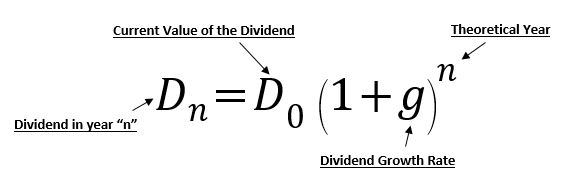

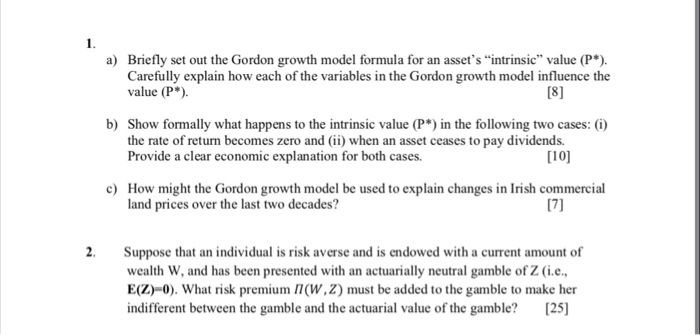

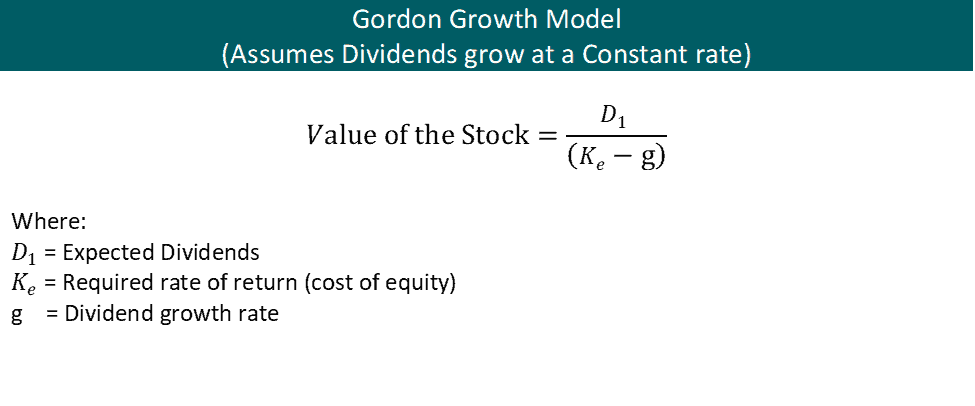

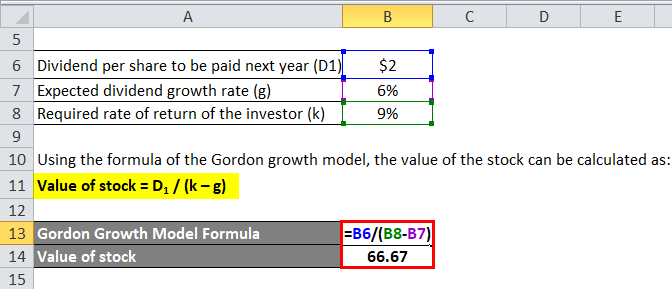

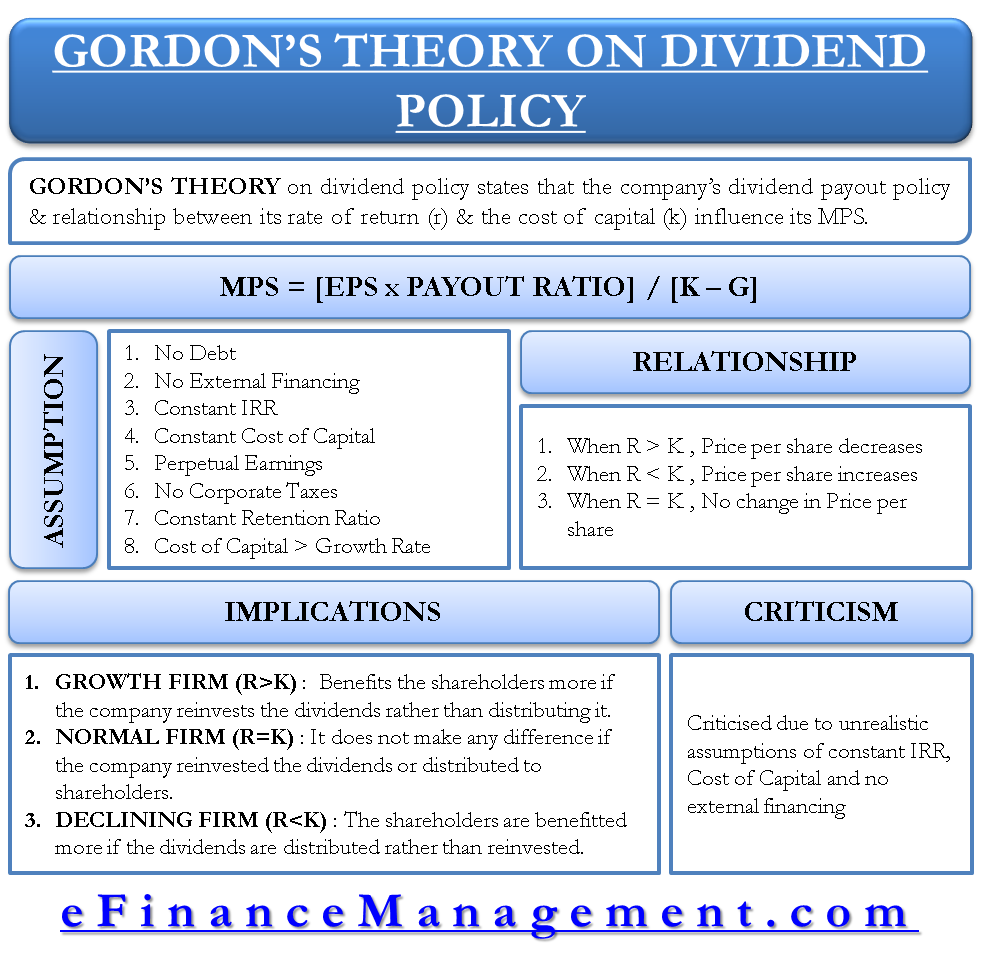

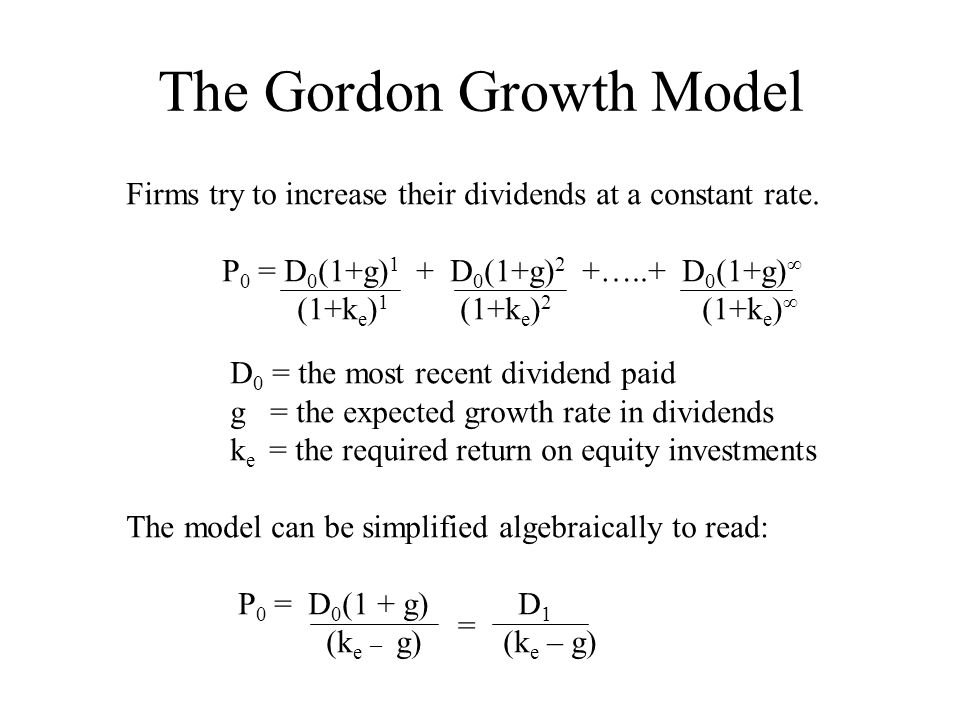

