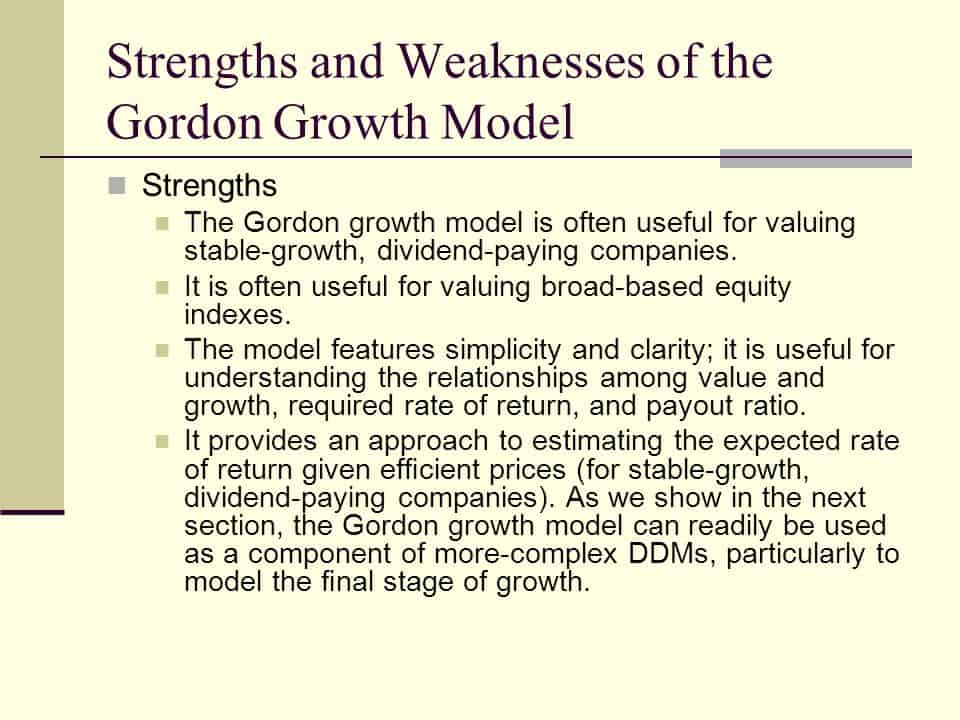

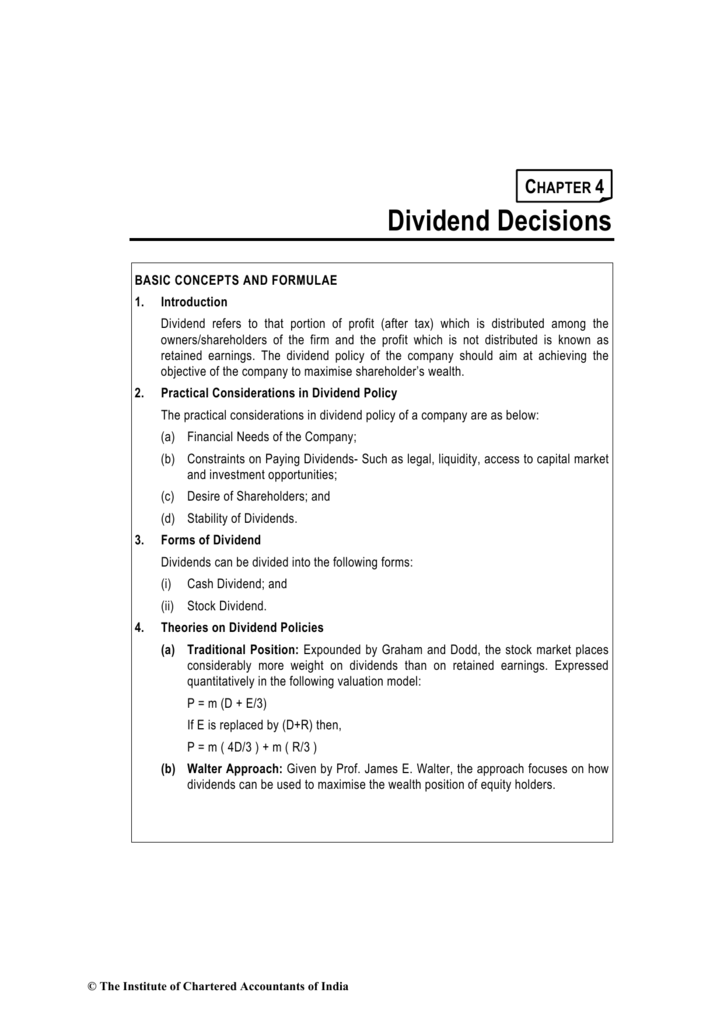

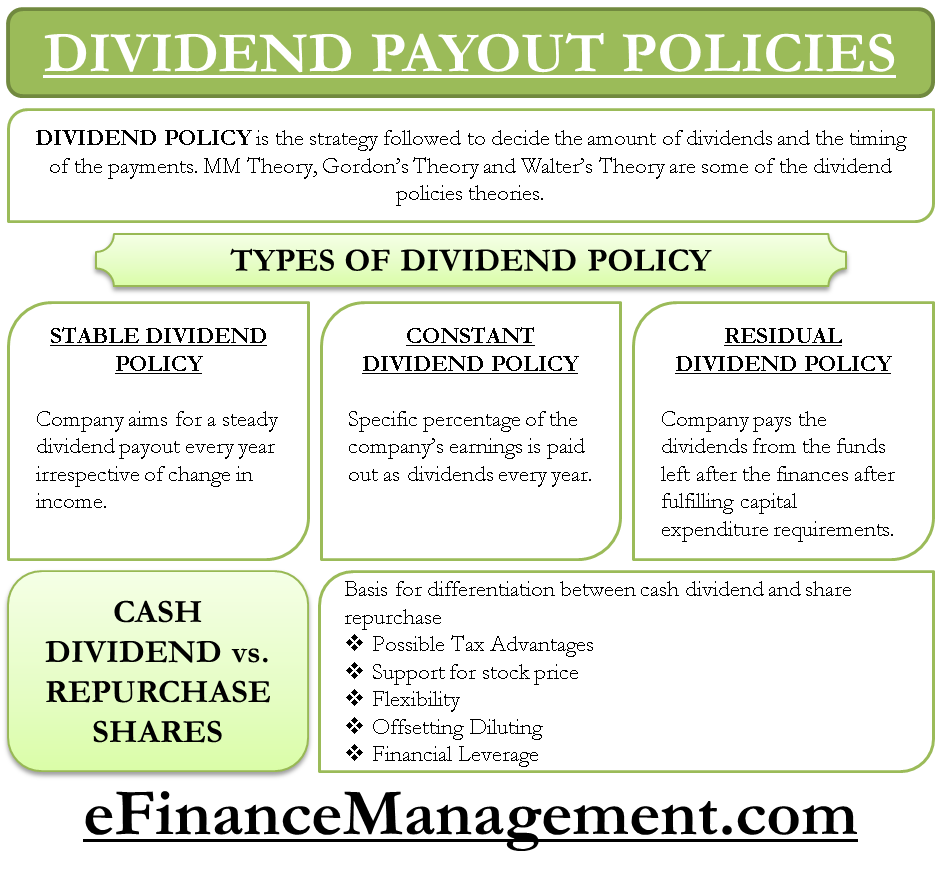

