Gordon Model Of Dividend Relevance Is Same As

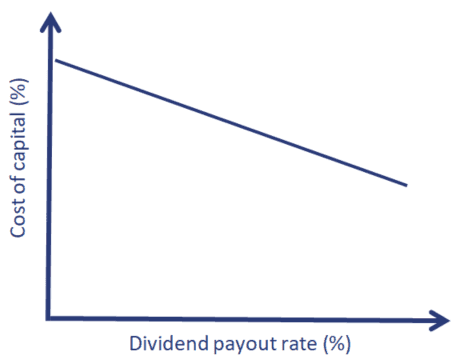

The wacc formula is ev x re dv x rd x 1 t.

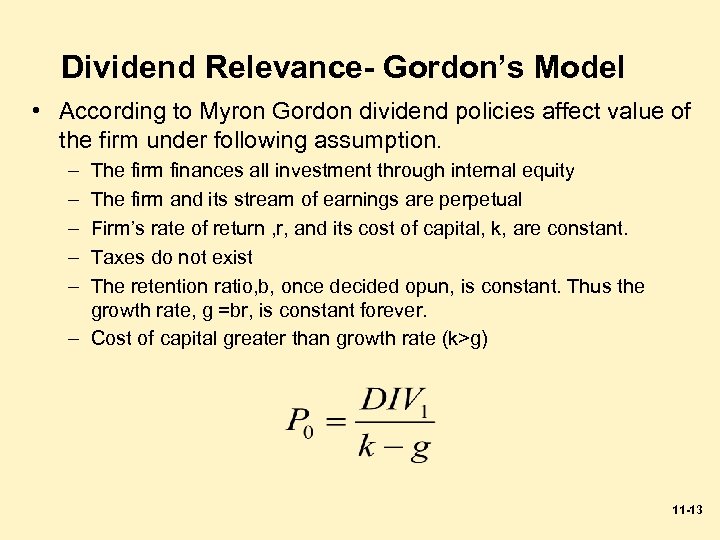

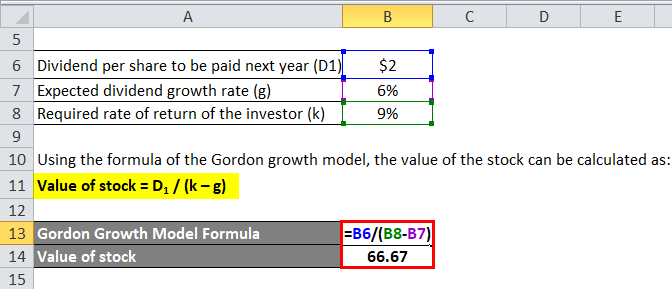

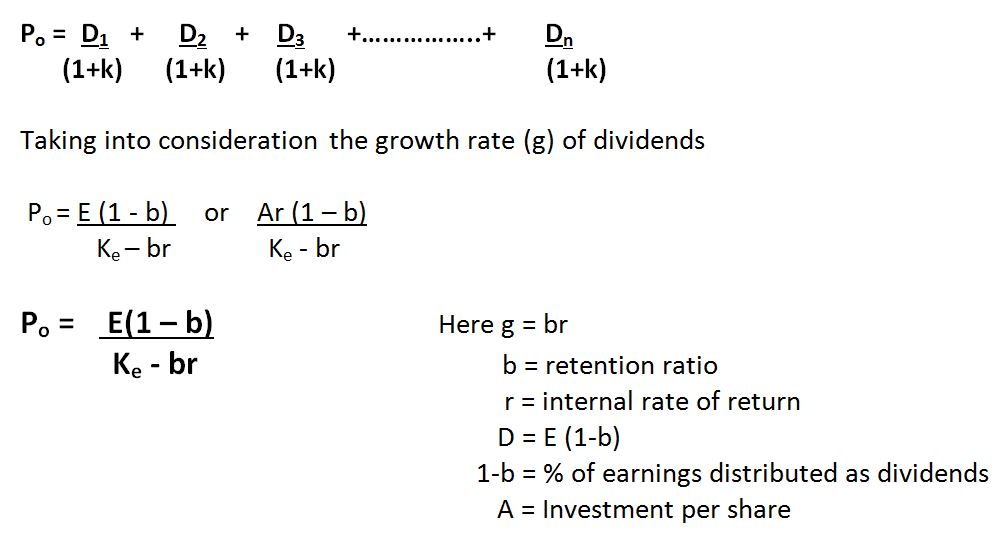

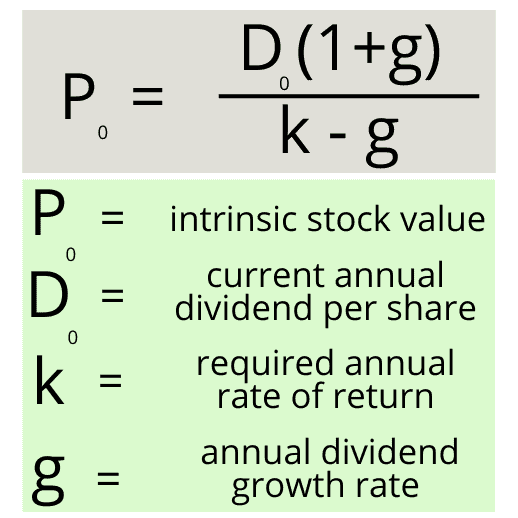

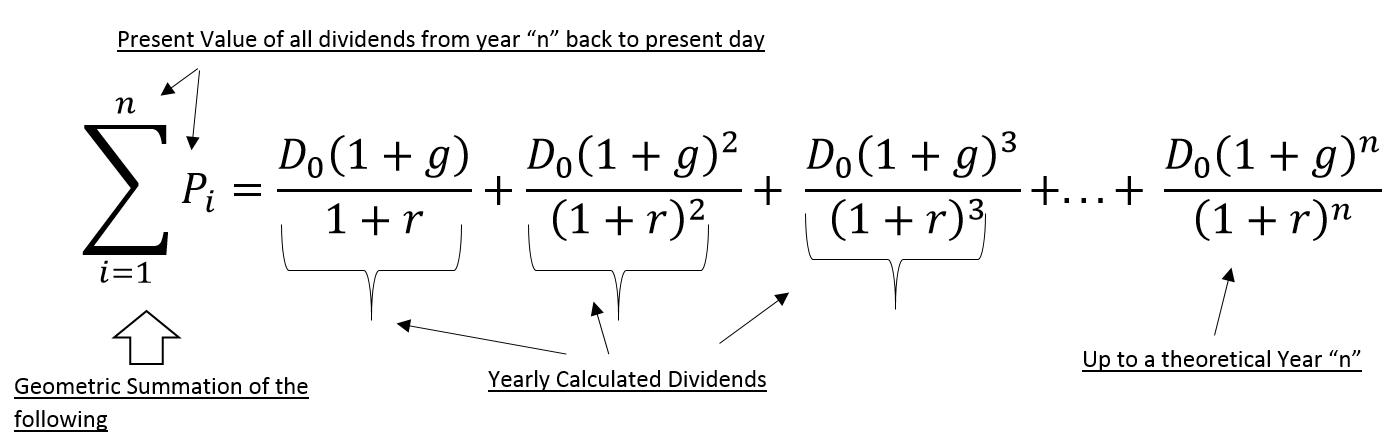

Gordon model of dividend relevance is same as. The model takes the infinite series of dividends per share and discounts them back into. The crux of gordons argument is based on the following 2 assumptions. 1 d1 or the expected annual dividend per share for the following year 2 k or the required rate of return wacc wacc is a firms weighted average cost of capital and represents its blended cost of capital including equity and debt.