Gordon Growth Model Formula

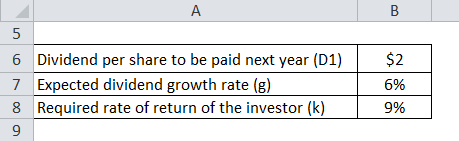

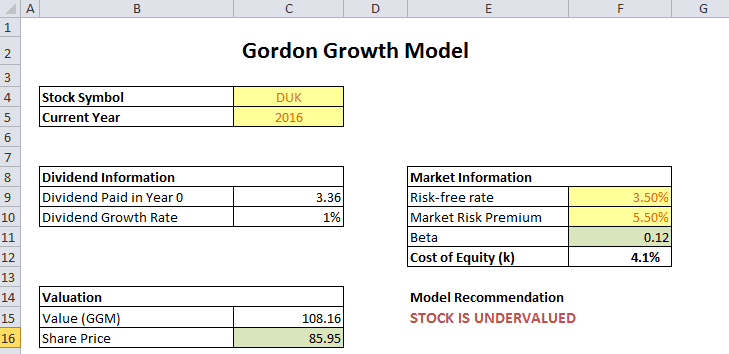

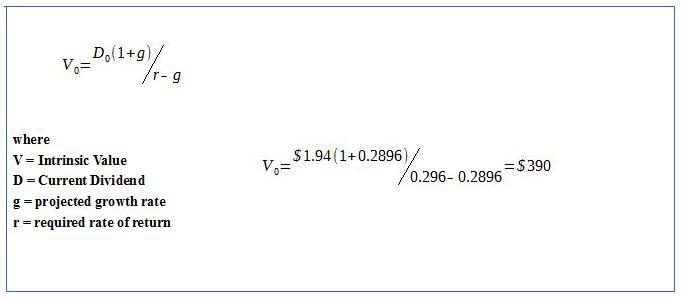

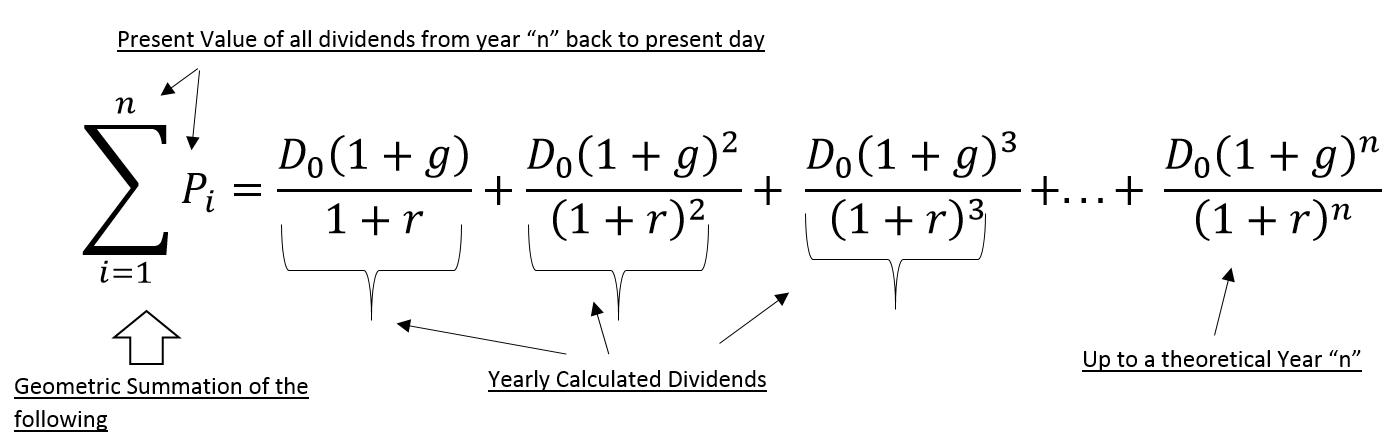

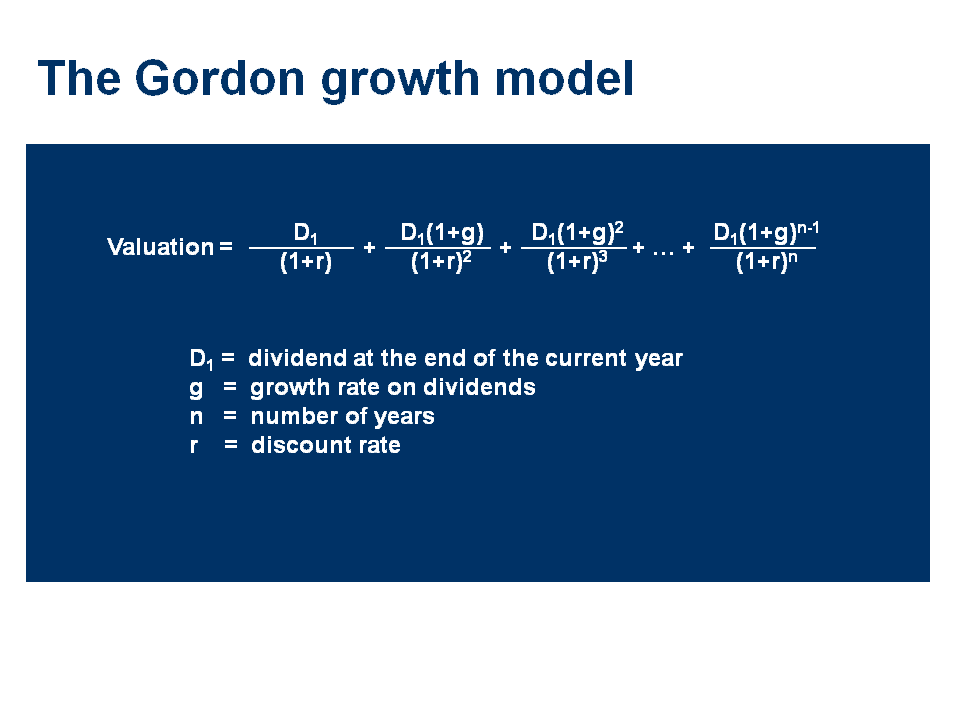