Gordon Model Of Dividend Policy Formula

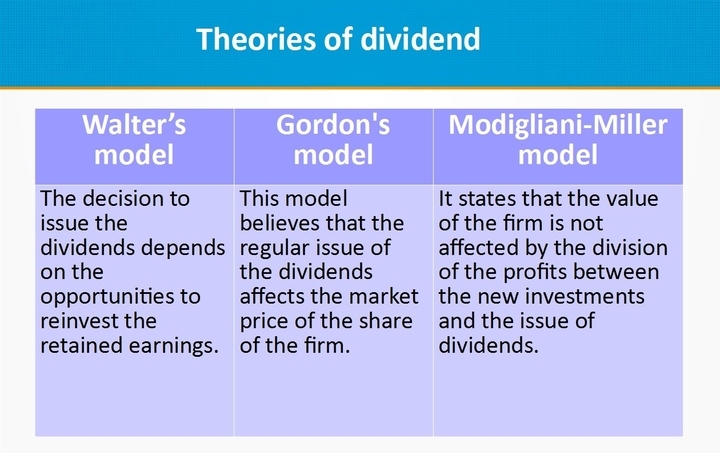

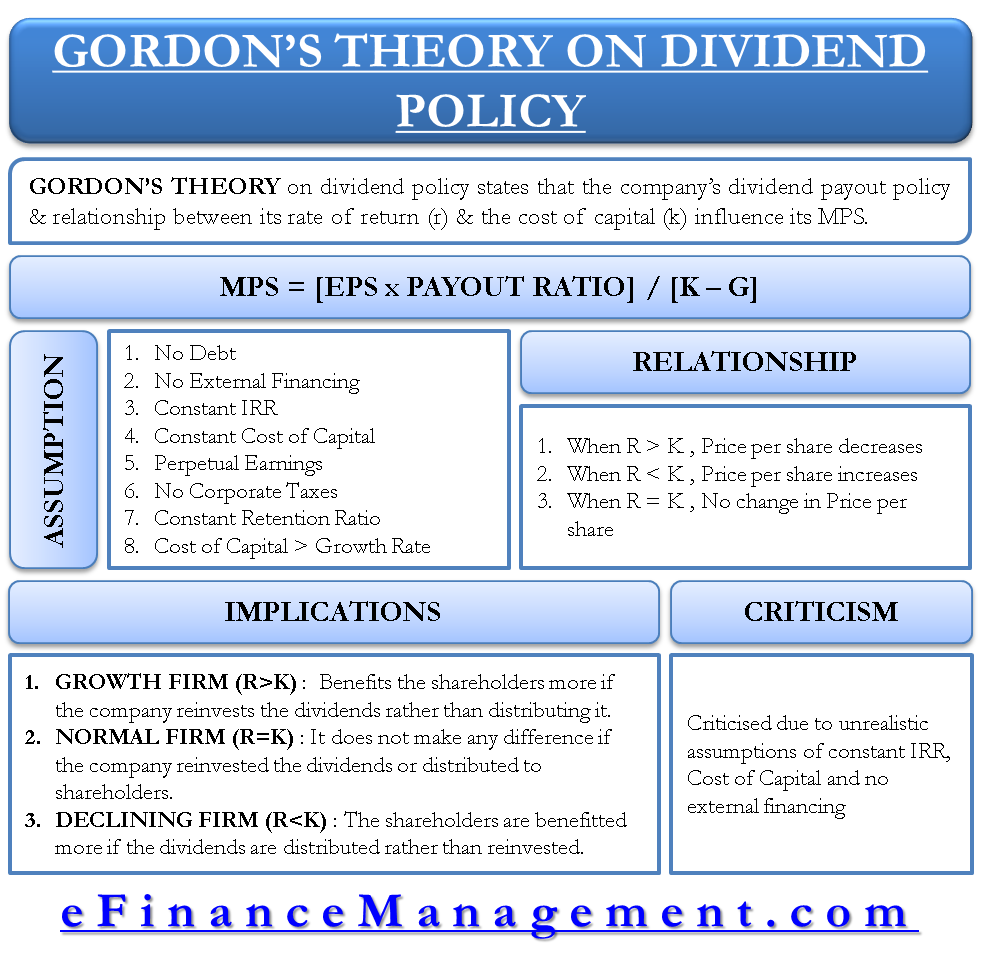

Implications of gordons model.

