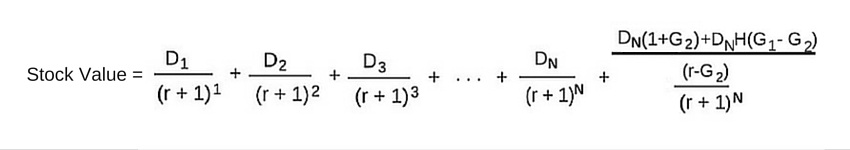

The gordon model assumes that the current price of a security will be affected by the dividends the growth rate of the dividends and the required rate of return by shareholders. And below that youll find the required rate of return minus the dividend growth rate k g. Gordon model is used to determine the current price of a security.

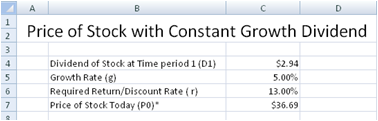

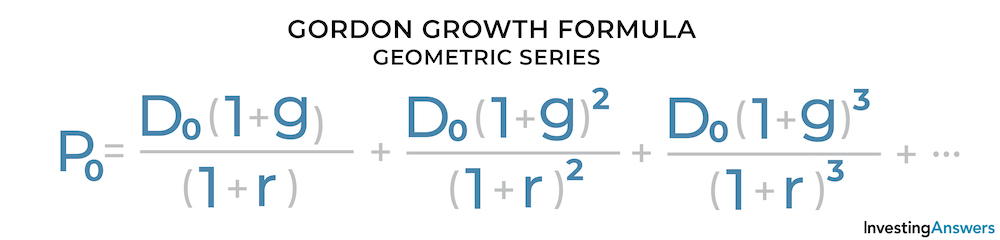

Gordon of the university of toronto in the late 1950s. Gordon growth model formula calculator gordon growth model formula the term gordon growth model refers to the method of stock valuation based on the present value of the stocks future dividends irrespective of the current market conditions. The model assumes that the stock pays an indefinite number of dividends that grow at a constant rate.

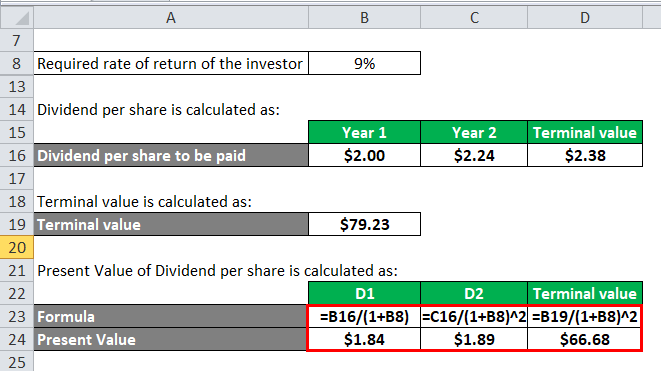

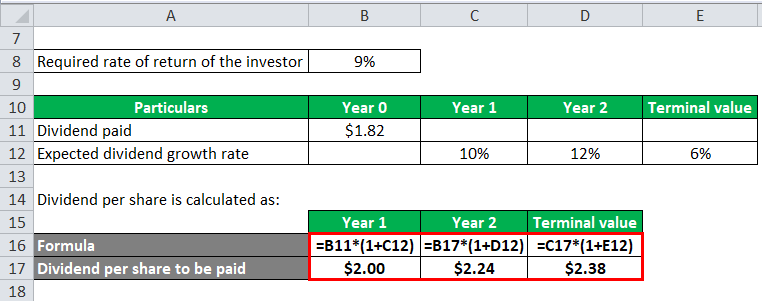

The gordon growth model formula equates this intrinsic value of a stock to the present value of a stocks future dividends. It can be estimated using the gordon growth formula we apply the formula in excel as seen below. The gordon growth model formula first calculates what the dividend would be next year.

We note that the growth stabilizes after 2020. Use this calculator to determine the intrinsic value of a stock.