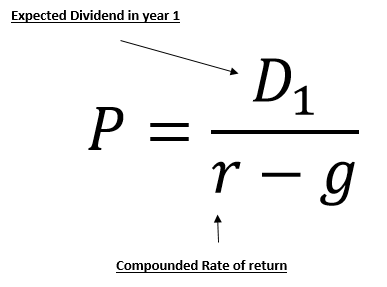

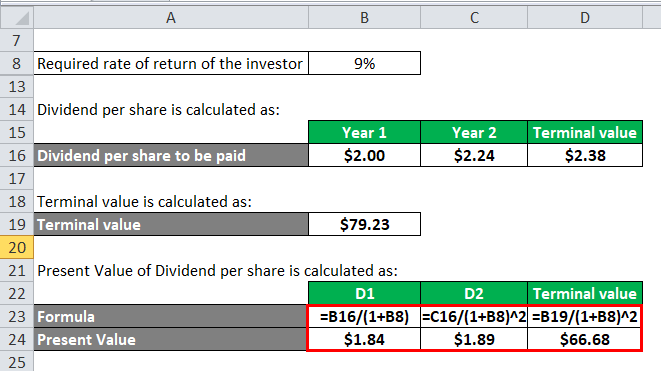

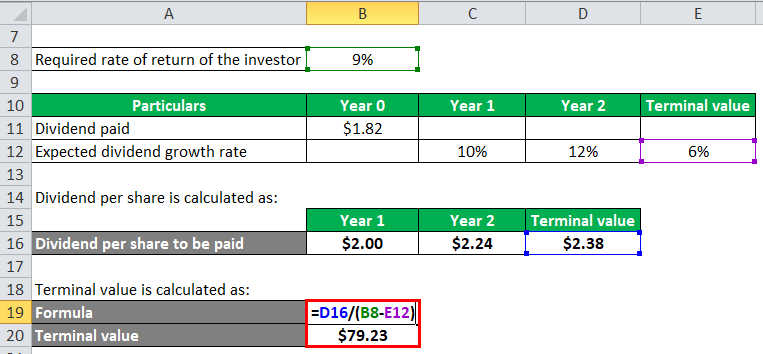

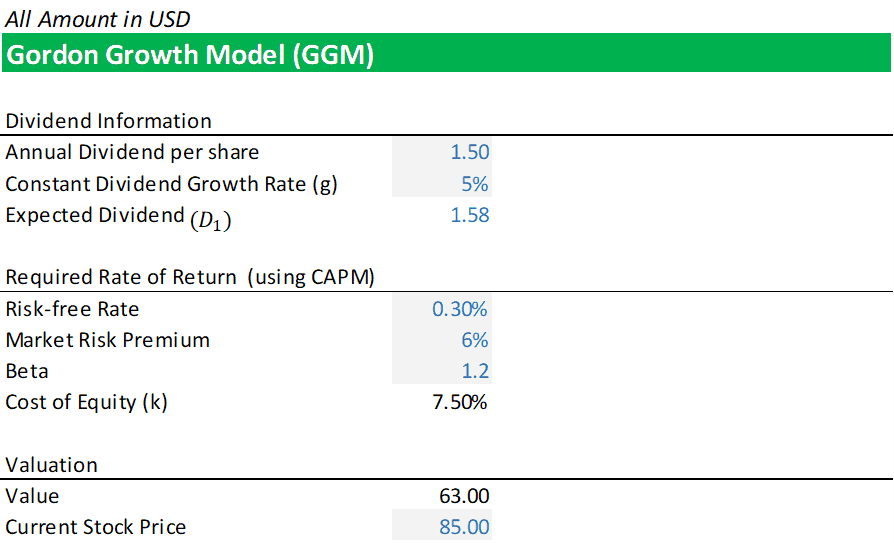

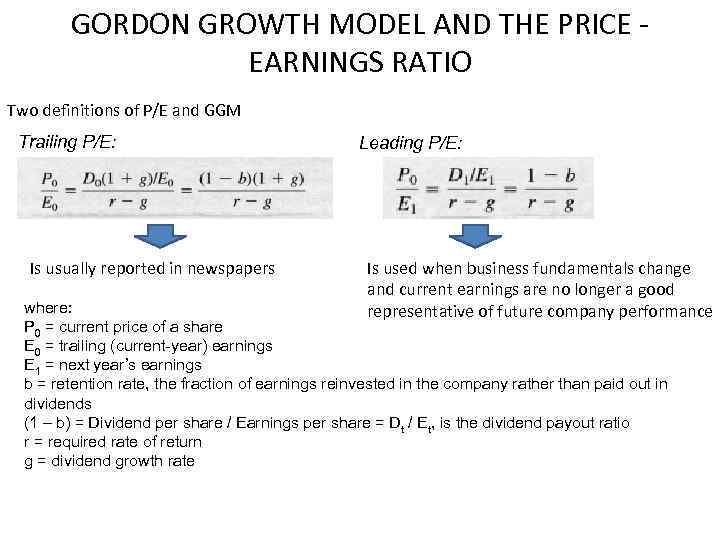

R cost of equity or the required rate of return.