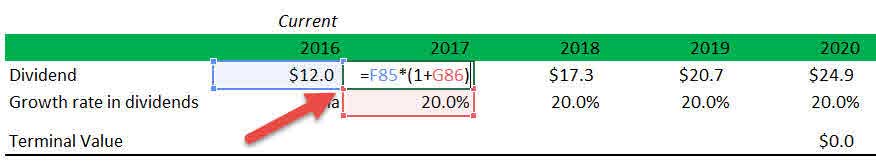

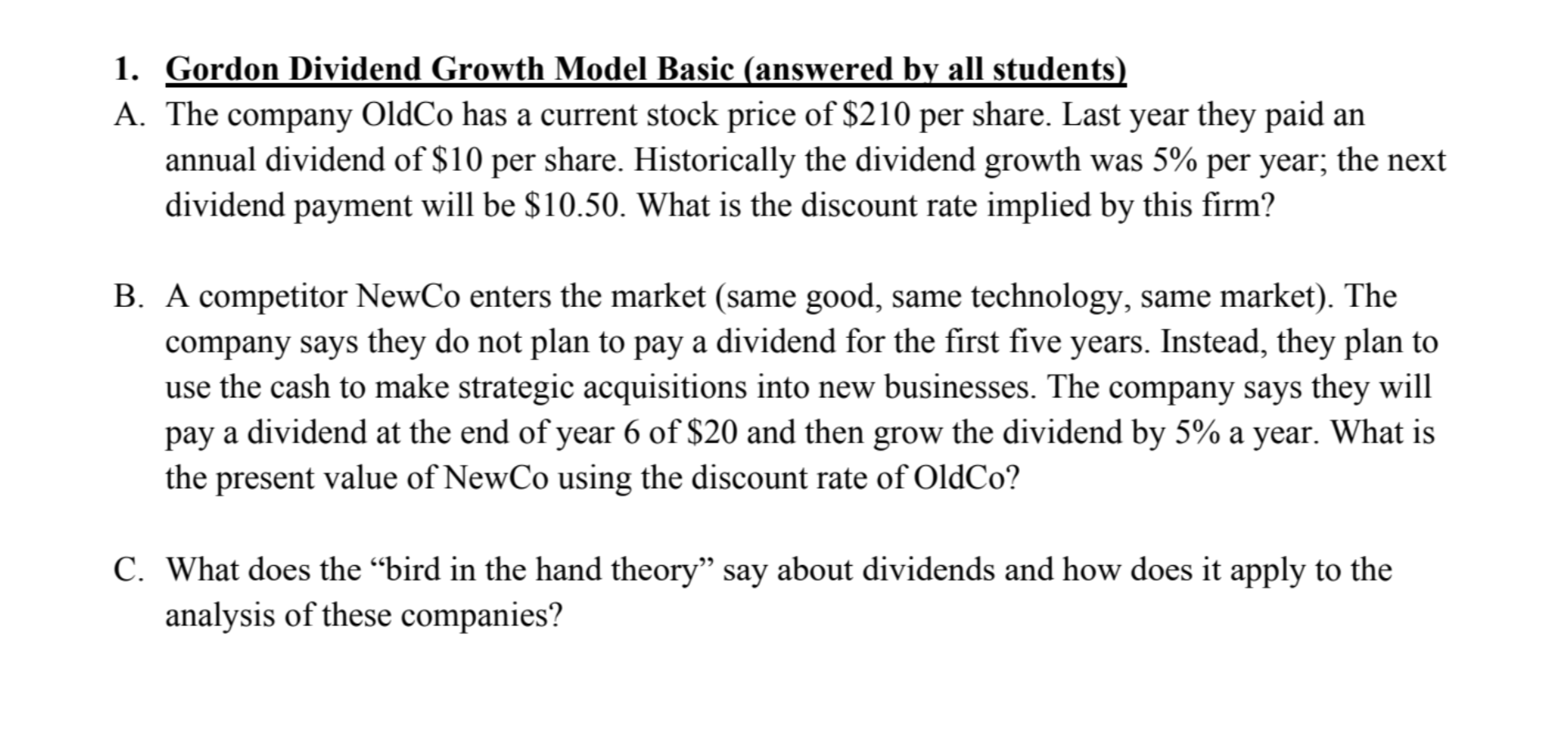

Gordon model of dividend policy formula. Puts less importance on it as compared to the current dividends. The company retains 70 of its earnings. The first number is your desired annual return on investment.