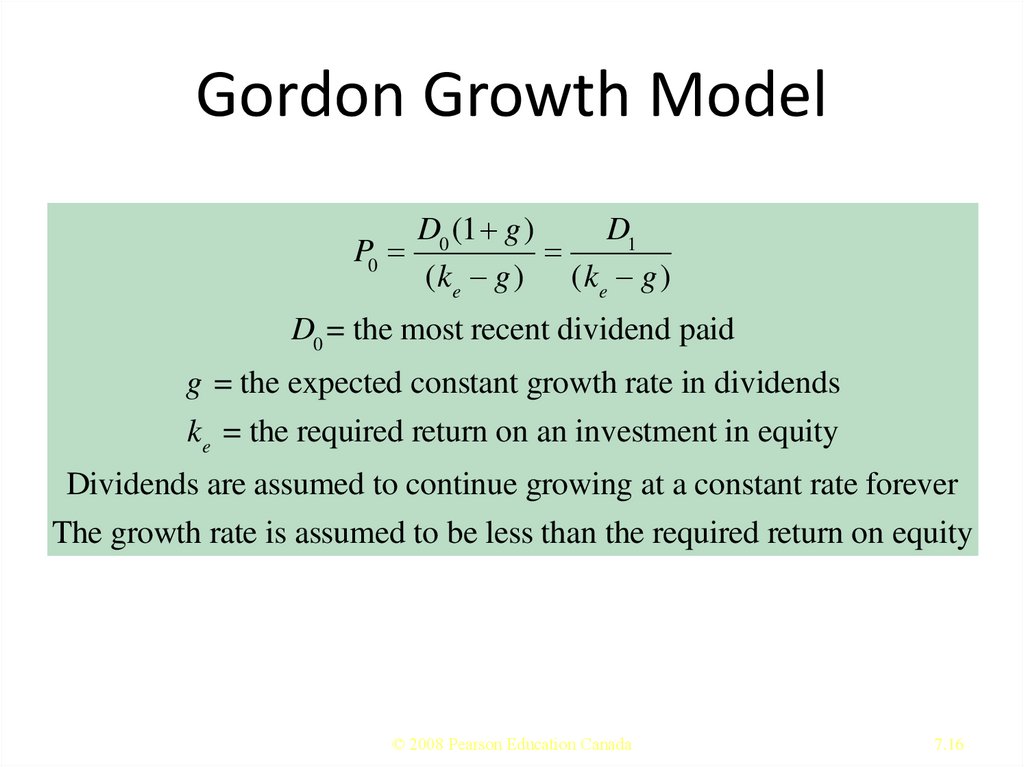

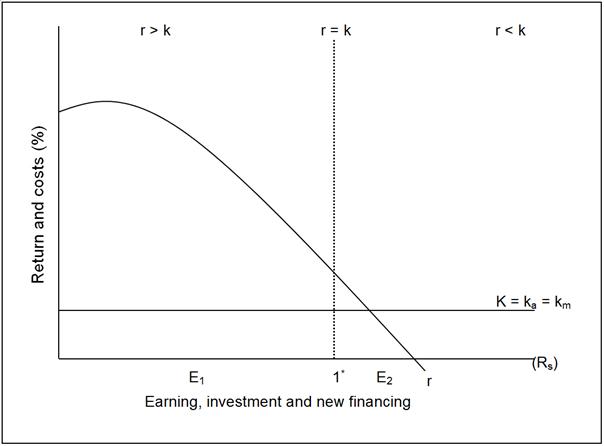

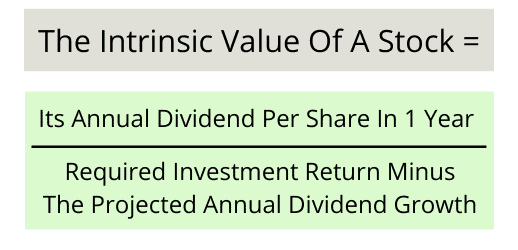

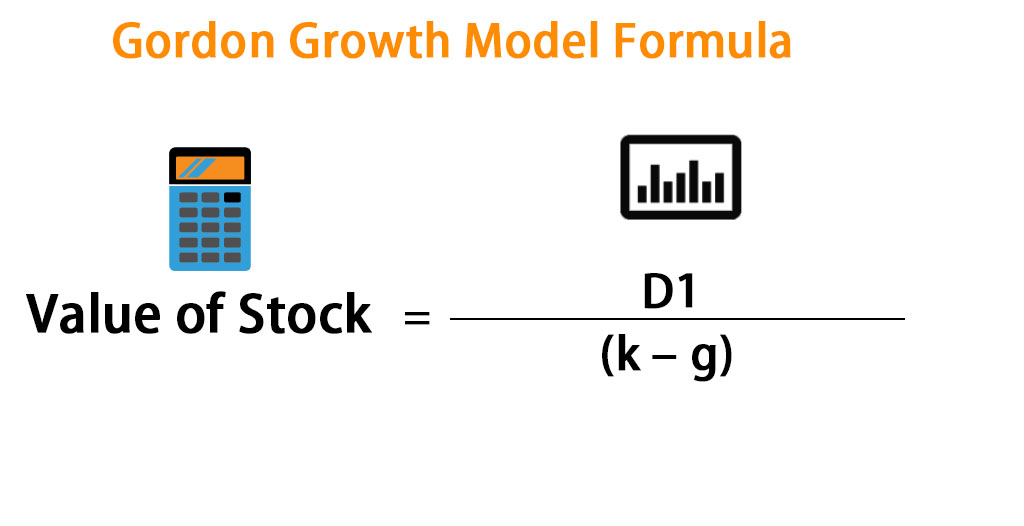

The gordon growth model ggm helps an investor to determine the intrinsic value of a stock based on the constant rate of growth of its future dividends. What is the gordon growth model. P d k e g p price of share e earning per share b retention ratio k e cost of equity capital b r g r rate of return on investment d dividend per share.