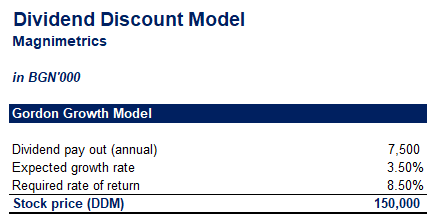

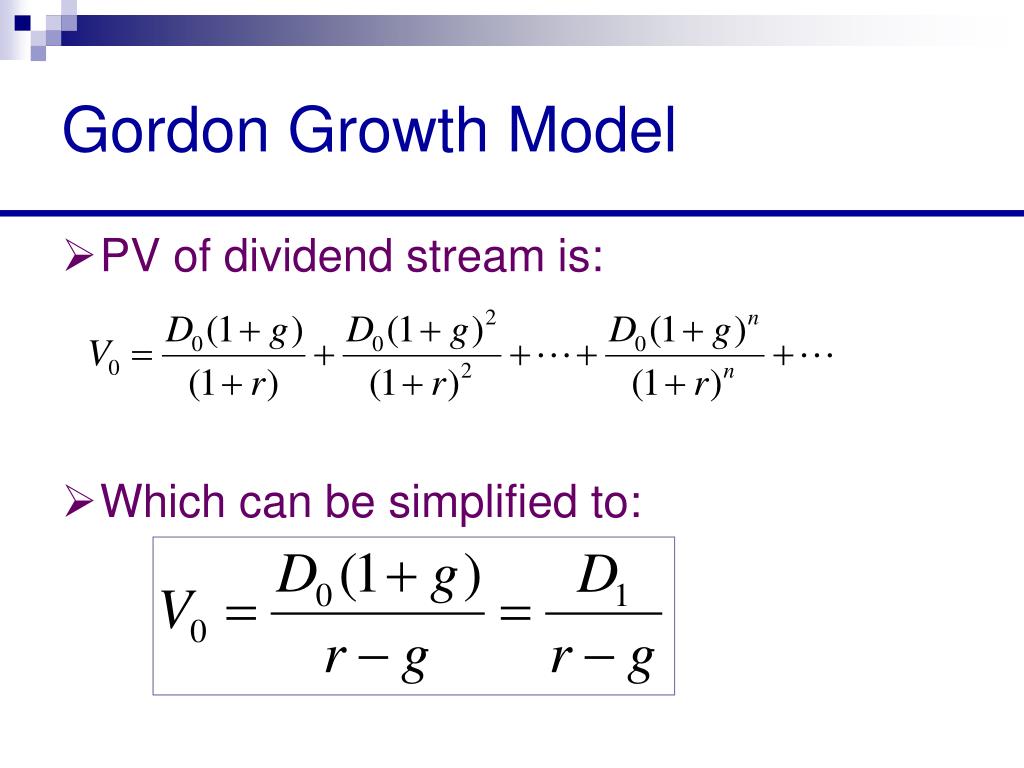

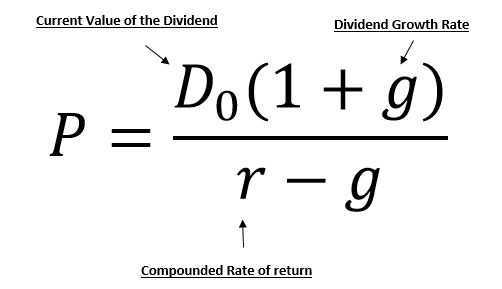

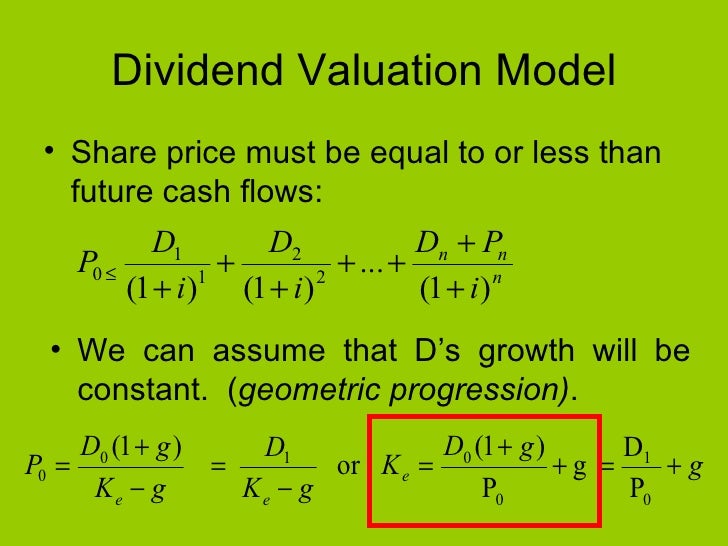

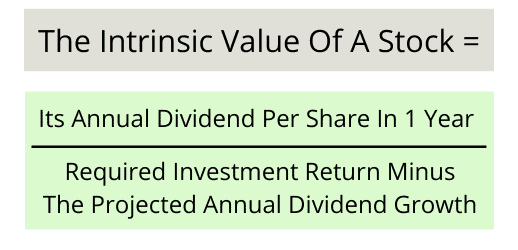

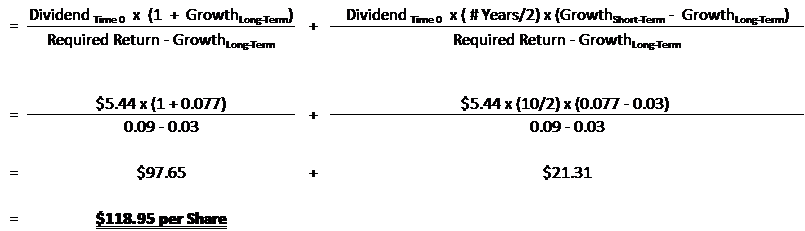

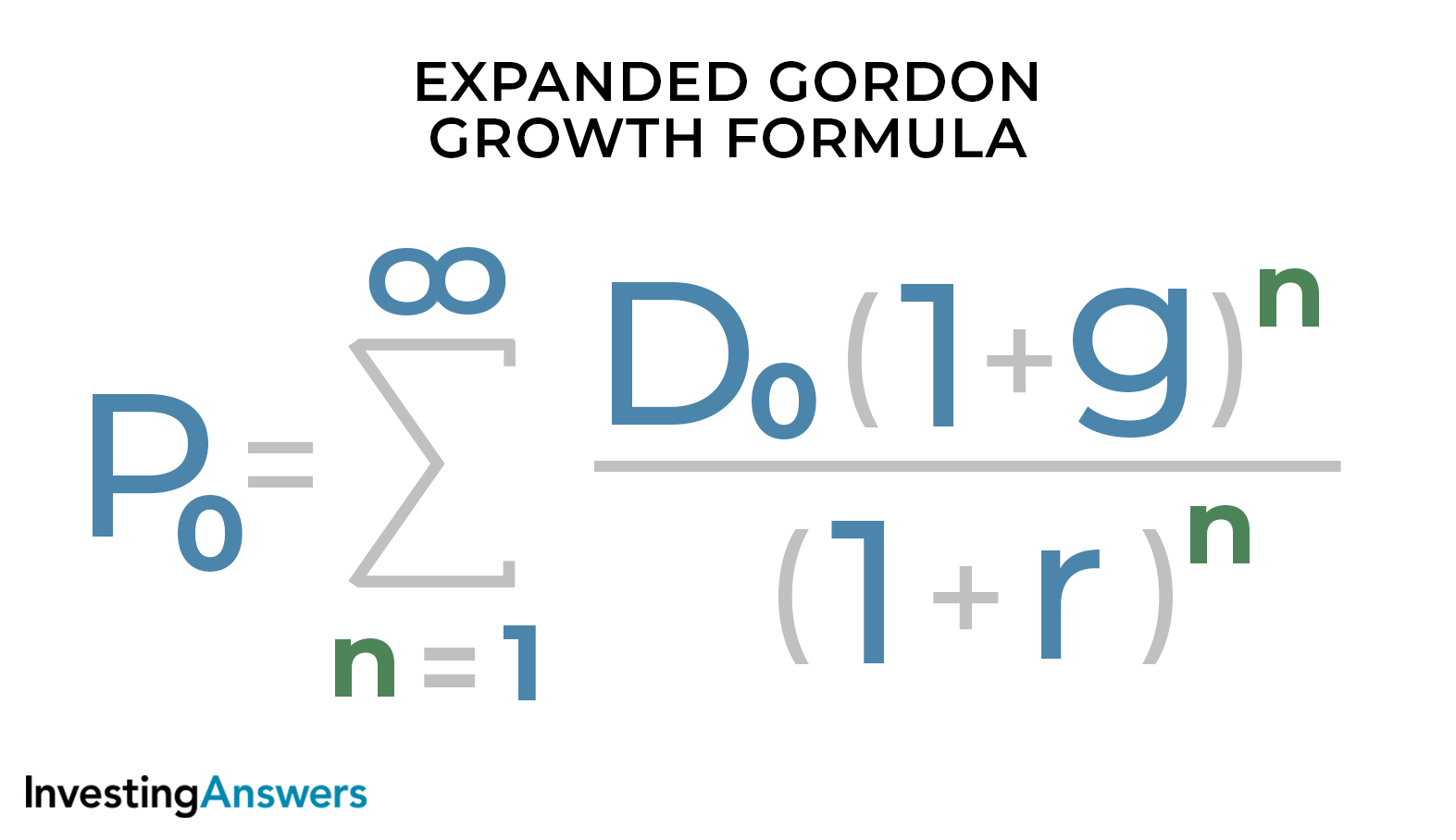

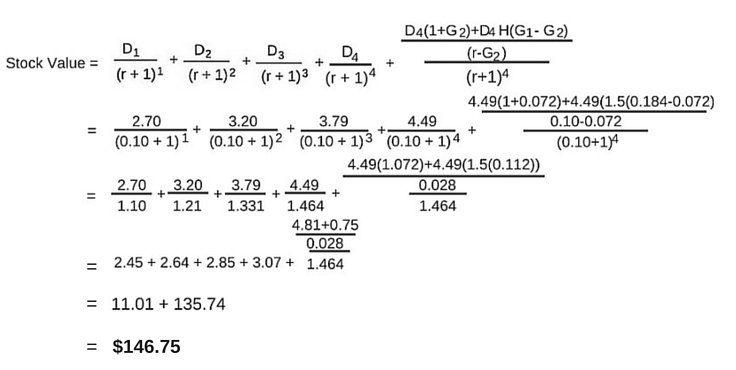

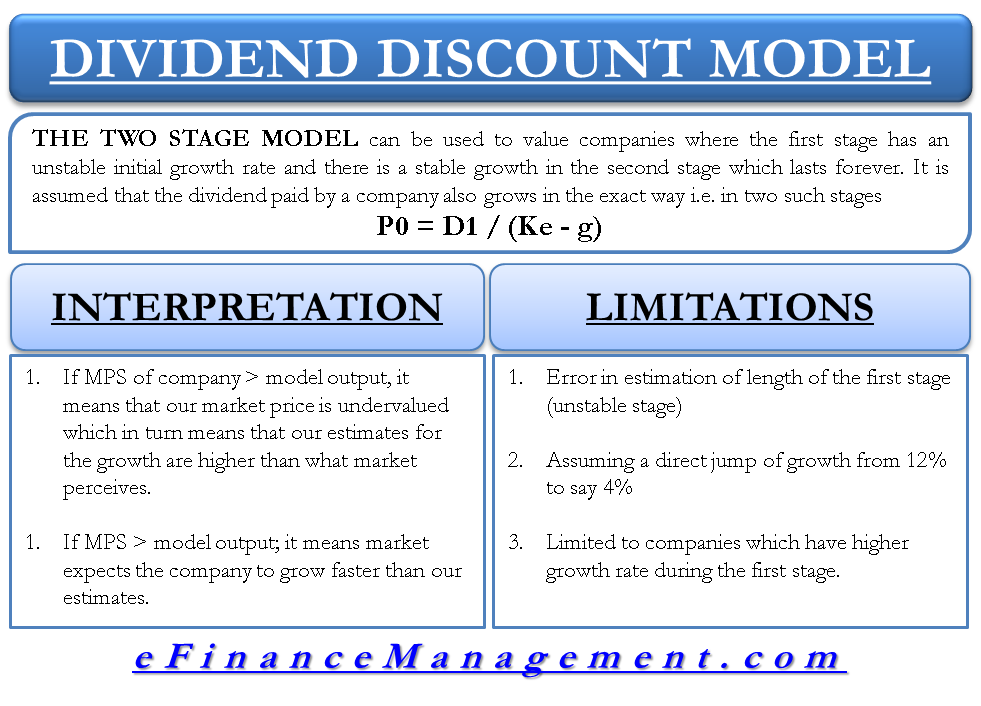