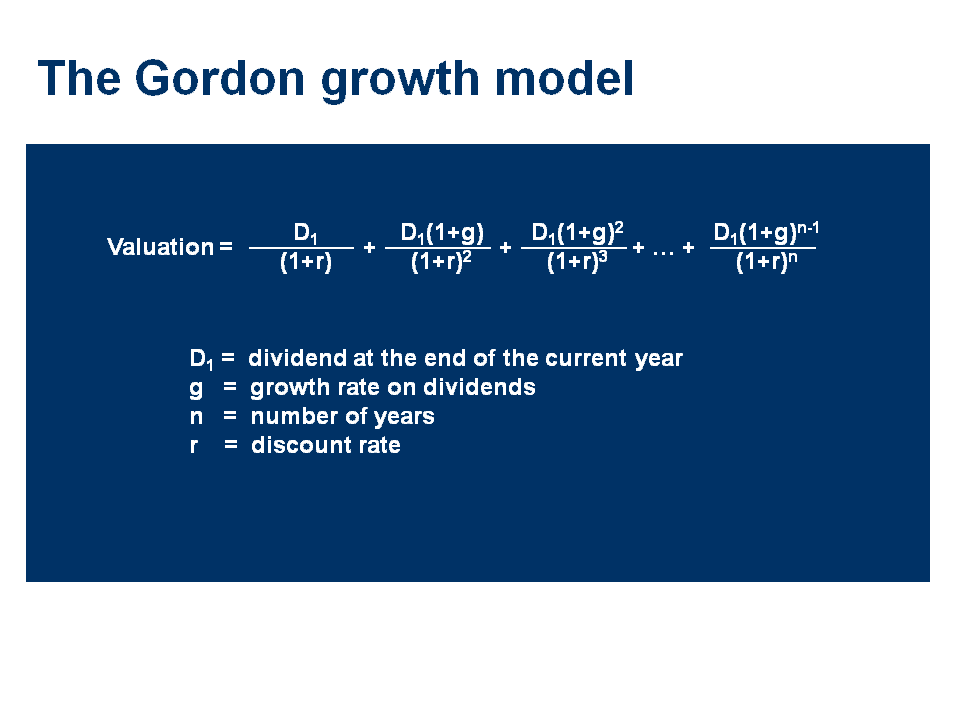

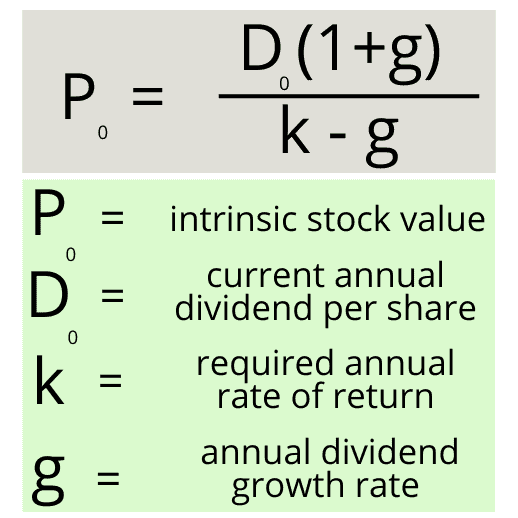

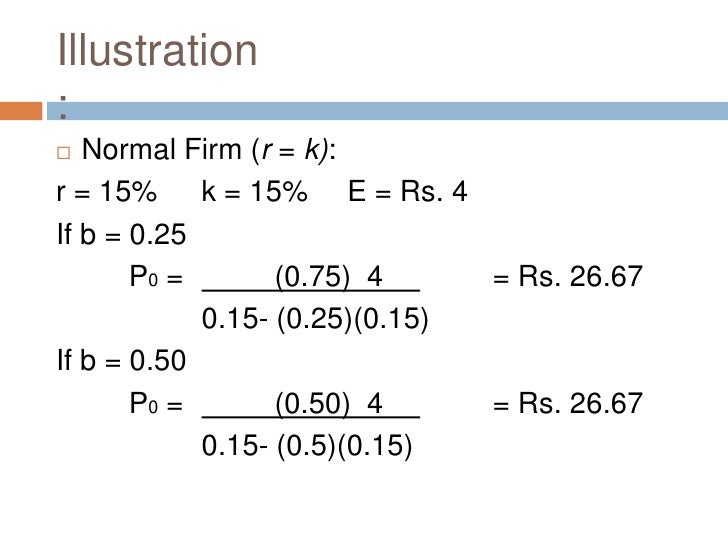

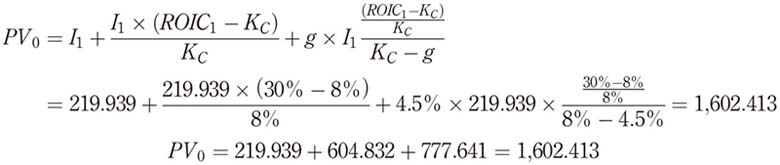

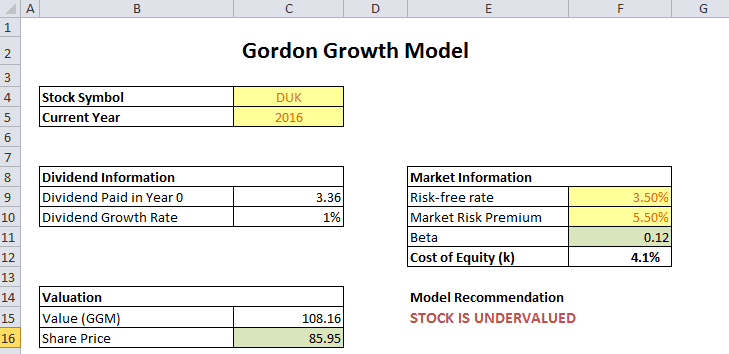

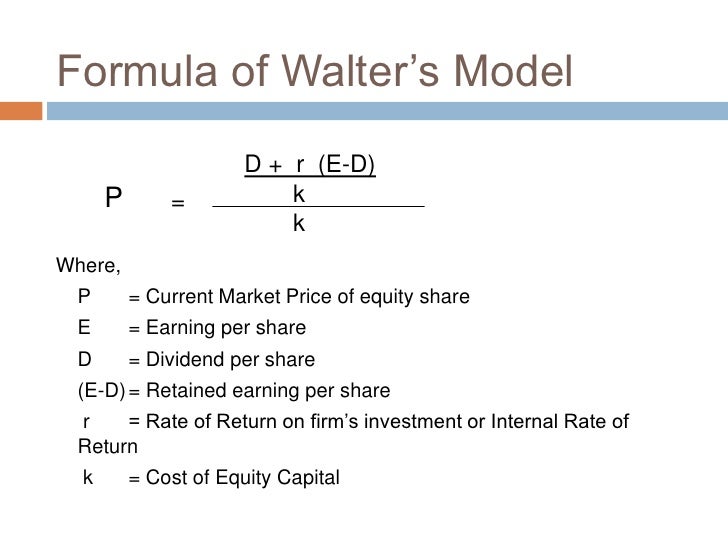

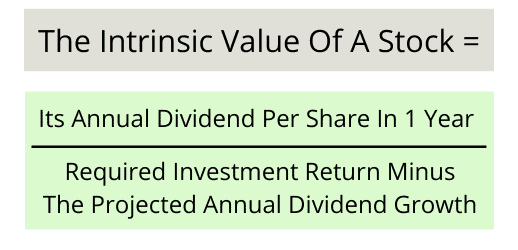

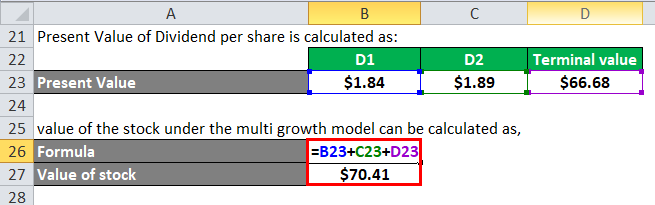

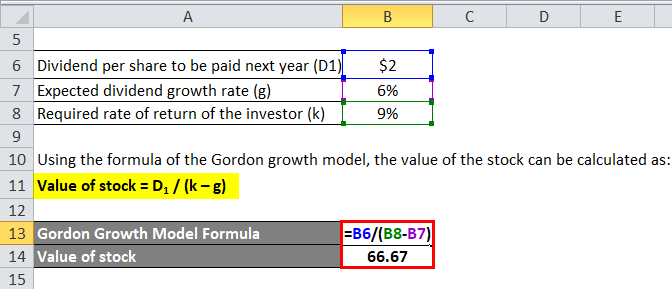

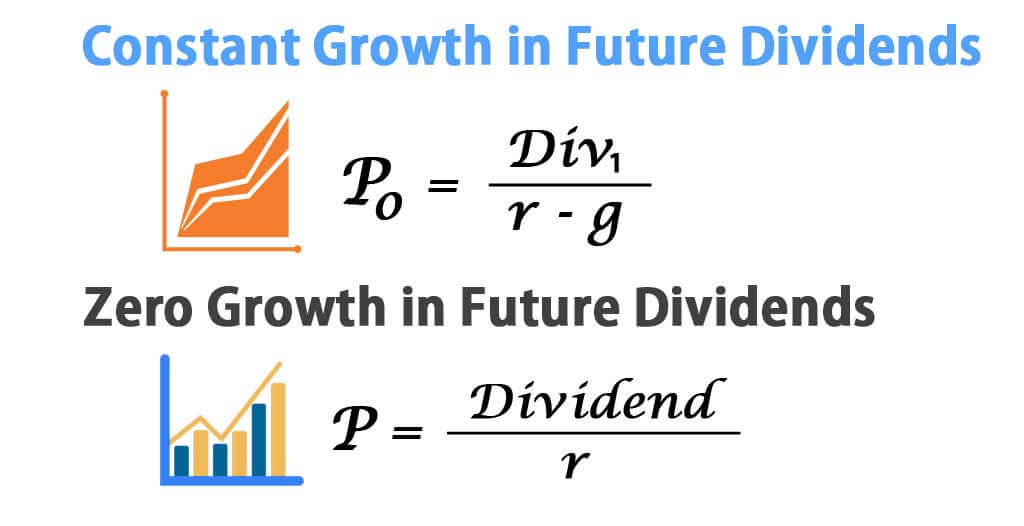