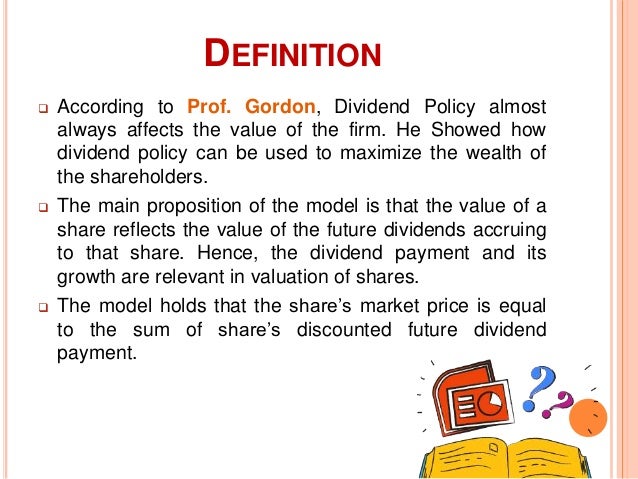

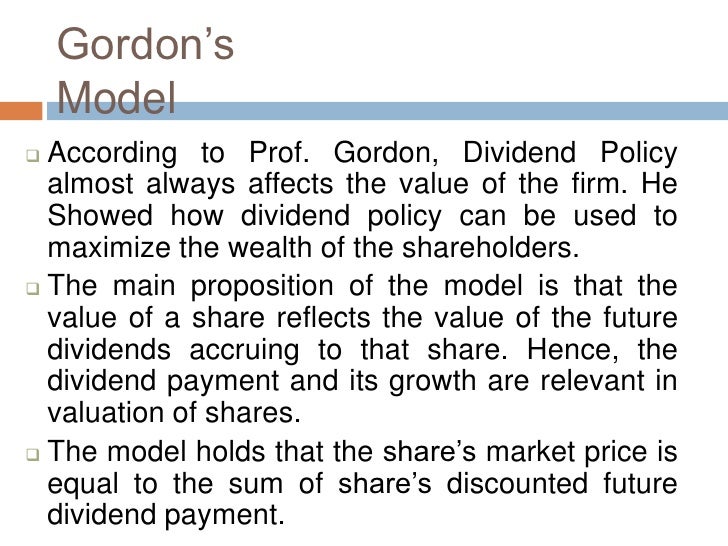

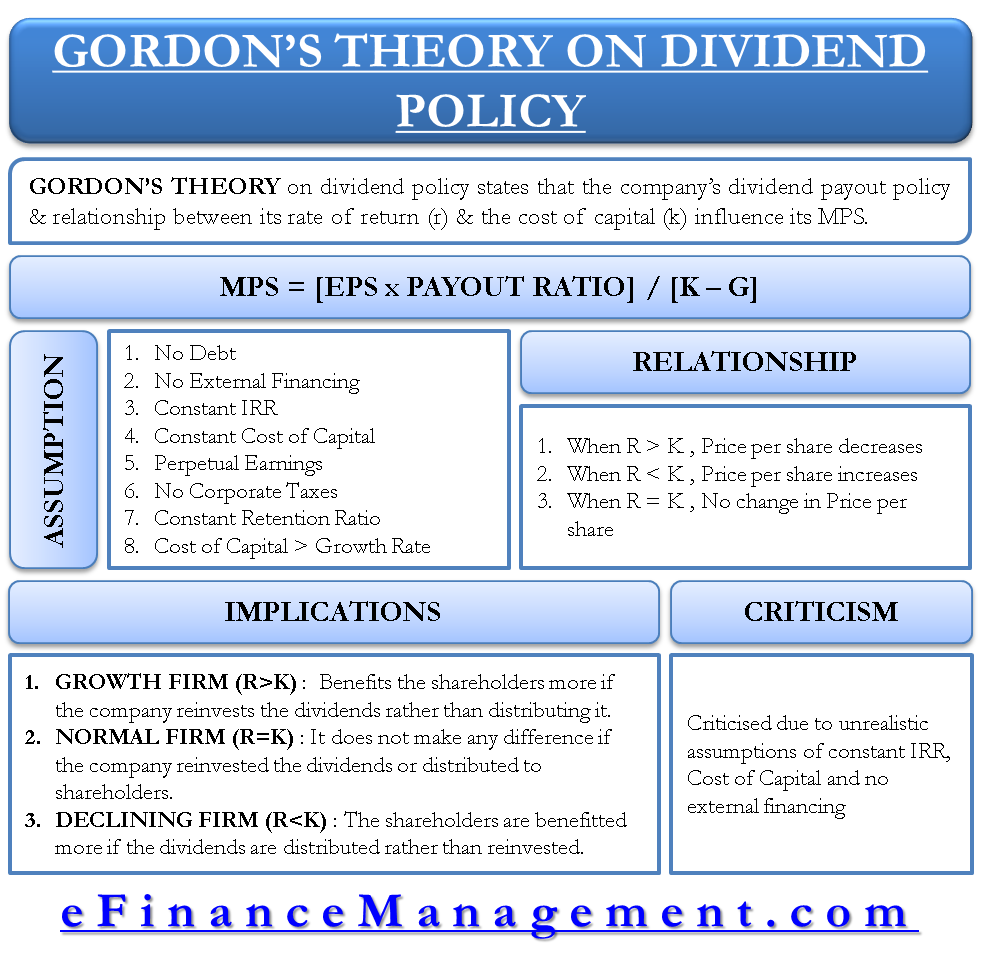