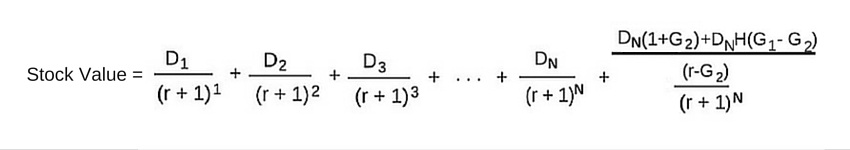

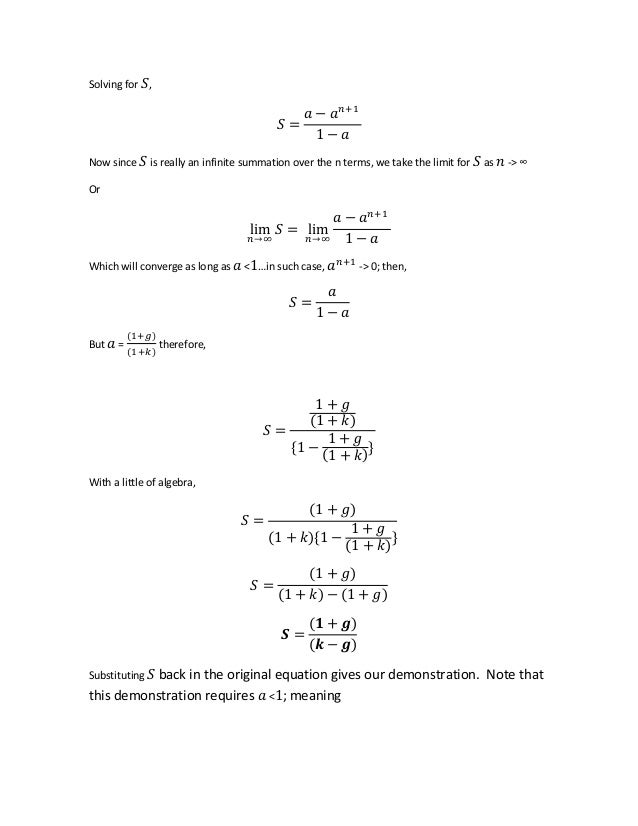

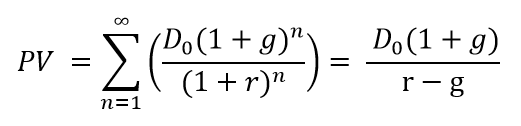

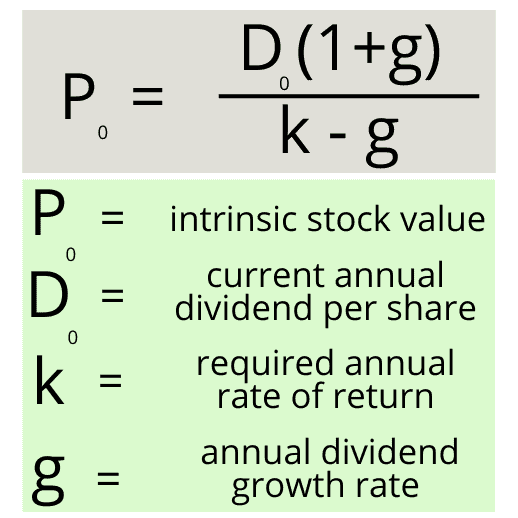

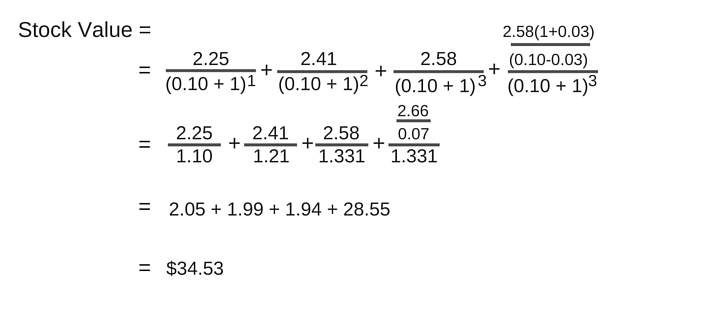

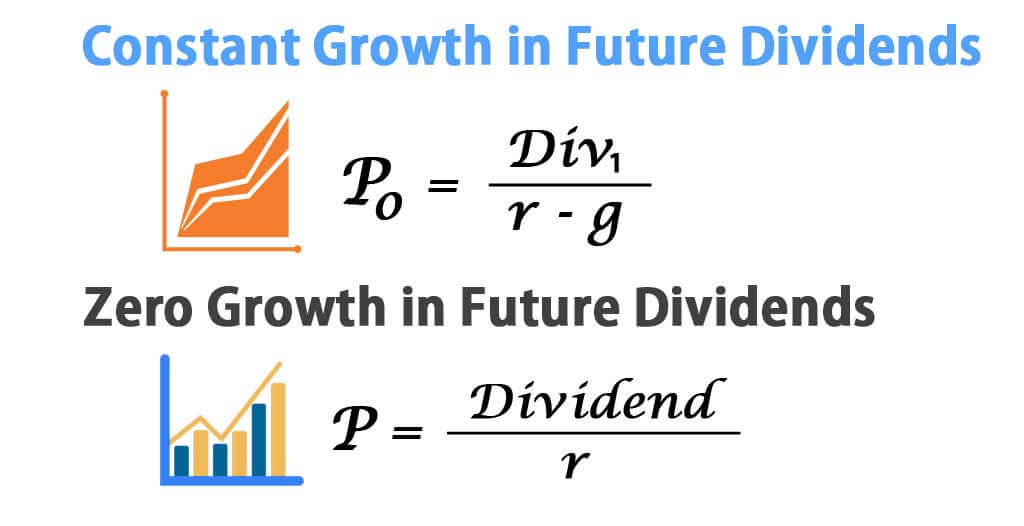

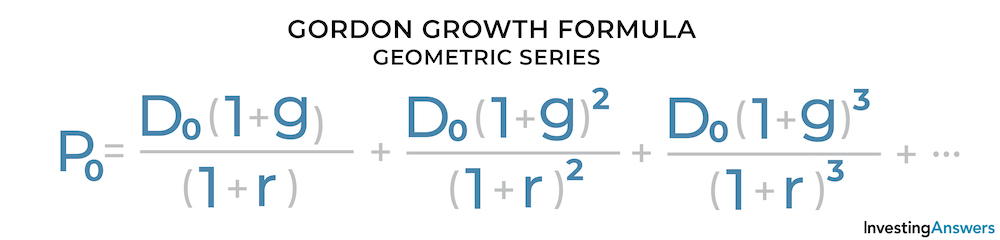

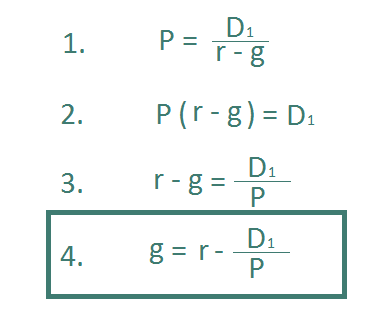

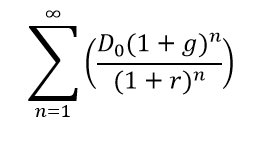