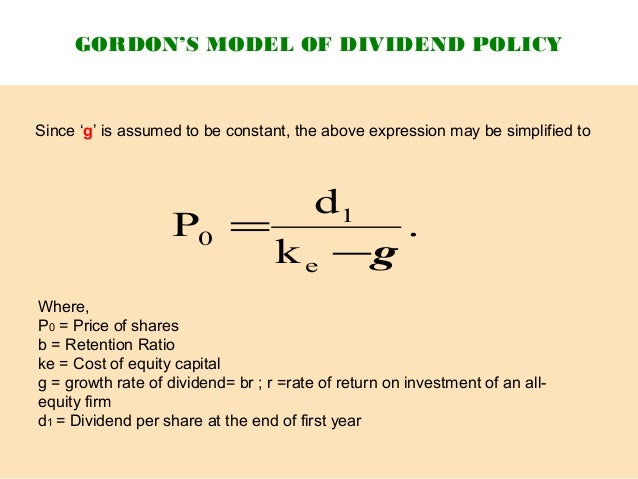

Market price of the share p 15 1 70 12 10 1530 02 225. P current stock price g constant growth rate expected for dividends in perpetuity r constant cost of equity capital for the company or rate of return d 1. Gordon growth model formula is used to find the intrinsic value of the company by discounting the future dividend payouts of the company.