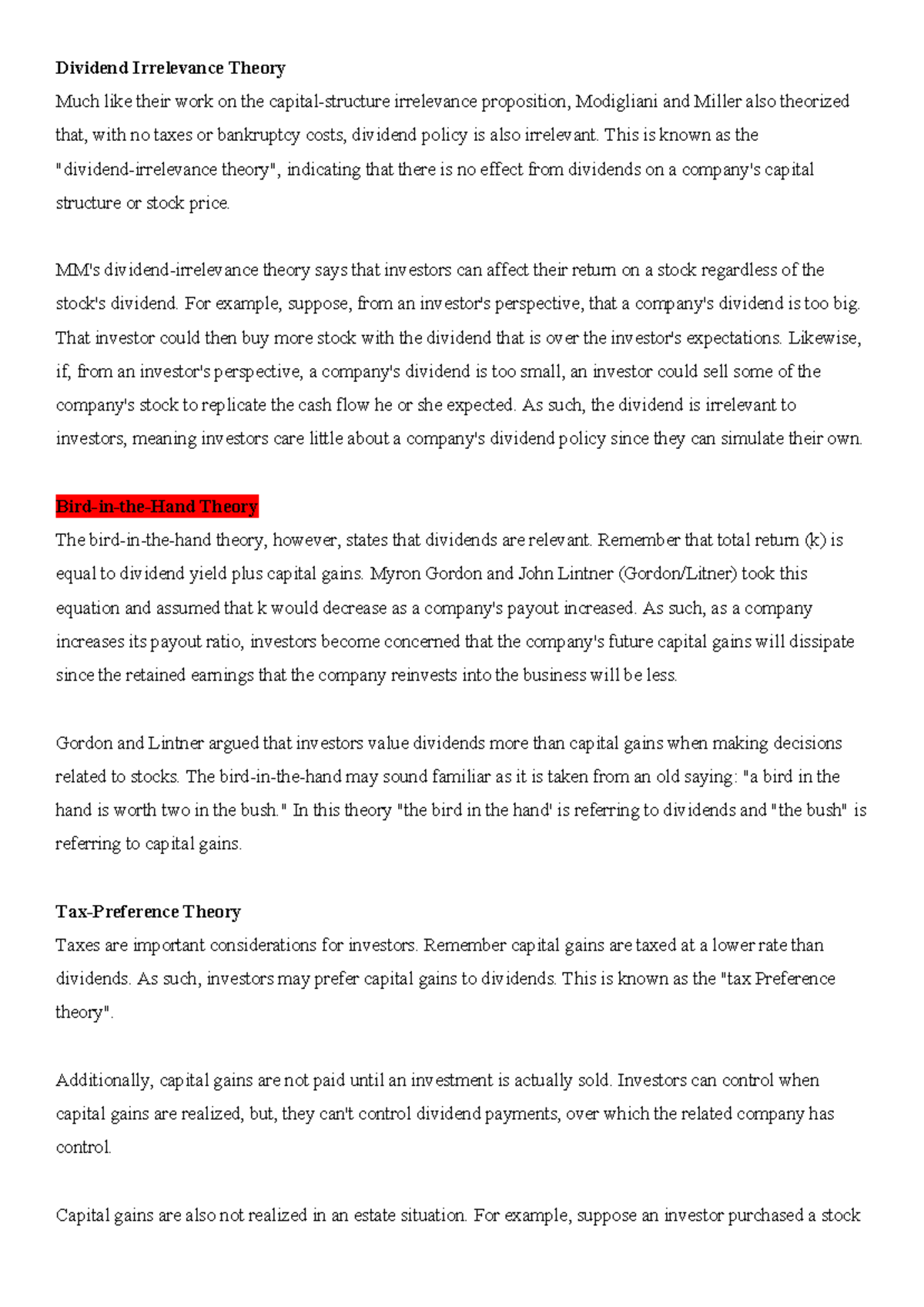

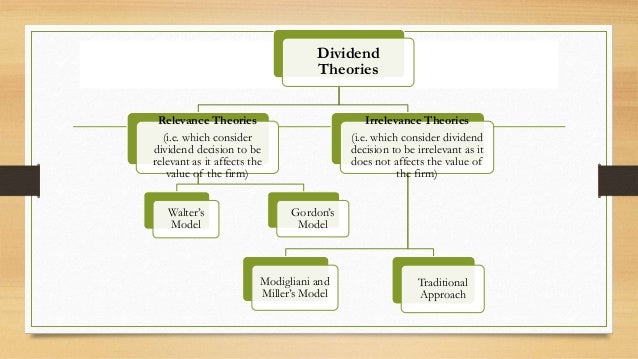

Gordens formula of relevance theory of dividend. It is represented as. It is also called as bird in the hand theory that states that the current dividends are important in determining the value of the firm.