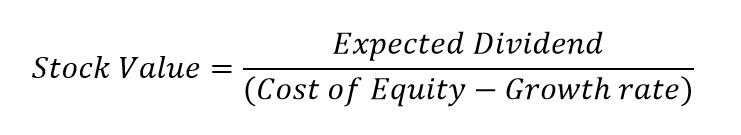

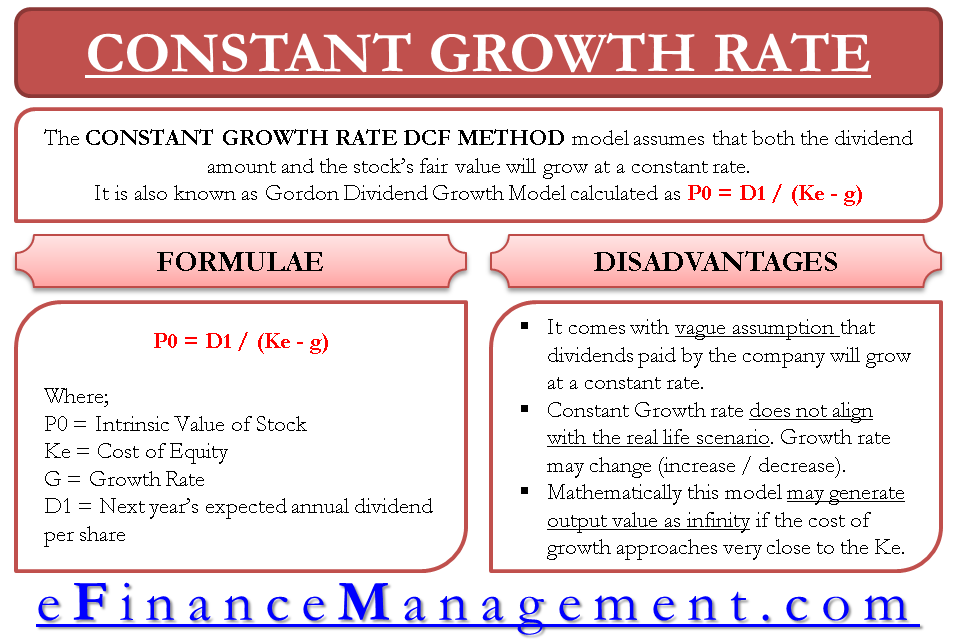

Gordon growth model formula. Div 1 estimated dividends for the next period. P d 1 r g where. Three variables are included in the gordon growth model formula.

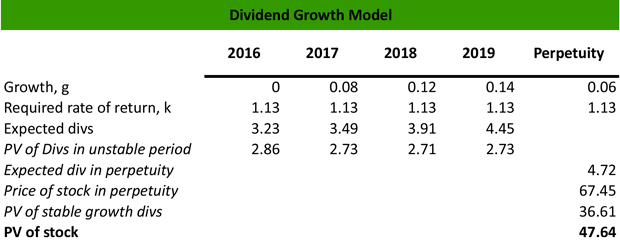

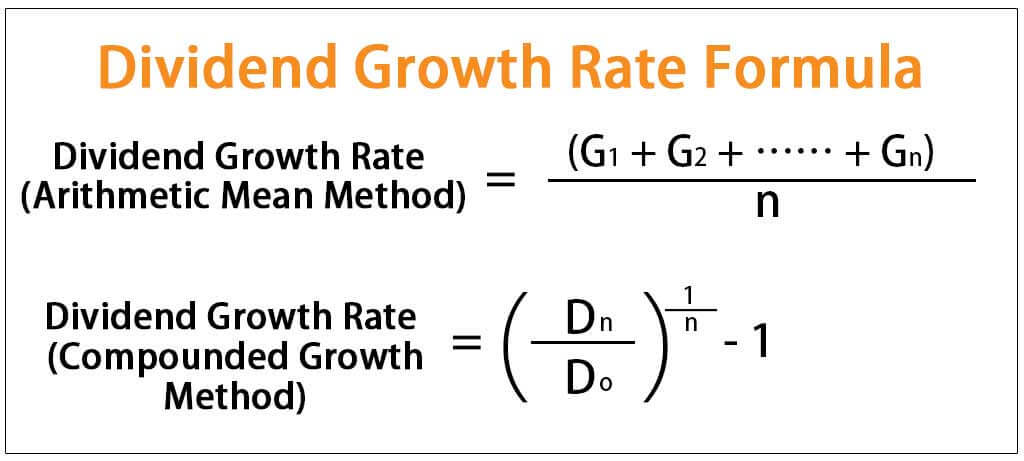

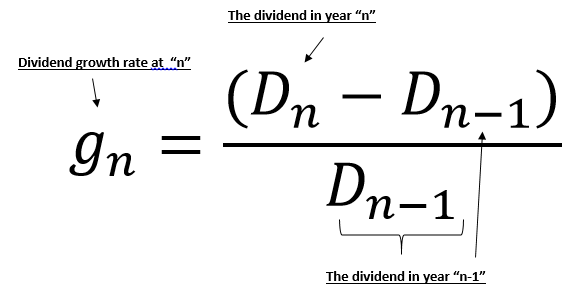

Lets have a look at the formula first. R required rate of return. G expected growth rate of dividends assumed to be constant the current dividend payout d 0 can be found in the annual report of a company.

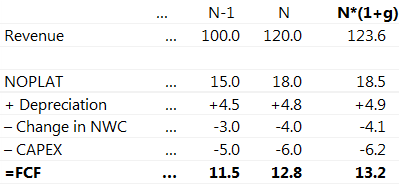

The gordon growth model formula that with the constant growth rate in future dividends is as per below. P current stock price g constant growth rate expected for dividends in perpetuity r constant cost of equity capital for the company or rate of return d 1. The wacc formula is ev x re dv x rd x 1 t.

1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. G growth rate. What is the gordon growth model formula.

:max_bytes(150000):strip_icc()/business-163467-3a437a8d553b4ca8a5c41692c37b61e1.jpg)