Calculate the market value of the share using gordons model. What is the gordon growth model formula. G expected growth rate of dividends assumed to be constant the current dividend payout d 0 can be found in the annual.

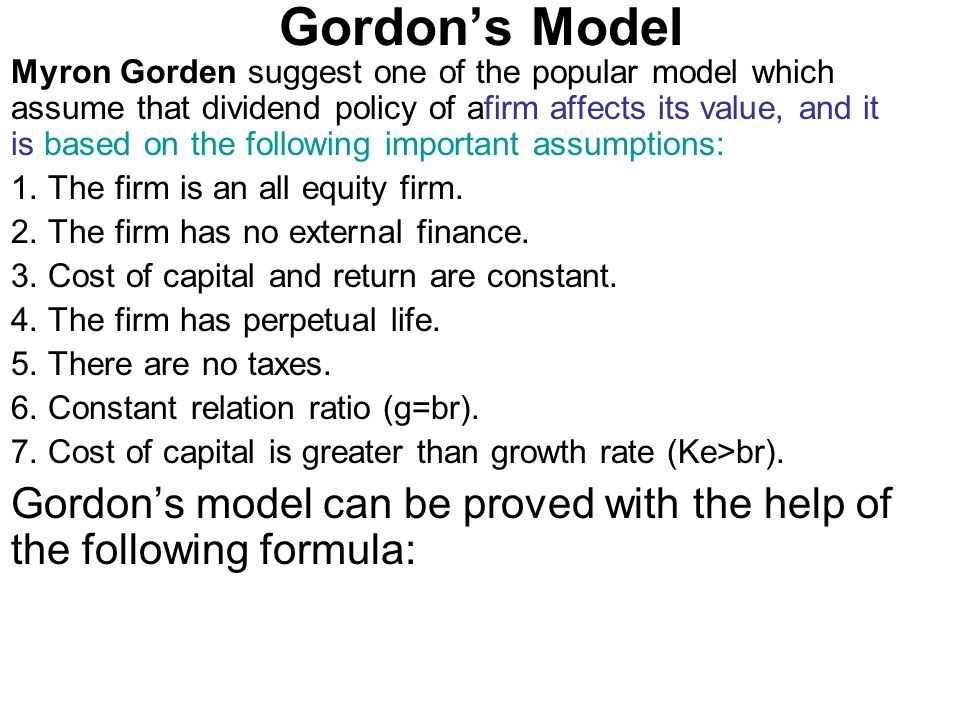

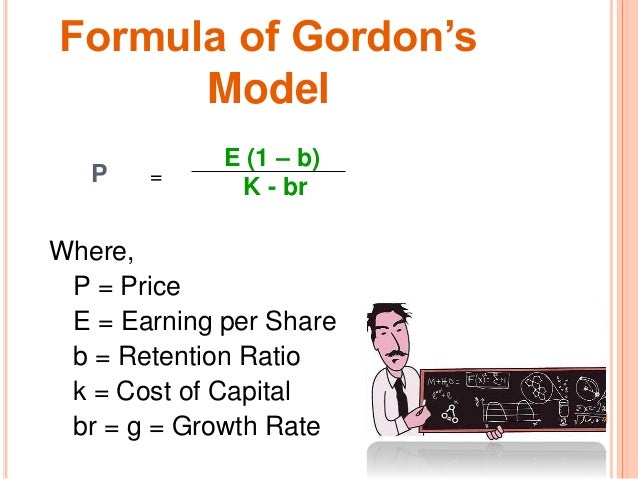

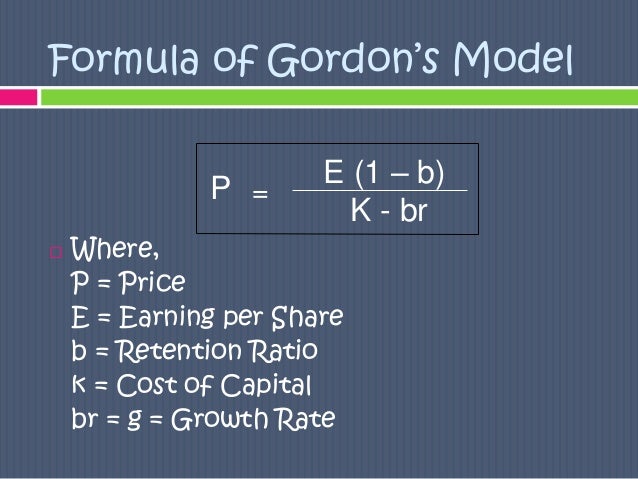

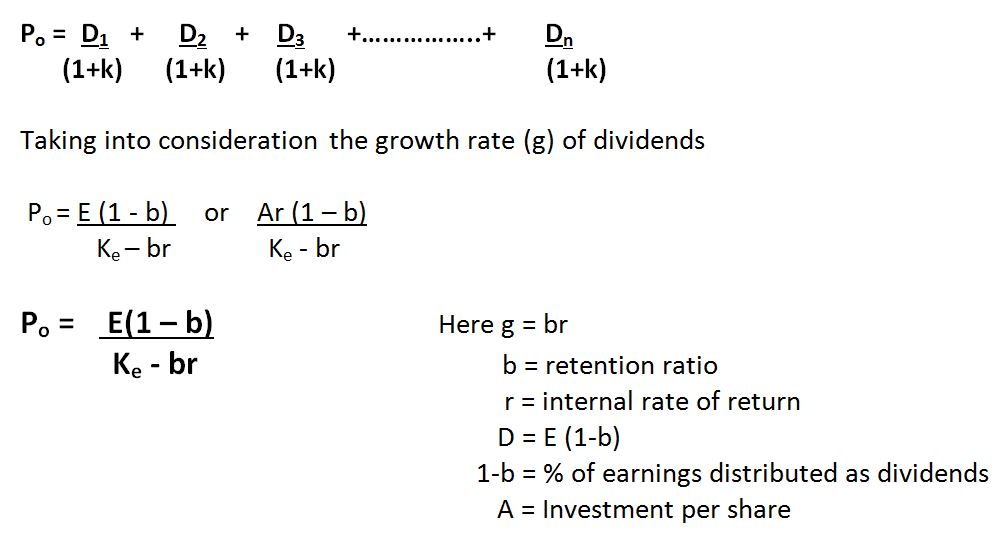

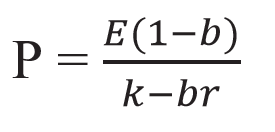

Where p price of a share e earnings per share b retention ratio. P d 1 r g where. As a formula the gordon growth model is quite simple.