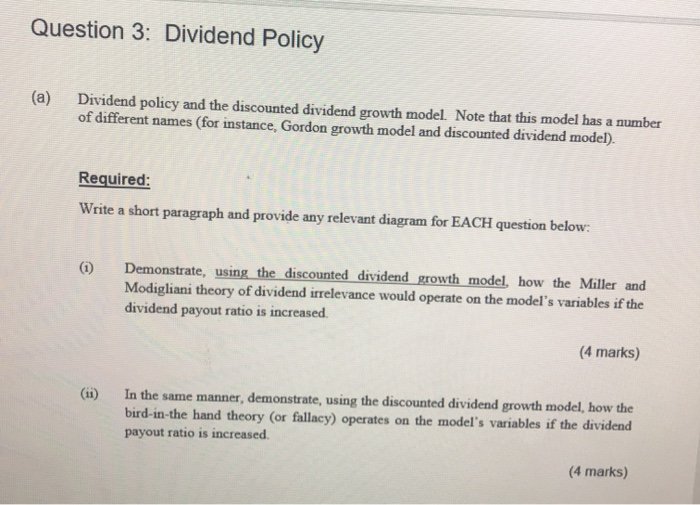

Gordons model of dividend relevance is same as a no growth model of equity valuation bconstant growth model of equity valuationcprice earning ratio d inverse of price earnings ratio 15. Gordons model like walters model contends that dividend policy is relevant. What is the gordon growth model formula.

The gordon growth model ggm values a companys stock using an assumption of constant growth in dividends. According to the gordons model the market value of the share is equal to the present value of future dividends. According to gordons dividend capitalisation model the market value of a share pq is equal to the present value of an infinite stream of dividends to be received by the share.

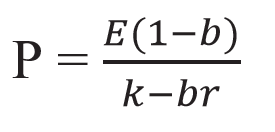

Assumptions of gordons model. Where p price of a share e earnings per share b retention ratio 1 b proportion of earnings distributed as dividends ke capitalization rate br growth rate. P e 1 b ke br.