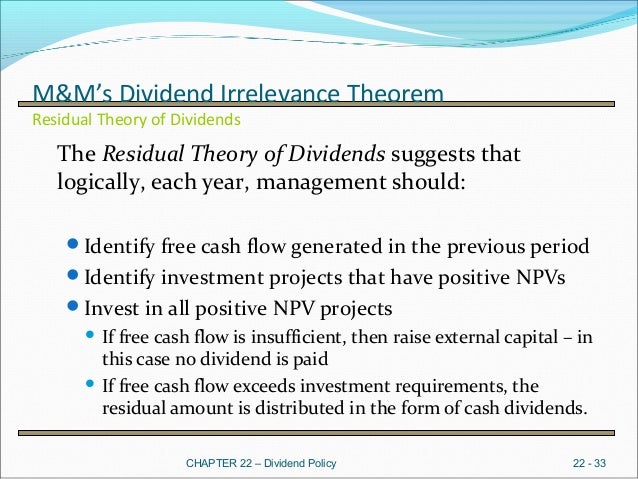

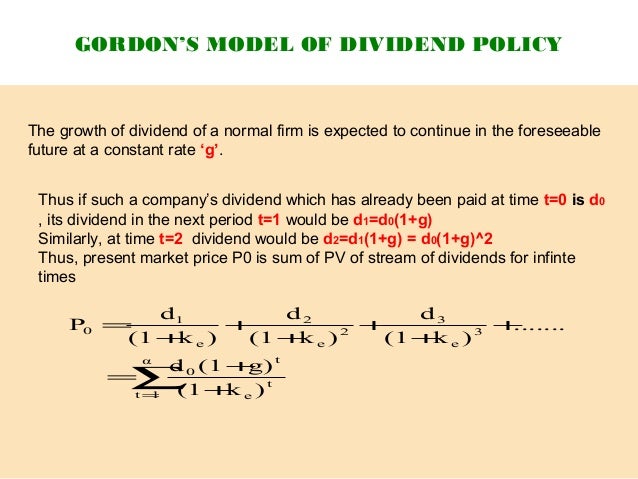

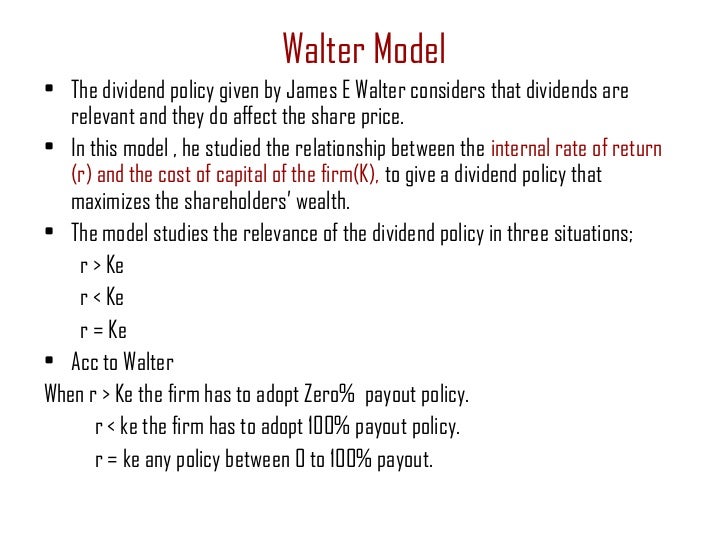

D 1 expected dividend amount for next year. Three variables are included in the gordon growth model formula. When investors buy shares they expect to get either or both of two types of cash flows dividend during the period for which they hold the share and capital appreciation based on an expected price at the end of the holding period.

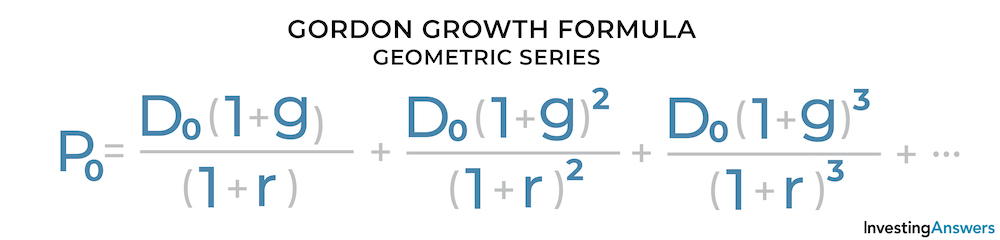

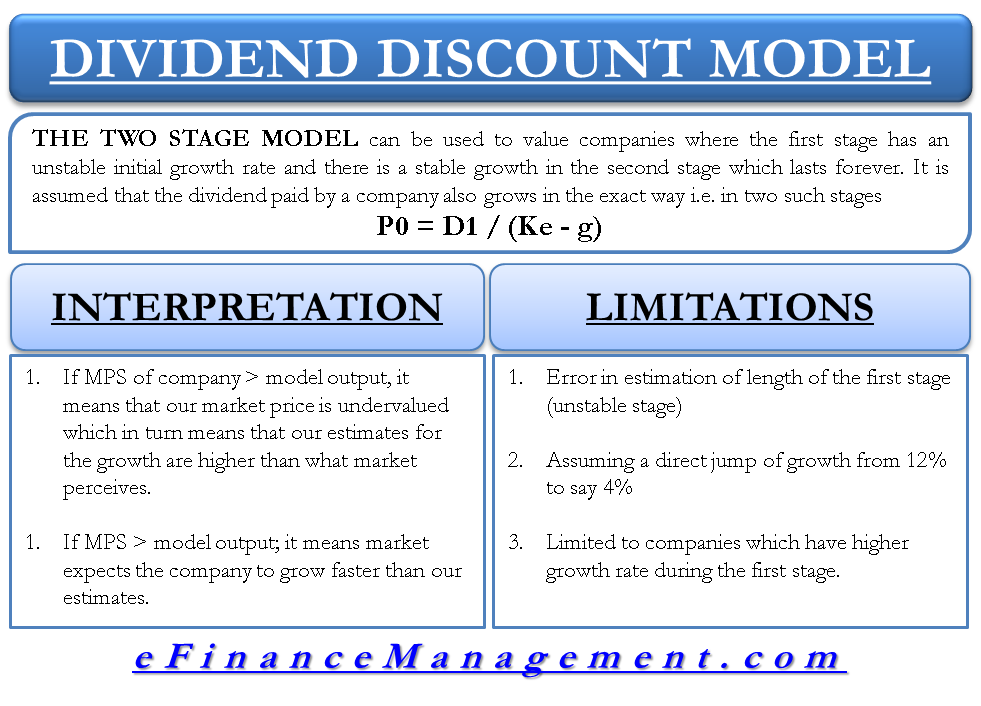

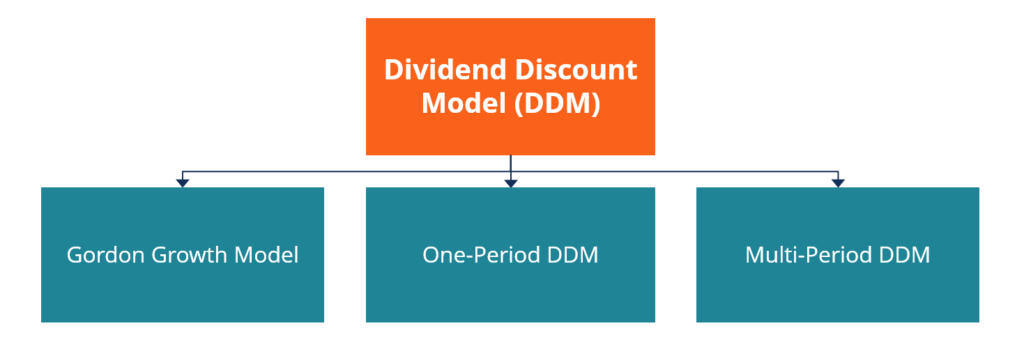

The dividend discount model is premised on the assumption that price of a share is determined by the discounted sum of all of its future dividend payments ie. According to the gordons model the market value of the share is equal to the present value of future dividends. Gordon growth model formula p dfracd1r g p fair value of the stock.

First i will describe it with words. It is simply a companys expected annual dividend payment 1 year from now. There are two formulas of growth growth model 1 gordon growth in future dividends 2 zero growth in future dividends.

Net present value of all future dividends. R cost of equity or the required rate of return. Here e 15.

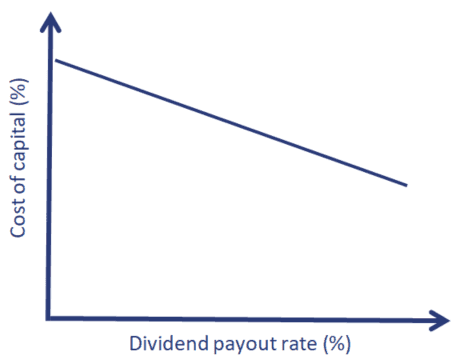

Divided by the difference between 2 numbers. Gordons model believes that the dividend policy impacts the company in various scenarios as follows. P e 1 b ke br.

Dividend discount model formula gordon growth model. 1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt. It is represented as.