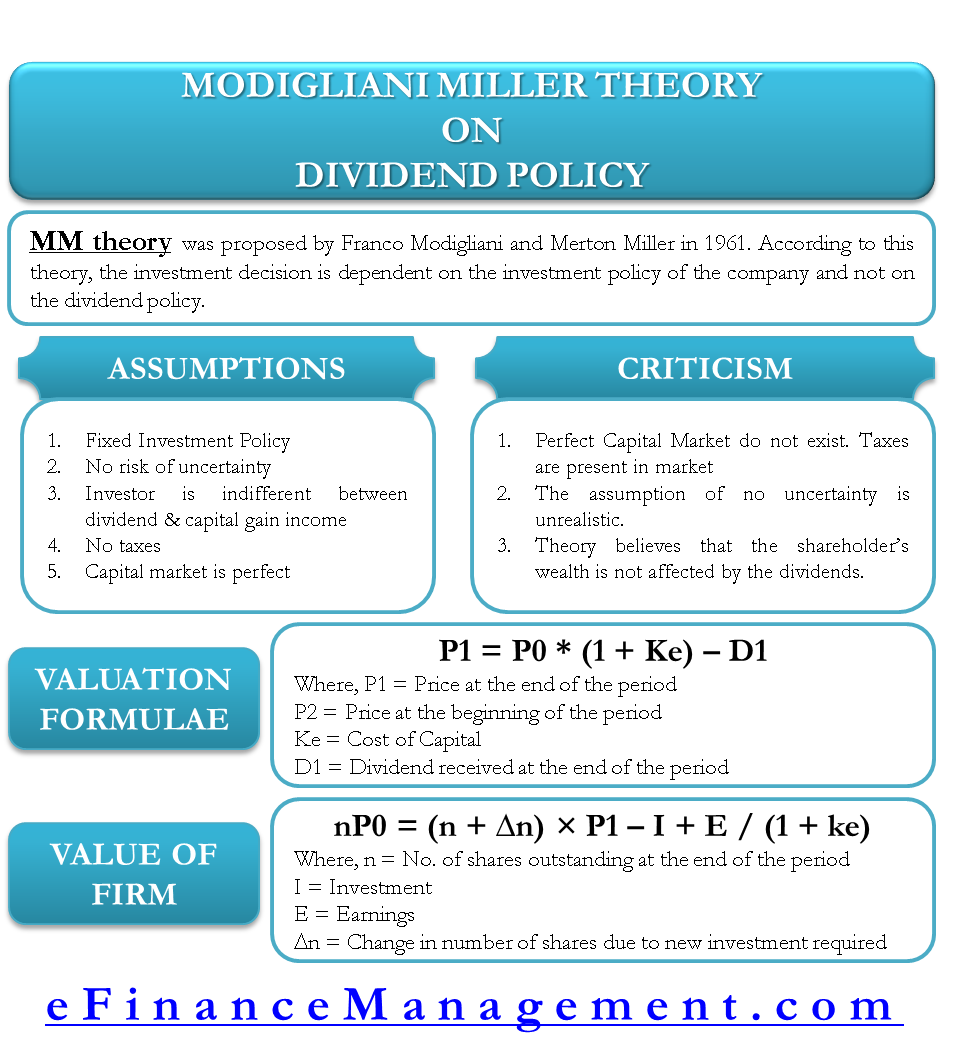

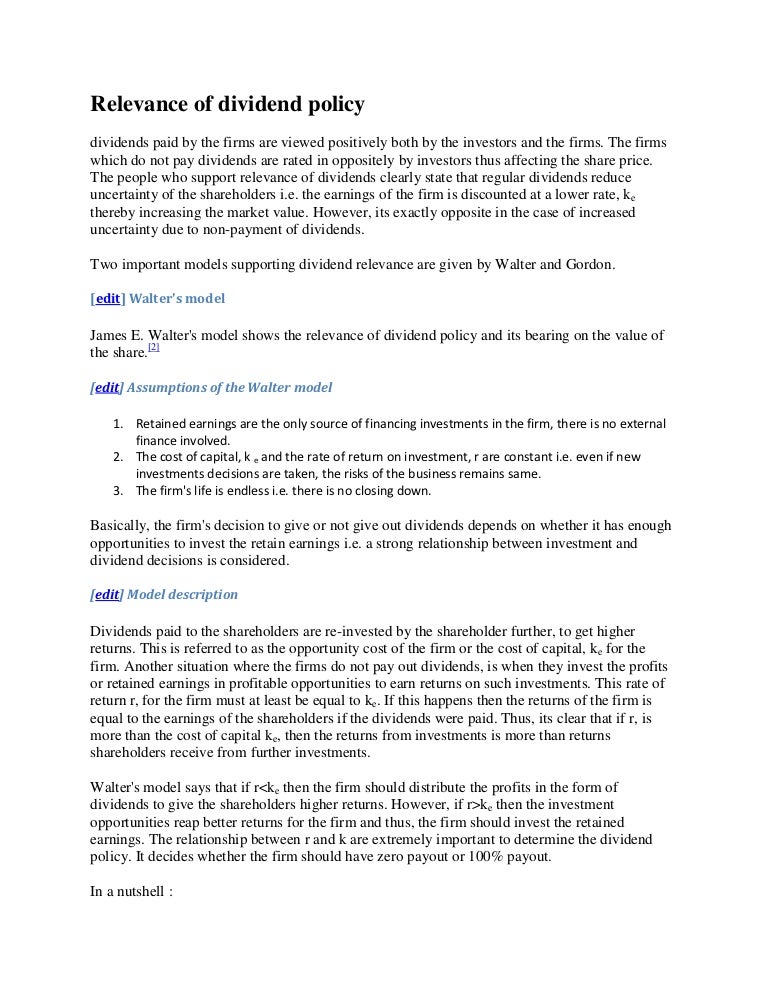

According to walter dividend policy will not affect the price of the share when r k. Gordons theory on dividend policy is one of the theories believing in the relevance of dividends concept. Put simply the gordon growth model uses a companys rate of return and its dividend growth to estimate the fair price of its stock.

P e 1 b k e b r or.